Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

Asia-Pacific markets head into the week with Australia’s CPI as the key domestic catalyst, Japan’s month-end inflation and activity data keeping JPY and equities in focus, and China’s official PMI providing an important read on regional growth momentum.

Quick facts

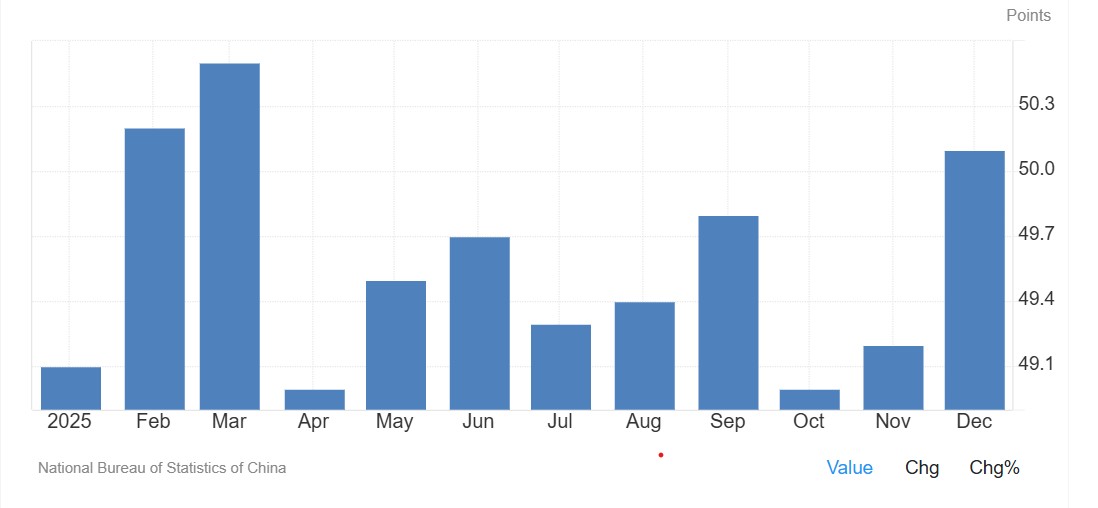

- China: NBS manufacturing PMI rose to 50.1 in December 2025. Consensus for Saturday’s release is 50.2.

- Australia: CPI, Australia (Dec) is the key local catalyst, with implications for rate expectations and AUD pricing.

- Japan: Tokyo CPI and month-end labour/activity data keep USD/JPY and Nikkei futures in focus following last week’s BoJ meeting.

- Global backdrop: US earnings momentum, US CPI expectations and geopolitical developments remain secondary but relevant drivers for Asia-Pacific risk sentiment.

China

Attention turns to China’s official PMI after December’s improvement saw the PMI move back above 50—a level commonly interpreted as expansion in the survey, though month-to-month readings can be volatile.

Consensus suggests a rise to 50.2; if met, it may help reinforce the view that growth momentum is stabilising into early 2026.

Key release

- Sat 31 Jan: NBS manufacturing and non-manufacturing PMI (Jan)

How markets may respond

- Regional equities and risk: Sustained PMI readings above 50 could support broader Asia risk appetite and materials-linked sectors. A reversal below 50 may temper recent optimism.

- AUD spillover: China-sensitive assets, including the AUD and materials stocks on the ASX, may react alongside domestic CPI outcomes.

Japan

Following last week’s BoJ meeting, focus shifts to Tokyo CPI and month-end activity data. These releases late in the week may shape near-term expectations around Japan’s inflation trajectory and the tone of the dataflow.

Key events

- Thu 29 Jan: Tokyo CPI (Jan) (medium sensitivity)

- Fri 30 Jan: Japan unemployment (Dec), retail sales (Dec), industrial production (Dec) (medium sensitivity)

How markets may respond

- USD/JPY: Month-end inflation and activity data can drive front-end rate repricing, with USD/JPY remaining a key transmission channel.

