Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

A última mudança no setor de petróleo colocou os nomes de energia de volta em foco. Nos últimos seis meses, a Exxon Mobil e a Baker Hughes superaram o petróleo Brent em uma base normalizada, a Chevron permaneceu amplamente construtiva, o SLB ficou atrás da commodity e o consenso dos corretores da Woodside foi mais medido.

Quando o petróleo bruto se move, o impacto raramente permanece contido na própria mercadoria. Os preços mais altos do petróleo podem afetar as expectativas de inflação, os custos de envio e as margens corporativas em toda a economia global.

O que a última jogada está mostrando

Existem três maneiras pelas quais as empresas podem se beneficiar de preços mais firmes do petróleo:

- Produzindo petróleo e gás, vendendo a mercadoria a um preço mais alto

- Fornecimento de serviços e equipamentos aos produtores

- Transportando petróleo ao redor do mundo

Cada um dos nomes abaixo representa um desses tipos de exposição, com um perfil de risco diferente quando o petróleo bruto sobe.

1. Exxon Mobil (NYSE: XOM)

Nos últimos seis meses, a Exxon Mobil superou o petróleo Brent, com o preço de suas ações subindo quase 35% em comparação com cerca de 30% do Brent. Em 11 de março de 2026, ambos estavam sendo negociados pouco mais de 3% abaixo de seus máximos históricos, enquanto a Exxon permaneceu perto de sua alta de 52 semanas.

A Exxon Mobil é uma das maiores empresas de petróleo integradas do mundo, com exposição que abrange exploração, produção, refino e produtos químicos. Quando os preços do petróleo sobem, seus negócios upstream podem se beneficiar de margens mais amplas, enquanto sua escala e diversificação podem ajudar a amortecer partes mais fracas do ciclo.

Desempenho de 6 meses da Exxon Mobil (XOM) versus Brent Crude

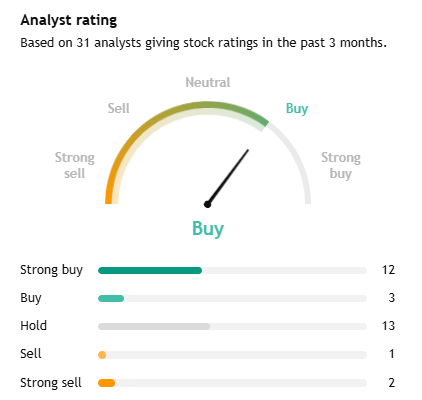

Consenso dos analistas: compre

De acordo com dados do TradingView, o sentimento dos analistas em relação à Exxon é amplamente positivo. Dos 31 analistas acompanhados, 15 classificam a ação como Strong Buy or Buy, 13 a classificam como Hold, 1 a classifica como Sell e 2 a classificam como Strong Sell.

Essa visão positiva está ligada à força do balanço patrimonial da Exxon e à produção com margens mais altas. Os analistas mais otimistas projetam uma meta de preço de 1 ano de até USD 183,00. O preço-alvo médio é de USD 145,00, cerca de 3,6% abaixo do preço de negociação atual.

2. Chevron (NYSE: CVX)

A Chevron é outra empresa global integrada que se beneficiou da recente alta do petróleo bruto, com suas ações sendo negociadas perto de máximos de 52 semanas. Como a Exxon, a Chevron opera em toda a cadeia de valor, incluindo produção inicial, refino e marketing.

A aquisição completa da Hess pela Chevron adiciona a Guiana e outros ativos upstream, que alguns analistas consideram favoráveis ao longo do tempo. Dito isso, o impacto nos lucros permanece sujeito aos riscos de integração, execução de projetos e preços de commodities.

Desempenho da Exxon Mobil vs Chevron, gráfico de 6 meses

Consenso dos analistas: compre

A Chevron é vista de forma semelhante à Exxon, com o sentimento do corretor permanecendo amplamente construtivo. Agregados recentes do TradingView mostram 30 analistas cobrindo as ações nos últimos três meses, com 17 classificando-as como Forte Compra ou Compra, 11 em Retenção, 1 em Venda e 1 em Forte Venda.

Analistas destacaram o portfólio diversificado da Chevron e a contribuição potencial da Hess, embora a volatilidade dos preços das commodities e o risco de execução possam manter alguns mais cautelosos.

