IntroductionSo, what is a Trading Edge?There is much written and many videos on social media that are out there singing the praises of developing a trading edge, and why it is a must if you want trading success, BUY in terms of practical “how do a get one” advice, most that is written seems to fall short of something substantive that you as a trader can work with.When you read articles discussing the concept of an "edge," they're talking about having some kind of advantage over other market participants; after all, there are always winners and losers in every trade.However, many traders are often mistakenly informed that edge relates solely to a system, but the reality is that it encompasses so much more than that. While systems certainly matter, your edge also includes how you think, act, and execute under pressure when YOUR real money is on the line.Your advantage may stem from speed, knowledge, technology, or experience, or better still a combination of all of these, the key point here is that you're not trading like so many others without the appropriate things in place and the consistency that is required when trading any asset class, on any timeframe to achieve on-going positive outcomes.Here's something worth considering before we have a deeper dive into your SEVEN secrets. Simply having a plan, trading it consistently, and evaluating it regularly gives you an advantage over more than 75% of traders out there. Most market participants lack these basic but critical elements of good trading practice. Just doing these fundamental things already puts you ahead of most, but refining further will truly set you apart from the crowd.At its core, a trading edge can be defined as a consistent, testable advantage that improves your odds over time. It's not about achieving perfection but developing repeatability in results and establishing statistically positive, i.e. evidence-based action that will work in your favour.So, despite what you may have seen or heard previously, a complete edge combines idea generation, timing, risk management, and execution; it's not just about focusing on high probability entries. It's a whole process, not a single isolated rule or signal.Just to give an example, a trading system that wins only 48% of the time may not seem that impressive on the surface to many, but if it consistently delivers a 2.5:1 reward-to-risk ratio can still achieve long-term profitability. The key issue in this example is the combination of numbers that creates the result, AND the word consistently.That IS an edge.In this article, we will explore SIX things that are not so regularly talked about in combination, this is the difference, and an approach that can move you towards creating such an edge.As we move through each of these, use this as your trading checklist for potentially taking action on the things that you need to take to the next level, and so take affirmative steps to sharpen your edge.Secret #1: An Edge Is Something You Build, Not Something You FindAs traders, we are always looking for the “holy grail”, that system or indicator that means we will be a success. As previously discussed, that is NOT what constitutes an edge. We need to let go of the idea that there's something magical waiting to be discovered and get to work on the things we need to.Your edge comes from testing, refining, and aligning strategies with your personal strengths and market access. The best edges are customised to your specific goals and circumstances, not simply downloaded from someone else's playbook, you may have heard on a webinar, conference or TikTok post.Your strategies should be a natural fit with your daily routine, available tools, trading purposes, and emotional style. If your approach you choose clashes with your lifestyle, mindset or experience, your execution and results will invariably suffer when you are in the heat of the market action and have decisions to make. For example, if you are a trader working a full-time job, it may be wise to either build a 4-hour chart trend model that matches your limited availability, consider some form of automation or restrict yourself to small windows of opportunity on very short timeframes for times that you can ringfence.We often come across systems that look attractive on the surface. When you copy others, you might get their trades, but you won't have their conviction (belief in your trading system is critical in terms of execution discipline) or context, e.g., their access to markets, and so you will find that you won't match their published results.Without the required deeper understanding of why a strategy works, you'll struggle to stick with it through the inevitable trades that don’t go your way, and drawdowns that WILL always test your resolve to keep with any system.So, the key takeaway is that you must make the investment in time, in yourself as a trader and do the work as you move towards building your edge. There are no shortcuts!Secret #2: Probability of Your Edge Is Only as Good as Your DataData that you can use in your decision-making for system development and refinement can come from accessing historical test data, but more importantly, YOUR results in live market trading (whether from journaling or automated tracking).The strength of this in developing an edge depends directly on two key things.Firstly, on data being clean, i.e. the key numbers relating to what happened, and sufficient detail with a sufficient critical mass of results that allows you to see beyond the profit/loss of a handful of trades. The meticulous recording to a high quality of this evidence makes it a priority if you are to create something meaningful on which to base decisions.Poor data creates false confidence in any system developed on such with fragile strategy and forces you to rely on guesswork to fill in any gaps or because you simply haven’t got enough numbers on which to make a strategic decision.Think about this for a moment, if you have 60 trades, across three strategies, and then of those 20 trades per strategy, 10 are FX and 10 are stock CFDS, and of those 10, 5 are long and 5 are short trades, to make substantive decisions on 5 trades hardly seems like enough evidence on which to base something so important. To think that this is ok, go full tilt into the market, your confidence based on a sample so small, there is a high chance your strategy will likely break under real market pressure.Always ensure the market conditions in your testing environment reasonably match your live trading environment.Even when using backtests to try to get more evidence, which on the surface seems worthwhile, it is not without pitfalls unless due care is taken. For example, back tests performed exclusively during trending market periods won't adequately prepare your system for range-bound price action.Secret #3: Simplicity May Beat