Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

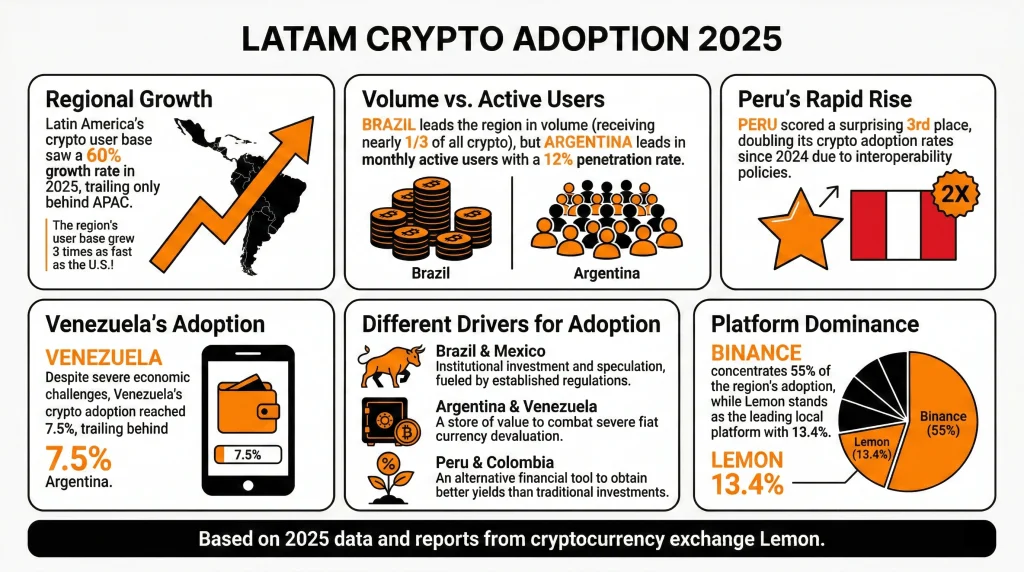

A América Latina (LATAM) registrou mais de 730 bilhões de dólares em volume de criptomoedas em 2025, um aumento de 60% em relação ao ano anterior que tornou a região responsável por cerca de 10% da atividade global de criptomoedas.

Em 2026, os atores institucionais estão começando a levar a região a sério, a regulamentação está se cristalizando e os fatores estruturais de 2025 não mostram sinais de enfraquecimento. Mas a região não é uma história única, e 2026 testará se o momento atual se baseia em fundamentos sólidos ou em otimismo especulativo.