3. SLB (NYSE: SLB)

A SLB, anteriormente conhecida como Schlumberger, é uma das maiores provedoras de serviços e tecnologia de campos petrolíferos do mundo. Ela fornece ferramentas, equipamentos e software que ajudam os produtores a encontrar, perfurar e concluir poços com mais eficiência.

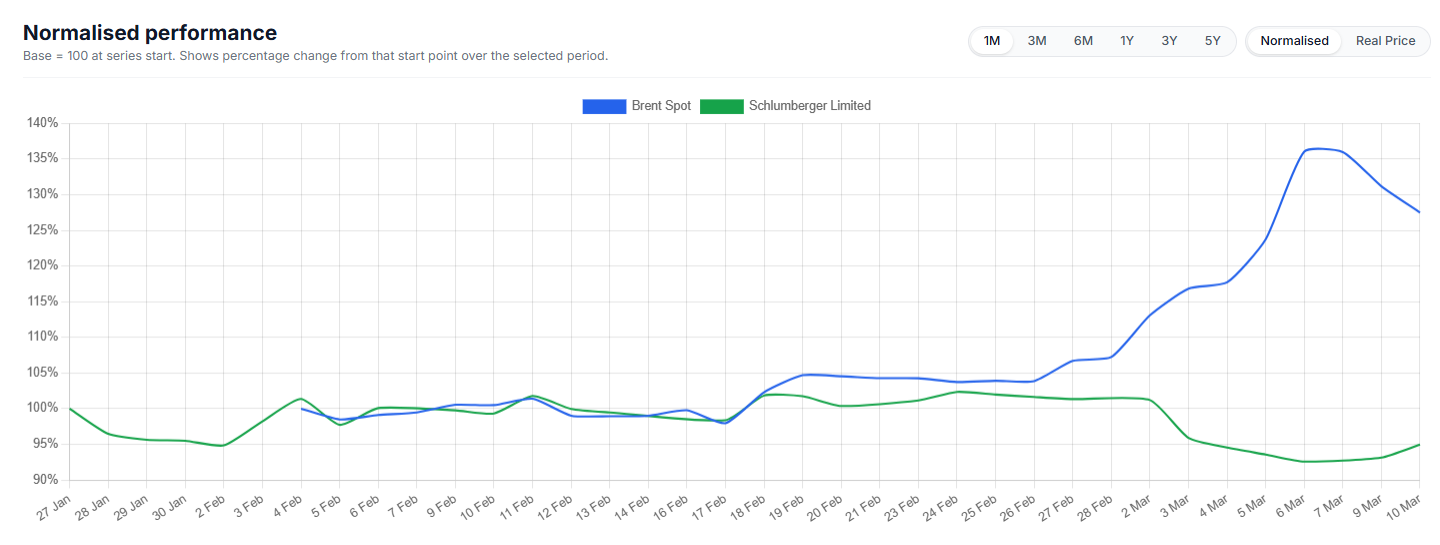

Nos últimos seis meses, o SLB ficou atrás do petróleo Brent, com o preço das ações sendo negociado em uma faixa mais agitada e permanecendo abaixo de seu pico recente. Isso sugere que o cenário mais forte do petróleo não se refletiu totalmente no preço das ações.

Esse padrão não é incomum em empresas de serviços de campos petrolíferos, nas quais as decisões de gastos dos clientes geralmente seguem os movimentos da mercadoria subjacente, em vez de se moverem em sintonia com eles. Qualquer reavaliação futura dependeria de fatores, incluindo gastos de capital do produtor, prazo do contrato, preços de serviços, atividade offshore e condições de mercado mais amplas. Não se deve presumir que um preço mais firme do petróleo se traduza automaticamente em um preço mais firme das ações da SLB.

SLB vs petróleo Brent, desempenho normalizado de 6 meses

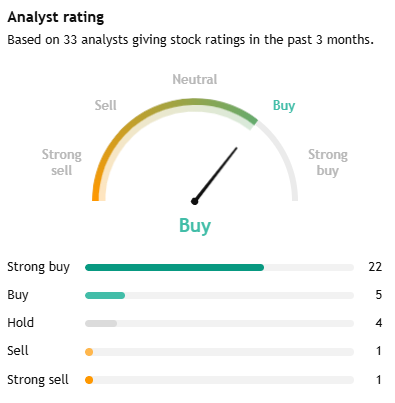

Consenso: Comprar

De acordo com dados do TradingView, o consenso de analistas terceirizados sobre o SLB é Buy. Dos 33 analistas que cobrem a ação, 27 a classificam como Strong Buy or Buy, 4 a classificam como Hold e 2 a classificam como Sell ou Strong Sell.