Complexity Under PressureSimple systems prove easier to create, allow you to find errors when they are occurring, and of course follow in the heat of inevitably volatile market moments. The more clarity you have about exactly what to do and when, significantly reduces hesitation and increases follow-through when decisive trading action may matter most.A complex system, as a contrast, increases your “thinking load”, slows your reaction time when speed of decision may count, and if you have 14 criteria to tick before action, may lead to the “that’s close enough” temptation for trade actions. Adding more indicators without evidence rarely does anything but make your charts look more impressive and typically leads to more doubt and “short-cutting” rather than better results.As a formula, more rules = more system and trader fragility, which is potentially a good rule of thumb to have in place.Consider how some automation, for example, the use of exit-only EAS, can help simplify the execution of otherwise complex situations and achieve consistency.It is not inconceivable that a trader using a simple price-only breakout strategy consistently outperforms another with a 12-indicator system by executing cleanly during volatile news events when others freeze with so-called “analysis paralysis”.Secret #4: Edge Disappears Without Execution DisciplineYou could have the most brilliant, robustly tested, evidence-based strategy on the planet and yet the reality of why many traders fail to reach their potential is at the point of action. Plans are often skipped, rushed, or mismanaged, and the harsh reality is that your system of systems that you have invested a considerable amount of effort and time to develop may crumble without precise, consistent and disciplined execution.Emotional interference in decision making is something we discuss regularly at education sessions, whether from fear of loss, greed, revenge trading or the fear of missing out on potential profit, can kill performance, even when presented with textbook setups and times when price action is telling you it is time to get out. Even momentary lapses in judgment and actions originating from cognitive biases can undo hours or days of careful preparation or remove the profit from several previous trades.Recency bias can creep in quickly, even after a couple of losses, where hesitation in action in an attempt to avoid the same again costs you the opportunity that the “plan-following” trade can give you.What brings your edge to life is consistency in action, not just having a good plan. The discipline of follow-through can transform a considered and carefully developed system into actual profits, and quite simply, to fail to do this is unlikely to deliver the results you seek.Secret #5: Evolve or Expire — Markets Consistently Change, So Should YouMarket circumstances, fundamental drivers and shifts in these create different conditions not only in price action and direction, but volatility and effects in sentiment can be changed for the long term, not just the next hour. If markets evolve to a new way of acting, it is logical that your systems must, at a minimum, be able to accommodate this. This is part of your potential edge that few traders master (or even look at!), but your systems must evolve accordingly when markets change. What works brilliantly in the last few months may not necessarily work forever—diligently monitor changes and adjust your approach.Static systems will potentially degrade in outcomes without regular review and adaptation, or at best have significant periods of underperformance. Perhaps think of your strategy as requiring a review and maintenance plan like any sophisticated machine.In practical terms, system evolution means identifying when strategies do well and not so well, including evaluation of performance in different market conditions. With this information, you can make informed changes based on evidence, not random tinkering or looking for the next new indicator to add.Remember, you always have the ultimate sanction of switching a strategy off completely during specific market conditions that may mean risk is increased.Secret #6: Effective Risk Management Is an Edge MultiplierIt is difficult when talking about a multi-factor approach to hone down on the most influential factor, but this may be it.Your position sizing approach in not only single but multiple trades determines whether your edge, even when followed to the letter, can scale profitably or self-destruct dramatically. The same system can either give you ongoing positive outcomes or destroy an account based depending on how you size your positions.Risk too much, and you'll potentially blow your account up; risk too little, and you'll generate gains that make little difference to the choice you can make with any trading success.Your sizing should align with both your system's statistical properties as we discussed before and your psychological comfort zone, as the latter is equally something that will develop over time with sufficient belief in your system – a key factor as we have discussed at length in other articles, in the ability to be disciplined in trade execution.Only scale your position sizing after accumulating a critical mass of trades and establishing a clear set of rules based on a record of positive trading metrics for doing so. Premature scaling should only be done when you have proved not only that your system looks as though it performed favourably but also that you have the consistency to move to the next level.Finally on this point, and perhaps the topic of a future article in more detail, concerning the previous point relating to market conditions, once you have developed a way of identifying market conditions and fine tune strategies accordingly, there is of course the possibility of using this information to position size more effectively, To give a simple example something like market condition A =1% risk, market condition B = 2% risk.Summary and Your Actions...As stated earlier, a good approach to this article is to use it as a checklist. Invest some time to review the material covered here and make a judgment of where you are right now with some of the things covered.For some of you, there may be a few things to work on; for others, it may be just some checking and fine-tuning. Either way, identify at least one specific area to work on immediately. One insight that you implement properly is worth far more in terms of the difference it can make than a few insights you just acknowledge but forget to take action on.Ask yourself honestly: "On a scale of 1-10, how do I perform on each of the above in the pursuit of my current trading edge?Or perhaps where would I like it to be six months from now?"Build yourself a roadmap to achieve these, and of course, commit to and follow through in making it happen.