- JP225 (Nikkei futures): The contract has recently traded in a defined range. Market participants may monitor the ~54,250 area on the upside and ~52,250 on the downside as reference points, with price action around these levels often used to gauge whether the range is persisting.

Australia

Australia’s week is dominated by the CPI release. The outcome may influence rate expectations, with the next scheduled RBA decision still in the balance.

ASX 30 Day Interbank Cash Rate Futures imply around a 56% probability of a cash-rate increase at the next scheduled RBA decision (implied pricing can change quickly and is not a forecast).

AUD pricing is likely to remain sensitive alongside broader global risk conditions.

Key release

- Wed 28 Jan: CPI, Australia (Dec) (high sensitivity)

How markets may respond

- ASX 200: Rate-sensitive sectors may react more to the policy implications than the headline CPI number, particularly given recent strength in materials.

- AUD/USD: CPI outcomes may influence whether AUD/USD sustains around/above its current zone or drifts back toward prior trading ranges.

All eyes will be on the Jackson Hole in Wyoming this week, where the annual Jackson Hole Economic Symposium will be held by the Federal Reserve Bank of Kansas City. This years symposium will take place from 23rd until the 25th of August and the topic for the upcoming event will be “Changing Market Structure and Implications for Monetary Policy”. About Jackson Hole Economic Symposium The key feature of the meeting is the discussion that takes place between the participants.

Because of the high-profile participants and the topics that are discussed in the event, there is a considerable interest in the symposium, however, to help foster the open discussion that is critical to the event, the attendance is very limited. The event receives a large number of requests from media agencies worldwide, however, the press presence is also limited to a group that is selected to provide transparency to the symposium. Importance of the event The symposium is closely followed by financial markets participants around the world and over the past decade it has attracted more attention, this is mainly because what has happened in the past.

Some of the biggest monetary policies were initially revealed at the event, although they were not formally announced. During the event, any unexpected comment from any participants can influence the global financial markets. Here are some notable moments from the Jackson Hole Symposium: 2005 – Raghuram Rajan (then the professor at the University of Chicago and former governor of Reserve Bank of India) warned about risks that the financial system had absorbed throughout the years.

Three years later, the US subprime mortgage crisis erupted into the global financial crisis. 2012 – Michael Woodford (macroeconomist and monetary theorist, Columbia University) presented where he said that Fed’s stance on keeping its main interest rate near zero until a certain time would reflect pessimism about the speed of the economy’s recovery. Later that year, the Fed announced it would keep rates near zero until unemployment fell to 6.50% and inflation did not climb above 2.50%. 2014 – Mario Draghi (ECB president) hinted that the ECB was edging closer to embarking on its QE path. During the event, Mario Draghi said that ECB could use ‘all the available instruments’.

His announcement came just two months after ECB introduced negative deposit rates in the Eurozone, the financial markets rallied during his speech at the Jackson Hole. The symposium is a must watch financial market event and it is worth keeping an eye on the discussions and speeches during the event as we may see statements from some of the most influential people from around the world. This year, Federal Reserve Chairman Jerome Powell will headline the event in Jackson Hole with a speech about monetary policy in a changing economy, according to the Fed Board so it’s time to mark your calendars!

Klāvs Valters Market Analyst

The annual Jackson Hole Economic Symposium sponsored by the Federal Reserve Bank of Kansas City has been held since 1978. From 1978-1981 it was held at different locations but since 1981 it has been held in Jackson Hole, Wyoming and this year is no exception. From 24 th – 26 th August 2017, the most influential central bankers, finance ministers, academics and other financial participants from around the world will meet again to discuss the issues facing economies around the globe.

About the Jackson Hole Economic Symposium The key feature of the meeting is discussion that takes place between the participants. Because of the high-profile participants and the topics that are discussed in the event, there is a considerable interest in the symposium, however, to help foster the open discussion that is critical to the event, the attendance is very limited. The topic for the upcoming meeting is "Fostering a Dynamic Global Economy".

