Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

Expected earnings date: Wednesday, 28 January 2026 (US, after market close) / early Thursday, 29 January 2026 (AEDT)

Key areas in focus

The Tesla earnings release can act as a barometer for both global EV demand and capital-intensive innovation across automation and energy systems.

Vehicle deliveries and margins are likely to be the primary near-term drivers of sentiment. Investors will also be watching updates across adjacent initiatives that may influence longer-term growth expectations.

Autonomy and software (FSD)

Tesla’s “Full Self-Driving” (FSD) is a branded advanced driver-assistance feature sold in some markets and requires active driver supervision; availability and capabilities vary by jurisdiction.

Further rollout and any expansion of autonomy-linked services remain subject to regulatory approvals and continued evolution of the underlying technology.

Energy generation and storage

Solar, Powerwall and Megapack remain a key focus, particularly given the segment’s recent growth contribution.

Robotics (Optimus)

Optimus remains early stage, with no disclosed revenue contribution to date. It may become more relevant to Tesla’s longer-term AI and automation aspirations.

Expectations remain delicately balanced between near-term margin pressure, the impact of demand and interest rate movements, and longer-term product and platform developments.

What happened last quarter?

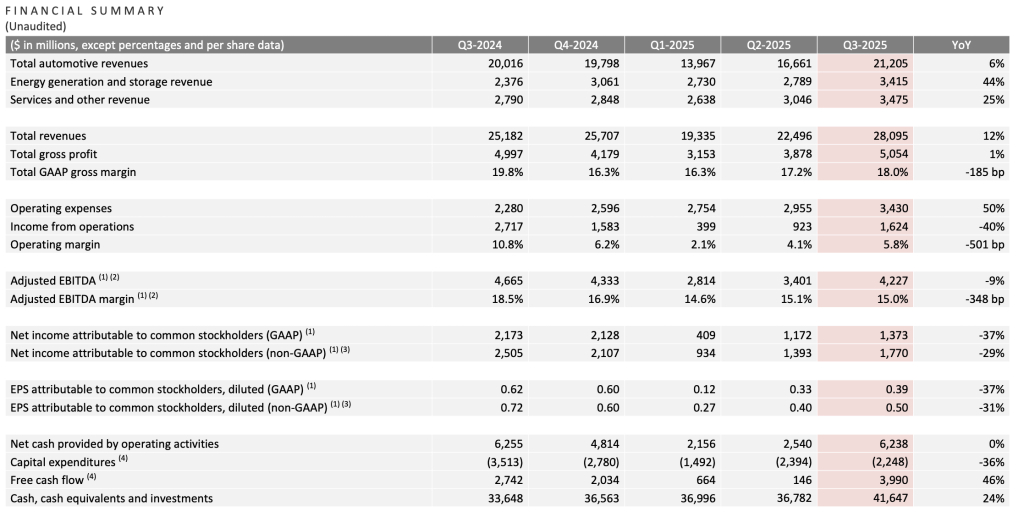

In Q3 2025 (September quarter), Tesla reported mixed results versus consensus expectations. Revenue and deliveries reached record levels, while earnings and margins remained under pressure amid pricing and cost dynamics.

Tesla said it was navigating a challenging pricing environment while continuing to invest for long-term growth (as referenced in the shareholder communications cited below).

Last earnings key highlights

- Revenue: ~US$28.1 billion

- Earnings per share (EPS): ~US$0.50 (non-GAAP, diluted)

- Total GAAP gross margin: ~18.0%;

- Operating margin: ~5.8%

- Free cash flow (FCF): ~US$4.0 billion

- Vehicle deliveries: ~497,099 units, up ~7% year on year (YoY)

How did the market react last time?

Tesla shares were volatile in after-hours trading, with attention focused on margins relative to revenue.

What’s expected this quarter?