The 6 Secrets of Developing a Trading Edge – What it is and how you get one!

Related Articles

Recent Articles

市场将进入未来一周,澳大利亚和日本的通货膨胀数据,以及地缘政治紧张局势的加剧,继续影响能源价格和更广泛的风险情绪。

- 澳大利亚居民消费价格指数(CPI): 通货膨胀数据可能会影响 澳大利亚储备银行(RBA))政策路径,澳元(AUD)和当地收益率对任何意外都很敏感。

- 日本数据集群: 东京消费者价格指数(初值)加上工业生产和零售销售提供了通货膨胀和活动脉冲,可能会影响日本银行(BoJ)的正常化预期。

- 欧元区和德国居民消费价格指数: 通胀速率数据将考验反通货膨胀的说法,并影响欧洲央行的降息时机预期。

- 石油和地缘政治: 由于中东紧张局势再起,布伦特原油创下2025年8月8日以来的最高收盘价,这加剧了能源驱动的通胀风险。

澳大利亚消费者价格指数:澳大利亚央行的预期会发生变化吗?

澳大利亚即将发布的消费者价格指数将受到密切关注,以了解通货膨胀是否稳定或超过预期的持续性。

随着利率预期的调整,强于预期的印刷量可能与更高的收益率和更高的澳元走强有关。较软的结果可能会支持人们对更稳定的政策立场的预期。

关键日期

- 通货膨胀率(MoM): 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

- CPI: 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

监视器

- 澳元在发布前后波动。

- 地方债券收益率反应。

- 利率定价变化。

日本通货膨胀和增长数据

日本周末发布的公告将东京消费者价格指数(初值)与工业生产和零售销售相结合,为价格压力和国内需求提供了更广泛的解读。

东京消费者价格指数通常被视为全国通胀动态和日本央行辩论的及时信号。工业产出和零售支出增加了活动的背景。

整个集群的意外情况可能会推动日元的急剧波动,特别是如果结果改变了人们对日本央行正常化步伐和持续性的看法。

关键日期

- 东京居民消费价格指数: 2月27日星期五上午 10:30(澳大利亚东部夏令时间)

- 工业生产: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

- 零售销售: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

监视器

- 日元对通胀意外敏感度

- 债券收益率因活动数据而变动

- 如果增长势头预期发生变化,股市的反应

能源和避险流动

在中东紧张局势再次爆发的情况下,油价已攀升至2025年8月8日以来的最高收盘价。

最近关于霍尔木兹海峡附近地区军事活动加剧和航运风险头条的报道加强了能源安全作为市场关注的焦点。霍尔木兹海峡仍然是全球能源流动受到广泛关注的阻塞点。

油价上涨会刺激通胀预期并影响债券收益率。同时,地缘政治的不确定性可以通过避险需求和相对利率定位来支撑美元。

监视器

- 布伦特原油价格水平

- 美元兑主要货币走强

- 随着通货膨胀风险溢价的调整,收益率变动

欧元区和德国的通货膨胀

德国和整个欧元区(HICP)的快速通胀数据将测试该地区的反通货膨胀趋势是否保持不变。

德国的发布可能会影响欧元区总体数据之前的预期。如果核心通胀被证明是棘手的,那么对欧洲央行可能放松政策的时机和步伐的预期可能会发生变化。

关键日期

- 德国通货膨胀率: 2月28日星期六上午12点(澳大利亚东部夏令时间)

