Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

Da infraestrutura de IA ao cuidado de animais de estimação, semicondutores e exploração de ouro, aqui estão os cinco principais candidatos com maior probabilidade de serem listados no ASX em 2026.

O que é uma oferta pública inicial (IPO)?

1. Tecnologias Firmus

A Firmus Technologies está construindo uma infraestrutura de data center com inteligência artificial na Tasmânia e pode ser uma das empresas de tecnologia mais estrategicamente posicionadas na Austrália no momento.

A Firmus é parceira de nuvem da Nvidia e ingressou no mercado Lepton da fabricante de GPU. A empresa projetou sua plataforma AI Factory modular e líquida em todos os lugares para evoluir com as arquiteturas mais recentes da Nvidia, incluindo a rede Ethernet Nvidia Spectrum-X.

Um aumento de A $330 milhões em setembro de 2025 fechou com uma avaliação pós-monetária de A $1,85 bilhão para a empresa. Em novembro de 2025, após um aumento adicional de A $500 milhões, essa avaliação triplicou para aproximadamente A $6 bilhões.

Um investimento subsequente de A $100 milhões do Grupo Maas no início de 2026 confirmou a avaliação de novembro. É relatado que a Firmus está contemplando um IPO da ASX nos próximos 12 meses e, dada a avaliação privada de A $6 bilhões, espera-se que qualquer aumento público seja bem acima 1 bilhão de dólares australianos.

Com a crescente demanda da Austrália por capacidade computacional soberana de IA e a vantagem de clima frio e energia renovável da Tasmânia para operações de data center em grande escala, a Firmus se destaca como uma das candidatas a IPO da ASX em maior escala em 2026.

No entanto, embora o interesse do mercado na Firmus pareça estar crescendo, o tempo é tudo quando se trata de IPOs. Fique atento à confirmação do momento exato do IPO, do sentimento dos data centers de IA e se a Nvidia sinaliza um aprofundamento de seu envolvimento como investidora-âncora estratégica após a listagem.

2. Raiz

A Rokt, fundada em Sydney, tornou-se discretamente uma das empresas privadas de tecnologia mais valiosas da Austrália. A plataforma adtech de comércio eletrônico que visa ajudar as marcas a monetizar o “momento da transação” agora é avaliada em ~ USD 7,9 bilhões.

Uma folha de termos preparada pela MA Financial projetou uma saída preço da ação de US$72 em cenários básicos, quando as ações são liberadas do depósito em garantia em novembro de 2027.

Espera-se que o Rokt seja potencialmente listado duas vezes nos EUA e no ASX em 2026, possivelmente já no primeiro semestre do ano. IG A estrutura mais amplamente discutida é uma listagem primária da Nasdaq com uma estrutura ASX CDI (CHESS Depositary Interest) para investidores australianos, em vez de uma listagem dupla completa.

A receita da Rokt para o ano encerrado em agosto de 2025 é projetada em USD 743 milhões (aumento de 48% em relação ao ano anterior), com EBITDA previsto em USD 100 milhões e uma margem de lucro bruto de aproximadamente 43%. Atualmente, projeta-se que ultrapasse a marca de receita anual de USD 1 bilhão até agosto de 2026.

A Amazon, a Live Nation e a Uber são todas consideradas clientes da Rokt, e a empresa se expandiu rapidamente na América do Norte e na Europa.

O fato de a Rokt optar por uma listagem primária da Nasdaq com uma estrutura ASX CDI ou por uma listagem dupla completa, isso pode afetar significativamente a liquidez e o acesso dos investidores locais.

3. Cruz verde

A Greencross, empresa por trás da Petbarn, City Farmers e Greencross Vets, está se preparando para se relistar na ASX depois de ser tornada privada pela empresa americana de private equity TPG em 2019.

Atualmente, a TPG possui 55% da Greencross, enquanto a AustralianSuper e o Healthcare of Ontario Pension Plan (HOOPP) detêm os 45% restantes.