Fatos rápidos

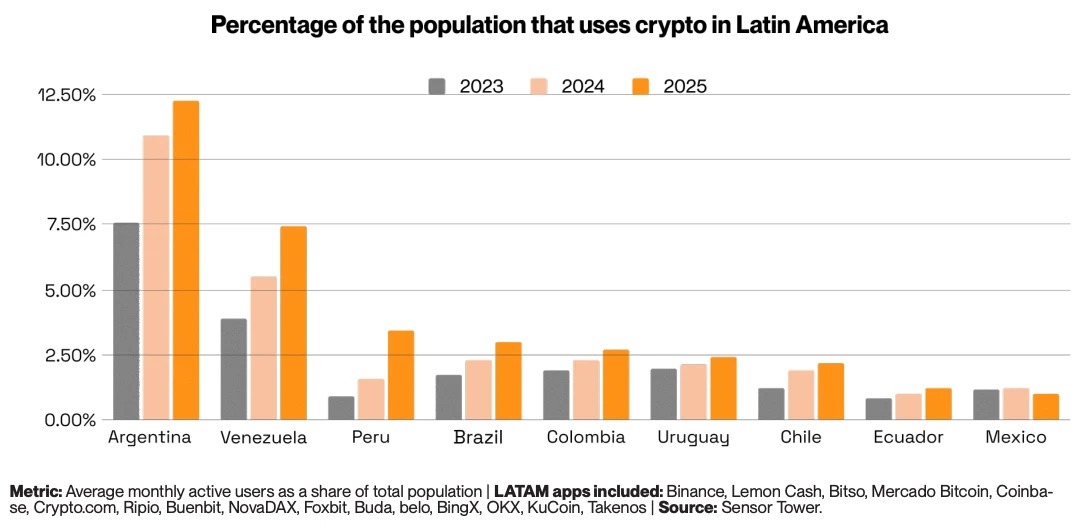

- Os usuários ativos mensais de criptomoedas da LATAM cresceram 18% em relação ao ano anterior (YoY), três vezes mais rápido do que os EUA.

- A Argentina atingiu 12% de penetração mensal de usuários ativos, representando mais de um quarto da atividade criptográfica da região.

- Mais de 90% dos fluxos de criptomoedas brasileiros agora estão relacionados a stablecoins.

- Três países da América Latina estão no top 20 global: Brasil (5º), Venezuela (18º), Argentina (20º).

- Os downloads de aplicativos criptográficos do Perú cresceram 50% em 2025, com 2,9 milhões de downloads.

Da ferramenta de sobrevivência à infraestrutura financeira

A América Latina não adotou a criptomoeda por causa da especulação. Ela o adotou porque os sistemas financeiros tradicionais repetidamente falharam com pessoas comuns. Nos últimos 15 anos, a inflação média anual nas cinco maiores economias da região foi de 13%, em comparação com apenas 2,3% nos EUA no mesmo período.

Na Venezuela, chegou a 65.000% em um único ano. Na Argentina, ultrapassou 220% em 2024. Para milhões de pessoas, manter as economias em moeda local foi um lento ato de autodestruição. As stablecoins se tornaram a resposta natural. Os ativos digitais atrelados ao dólar americano ofereciam uma reserva confiável de valor, transferibilidade sem fronteiras e acesso sem uma conta bancária.

Ao contrário do Ocidente, onde a criptografia é vista mais como um instrumento especulativo, na América Latina ela se tornou uma ferramenta financeira necessária. No entanto, os fatores de adoção não são totalmente uniformes em toda a região. Brasil e México são histórias institucionais, impulsionadas pela participação regulada no mercado e por atores financeiros estabelecidos.

A Argentina e a Venezuela continuam sendo jogadoras de reserva de valor, com a criptografia servindo como uma proteção direta contra o colapso fiduciário. E o Perú e a Colômbia são mercados mais lucrativos, onde a criptografia oferece retornos que as contas de poupança tradicionais não conseguem igualar.

Com que rapidez a LATAM está adotando a criptografia?

O volume de criptomoedas em cadeia da LATAM aumentou 60% em relação ao ano anterior em 2025. A região registrou quase 1,5 trilhão de dólares em volume cumulativo desde meados de 2022, atingindo um recorde de 87,7 bilhões de dólares em um único mês em dezembro de 2024.

Os usuários ativos mensais de criptomoedas em toda a América Latina também cresceram 18% em 2025, três vezes mais rápido do que nos EUA.

As Stablecoins são o principal veículo que impulsiona essa adoção. Dos $730 bilhões recebidos em 2025, $324 bilhões passaram por transações de stablecoin, um aumento de 89% em relação ao ano anterior. No Brasil, mais de 90% de todos os fluxos de criptomoedas estão relacionados a stablecoins e, na Argentina, as stablecoins respondem por mais de 60% da atividade.

Olhando para o futuro, prevê-se que o mercado de criptomoedas da América Latina alcance US$442,6 bilhões até 2033, crescendo a uma taxa anual composta de 10,93% a partir de 2025, de acordo com o IMARC Group.

Para os traders, a velocidade de adoção importa menos como manchete do que o que a impulsiona: uma região de 650 milhões de pessoas construindo infraestrutura financeira paralela em tempo real, com stablecoins como base.

A virada institucional

Durante a maior parte da história da criptografia da LATAM, a adoção foi de baixo para cima. Usuários de varejo sem conta bancária ou sem conta bancária impulsionaram volumes por meio de bolsas locais. Essa imagem agora está mudando no topo do mercado.