Isso indica um sentimento construtivo dos corretores, embora a diferença entre os preços do petróleo e o desempenho recente do preço das ações da SLB sugira que os investidores ainda possam querer evidências mais claras de melhorar a demanda e os preços dos serviços antes que as ações reflitam totalmente o cenário mais forte das commodities.

4. Baker Hughes (NASDAQ: BKR)

A Baker Hughes é outra grande fornecedora de serviços e equipamentos para campos petrolíferos, com exposição adicional a segmentos industriais, como GNL e infraestrutura de energia. Mesmo quando os preços do petróleo não estão em níveis extremos, os avanços na tecnologia de perfuração e os menores custos de equilíbrio ajudaram a manter lucrativas muitas áreas de xisto, apoiando a demanda por seus serviços.

A empresa também foi descrita como bem posicionada por causa de seu balanço patrimonial e sua exposição à atividade contínua de exploração e produção. Em um período de preços do petróleo mais altos, ou mesmo estáveis para firmes, essa combinação de serviços e tecnologia de energia pode criar vários geradores de receita.

Nos últimos seis meses, a Baker Hughes superou materialmente o petróleo Brent de forma normalizada. O Brent foi negociado em uma faixa muito mais estreita durante a maior parte do período, antes de subir mais tarde, enquanto o BKR subiu de forma mais constante e alcançou um ganho cumulativo significativamente mais forte. Isso sugere que o preço das ações da BKR se beneficiou não apenas do cenário do petróleo, mas também do otimismo específico da empresa e do apoio mais amplo aos nomes de serviços de campos petrolíferos e tecnologia de energia.

BKR vs petróleo Brent, desempenho normalizado de 6 meses

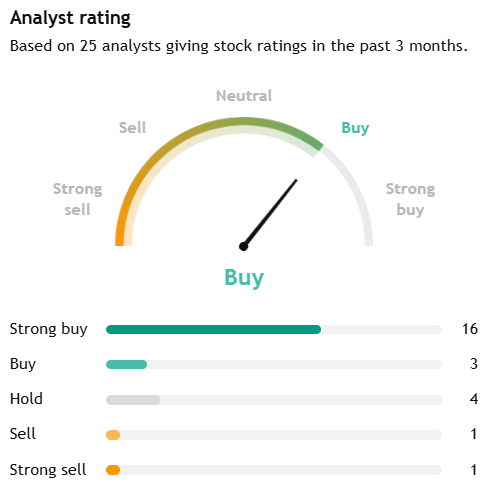

Consenso dos analistas: compre

De acordo com os dados do TradingView, a Baker Hughes é classificada como Strong Buy. Com base em 25 analistas que forneceram classificações nos últimos três meses, 16 classificaram a ação como Compra Forte, 3 a classificaram como Compra, 4 a classificaram como Manter, 1 a classificou como Venda e 1 a classificou como Forte Venda.

No geral, o sentimento dos corretores em relação à Baker Hughes é amplamente positivo, com mais de três quartos dos analistas de cobertura classificando as ações como Strong Buy ou Buy, enquanto a maioria do restante estava em espera. Essa visão solidária dos analistas parece refletir a exposição da BKR aos serviços tradicionais de campos petrolíferos e aos mercados mais amplos de energia e tecnologia industrial, incluindo a infraestrutura de GNL.

5. Woodside Energy (ASX: WDS)

A Woodside Energy apresenta à lista um produtor com sede na Austrália com exposição significativa aos mercados de GNL e petróleo. Seus lucros estão intimamente ligados aos preços realizados das commodities, o que torna as ações sensíveis às mudanças nos preços do petróleo bruto e do gás, bem como à demanda global de energia mais ampla.

Em comparação com alguns dos maiores nomes de energia dos EUA, o sentimento dos corretores em relação à Woodside parece mais moderado. Os investidores estão equilibrando a exposição global da empresa ao GNL e a alavancagem para preços de energia mais fortes contra preços mais baixos realizados recentemente, riscos de projeto e execução e pressões regulatórias e de descarbonização de longo prazo.