监视器

- 欧元围绕通胀数据波动

- 欧洲主权债券收益率

- 降息概率调整

关键经济事件

从科技颠覆者到国防承包商,一些市场上最受关注的公司开始了首次公开募股(IPO)的公开征程。对于交易者来说,这些首次公开上市可能代表一个独特的交易环境,但也是一个不确定性加剧的时期。

事实速览

- 首次公开募股是指私人公司首次在公共证券交易所上市其股票。

- 首次公开募股可以让交易者尽早进入高增长的公司,但波动性较大,价格历史有限。

- 上市后,交易者可以通过直接购买股票或衍生品获得对IPO股票的敞口,例如 差价合约(CFD)。

什么是首次公开募股(IPO)?

首次公开募股是指公司首次向公众发行股票。

在进行首次公开募股之前,公司的股票通常仅由创始人、早期员工和私人投资者持有。上市使任何人都可以购买股票。

根据公司的规模,它通常会在当地证券交易所上市其公开股票(例如 ASX 在澳大利亚)。但是,一些大估值公司选择只在纳斯达克等全球证券交易所上市,无论其主要总部位于何处。

对于交易者而言,首次公开募股通常是获得公司股票敞口的第一个机会。鉴于价格历史的有限和对情绪波动的敏感性,它们可以创造一个波动性和流动性增加的独特环境,但也会带来更高的风险。

公司为什么要上市?

进行首次公开募股的最大推动力是获得更多资金。在公共交易所上市意味着公司可以通过出售股票筹集大量资金。

它还为现有股东提供流动性。创始人、早期员工和私人投资者经常在公开市场上出售其现有资产的一部分,从而实现他们多年支持的回报。

除了金钱收益外,上市还意味着公司可以使用股票作为收购的货币,并提供股权薪酬以吸引人才。公开估值提供了透明的基准,这对于战略定位和未来筹资很有用。

但是,它确实需要权衡取舍。上市公司必须遵守持续的披露和报告义务,如果许多公司专注于短期业绩,来自公众股东的压力可能会成为长期进展的障碍。

首次公开募股流程如何运作?

虽然具体情况因司法管辖区而异,但从私营公司到公开上市通常涉及以下阶段:

1。准备

公司首先选择承销商(通常是投资银行)来管理此次发行。他们共同评估公司的财务状况、公司结构和市场定位,以确定最佳的上市方法。这是确保公司真正做好上市准备的繁重规划阶段。

2。注册

一切准备就绪后,承销商将进行彻底的尽职调查,然后向相关监管机构提交所需的披露文件。这些文件向监管机构详细披露了该公司、其管理层及其拟议的发行情况。在澳大利亚,这通常是向澳大利亚证券投资委员会提交的招股说明书;在美国,这是向美国证券交易委员会提交的注册声明。

3.路演

然后,公司的高管和承销商将在 “路演” 中向机构投资者和市场分析师介绍投资案例。该展示旨在评估对股票的需求并帮助激发兴趣。机构投资者可以登记首次公开募股的利息和估值,这有助于为初始定价提供信息。

4。定价

根据路演的反馈和当前的市场状况,承销商设定了最终股价并确定了要发行的股票数量。股票在 “初级市场” 上分配给参与要约的投资者(股票在二级市场公开上市之前)。该过程设定了上市前价格,这有效地决定了公司的初始公开估值。

5。清单

上市当天,该公司的股票开始在所选证券交易所交易,正式开放二级市场。对于大多数交易者来说,这是他们可以直接或通过衍生品交易股票的第一点,例如 股票差价合约。

6。首次公开募股后

上市后,公司将受到严格的报告和披露要求的约束。它必须定期与股东沟通,公布其财务业绩,并遵守其上市交易所的治理标准。

交易者的首次公开募股风险和收益

交易者如何参与首次公开募股?