Em fevereiro de 2026, o Crypto Finance Group, parte da principal operadora global de câmbio Deutsche Börse Group, anunciou sua expansão na América Latina, visando bancos, gestores de ativos e intermediários financeiros que buscam infraestrutura de custódia e negociação de nível institucional.

Bancos e fintechs tradicionais estão seguindo o exemplo. O Nubank agora premia os clientes por possuírem USDC. A bolsa B3 do Brasil aprovou os primeiros ETFs XRP e SOL à vista do mundo, à frente dos EUA, em 2025. As bolsas centralizadas, incluindo Mercado Bitcoin, NovaDAX e Binance, listaram coletivamente mais de 200 novos pares de negociação denominados em BRL desde o início de 2024.

Em março de 2025, a fintech brasileira Meliuz se tornou a primeira empresa de capital aberto no país a lançar uma estratégia de acumulação de Bitcoin, agora detendo 320 BTC.

“A adoção de criptomoedas na América Latina já está em escala global. O que o mercado precisa agora é de governança de nível institucional, e é exatamente por isso que estamos aqui”, — Stijn Vander Straeten, CEO do Crypto Finance Group

Caso de uso de remessa criptográfica

A América Latina recebe centenas de bilhões de dólares anualmente de trabalhadores no exterior, tornando as remessas um dos casos de uso de criptomoedas mais concretos e mensuráveis da região. Os serviços de transferência tradicionais cobram em média 6,2% por transação. Em uma transferência de USD 300, são aproximadamente USD 20 em taxas.

A infraestrutura baseada em blockchain oferece, de forma mais ampla, reduções drásticas de taxas. O Bitcoin traz custos para cerca de USD 3,12 por USD 100 transferidos. Embora alternativas mais baratas, como a infraestrutura de camada 2 de XRP ou Ethereum, possam reduzir isso para menos de USD 0,01.

Para um trabalhador migrante que envia USD 1.500 para casa no Perú, mudar de um banco antigo economiza mais do que o salário semanal peruano médio apenas em taxas.

Ambiente regulatório de criptomoedas da LATAM

A variável que mais determinará se a LATAM está à altura de seu potencial de 2026 é a regulação de criptomoedas. E aqui, a imagem é genuinamente mista.

O Brasil lidera a região com sua Lei de Ativos Virtuais, que abrange segregação de ativos, licenciamento VASP, requisitos de AML/KYC e padrões de capital. Também implementou a Regra de Viagem para transferências domésticas do VASP, que entrou em vigor em fevereiro de 2026. No entanto, algumas propostas mais controversas, incluindo um limite de USD 100.000 para transações transfronteiriças de stablecoin e a proibição de transferências de carteira de autocustódia, permanecem sob consulta ativa.

A Lei Fintech de 2018 do México continua sendo um dos primeiros reconhecimentos formais de ativos virtuais do mundo. A Lei Fintech de 2023 do Chile estabeleceu licenças para bolsas, carteiras e emissores de stablecoin, reconhecendo formalmente os ativos digitais como “dinheiro digital”.

A Bolívia reverteu uma proibição de criptomoedas de uma década em junho de 2024 ao autorizar transações regulamentadas de ativos digitais. A Argentina introduziu o registro cambial obrigatório em 2025. E El Salvador continua expandindo as iniciativas econômicas tokenizadas, apesar de remover o status de moeda legal do Bitcoin.

Dez países da região agora têm algum tipo de estrutura formal de criptografia. Mas para os comerciantes, a divergência regulatória continua sendo um risco real e, como o Brasil recebe quase um terço de todo o volume de criptomoedas da América Latina, qualquer reversão significativa de política pode ter consequências descomunais.

O que os traders devem observar

O impulso institucional do Brasil é a tendência estrutural mais significativa. Com um volume de 318,8 bilhões de dólares em cadeia em 2025, o Brasil é efetivamente o mercado da América Latina.