Consenso dos analistas: aguarde

De acordo com os dados do TradingView, a Woodside é classificada como Neutro/Hold. Dos 15 analistas, 2 a classificam como Strong Buy, 4 a classificam como Buy, 7 a classificam como Hold, 1 a classifica como Sell e 1 a classifica como Strong Sell.

O preço-alvo médio de 12 meses é de A $29,20 versus um preço atual de cerca de A $30,28, o que implica uma queda de aproximadamente 3,6%. Em relação aos maiores nomes de energia dos EUA nesta lista, isso aponta para uma visão mais cautelosa do corretor.

6. Operadores globais de petroleiros

As empresas petroleiras podem se beneficiar quando preços mais firmes do petróleo, mudanças na política da OPEP+ e tensão geopolítica aumentam os embarques de longa distância e interrompem as rotas comerciais usuais. Quando os volumes de petróleo aumentam, a demanda de “toneladas-milha” pode suportar as tarifas diárias e a lucratividade dos petroleiros, mesmo quando o mercado de energia em geral é volátil.

Consenso dos analistas: N/A

Essa é uma categoria mais ampla do setor, em vez de uma única ação negociada publicamente, portanto, não há um consenso único de corretor a ser citado. As opiniões dos analistas precisariam ser avaliadas no nível da empresa, como Frontline plc (FRO), Euronav (EURN) ou Scorpio Tankers (STNG).

De forma mais ampla, o setor é cíclico. Qualquer benefício de mercados de transporte marítimo mais apertados pode ser revertido se as rotas se normalizarem, as taxas de frete caírem ou a oferta aumentar.

Riscos e restrições

Os preços mais altos do petróleo não eliminam o risco desses nomes.

- Se os preços subirem muito, muito rápido, a destruição da demanda e as respostas políticas podem pesar sobre os lucros futuros.

- Decisões políticas da OPEP+ ou de outros grandes produtores podem reverter uma alta aumentando a oferta.

- As empresas de serviços e petroleiros são altamente cíclicas. Quando o ciclo muda, o poder de precificação pode diminuir rapidamente.

- Questões específicas da empresa, incluindo execução de projetos, preços realizados e gastos de capital, ainda são importantes.

Juntos, esses nomes podem se beneficiar de preços mais firmes do petróleo, mas também acarretam riscos setoriais, geopolíticos e de nível empresarial que merecem muita atenção.

Principais observações do mercado

- A Woodside fornece exposição a GNL e petróleo, embora o sentimento atual dos corretores seja mais neutro do que o dos grandes nomes dos EUA.

- Os operadores de petroleiros podem se beneficiar quando os mercados de frete se estreitam, embora esse comércio permaneça altamente cíclico e dependente da rota.

- A SLB e a Baker Hughes podem se beneficiar se preços mais firmes do petróleo se traduzirem em mais atividades de perfuração e conclusão, mas a resposta do preço das ações tem sido mista.

- A Exxon Mobil e a Chevron oferecem exposição direta a margens upstream mais fortes, apoiadas por operações diversificadas.

As referências neste artigo à Exxon Mobil, Chevron, SLB, Baker Hughes, Woodside, operadores de petroleiros, classificações consensuais de analistas e metas de preço estão incluídas apenas para comentários gerais do mercado e não constituem uma recomendação ou oferta em relação a qualquer produto financeiro ou título. Dados de terceiros, incluindo classificações de consenso e preços-alvo, podem mudar sem aviso prévio e não devem ser considerados isoladamente. As exposições à energia e ao transporte marítimo são cíclicas e podem ser materialmente afetadas pela volatilidade dos preços das commodities, preços realizados, mudanças na produção, execução de projetos, interrupções geopolíticas, condições do mercado de frete, desenvolvimentos regulatórios e mudanças no sentimento dos investidores. Qualquer opinião sobre os potenciais beneficiários dos preços mais altos do petróleo está sujeita a incertezas significativas.

After a stellar year in 2017, investors were taken aback by the massive swings in the markets in 2018. The turmoil in the financial markets has created an environment of panic and fears about a global recession. Even though the risk of a recession is not on the horizon yet, we do expect 2019 to remain volatile.