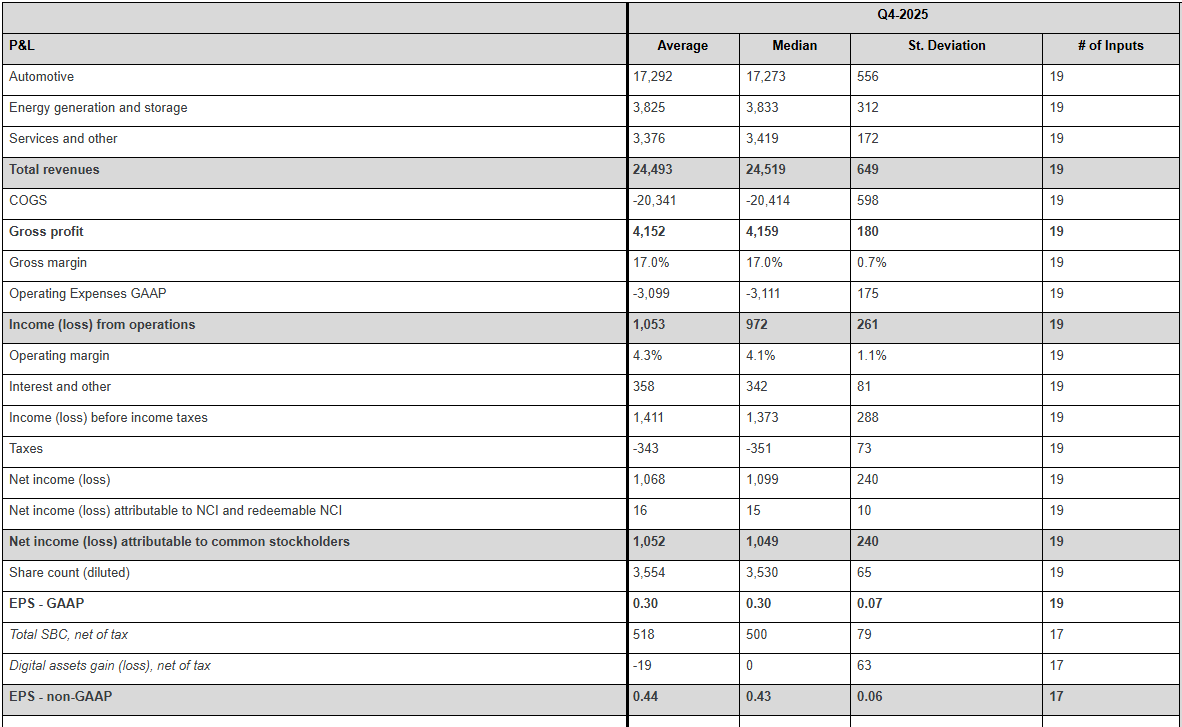

As of mid-January 2026, third-party consensus estimates (Bloomberg) indicated continued focus on revenue growth alongside profitability and margin resilience. These are third-party estimates, not company guidance, and can change.

Key consensus reference points include:

- Revenue: market expectations ~US$27 billion to US$28 billion

- EPS: consensus clustered near US$0.55 to US$0.60 (adjusted)

- Deliveries: market estimates ~510,000 to 520,000 vehicles

- Margins: focus on whether automotive gross margin stabilises near recent levels or trends lower

- Capital expenditure (capex): focus on spending discipline and efficiency rather than acceleration

*All above points observed as of 16 January 2026.

Key areas markets often focus on include:

- Profit margin trajectory, and whether cost efficiencies are offsetting pricing pressure

- Delivery volumes relative to consensus expectations

- Pricing strategy and evidence of demand elasticity across regions

- Capex and implications for future FCF

- Progress in energy storage and non-automotive revenue streams

- Commentary on AI, autonomy and longer-term investment priorities

Expectations

Market sentiment could be described as cautiously optimistic, with investors weighing revenue momentum against margin concerns.