O resultado da consulta da stablecoin no Brasil pode ter uma grande influência. Uma restrição às stablecoins estrangeiras em pagamentos domésticos impactaria diretamente a classe de ativos mais negociada no mercado dominante da região.

A Argentina é o jogo da volatilidade. A penetração mensal de usuários ativos de 12% e 5,4 milhões de downloads de aplicativos criptográficos em 2025 sinalizam um engajamento profundo e crescente do varejo.

A Colômbia é um mercado de alerta precoce a ser observado. A depreciação de 5,3% do peso em 2025 e o aprofundamento da crise fiscal estão impulsionando as entradas de stablecoin em um padrão que reflete a trajetória da Argentina em anos anteriores. Se a situação macro da Colômbia se deteriorar ainda mais, a adoção de criptomoedas poderá acelerar.

Também existe um risco de concentração cambial em jogo. A bolsa de criptomoedas Binance é a principal bolsa para mais de 50% dos usuários de criptomoedas da América Latina. Se a bolsa enfrentar qualquer ação regulatória, interrupção operacional ou choque competitivo, ela poderá ter um impacto enorme no mercado.

Conclusão

O mercado de criptomoedas da América Latina entrou em uma nova fase. Os fatores estruturais que causaram a demanda inicial de criptomoedas na região não desapareceram: inflação, remessas, exclusão financeira e instabilidade cambial ainda estão em jogo.

O que mudou foi a camada que está sendo construída sobre eles. Infraestrutura institucional, estruturas regulatórias, adoção de tesouraria corporativa e capital cambial global fluindo para uma região que era, até recentemente, amplamente independente.

O crescimento de volume de quase -250% do Brasil em 2025 e sua posição de receber quase um terço de todas as criptomoedas da América Latina são os principais desenvolvimentos do mercado. Sua trajetória regulatória, decisões de política de stablecoin e pipeline de ETF definirão efetivamente o tom para a região em 2026.

Para os traders, os principais números de crescimento são reais, assim como os riscos de concentração, as incertezas regulatórias e as divergências em nível de país que estão abaixo deles.

USD rallied in Tuesday’s session, with the US dollar Index hitting a 2024 high of 106.510 after hawkish Fed Chair Powell commentary where he noted recent data was showing a lack of further progress on inflation. Powell also added that if higher inflation persists the Fed can maintain current rate as long as needed. On data, building permits and housing starts came in beneath analyst expectations while industrial production was in line with forecasts but manufacturing output beat.

USDJPY moved higher for a 5 th straight session, with the pair closing the New York session at highs of 154.78. There was what appeared to be an intervention earlier in the US session with a steep 100 pip drop on no headlines that quickly retraced. This looked like a shot across the bow from the BoJ with market participants suspecting intervention and will likely strengthen expectations that 155.00 is the line in the sand for Japanese officials.

Data releases this week have hinted that the strong US activity story may be about to turn. The ISM services index declined more than expected, with the “prices paid” component slowing meaningfully to a four-year low. Yesterday, the NFIB reported that small business was looking to cut back on hiring and with small businesses accounting for almost half of total US jobs suggest we could see sub-50k payrolls by June.

Today’s March NFP figure is expected at 214k with some economists predicting a miss to the downside, a print below 200k should put pressure on the dollar given it’s high sensitivity to data recently as the market tries to get ahead of future Fed actions. The US Dollar Index (DXY) is currently trading between resistance at 105, which was the February high, and support at the psychological 104 level. Both these levels will be in play on the back of today’s NFP, FX traders will be watching for breaks or holds of these key levels to gauge short term momentum for DXY.

A May cut from the Fed looks off the table, but June remains in play with odds currently at 60% in the Fed Funds futures market. Should the pricing for a June cut move from 60% to 100%, the dollar may well take a bigger hit than what the swing in rate differentials would imply.