Prudent investors will likely favour cautious positioning. Economic Growth Slowing Global Growth will be the dominant factor that will drive markets’ sentiment across various asset classes, as external crosswinds have exacerbated fears of decelerating economic growth. A series of surveys on the Manufacturing activities released at the beginning of the year have shown that major economies are likely to see slower activity in 2019.

So far, the weakness in China has been significantly higher than other major economies, and is expected to weaken further. China made its first bank’s reserve requirement ratios in 2019 on the 4 th of January, after mounting pressure from the US tariffs and its weakest growth since the global financial crisis. Aside from trade tensions, the US government shutdown and the gridlock in Washington will not be market-friendly.

The fiscal stimulus will fade which will hurt the US economic performance. Overall, we expect investors to keep an eye on the role of China in tackling slow domestic growth in the first quarter as the country will probably fight back with stronger monetary and fiscal policies. Economic growth will be slower compared to last year as the sugar tide from fiscal stimulus will fade, but we do not expect a recession in 2019.

Central Banks The Federal Reserve (Fed) will stay in the limelight among the major central banks in the near term. The markets are expecting the Fed to end its hike cycles in 2019 and there are still many uncertainties in the Fed’s messages, despite the “patient” pledge from Jerome Powell on Friday. The Fed is trying to walk on the fine line on data-dependency, and until there is more clarity on the rate path or more dovish signals, investors will stay prudent in their positioning.

It is unlikely that other central banks like the European Central Bank, Bank of Japan or Reserve Bank of Australia will hike in the near term. However, a rate hike by the ECB in September is possible. We may see investors switching their attention from the Fed to the ECB towards the second half of the year.

The Bank of England will remain underpinned by Brexit uncertainties as its economy remains vulnerable to Brexit risks. The first quarter of 2019 will provide more insights into the economy, once the uncertainty around Brexit reduces. We do not expect the BoE to alter interest rate until there is more clarity on Brexit.

Geopolitical Risks Against the global growth backdrop, political risks will also pose challenges for investors. There have been a lot of political noises and speculations in 2018 which significantly drove the overreactions in the markets. However, in 2019 investors may be better equipped to separate signals from noises.

European political risks may be calmer but will remain a worry, given the backlash from populist parties and Italy’s fiscal dispute with Brussels. The budget agreement was deemed as a “borderline compromise” that prevented the EU from opening a debt procedure. More importantly, the tensions between ruling parties in Italy is another threat that can plunge the country into another political chaos and dampen risk sentiment in the Eurozone area.

The relationship between the US and China- the world two biggest economies will remain the biggest risk for the global economy in 2019. The rise of China is a potential threat for the US, and the markets are not expecting a quick resolution of the cold trade war despite the G20 trade truce. The first quarter of the year will remain gripped by trade headlines.

In the US, the government shutdown continues and is among the longest one since 1980. President Trump lost the majority in the House of Representatives, and Washington is trapped in gridlock. Therefore, another fiscal boost is extremely low.

At the same time, we also anticipate more drama and threatened government shutdowns during the year with a Democrat-controlled House. The Technology Sector Technology stocks have been the primary driver of the global stock markets in the past decade. The overall performance of the tech sector was outstanding since the financial crisis.

However, 2018 has shown us that the tech giants are facing their own unique challenges and have went into a freefall. Investors are worried about future earnings, and the markets’ reactions after Apple’s rare revenue warning statement is an example of how fragile investors’ sentiment is toward earnings forecasts for 2019. Fundamentals are still here and supportive, and we can see the technology sector improving towards the end of the year.

However, the uncertainties and volatility around the growth of this sector may persist for the first half of the year which can prompt investors to diversify to cope with any downside. This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions.

Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Without any doubt it was a difficult year for the stock markets. Recently nearly all equity indices have erased their 2018 gains. October has also lived up to its reputation in being the worst month for equities.

The stock markets bled red, and investors were anxious and cautious. The equity markets have gone through their longest bull run, and markets participants were only expecting a correction of 10% at some point. However, the recent massive sell-off prompted increased fears as the markets were navigating into a sea of headwinds, with growing concerns that it is more than just the markets correcting themselves.