A empresa registrou receita de A $2 bilhões para o exercício financeiro de 2025, um aumento modesto em relação a A $1,95 bilhão em 2024. A TPG pagou A $675 milhões em valor patrimonial pela empresa em 2019; vendeu uma participação de 45% em 2022 com uma avaliação de mais de A $3,5 bilhões. O IPO proposto implica uma avaliação de mais de A $4 bilhões.

A TPG tem como meta uma oferta pública inicial de pelo menos A $700 milhões. O IPO marcará o retorno da Greencross à ASX após uma ausência de oito anos. O tamanho relativamente pequeno do aumento da TPG sugere que a empresa está apostando em um forte desempenho no mercado de reposição antes de sair totalmente.

O anúncio do cronograma de saída da TPG ainda mostra se um IPO de 2026 está previsto. E se a empresa busca um IPO tradicional ou uma venda comercial, esse continua sendo um caminho alternativo.

4. Morse Micro

A Morse Micro é uma empresa de semicondutores com sede em Sydney que desenvolve chips Wi-Fi HaLow projetados para aplicações de IoT na agricultura, logística, cidades inteligentes e monitoramento industrial.

A Morse Micro realizou uma rodada da Série C em setembro de 2025, arrecadando USD 88 milhões, seguida em novembro de 2025 por um aumento pré-IPO de USD 32 milhões, elevando o financiamento total para mais de A $300 milhões.

Ela tem como alvo uma listagem da ASX nos próximos 12 a 18 meses. A Série C foi liderada pela gigante japonesa de chips MegaChips e pela National Reconstruction Fund Corporation.

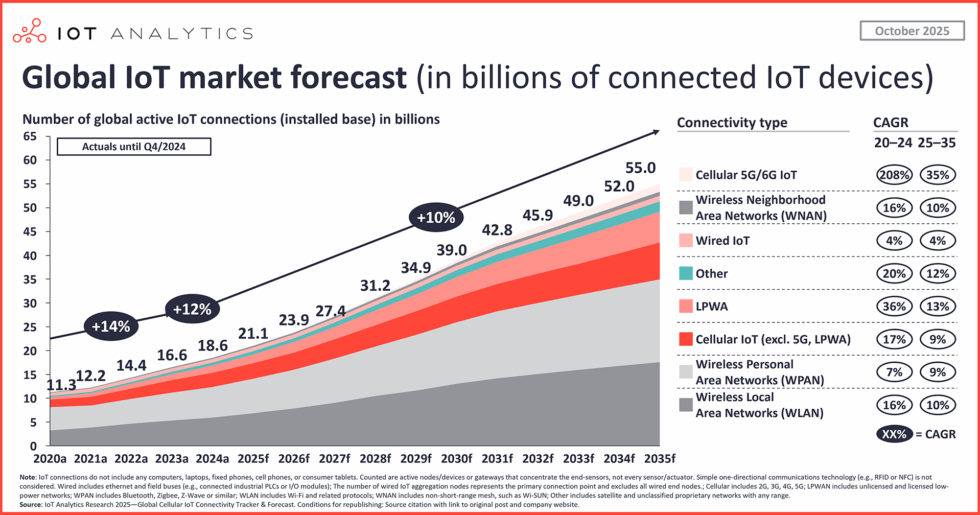

Prevê-se que as conexões globais de dispositivos de IoT excedam 30 bilhões até 2030, e a Morse Micro seria uma rara empresa de semicondutores puros listada na ASX, que poderia atrair um interesse significativo de gestores de fundos com foco em tecnologia.

A tração de receita da Morse Micro com parceiros de hardware de primeira linha antes da listagem é uma questão de saber se a empresa busca uma listagem simultânea nos EUA, dada a profundidade do apetite dos investidores em semicondutores dos EUA.

5. Recursos para bisontes

A Bison Resources é uma recém-incorporada exploradora de ouro e metais preciosos com foco nos EUA, atualmente no meio de seu IPO na ASX.