USD continued the move lower sparked by a somewhat dovish Powell in Wednesdays FOMC meeting. And ahead of today’s key NFP print. DXY did hit highs after hot labour costs data, though quickly reversed to hit 3-week lows of 105.29, closing at session lows and looking to test the major support at 105.

JPY was the clear outperformer of G10 currencies, helped by a Reuters report that BoJ data suggesting that the sharp spikes in Yen strength on Monday and Wednesday this week were indeed BoJ intervention. USDJPY dropping almost 4.5% from the spike high early in Monday’s session to be hovering just above the 153 mark coming in to today’s APAC session. CHF was also an outperformer in Thursday’s session, led higher by a hot April Swiss CPI print where the headline figure of 1.4% Y/Y was well above the expected 1.1%.

USDCHF dropped to a low of 0.9094 before finding some buyers at the April support level of 0.9085, this will be a key level to watch in this pair ahead oh US NFP later today.

Mondays FX trade was relatively quiet on ahead of a some key central bank meetings today in the RBA and especially the BoJ. USD saw gains with the Dollar Index (DXY) rising from lows of 103.33 to highs of 103.65, with the index heading into APAC trade near Monday’s session high after yields were higher across the curve ahead of key risk events this week. JPY stuttered against the Dollar with USDJPY rising slightly and holding above the 149 level ahead of today’s BoJ rate decision.

The latest from Nikkei suggests the BoJ is set to end NIRP, end YCC and also end ETF purchases at today’s meeting. Markets are not fully convinced though with rates futures pricing in around a 50-50 chance of a move from the BoJ today, with April being the timeline some economist’s favour. AUDUSD was flat ultimately flat with AUDUSD rallying modestly in the APAC and UK session before paring gains in the US session ahead of today’s RBA meeting.

The Aussie central bank is widely expected to hold rates, but it will be the statement and presser to see what level of tightening bias (if any) the RBA still holds that will move the Aussie. Gold bounced back modestly, despite a mostly bid USD and higher yields, finding buyers and holding the key 2150 USD an ounce support level.

The negative dollar reaction to a modest tick-up in US jobless claims yesterday (231k versus consensus 212k) where the US Dollar Index (DXY) dropped from session highs at 105.74 to close at session lows of 105.20 seems to be telling FX traders that tells us that: a) markets are probably lacking some sense of direction in the period between payrolls and US CPI. b) the generally overbought dollar remains quite vulnerable to even slightly softer US data releases. c) markets may be buying in more convincingly on the softening US jobs market narrative. Beyond very short-term price movements, it’s looking like the key for the USD to trend materially lower remains inflation. Consensus is looking at 0.3% month-on-month core CPI print on Wednesday, which is still too high for the Fed to start cutting rates this summer.

Today’s US calendar includes only the University of Michigan surveys. Markets will be watching closely whether the medium and long-term inflation expectations have moved at all from April’s 3.0/3.2% levels. From the Fed the most interesting speaker will be Neel Kashkari, who recently argued for a higher neutral rate, which would suggest current monetary policy is not as restrictive as perceived.

USD was notably lower after what was seen as a dovish FOMC meeting on Wednesday. The Fed 2024 median dot was left unchanged with 3 cuts for 2024 still the Fed forecast but the dovish part came at the presser where Fed Chair Powell downplayed the hot January and February CPI numbers. This dovish tilt saw risk assets surge and the USD dump.

USDJPY bucked the weak Dollar trend pushing up to 152 before the result from the FOMC saw it pare some of those gains. A hawkish BoJ source reporting in Nikkei that suggested another hike could come in July or October also supporting the Yen somewhat. There is also speculation if the Yen weakness were to continue the BoJ/MoF could step in to intervene, with ING noting that local accounts felt that 155 would be red line.

Gold ripped to all time highs, with XAUUSD hitting a high of 2222 USD an ounce on the back of USD weakness and falling yields post FOMC, before falling back just above the old high at 2195 heading into the APAC session. Today ahead, more Central Bank action out of the BoE and SNB for FX traders to look forward to.