Has Jerome Powell emerged as the saviour? The policy divergence between the US and the other major central banks was the dominant driver that had altered the spectrum of the buoyancy in the markets at the beginning of the year. A hawkish Fed prevented the equity markets to outperform in 2018.

A sudden dovish shift whereby a few Fed officers appeared to be less hawkish has captured the markets’ attention. Chairman of the he Federal Reserve, Jerome Powell’s comments were the trigger: “ interest rates are close to neutral ” compared to “interest rates are a long way from neutral” which were embraced by equity traders. Wall Street slowly moved into green again as the possibility of fewer rate hikes boosted equity benchmarks: The Dow Jones Average Industrial surged by 600 points to close at 25,366.43 S&P500 jumped by 2.3% to finish at 2,743.79 Nasdaq Composite advanced by 2.95% to end at 7,291.59 Jerome Powell appears to have just put a floor under stocks!

Source: Bloomberg Is the renewed optimism justified? It would make sense to say “yes” as the Fed risk has resolved itself and now the markets have “one less” headwind to think about. When the markets dropped as much as 10%, such dovish news is deemed favourable as it plays an essential part to the bottoming process.

However, while the change in language does indicate “dovishness” and be the reason for the market to cheer up, the price action might be exaggerated or could lose steam as trade tariffs with China is far from resolved even though there is more optimism regarding trade negotiations. The stock markets are still fragile and vulnerable to: Peaked earnings Slow growth in China Reduction in global demand Brexit jitters The rout in oil markets Regulatory measures We have also seen that technology investors had a rough two months having witnessed the FAANG group wiping off $1 trillion in market value. Fundamental and external risks have forced investors to stop and think.

Apple shares fell in a bear market territory shaking up the technology sector this month. Being the bellwether of technology stocks, the rout in Apple shares over the decrease in iPhone sales put downward pressure Wall Street. Apple erased $190 billion in five weeks and it lost its $US1 trillion valuation.

Trump tariffs threat on iPhones did little to help Apple in staging a recovery. Source: Bloomberg If it were not for the relief bounce in late November, Amazon was down by 21% since the first of October losing $200 billion market cap at some point. Fundamentals are not flashing red signals that justified such a massive sell-off.

The stock’s recent decline may be an overreaction, but it appears that fears were elevated after the disappointing revenue forecasts. Source: Bloomberg Other big stocks in the FAANG group are facing regulatory headwinds and concerns over the valuations of such big names. Regulation has just started to come down on companies and will likely get tougher.

These highflying stocks have grown so large that institutional investors are wary to go back to that overweight position. Are investors seeking more large-cap value over large gap growth? Overall, the equity markets were mostly hit by two major headwinds: Higher rates and Trade tariffs.

Now that Powell cleared investor’s doubts regarding interest rate. The attention now moves to the G20 summit. Traders are contemplating different scenarios on how the summit will unfold.

The most likely situation given the conflicting news from the White House will be that: Both parties will announce some kind of negotiation to somewhat calm the markets, but the US will most probably increase tariffs as expected. Whether the Stock Market will end in the green or still be flashing red, it may very well depend on President Trump.

The World Economic Outlook has further shifted to the downside. The growth estimates for 2019 and 2020 were downgraded in October 2018 mainly due to trade tensions. The recent further downward revisions were the result of the weakening momentum in key industrialised economies.

The table below depicts the “Weakening Global Expansion”: The outlook for Developed Economies Eurozone Area: The most significant revisions came from Europe- mainly Germany and Italy. Germany is experiencing weakness in the auto industry, following new fuel emissions standards and soft private investment. Italy is facing weak domestic demand and high borrowing costs.

France is being dragged by yellow vest protests and weak industrial production. In addition to the above, the rise in populism in the Eurozone area, Brexit and cross-border spillovers are some other Europe-specific factors that are weighing on economic activity. United States: Washington is in gridlock, and the fiscal sugar rush died down.

The US expansion continues, but growth momentum will soften. In comparison with the Eurozone area, the US’s growth will remain high. The prolonged US government shutdown is also posing risks to economic activity.

Japan and the United Kingdom: Despite natural disasters in Japan and Brexit in the UK, IMF has upgraded growth forecasts for these two economies. Japan’s fiscal support and mitigating measures to the tax hike enabled the IMF to revise the estimates to the upside. Given that the uncertainty around Brexit is eliminated and a deal has been reached, the UK economy is expected to move up because data has shown that it is not as sluggish as the Eurozone area.