对于大多数交易者来说,一旦股票上市并开始在二级市场上交易,就可以参与首次公开募股。

股票在交易所上线后,投资者可以直接通过经纪人或在线交易所购买实物股票,也可以使用衍生品,例如 股票差价合约 在不拥有标的资产的情况下持有价格头寸。

首次公开募股交易的前几天往往波动很大。交易者应确保他们已采取适当的风险管理措施,以帮助防范潜在的价格剧烈波动。

底线

首次公开募股标志着一家公司可以向公众投资。他们可以为高增长公司的早期准入提供机会,并在波动性和市场兴趣的增加的推动下创造独特的交易环境。

对于交易者而言,在持仓之前,了解流程是如何运作的,是什么推动了定价和首次公开募股后的表现,以及如何权衡潜在回报和交易新上市股票的风险。

.jpg)

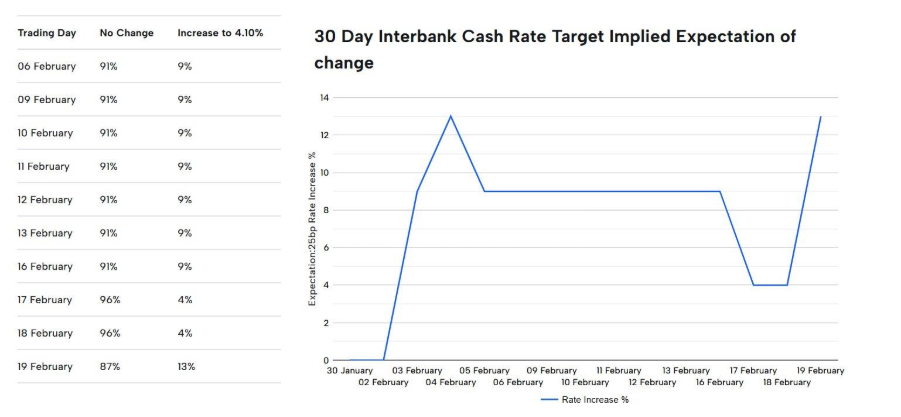

澳洲 联储在2月的货币政策会议上 一致同意将现金利率提高 25 个基点至 3.85%,这是自 2023 年以来的首次加息,并反转了此前 2025 年的几次降息。

1会议核心判断:通胀风险显著加大

会议纪要显示,与此前判断相比,官员们认为 通胀风险已经“实质性改变”,并且比预期更为持久。虽然部分价格压力可能暂时性,但更大范围的通胀已从临时性转向较结构性,推高了通胀预期。

2 决定加息 25 个基点

委员会一致 将官方现金利率上调0.25 个百分点至3.85%,认为如果维持在会上次水平(3.60%),经济中 过度需求和通胀压力可能持续存在,难以回落至目标水平。

3经济活动和需求超出供应能力

纪要指出,国内需求增长明显领先于供应扩充,产能紧张情况加剧。委员们普遍认为这种需求与供给失衡是通胀持续性更强的关键因素之一。

4劳动力市场仍然紧俏

会议强调劳动力市场仍显紧张,失业率较低,这进一步增强了工资和价格压力,从而对通胀带来持续向上推动力。虽然紧俏程度较前期有所缓和,但整体仍支撑价格维持在高位。

5金融状况不再足够收紧

纪要讨论中提到 金融条件已明显放松而不再具有足够的抑制作用,即使市场预期利率上行、澳元走强,但整体资金环境及信贷活动仍被认为对通胀形成刺激,这也是加息理由之一。

6未来路径依赖数据、无固定预设路径

会议明确指出 没有对未来利率路径的固定设定,未来政策决定将高度依赖最新经济数据,尤其是通胀和就业表现。纪要强调需要评估即将公布的CPI、就业等关键指标再决定下一步行动。

7对未来政策的观点分歧与不确定性

虽然大多数委员支持加息,但会议纪要还显示存在对保持利率或未来进一步加息 观点上的讨论与谨慎。部分委员认为在观望更多数据后再行动或更为适当;整体对未来经济走势仍存在不确定性。