A oferta termina em 20 de março de 2026, com uma listagem da ASX prevista para meados de abril de 2026. Em uma capitalização de mercado indicativa de A $13,25 milhões na assinatura completa, Bison é o nome mais especulativo desta lista por uma margem significativa.

A empresa possui quatro projetos de exploração no nordeste de Nevada, dentro da Carlin Trend (um dos cinturões produtores de ouro mais prolíficos do mundo), responsável por aproximadamente 75% da produção de ouro dos EUA.

O IPO busca levantar A $4,5 a A $5,5 milhões (22,5 a 27,5 milhões de ações a A $0,20 por ação). A equipe tem experiência anterior na Sun Silver (ASX: SS1) e na Black Bear Minerals, o que lhe confere um histórico nas listagens de mineração júnior da ASX em Nevada.

IPOs globais: Quais são os maiores IPOs que acontecerão globalmente em 2026?

Conclusão

O calendário de IPO de 2026 da Austrália abrange todo o espectro de risco. Um jogo de infraestrutura de IA apoiado pela Nvidia, uma plataforma de comércio eletrônico de bilhões de dólares e um explorador júnior de ouro com seu IPO já em andamento.

Cada candidato reflete um estágio diferente de maturidade e um perfil de investidor diferente. Juntos, eles sugerem que o ASX pode ter uma injeção significativa de novas listagens em setores que estiveram praticamente ausentes do mercado local nos últimos anos.

In a previous article we addressed the concept of cognitive trading biases as a barrier to potential successful implementation of a trading plan in the heat of the action you “press the button” on entry or exit action. This article discussed these biases - “loss aversion” which you can read here ( click to read ). In this article we examine another common cognitive trading bias, termed minimalisation bias.

Trading biases revisited People have inbuilt set of belief and value developed outside the trading context but when the trader interacts with the market, these individual natural ways of thinking and feeling become part of decision-making. Some of these natural in-built responses may not serve you well and are termed ‘cognitive biases’ which may take over from your written and planned ‘trading system’ and become the major influence on your market behaviour. Recognising that these exist and developing awareness of whether one or some of them are part of your trading psychology is the first stage in addressing any bias.

The aim of this series is to help explain what they are, and you are able to make the judgement on your market interaction. What is a minimalization bias? Logically, good decisions in any context (including trading of course) are based on having complete and accurate information, to enable us to process this, and subsequently take appropriate action.

In a trading context, we have access to not only information relating to market sentiment, and tools (indicators) that can help us make sense of this, but also resources that may indicate terms of increased risk e.g. economic data release dates and times. Ideally, the way we use this information both for entry and exit should be specifically articulated within a trading plan which acts as a guiding light for action. In simple terms, many plans will have a set of criteria, or checklist, that if all can be ticked off as present, then act e.g. trade entry can be taken.

With a minimalization bias, the trader basis their decisions on small amounts of usually incomplete information, or in other words, act when all of the criteria have NOT been met. What happens with a minimalisation bias? This bias often leads to premature entry and exit before a full set of signals are confirmed.

Common examples of this may include low trading volumes, not keeping an eye an eye on the economic data release, attempting to predict the next price move often seen when acting on immature candles or bars, or before there is confirmation of a breakthrough a key price point. Commonly, such errors originate from time pressures, poor charting techniques, a lack of specificity in trading instructions within a plan or a lack of, or skipping looking at, appropriate resources to help inform decisions. When in an open trade we may see action (e.g. exit) without substantial evidence of a weakening price, retracements often used as exits rather than clear reversal signs.

The impact of this is limiting the profit potential of a specific trade. Trying to ‘bottom pick’ at the market (if looking for a long trade) may also be a problem in more severe cases, where the investor believes the price had stopped going down on a slow down on the drop rather than waiting for a clear reversal signal. Remember, an exit signal is not necessarily a reason to trade in the opposite direction.