The Outlook for Emerging & Developing Economies China: Despite the recent stimulus program which will tackle some of the impacts of trade frictions, China’s economy is forecasted to slow towards the lower range of 6%. A combination of financial regulatory tightening, trade dispute and rout in commodity prices have caused a deeper slowdown than initially forecasted. The warnings from IMF is a reminder that China’s slowdown will have a global impact.

Saudi Arabia: Tumbling oil prices have forced IMF to also lower growth forecasts for Saudi Arabia. India and Brazil: “India’s economy is poised to pick up in 2019, benefiting from lower oil prices and a slower pace of monetary tightening than previously expected, as inflation pressures ease.” The main factor behind the revisions is the declining commodity prices, which will eventually aid policy easing. Brazil’s recovery is expected to continue, which allowed IMF to upgrade its forecasts.

These moderate downward revisions to forecasts which were already revised down in October 2018 are warnings that investors will be keen to keep an eye on. IMF stretched the importance of recognising the growing risks, even though we are not anticipating a significant downturn at this stage. This may be the reason why the World Economic Outlook is placing more emphasis on the Multilateral Cooperation, and call for policies as well to reverse the current headwinds and prepare for the forecasted downturn.

As of writing, the concerns about the global economic outlook have resurfaced with IMF warnings and its impact on risk sentiment can be seen in the Asian markets today.

It might be difficult to stay optimistic in such plunging markets. Global equities are in a bear market and investors are moving away from riskier assets. Amid the mayhem, there may still be some buying opportunities if investors are selective about certain stocks.

We are facing a global pandemic that is slowly forcing major countries into lockdown and halting global activity. Investors are therefore tapping into sectors that offer bargains or where they see long-term growth opportunities. The health care sector seems to be on investors’ watchlists.

It should be highlighted not all health care stocks are performing the same way. Our attention turns to two stocks that have so far outperformed amid the coronavirus outbreak. Moderna Inc (NASDAQ: MRNA) In the US markets, Moderna Inc. is standing out.

As several companies are racing against time to create a vaccine for the COVID-19, Moderna Inc. is among the first to develop a vaccine against coronavirus. For a relatively young and small company, the Massachusetts-based biotechnology firm has performed its first human trial of the coronavirus vaccine on Monday. Ever since they received funding from the CEPI to accelerate the development of messenger RNA Vaccine against the novel coronavirus, the biotech company became popular among investors.

Moderna Inc. is among the best-positioned mRNA company with 16 Phase 1 trial started and five out of their first five modalities demonstrating success in the clinic. As of writing, the company’s share price is currently trading at $26.57 after reaching an all-time high of $31.48 last week. Source: Bloomberg Terminal For the past month, the company’s share price is currently up by more than 40%!

The coronavirus vaccine could be a key turning point for the success of Moderna, which is yet to produce a proven product on the market using its mRNA technology. Share Price & Information Moderna, Inc. is a Cambridge, Massachusetts-based biotechnology company focused on drug discovery and drug development based on messenger RNA (mRNA). In January, Moderna announced the development of a vaccine to inhibit COVID-19 coronavirus.

NASDAQ Profile NASDAQ:MRNA Market Cap: 8,741,616,884 Today's High/Low: $29.81/$26.25 Get in touch with your account manager to find out how you can start trading Moderna Inc today. Don't have an account? Sign up here.

Fisher & Paykel Healthcare Corp Ltd (ASX:FPH) In the Australian share market, Fisher & Paykel Healthcare Corp Ltd is among the best performers. The company is a manufacturer, designer and marketer of products and systems for use in respiratory care, acute care, and the treatment of obstructive sleep apnea. Fisher & Paykel Healthcare’s share price added above 40% since the widespread of the COVID-19 (Year to Date).

With a rise of 85% in the last 6 months, the company is currently the best performing stock of the S&P/ASX200. Back-to-Back Upgrades While most companies are downgrading forecasts in this bear market environment, the company has issued two upgrades since the beginning of the year. Vitera, a new full face mask used in the treatment of obstructive sleep apnoea has outperformed in the early stages.