The event receives a large number of requests from media agencies worldwide, however, the press presence is also limited to a group that is selected to provide transparency to the symposium. Importance of the event The symposium is closely followed by financial markets participants around the world and over the past decade it has attracted more attention, this is mainly because what has happened in the past. Some of the biggest monetary policies were initially revealed at the event, although they were not formally announced.

During the event, any unexpected comment from any participants can influence the global financial markets. Here are some notable moments from Jackson Hole Symposium: 2005 – Raghuram Rajan (then professor at the University of Chicago and former governor of Reserve Bank of India) warned about risks that the financial system had absorbed throughout the years. Three years later, the US subprime mortgage crisis erupted into global financial crisis. 2012 – Michael Woodford (macroeconomist and monetary theorist, Columbia University) presented where he said that Fed’s stance on keeping its main interest rate near zero until a certain time would reflect pessimism about the speed of the economy’s recovery.

Later that year, the Fed announced it would keep rates near zero until unemployment fell to 6.50% and inflation did not climb above 2.50%. 2014 – Mario Draghi (ECB president) hinted that the ECB was edging closer to embarking on its QE path. During the event, Mario Draghi said that ECB could use ‘all the available instruments’. His announcement came just two months after ECB introduced negative deposit rates in the Eurozone, the financial markets rallied during his speech at the Jackson Hole.

The symposium is a must watch financial market event and it is worth keeping an eye on the discussions and speeches during the event as we may see statements from some of the most influential people from around the world, including FED’s Janet Yellen and ECB’s Mario Draghi, to name a few which could create some volatility in the markets. By: Klavs Valters GO Markets

Upcoming News » 10:30pm GDP - CAD » 10:30pm Advance GDP - USD » Sat 6:00am EBA Bank Stress Test Results - EUR, USD, JPY The JPY saw a wild trading session today as the BOJ boosts dollar lending and ETF purchases. Interest rates to be kept steady at this point. We found out on Wednesday the amount of the stimulus package.

This weekend we have the EBA stress test results, while today was important this could be critical. News has been emerging of the unserviceable debt the Italian Banks are holding. If we have very bad news emerging from these tests it could put real pressure on the European Union.

Some have spoken of a second financial crisis in the EU, lead by the collapse of the Italian banks. I hope we see levels not outside what’s known about currently. If there are very negative results released on Saturday we could see the USD open a lot stronger on Monday.

We had a wild Asian session today on the JPY with the JPN225 and JPY pairs all making strong moves. Today was a classic stay out and watch day. We had strong moves down but the counter rallies were deep.

The USDJPY had a 256 pip range. The JPN255 reached 16732 before dropping down to 16025 45 minutes later. Gold fell $9 and recovered back to a high of 1343 all in 30 minutes of trade.

The AUD, GBP,and EUR had smoother starts to the day all making ground on the USD. The AUS200 has pared early losses to be trading positively at 5575. I’m seeing 5585 as current resistance for the AUS200.

US30 is showing short-term support at 18385. JPN225 – You can see how strong the moves where today off the 15 min chart. Breakout type trades today could have been disastrous.

Two classic bull traps at the top of the range. The two largest moves all happened in under 30 minutes. We did have a nice bounce off the bottom of the range that produced a smooth rally.

I hope seeing this chart takes away the idea of trading events like today. While there was a lot of movement, catching it is the hard part and could have resulted in some good trades but possibly a lot of damage. AUDUSD – We had a very nice rally to start the Asian session.

Once.7544 was touched we have seen a turn..7500 is showing possible support on the 4H chart. This will need to be confirmed. The USD has started to show some strength early in the European session.

Good Trading. All times are in AEST Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets.

You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies. Joseph Jeffriess, GO Markets Market Strategist

The newly-elected populist government in Italy will deliver its very first budget which will be pivotal to the Eurozone area. Italy has the second largest public government debt pile in Europe after the Greeks. The debt to equity ratio in Italy currently stands at 131.81% of its GDP, and market participants are questioning whether Italy will be able to repay its debt.