Price has pulled back into a range following a brief test of recent highs in December. Given the recent range-bound price action, deviations from consensus across key earnings metrics may prompt a larger move in either direction.

Listed options were pricing an indicative move of around ±5.5% based on near-dated options expiring after 28 January and an at-the-money (ATM) options-implied expected move estimate.

Implied volatility (IV) was about 47.7% annualised into the event, as observed on Barchart at 11:30 am AEDT on 16 January 2026 (local time of observation).

These are market-implied estimates and may change. Actual post-earnings moves can be larger or smaller.

What this means for Australian traders

Tesla’s earnings may influence near-term sentiment across US growth and technology indices, with potential flow-through to broader risk appetite.

For Australian markets, any read-through is often framed through supply chain sensitivity. Market participants may look to related sectors such as lithium and rare earth producers linked to EV inputs are one potential channel, alongside broader sentiment impacts from Tesla’s innovation commentary.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Upcoming News » 6:30pm Manufacturing Production – GBP Overnight we saw small drops on the DOW and S&P500, Gold settled around its lows still finding support around 1333.50. Oil rallied higher with hopes OPEC will stabilize supply. The USD was mixed as the AUDUSD tested highs.

The USDJPY rallied by 37 pips to test short a term high of 102.55. NAB Australia tips two more RBA rate cuts, despite solid business. Chinese inflation see’s new lows as PBOC signals need for “Innovative” monetary policy.

Asian and local equity markets have been a little stronger than I expected this morning with the Nikki increasing by 86.76 points. ASX200 up by 8.16 points at this point in the session. I expected flatter to slightly weaker sessions today.

The HSI has followed my original thoughts currently lower by 0.19%. The EUR/USD is putting in a stronger Asian session off its lows and holding firm above 1.1070 support. The CAD continues to see sellers as the USDCAD is currently testing its weekly high at 1.3180.

Gold has started to edge lower, I want to see 1333.50 holds on the short term to keep a trend continuation idea in play. I’m seeing some signs we could see some weakness creep into stock indices tonight. A few are sitting and struggling at highs, more on this below.

AUDUSD – Sell idea still forming for me at this point, I’m still looking for it to confirm. Divergence is still present. Buyers are still struggling to break through the upper resistance.

The current move up is in more of an ending diagonal now than a clean cut trend channel. A break out tonight to the upside changes the picture entirely. Until this happens I’m continuing my wait.

GER30 – Seeing a possible sell idea forming. We have seen price hit a previous high and find some selling pressure. The current candle can be seen as an evening star due to its gap.

Divergence is starting to form. A rally tonight through the yesterday’s high cancels this idea out. SPX500 – As with the above, price stalling at highs.

Divergence has formed. I looking for price to close lower tonight to confirm a sell idea. If we have a stronger session tonight and break above 2188 my sell idea will be canceled.

Good Trading. Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets.

You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies. All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market Strategist

Report by Deepta Bolaky A buoyant open on Oil markets this week amidst clampdown on corruption. The sudden arrests of a dozen princes, business tycoons and top officials in Saudi Arabia has caused a rally in oil prices, hitting a 2-year high. UKOUSD and USOUSD Source: GO Markets MT4 It is reported that private airports were closed to prevent jets being used for any escape swiftly after King Salman ordered the arrests.

A new anti-corruption commission has been set up and is being led by King Salman’s 32- year old son, Crown Prince Mohammed bin Salman. The Crown Prince has been praised for his young and fresh attitude towards politics and has shown his determination in shifting Saudi Arabia away from its heavy dependence on oil. He demonstrated commitment towards foreign and social policy and has played a leading role in removing the ban on female drivers.

However, the Prince’s rapid rise in power, austerity measures and recent arrests have reportedly raised concerns over his motives, particularly within his own royal family. The crackdown came at a time when Saudi Arabia also intercepted a ballistic missile over Riyadh. Iran was accused of supplying the weapon fired towards Riyadh’s airport.