Overtrading due to poor entries, followed by rapid exits may also be a symptom. What you can do if you think you may have a minimalisation bias? If this resonates with you, then the purpose of this article is fulfilled, as recognising and “owing” that there is something that needs to be addressed.

It is the VITAL first step in making a change. Obviously, there are steps you can take to address this (and you MUST). Here are some suggestions: a.

You have a complete trading plan that articulates trading actions both for entry and exit. The more specific these are, the less likely you are to stray. Make sure EVERY one of your criteria is crystal clear. b.

Record and review in your journal how you are feeling as you trade and the market circumstances during your decision-making. It would be rare that this bias is present in every trade. Through recording this information, you may be able to see common thread as to when this bias raises its ugly head.

Armed with this information you will then be able to either avoid trading in certain circumstances, or simply “checking yourself” a little more rigorously. Sometimes the very process of formally recording what you are doing helps in doing the right thing more consistently. c. Re-align with your trading plan prior to every trading session, remind yourself prior to looking at the market what your key criteria for action are. e.

Take regular breaks from the market during any session, particularly when trading shorter timeframes, to re-align with purpose and plan and avoid over-emotional trading. f. If you are in a position where you are finding information difficult to access, then simply ASK. There are many out there with those resources not only at hand but also how to get that information efficiently.

Finally, as we finished when we discussed “loss aversion” as you work on this please be gentle on yourself in terms of your development. Biases by nature are usually deeply ingrained and will take some work to address.

Warning: Turn your sensitivity meter down a little. This is a no sugar-coating, tell-it-how-it-is article (but rest assured it comes from a nurturing place). All over the globe, trading gurus attempt to sell their wares (software, the ‘holy grail’ of trade set ups etc) using retrospective charting examples.

Such powerful visual “evidence” is often used to persuade prospective FX clients that this vehicle is ‘easy’ to make profit with. With little work, little time, or whatever marketing buttons they are using to press to get a response. So, hours of energy invested, often cash is exchanged and yet more often than not, with an off the shelf system in place (often just an entry system which we know is never going to offer a complete trading solution) traders are left feeling more than a little disappointed that such “guaranteed, easy riches” are not showing up in their trading account.

On an individual level we see similar. Much airplay is given to the merits of back-testing and yet as with the aforementioned guru approach, you can just about find examples, if you look hard enough, of chart examples that mean this “next new indicator thing” is now the answer to replenish your now depleted finds. So, what happens, we have a system change, and yet results still often fall short of expectations.

There are 3 common dangers of the retrospective approach to creating (if you haven’t a trading plan already) or altering an existing plan that are worth highlighting. #1 – Overstating the function of back-testing. Let us be completely blunt. The purpose of back-testing is NOT, nor should ever be viewed as evidence that a trading plan, based on what ever system you are exploring, will work for you in the reality of live trading.

Back-testing does not generally consider: a. The impact of economic data releases and revisions, b. The political and general climate both globally and specifically in the countries that currency pairs relate to, c.

Individual investor behaviour re. timeframes, time of day that they trade, nor their ability (or otherwise) to act or inaction on a change of sentiment, d. Unplanned events such as escalating conflict (or the threat of such), e. The relationship and impact of other financial instruments of FX pairs e.g. equity and bond markets, commodities So, why back-test at all if the evidence could be so flawed?

The answer is simple, back-testing creates evidence, not that a system will definitely work for you as a trader, but ONLY as evidence that a forward (or prospective) test may be worthwhile. So, the bottom line is the function of back-testing is to justify the time and effort to prospectively test. It is after such a prospective test that system changes can be made/developed. #2 – Failure to gather a critical mass of evidence There are two issues here. a.

What constitutes enough evidence to move to the next stage of system testing. Quite often traders will make decisions on a limited amount of data e.g. one timeframe and one currency pair, over the last couple of months on which to make system decisions. Now you have read this it may seem obvious and may not need pointing out (but we will anyway) why this is insufficient information on which to base a “cross the board’ entry and exit system. b.