Debt to GDP ratio (%) [gallery size="large" ids=""] Why is the Italian budget a key event for the markets? The Italian Budget is crucial because it poses a potential threat to the stability of the bloc and the Euro. The Budget will dictate whether the new government will follow the European Union’s rules but most importantly, it will help to gauge whether the coalition parties are getting along well.

The Italian economy might not be able to support a massive spending bill. Investors will be most concerned about the fiscal roadmap of the country. The Five Star and the League have ambitious tax and spending plans which are the foundations of their respective party.

They have vowed to spend more, and for the coalition to work, the spending plans of both parties will have to be considered. The critical question that arises is: “Will the Budget blow the EU’s 3% deficit level?” Being one of the weakest links of the Eurozone, markets participants are wary of the possibility of a debt crisis. The EU has a ceiling level of 3% concerning a budget deficit, and investors are increasingly alarmed at the prospect that Italy might breach this limit.

The Budget will likely be focal in gauging its fiscal discipline. The budget proposals by the new Italian government has also placed Italy on the negative watch for Moody’s rating back in May. The evaluation has been postponed until further information on the budget is revealed.

The markets could see fresh turmoil if credit rating agencies flashed an adverse outlook on what the government is doing. According to the Minister of Finance, the Budget deal will be published in September, and we expect it to bring some volatility in the EUR pairs. Currently, the EURUSD is relieved from its selling pressure on the back on the US dollar weakness.

It is very probable that any noises about the Budget will cap any gains if there are rising fears that it will breach the EU Budget rules. Alongside any developments in the Italian Budget, EUR bulls might want to keep an eye on the Italian bond yields for fresh impetus!!

After being under a tremendous amount of pressure over the five past years, commodities, represented by the Bloomberg Commodity Index, finally started to show signs of relief when they rallied by some 11% (measured from close to close) over the past three months. This may not seem too much, but when you consider that since 1991 only 8% of the times the commodity index has rallied by 11% or more in any three-month period, and the fact that the size of this rally is almost twice the size of average three monthly rallies, then all of a sudden it becomes a meaningful one to watch. In previous articles, we have discussed why commodities, especially gold and oil have rallied so much, but the current question that traders face is whether this trend is going to continue or has it reached the exhaustion point?

In this article, we will look at history and try to answer the above question from purely price action point of view. To do this, we’ve looked for any historical returns that matched the current returns (plus or minus 10% variation to allow for random market fluctuations) and got the models to investigate what has happened to each commodity 1, 3 and six months after such events. The Commodity Index In total, there have been 15 other cases where the Bloomberg Commodity Index has rallied by around 11% over a three-month period.

Out of these, seven happened after the GFC (during the commodity boom), and the rest belong to periods before 2008 through to 1991. The table below shows what’s happened to the commodities each time they rallied by 11% in a three month period. The Commodity Index performance after an 11% rally in three months As you can see, an 11% three-month return doesn’t have much of explanatory power for the next 1-3 months as the number of positive and negative case over the next 1-3 months are almost equal.

While the next 1-3 months are not clear, trend direction in the next six months is in a much better position. Based on the table below, there is a 77% chance that commodities end up being higher over the next six months. Gold For the month ending 29/4/2016, gold was up by 21% compared to the closing price at the end of November 2015.

Since 1928, only 5.6% of the times gold has rallied by 21% or more in any five month period. During this period, gold’s average five-month positive return was around 12.6%. Therefore, the rally from the end of November 2015 to end of April 2016 is significant in both the size and the frequency of gold rallies.

The table below shows what’s happened to gold each time it has rallied by almost 19% over a five month period. Gold’s performance after a 21% rally in five months Like the commodities index, while the table above doesn’t have much to say about the direction of gold in the next 1-3 months, it suggests however, that over the longer term (August onwards) it may resume its rally. Oil As at the end of April 2016, Oil (represented by Brent) was up 39% from the January close.

Out of 331 three monthly returns from 1998 up to now, there have only been 12 cases where oil has rallied by 19% or more in any three months. With the average of positive three-month ret urns being around 14%, the recent rally is rare both in size and frequency. The table below shows what has happened to oil each time it has rallied by almost 39% over a three month period.