Whilst the war of words has escalated between the two countries since the weekend, putting pressure on oil prices, major US indices appear to be subdued, partly because markets were more focused on tax reforms.

Free-falling gold prices The latest weekly chart for gold does not look favourable for the precious metal. Below we can see that in twelve of the past sixteen weeks, gold prices have ended down and is one of the worst runs for the metal in decades. What is surprising is that the demand for gold continues to fall despite an increasingly volatile geopolitical situation unfolding between the US and China.

If anything, the US Dollar appears to be getting stronger as tensions grow, and as a result gold is feeling the pinch. Given the circumstances, we would expect the opposite for XAUUSD. So what are the possible causes for the loss of interest in this market?

In short, we have so many elements at play here that it would be difficult to pinpoint any one reason. However, as follows, there are a few standout factors which deserve mentioning. Overall Demand According to the World Gold Council, we saw a total demand of 1,959 tonnes during the first half of the year.

This amount is the lowest level since 2009, and a further 2,086 tonnes less than the previous year. Rates Hikes Let's also not forget that the Federal Reserve has lifted interest rates twice this year, and plans further additional raises towards the end of the year. This news alone would typically put pressure on gold and silver prices.

It does pose an interesting question though; what if the two remaining rate hikes predicted for 2018 is already fully priced into the market? Given the media hype surrounding the policy decisions, it would make sense that many have considered this aspect before the recent drop. In short, there isn't much scope for a surprise, so it becomes hard to rationalise this latest activity based on this evidence alone.

Investor Sentiment Another factor could be the onwards and upwards march of US equities. Market sentiment currently favours the equities asset class which makes it a more appealing place to invest capital than metals. This mostly risk-on sentiment keeps driving US stocks higher, despite Washington's woes elsewhere around the globe.

So, with the focus squarely on equities, it's perhaps not a great shock that gold is suffering, as investors will generally flock to the highest yields. Unfortunately, gold as a non-interest bearing asset will always come off second best in this scenario. Of course, we also have gold stocks, or more commonly, gold ETF's (Exchange Traded Funds) which are increasingly becoming the popular method of gaining exposure to the metal.

Although, these types of investments appear to have only made things worse as US investors have started shuffling gold ETF funds into other sectors. Perhaps the biggest clue is that ETF's purchased only 60.9m tonnes of gold in the past six months, versus 160.9 tonnes during the same time last year. Technicals As shown on the previous weekly chart, the technicals are noticeably bearish longer-term.

Gold prices are grinding lower to the psychological support level of $1,200 per ounce. Sticking with the longer-term view, if we study the Ichimoku monthly chart above, you'll notice that the $1200 level coincides with the bottom of the cloud formation. I see this going either one or two ways; perhaps we will see the price rebound off this mark and attempt another move towards the $1300 region, or, the slide will turn into an avalanche as the price gravitates towards the $1122.51 lows that were seen in December 2016.

Should we see a close below $1200, I suspect this level will turn to an area of resistance and stifle movement in the short-medium term. As long as the US Dollar holds its ground and investors continue to cherish equities over other asset classes, we will likely see further pressure on gold, silver and commodity trading markets as a whole. By Adam Taylor CFTe This article is written by a GO Markets Analyst and is based on their independent analysis.

They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. Sources: World Gold Council (gold.org), Tradingview, Bloomberg

An Update on Brexit The dust has finally settled after the UK Snap elections and now the United Kingdom can turn their heads to discussions with the European Union about how and on what terms they will leave the Union. The Brexit negotiations officially began on 19 th June in Brussels, the opening day mainly consisted of the timing and structure of the negotiations with actual trade talks expected to begin on 24 th July. One of the main issues that both parties want to get resolved as soon as possible is the status of EU nationals in the UK and the UK citizens living within the European Union.