The second issue here is one of selective evidence gathering. A natural human response when excited by an idea is search for evidence to back up that idea. The potential danger with this is that we often tend in this search, to ignore information that refutes our idea. #3 – The reason behind doing this may not be that your system is failing rather it could be a YOU issue.

System skipping is common amongst many traders and is invariably motivated by results that are not as desired. Here is the danger. As much of what goes into creating trader results (some would suggest up to 80%) is due to behavioural issues (we have waxed lyrical about trading discipline previously) unless you: a.

Have a trading plan that is specific, measurable and comprehensive AND b. Follow it religiously ‘to the letter” then you are not really in a position to make a judgement on whether system could serve you well or is likely not to produce desired results. AND to add to this, as such behavioural issues have not been either acknowledged or addressed whatever system (based or retrospective charts or not) is more likely to produce equally disappointing results.

So, before you start on the journey of altering a system you should logically make every effort to have, follow and measure the impact of any system before you even consider changing it (or looking into what you may change it to). This MUST be your #1 priority before going down any path of system alterations. So there you have it.

You have a choice to take action of course on what you have read, If so, your missions going forward are: a. Make sure you have a comprehensive plan that you follow. Then, and only then, should you begin to explore further development including the use of retrospective charts (or back-testing) b.

Recognise the SOLE PURPOSE of back-testing is to create evidence that a forward (or prospective) live test is justified. c. Make sure you are basing any potential system change on a enough “balanced” data.

The EUR has been on a run since it bottomed in September 2022. From that time, the price is up almost 15% and is currently trading at 1.0863. However, with important economic data to come out of the USA and the next interest rate decision from both the ECB and the Federal Reserve coming out in the next few days the market may find some more direction for the EUR.

A Hawkish Federal Reserve may be detrimental for a move to the upside of the EUR, whilst a Dovish response may support more growth in the EUR. In addition, with employment data to come out of the USA softer data may support a more dovish Federal reserve. In the past few days and weeks, the EUR has seen some strong momentum on the back of growth data that has seen the region avoid a recession.

Crucially, the GDP of the Eurozone grew by 0.1% which beat an expected 0.1% retraction for the quarter. A general weakening of the USD has also supported a bounce of the EUR as money has moved away from the safety of the greenback and into other assets. Technical Analysis In terms of the long-term analysis, the price has mostly ranged between 1.04 and 1.25 except when the price bottomed last year.

The price is currently showing some weakness and has so far been unable to break through 1.09 and has sold down on candlesticks that are testing the 1.09 level. Therefore, it would not be surprising to see the price retrace to the previous support level at 1.06 before another move to the upside. On the daily price chart, the price is showing a strong upward channel/trend.

This channel shows how the bottom of the channel fall along an important area of market structure. This zone acts as the 50-day moving average, the recent support level and the bottom of the channel. This bolsters this region as a zone for ana entry should the price retrace.

With a target of 1.12 this represents a risk reward of 2.5. Ultimately the trend of the EUR will most likely be dictated by the movements of the Federal reserve and the ECB. However, should the macroeconomic factors permit, the EUR could very well continue its run.

US Dollar Fundamental Analysis Recent data indicated that the U.S. economy grew strongly in the fourth quarter which has boosted the Dollar against the Euro. This has supported the Federal Reserve's hawkish stance in spite of reports that US consumer spending has fallen, and inflation has cooled. According to the Commerce Department, the Consumer Price Index (CPI), the Federal Reserve's preferred inflation measure, increased 0.1% in November after a similar gain the month before.

With traders eagerly awaiting the Federal Reserve's guidance for interest rate rises, the Dollar firmed on Monday and distanced itself from an eight-month trough. Despite last week's eight-month low of 101.50, the U.S. dollar index rose 0.03% to 101.92. US Dollar Index Technical Analysis The Dollar Index is currently testing a major support area taken from the weekly time frame, around $101.55.