Oil’s performance after a 39% rally in three months According to this table, there is a 57% chance that oil keeps on trending higher from May to the end of July. However, this is not a great probability as it’s only slightly better than tossing a coin to predict the future direction of oil. Therefore, I won’t hold my breath on it.

Another concerning point in the short term is the sequence of monthly returns. If Brent manages to finish higher for May, then it would be the fourth consecutive month that oil has posted positive back- to-back returns. Historically, there is only a 40% chance that oil continues trending higher after it’s had four consecutive positive monthly returns.

Therefore, in the short term, I am not confident that oil can continue going higher (unless we get some new news about further supply disruptions which is a different story all together). US Dollar Since none of the above tables were able to give me a rather confident guidance for the direction of commodities over the next 1-3 months, I turned my attention to the USD index for some clues and this time I found something useful. In early May 2013, the USD index briefly dipped below the 93 support level.

However, it wasn’t long before the index rapidly rallied back up and went above its bearish trend line. According to the chart below, the last three times USD bounced back from the 93 support line, it easily rallied to 98 and once even touched the 100 area. Monthly USD index Chart The current rally also ended a three-month losing streak which began in February.

Based on historical data, once the greenback ends a three consecutive losing streak, it usually climbs by an average of 2% in the first month and keeps on appreciating by an average of 3% over the next 2-3 months. The table below suggests there is a 69% chance that the dollar keeps going up in the next 60 days. USD dollar performance after breaking a three month losing streak So no firm sign of exhaustion but… So far in this article, it is reasonable to conclude that while the current rallies in the commodities themselves have not yet reached a specific exhaustion point, due to a 69% chance of stronger dollar in the near term, one should adopt a rather bearish view or at least a conservative view on commodities.

Therefore, it may be the time to take some profits or at least not add any more long positions. Based on technicals, should the USD rally, I can see gold dropping to 1206 and then to the 1150 area. In the case of Brent, my first major support is around $43 with a possible extension to $41.

Weekly AUDUSD Chart Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks.

Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies. Ramin Rouzabadi (CFA, CMT) | Trading Analyst Ramin is a broadly skilled investment analyst with over 13 years of domestic and international market experience in equities and derivatives. With his financial analysis (CFA) and market technician (CMT) background, Ramin is adept at identifying market opportunities and is experienced in developing statistically sound investment strategies.

People often ask me how they can get an edge over other traders in the currency market. My simple answer is this. Study financial market history and it will greatly enhance your profit opportunity because Forex markets will highly likely react the same way each time based on how they reacted last time.

Human beings are what drive all financial markets and as a whole the big money is reasonably predictable in what it will do. It will likely do the same is it did last time when a similar event occurred. Take for example the Yen, which has risen some 17% in 2016 as the BOJ has tried to lower its value by printing more money and putting interest rates into the negative.

Each time the BOJ announces more of the same (money printing & bond and stock buying) the forex market buys more Yen. This is one of the reasons why you have to be in this business for the long haul because the longer you are in the business the more you learn about the history of how the forex market behaves. The average trader often doesn’t want to do the time and they want the profits quickly without doing the forex trading apprenticeship that is required.

This does not mean sitting in front of a computer for hours a day it simply means reading for 15 or 20 minutes a day about why price is moving. The chart is NOT making the price move, the news is making the price move and the chart is simply a reflection of how traders have interpreted the news and bought up or sold off a currency. Join with me and become a detective of forex trading and you will highly likely enhance your profit making potential.

You can join me every Wednesday evening at 7pm AEST for a free one-hour live currency coaching session. Simply click on this link to join the session. http://gomarkets.webinato.com/room1 Andrew Barnett | Director / Senior Currency Analyst Andrew Barnett is a regular Sky News Money Channel Guest and one Australia’s most awarded and respected financial experts, and is regularly contacted by the Australian Media for the latest on what is happening with the Australian Dollar. Connect with Andrew: Email