On 26 th June, Theresa May set out her plans for the EU citizens living in the United Kingdom, advising she wants the EU nationals to stay in the UK. Mrs May outlined that all EU citizens living in the UK before it leaves the EU will be able to apply for a ‘settled status’ but only if the UK citizens will get the same deal within the EU and with the actual trade talks beginning towards the end of July, we should soon see what the details of the Brexit divorce will look like. Financial Markets The Pound When the UK Election results came in, we saw the Pound weakening against the US Dollar as it emerged that Theresa May did not win the majority which meant more uncertainty for Britain going into the Brexit negotiations.

Since then, the Pound has strengthened against the US Dollar, but with the beginning of Brexit talks we can expect some movements in the financial markets in the coming months. Source: GO Markets MT4 FTSE100 We saw the FTSE100 reach record highs at the beginning of June, however since then there has been slight decline in the Index. Source: GO Markets MT4 Economy A lot of people expected the UK economy to slow down drastically after the Brexit vote but instead we saw a steady growth in the months after the result was announced.

The latest economic figures show that UK economy was the worst performer in European Union with economic growth of just 0.2% in the first three months of 2017 with Romania, Latvia and Slovenia with the strongest expansion with 1.7%, 1.6% and 1.5% respectively. However, in terms of year-on-year the UK is still closer to the EU performance and ahead of 19-nation eurozone (EU countries with Euro as their currency). Source: Office for National Statistics Brexit timeline June 2017 saw the start of what looks to be a two year journey which culminates in The United Kingdom leaving the EU.

Source: http://www.parliament.uk/ By: Klavs Valters GO Markets GO Markets may recommend use of software, information, products, or web sites that are owned or operated by other companies (“third-party resources”). We offer or facilitate this recommendation by hyperlinks or other methods to aid your access to the third-party resource. While we endeavor to direct you to helpful, trustworthy resources, we cannot endorse, approve, or guarantee software, information, products, or services provided by or at a third-party resource.

Thus, we are not responsible for the content or accuracy of any third-party resource or for any loss or damage of any sort resulting from the use of, or for any failure of, products or services provided at or from a third-party resource. We recommend these resources on an “as is” basis. When you use a third-party resource, you will be subject to its terms and licenses and no longer be protected by our privacy policy or security practices, which may differ from the third policy or practices or other terms.

You should familiarise yourself with any license or use terms of, and the privacy policy and security practices of, the third-party resource, which will govern your use of that resource.Whilst Go Markets has used reasonable endeavours to ensure that the information provided by Go Markets in the newsletters/reports is accurate and up to date as at the time of issue, it reserves the right to make corrections and does not warrant that it is accurate or complete. News will change with time. Go Markets hereby disclaims all liability to the maximum extent permitted by law in relation to the newsletters/reports and does not give any warranties (including any statutory ones) in relation to the news.

This is a free service and therefore you agree by receiving any newsletter(s)/report(s) that this disclaimer is reasonable. Any copying, redistribution or republicationof Go Markets newsletter(s)/report(s), or the content thereof, for commercial gain is strictly prohibited.

Many traders consider trading daily timeframes but when used to trading the shorter timeframes, overnight holding costs of positions may not be something they have come across previously. This brief article has the aim of understanding why these trading costs exist and how they are calculated. But First…An important message about holding costs… Let us start by stating a little “reality check” perspective.

Holding costs, like “slippage” and Pip spreads are NOT ultimately the deciding factors as to whether you become a successful trader with sustainable positive results. Much is made of these, but the reality is there are other things which are far more impactful such as effective position sizing and appropriate and timely exits from trades. Nevertheless, for those of you that are treating trading seriously enough, indeed, let’s use the term “trading as a business”, as with all the above, holding costs should be considered in your trading.