It has been consolidating and testing the area for almost 10 days, strongly suggesting that bulls are starting to take back control of the market after a steady decline of roughly -4% in the last 4 weeks. In alignment with the weekly analysis, on the daily timeframe, a trend line from the lower lows can be drawn, and from the chart below, the price has recently reached the bottom of the trend line. The price has consolidated for a number of days at the weekly support level mentioned earlier.

The Dollar may potentially climb towards the resistance level at $104, if it remains above and respects the bottom of the channel.

Bitcoin has rallied extremely hard to start the year as risk on sentiment returned to begin the year with the price of the leading cryptocurrency at its highest level since August of 2022. Risk assets have been the play in early 2023 with hopes for a settling of interest rate hikes by major central banks. As the technology sector and other growth areas have continued to rise up the price of Bitcoin has followed.

The price is almost 50% up from its lows in the middle of December 2022. With the macroeconomic factors still largely the main drivers of the risk sentiment and the upcoming Federal Reserve Funds to be announced on Thursday, the rate announcement could play a large role in the short term price action. The Fed is expected to increase the official rate by 25 bps.

However, all eyes will be on the accompanying commentary that will provide important direction on the Fed’s future plans in the upcoming months. Moreover, a hawkish commentary will likely lead to a selloff in risk assets and dovish commentary the opposite. In terms of the long term perspective the price of Bitcoin has had its best month since October 2021.

The price has made a significant bounce off the 15,000-20,000 support zone and looks to have reclaimed the 50 month moving average. This indicates a potential reversal or at least shift in sentiment. The next region of resistance is the original neckline of the long-term double top, between $30,000 and $40,000.

It may be difficult for the price to break above this resistance in the short term without a catalyst. The other thing to remember is that there is a lot of supply that still needs to be worked through before any significant move upward can occur, although, the monthly candle is looking very encouraging. This next zone of resistance looks to be the primary target in the short to medium term for a long trade on Bitcoin.

Looking at the shorter term charts, they price actions tells a similar story. Specifically, on the daily chart, the price has seemingly paused as it awaits confirmation of a breakout at 25,000. If this breakout can be supported by some significant volume it may confirm the reversal.

The other element that must be considered with Bitcoin is the potential for a short squeeze. With the asset so beaten down, it is possible that shorts will become squeezed leading to aggressive moves to the upside if momentum can begin to build. Ultimately, the price action of Bitcoin will most likely be led by the overall risk sentiment in the market and as such traders should be weary of the overall market sentiment.

FRITZ, CILIC JOIN ALCARAZ AND DE MINAUR AT CARE A2+ KOOYONG CLASSIC GO MARKETS ANNOUNCED AS NEW PARTNER Top-ranked American Taylor Fritz and former US Open Champion Marin Cilic are the latest headline acts for the Care A2+ Kooyong Classic in 2023, with Australian-owned online brokerage, GO Markets also announced as a new tournament partner. Fritz and Cilic join two of tennis’ most outstanding young players in new world No.1, Spaniard Carlos Alcaraz, and Australian star Alex de Minaur at the tournament from Tuesday, January 10, to Thursday, January 12, at the Kooyong Lawn Tennis Club. Fritz advanced to the fourth round of a Grand Slam for the first time at this year’s Australian Open, reached his first Grand Slam quarter-final at Wimbledon and achieved a career-high ranking of No. 12 in July.

Earlier this year he snapped the 20-match winning streak of Rafael Nadal to capture the Indian Wells title, his third ATP Tour singles championship. “I’m very much looking forward to playing at Kooyong for the first time and experiencing the Club,” said Fritz. The matches I get to play there will be the perfect preparation for the Australian Open.” Ranked 16 in the world, Cilic has won 20 ATP Tour singles titles, and owns an incredible Grand Slam record having reached the final of Wimbledon and the Australian Open and highlighted by his famous victory in the 2014 US Open. This year Cilic has established himself in the World’s Top 20 and upset world No. 4 Daniil Medvedev on the way to the French Open semi-finals at Roland Garros.