The company also received clearance to sell the mask in the US sooner than expected which contributed meaningfully in driving its share price to new record highs. The company also delivered a strong financial performance for the six months to 30 September 2019: Net profit after tax was up by 24% at $121.2million Operation revenue rose by 12% at $570.9 million The COVID-19 outbreak has substantially increased demand for certain products, which has enabled the company to upgrade its revenue and earnings guidance for the financial year ended 31 March 2020 a couple of times since January. Taking into consideration exchange rate revisions, the company is now expecting: Full-year operating revenue to be approximately $1.24 billion instead of $1.19 billion in November’s guidance.

Net profit after tax to be within the range of approximately $275 million to $280 million instead of approximately $255 million to $265 million back in November. On the supply side, the fact that the company does not have a manufacturing facility in China, they are not expecting major supply disruptions. Overall, the company is also making progress with other major initiatives and is establishing a presence in more countries while undertaking numerous other studies.

The continuous growth of Fisher and Paykel in the near and medium-term is looking promising.

Hawkish and Dovish are two crucial words widely used in our industry whenever there are central bank speeches or talks about monetary policies. But what does it mean? Central banks are more transparent than ever and forex analysts or traders try to dissect the overall tone and language used when central bankers speak to see: How the economy is flaring How interest Rate will change or foresee How the monetary policy will develop over time and affect the value of a country’s currency A hawkish tone means that a central bank is seeing the economy growing too fast and is warning the markets of excessive inflation.

Therefore, to curb inflation and slow economic growth, central banks might increase interest rate which will be positive for the domestic currency. A dovish tone is a complete opposite – The economy is not growing and the central bank is warning against deflation. In other words, there might be interest rate cuts to stimulate the economy which is negative for the domestic Currency.

Put simply, when there is a Hawkish tone, there are talks about tightening monetary policy which will probably lead to interest rate hikes. On the other side, a dovish central bank will use easing or accommodative monetary policy which will result in interest rate cuts. Recently, Major Central Banks of Key economies have turned dovish due to slowing global growth and this week the Reserve Bank of New Zealand joined the dovish chorus as well.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Liquidity Crisis High levels of liquidity happen when there is both supply and demand for an asset, meaning transactions can take place easily. A market is considered to be liquid if it can absorb liquidity trades with significant changes in price. A liquidity crisis is, therefore, an acute shortage or drying up of liquidity.

In simple terms, it occurs when there is a simultaneous increase in demand and a decrease in the supply of liquidity across many financial institutions or businesses. As the impact of the coronavirus has rattles markets, global central bankers and governments are ramping up efforts to address liquidity issues across markets. Gold – A Highly Liquid Asset In times of uncertainties, investors generally seek safety with traditional haven assets like Gold.

Why is Gold also selling off? Gold is set apart as it has a feature of a liquid asset just like cash. Investors are on the hunt for liquidity which is prompting the gold market sell-off.

An environment of thin liquidity and high volatility is forcing investors to unlock capital in gold to fulfil liquidity requirements. Gold was seen outperforming this year which makes it a profitable asset- prompting investors to take profit. As the turmoil in global stocks intensifies, investors are looking for ways to cash in to meet margin calls.

At the same time, the safe-haven status of the gold is being hammered by a stronger US dollar. Despite the Fed’s bold emergency rate cuts, the greenback made an impressive comeback against its peers. Another wave of global easing hits markets, making the US dollar the preferred choice compared to other major currencies.

The unusual tandem between the US dollar and Gold seen since the beginning of the year seems to have also faltered at the start of March. Gold has recently lost some of its haven appeal as investors search for liquidity, but it has remained around elevated levels seen in the past 12 months. On Tuesday, reports of a big stimulus package of more by $1 trillion have helped the gold to rebound slightly Source: Bloomberg Terminal Gold Stocks Gold is a victim of the sell-off because of its outperformance and liquidity features which are beneficial to investors during times of financial crisis.

However, gold miners’ stocks have the potential to rally in anticipation that the price of precious metals will go up once the markets stabilise. In the Australian share market, the rebound on Tuesday was mostly driven by the gold mining stocks, which surged by more than 15% despite a fall in gold price. Source: Bloomberg Terminal It is therefore not uncommon for gold to act as a source of liquidity at the start of a liquidity crisis.

As investors are convinced that central banks’ intervention measures like rate cuts and quantitative easing will inject enough liquidity in the financial market, Gold will likely find buyers.