So how does it work… To understand overnight holding costs it is worthwhile starting by looking at what you are doing when you trade a currency pair. If you are buying 0.5 EURUSD position for example, in practical terms you are ‘borrowing’ US dollars and buying euros with the proceeds. If this position is held “overnight”, (i.e. in practical terms this means at 4.59pm US EST), you pay interest on the US dollars you borrow, but earn interest on the euros you bought.

There is a long rate and a short rate which you can find on your MT4 platform (This obviously changes daily). Rates are set globally, and the actual dollar figure is dependent on the size of position you have. To find this on your platform: a.

Right click on your chosen currency pair in “Market Watch” b. In the drop-down menu choose “Specification”. This brings up a pop-up with details of the contract information relating to that specific currency pair. c.

Scroll down to find the long and short swap rates (the example shown is of EURUSD). This calculation creates either a debit or credit to your account per day (termed the swap rate) and is shown in the “swap” column in your trade window at the bottom of your screen. The calculation is as follows: Current long/short rate x number of lots = swap debit/credit in second currency For example, if we held long 5 mini-lots of EURUSD, the “swap long” shown is Long Swap rate of -12.88.

Therefore this looks like -12.88 x 0.5 (contracts) = -$6.44USD This is then converted into your account currency (so AUD if based in Australia) and shown accordingly as a debit. Likewise, If we held short 5 contract of EURUSD, then the calculation would be: 7.14 x 0.5 (contracts) = $3.57 This is then converted into your account currency) and shown accordingly as a credit. We trust that helps.

Of course, please get in touch with us if you need any more clarity on holding costs at any time. This article is written by an external Analyst and is based on his independent analysis. He remains fully responsible for the views expressed as well as any remaining error or omissions.

Trading Forex and Derivatives carries a high level of risk.

All eyes will be on the Jackson Hole in Wyoming this week, where the annual Jackson Hole Economic Symposium will be held by the Federal Reserve Bank of Kansas City. This years symposium will take place from 23rd until the 25th of August and the topic for the upcoming event will be “Changing Market Structure and Implications for Monetary Policy”. About Jackson Hole Economic Symposium The key feature of the meeting is the discussion that takes place between the participants.

Because of the high-profile participants and the topics that are discussed in the event, there is a considerable interest in the symposium, however, to help foster the open discussion that is critical to the event, the attendance is very limited. The event receives a large number of requests from media agencies worldwide, however, the press presence is also limited to a group that is selected to provide transparency to the symposium. Importance of the event The symposium is closely followed by financial markets participants around the world and over the past decade it has attracted more attention, this is mainly because what has happened in the past.

Some of the biggest monetary policies were initially revealed at the event, although they were not formally announced. During the event, any unexpected comment from any participants can influence the global financial markets. Here are some notable moments from the Jackson Hole Symposium: 2005 – Raghuram Rajan (then the professor at the University of Chicago and former governor of Reserve Bank of India) warned about risks that the financial system had absorbed throughout the years.

Three years later, the US subprime mortgage crisis erupted into the global financial crisis. 2012 – Michael Woodford (macroeconomist and monetary theorist, Columbia University) presented where he said that Fed’s stance on keeping its main interest rate near zero until a certain time would reflect pessimism about the speed of the economy’s recovery. Later that year, the Fed announced it would keep rates near zero until unemployment fell to 6.50% and inflation did not climb above 2.50%. 2014 – Mario Draghi (ECB president) hinted that the ECB was edging closer to embarking on its QE path. During the event, Mario Draghi said that ECB could use ‘all the available instruments’.

His announcement came just two months after ECB introduced negative deposit rates in the Eurozone, the financial markets rallied during his speech at the Jackson Hole. The symposium is a must watch financial market event and it is worth keeping an eye on the discussions and speeches during the event as we may see statements from some of the most influential people from around the world. This year, Federal Reserve Chairman Jerome Powell will headline the event in Jackson Hole with a speech about monetary policy in a changing economy, according to the Fed Board so it’s time to mark your calendars!

Klāvs Valters Market Analyst