Care A2+ Kooyong Classic tournament director Peter Johnston said the signings of Fritz and Cilic alongside de Minaur and Alcaraz already solidifies the tournament as an event not to be missed. “It’s fantastic to have Taylor playing at Kooyong for the first time and to welcome Marin back for the 2023 tournament,” said Johnston. “With these two stars, Alex and the newly crowned US Open champion and World number 1 Carlos Alcaraz in the field, the 2023 Care A2+ Kooyong Classic is shaping up as a “must see” for fans in January. We look forward to announcing more players shortly. “It’s great to have the support of GO Markets, building momentum and excitement for the return of the tournament to Australia’s Summer of tennis.” The Kooyong Classic has attracted legends of the game regularly to compete since its inception more than three decades ago. A world-class field assembled when the Kooyong Classic was last played in 2020 and another quality field is assured in 2023 when the tournament returns bigger and better than ever.

The 2023 event will be supported by GO Markets, an award winning Australian-owned online brokerage, offering premium trading services. The partnership has been made possible by Kooyong Classic’s marketing partner, MediaPro Asia. Chief Financial Officer of GO Markets, Soyeb Rangwala said of the partnership: “GO Markets is excited to be a part of the prestigious Kooyong Classic, an event which holds an important place in Australian sporting history,” said Rangwala. “Founded in Australia in 2006 as an online provider of CFD trading services, GO Markets is aligned with Kooyong in our proud Australian foundations and our pursuit of excellence in local and global markets.

We look forward to kicking off an exciting summer of tennis at the Classic and welcoming some of the world’s best tennis talent back to Melbourne.” The tournament offers plenty for fans, and champions of the sport consider Kooyong an ideal destination to fine-tune ahead of the Australian Open. 2023 Care A2+ KOOYONG CLASSIC WHEN: Tuesday, January 10, 2023, to Thursday, January 12, 2023 WHERE: Kooyong Lawn Tennis Club - 489 Glenferrie Rd, Kooyong VIC 3144 TICKETS: Ticket on-sale dates will be available soon. Meanwhile, Corporate Box packages are available and can be purchased by contacting the Kooyong Lawn Tennis Club: [email protected] BROADCAST: The 2023 Care A2+ Kooyong Classic will be broadcast live nationally and streamed online on SBS between 11am - 5pm on each day of the event and distributed internationally through Media Pro Asia. MEDIA: Please note that accreditation is essential for all media wishing to cover this event.

Details on how to apply will be made available soon. For enquiries, please contact Stamping Ground: Michelle Stamper | [email protected] Jordie Browne | [email protected] About the Care A2+ Kooyong Classic: As part of the Summer of Tennis in Melbourne, Australia, the world’s top players grace Kooyong’s historic centre court in January each year, maintaining its long and distinguished tradition as the spiritual home of Australian tennis. As a key part of player’s preparation in the lead up to the Grand Slam of the Asia/Pacific, the Australian Open, the tournament offers an atmosphere like no other and is one of tennis’ most storied events.

About GO Markets GO Markets is a multi award-winning global financial services provider, which has always been dedicated to providing its clients with an excellent trading experience. Over the last 17 years, GO Markets has been dedicated to evolving their technology, services and education, in order to provide clients with the best possible trading experience. Through this dedication and because of the trust and loyalty of their clients, they have established themselves as the first choice for trading for our clients globally.

About Mediapro Asia: Mediapro Asia has recently renewed the marketing and media rights for the Kooyong Classic event. The deal means that the company is responsible for distributing broadcast and selling sponsorship rights both domestically in Australia, and overseas. Mediapro Asia, based in Singapore, has been working with the Kooyong Classic event since 2018.

Mediapro Group is best known as LaLiga’s exclusive media rights agency, distributing Spanish LaLiga audio-visual rights globally. Mediapro Asia is also responsible for marketing several other top sporting events, including the Ladies European Tour, the Chinese Super League, ManCity TV and Belgian Pro League. www.kooyongclassic.com.au