ข่าวสารตลาด & มุมมองเชิงลึก

ก้าวนำตลาดด้วยมุมมองเชิงลึกจากผู้เชี่ยวชาญ ข่าวสาร และการวิเคราะห์ทางเทคนิค เพื่อเป็นแนวทางในการตัดสินใจซื้อขายของคุณ.

ตั้งแต่โครงสร้างพื้นฐาน AI ไปจนถึงการดูแลสัตว์เลี้ยง เซมิคอนดักเตอร์ และการสำรวจทองคำ ต่อไปนี้คือผู้สมัครชั้นนำห้าคนที่มีแนวโน้มที่จะอยู่ในรายชื่อมากที่สุด แอ็กซ์ ในปี พ.

การเสนอขายสาธารณะเบื้องต้น (IPO) คืออะไร?

1.เฟอร์มุส เทคโนโลยี

Firmus Technologies กำลังสร้างโครงสร้างพื้นฐานศูนย์ข้อมูลที่ขับเคลื่อนด้วย AI ในแทสเมเนีย และอาจเป็นหนึ่งในบริษัทเทคโนโลยีที่มีตำแหน่งเชิงกลยุทธ์ที่สุดในออสเตรเลียในขณะนี้

Firmus เป็นพันธมิตรคลาวด์ Nvidia และได้เข้าร่วมตลาด Lepton ของผู้ผลิต GPUบริษัท ได้ออกแบบแพลตฟอร์ม AI Factory แบบแยกส่วนที่เหลวทุกที่เพื่อพัฒนาด้วยสถาปัตยกรรมล่าสุดของ Nvidia รวมถึงเครือข่ายอีเธอร์เน็ต Nvidia Spectrum-X

การระดมทุนในเดือนกันยายน 2025 จำนวน 330 ล้านเหรียญสหรัฐปิดโดยการประเมินมูลค่าหลังการเงิน 1.85 พันล้านเหรียญสำหรับ บริษัทภายในเดือนพฤศจิกายน 2025 หลังจากเพิ่มขึ้นอีก 500 ล้านเหรียญสหรัฐ การประเมินมูลค่าดังกล่าวเพิ่มขึ้นเป็นสามเท่าโดยประมาณ 6 พันล้านเหรียญสหรัฐ.

การลงทุน A$100 ล้านต่อมาจาก Maas Group ในช่วงต้นปี 2026 ยืนยันการประเมินมูลค่าเดือนพฤศจิกายนรายงานว่า Firmus กำลังพิจารณา ASX IPO ภายใน 12 เดือนข้างหน้า และเนื่องจากการประเมินมูลค่าส่วนตัวจำนวน 6 พันล้านเหรียญสหรัฐ การเพิ่มขึ้นของสาธารณะคาดว่าจะสูงกว่ามาก เหรียญพันล้านเหรียญ

ด้วยความต้องการที่เพิ่มขึ้นของออสเตรเลียสำหรับกำลังการคำนวณ AI และความได้เปรียบด้านสภาพอากาศเย็นและพลังงานหมุนเวียนของแทสเมเนียสำหรับการดำเนินงานศูนย์ข้อมูลขนาดใหญ่ Firmus ถือเป็นหนึ่งในผู้สมัคร ASX IPO ที่มีขนาดใหญ่ที่สุดในปี 2026

อย่างไรก็ตาม แม้ว่าความสนใจของตลาดใน Firmus ดูเหมือนจะเพิ่มขึ้น แต่เวลาคือทุกอย่างเมื่อพูดถึง IPOตรวจสอบการยืนยันเวลา IPO ที่แน่นอน ความเชื่อมั่นของศูนย์ข้อมูล AI และ Nvidia ส่งสัญญาณการมีส่วนร่วมมากขึ้นในฐานะนักลงทุนเชิงกลยุทธ์หลังการจดทะเบียนหรือไม่

2.ร็อคต์

Rokt ที่ก่อตั้งขึ้นในซิดนีย์ได้กลายเป็นหนึ่งในบริษัทเทคโนโลยีเอกชนที่มีค่าที่สุดของออสเตรเลียอย่างเงียบ ๆแพลตฟอร์ม Adtech อีคอมเมิร์ซที่มีวัตถุประสงค์เพื่อช่วยให้แบรนด์สร้างรายได้จาก “ช่วงเวลาการทำธุรกรรม” มีมูลค่าอยู่ที่ ~7.9 พันล้านเหรียญสหรัฐ.

เอกสารระยะเวลาที่จัดทำโดย MA Financial คาดการณ์การออก ราคาหุ้น 72 เหรียญสหรัฐ ภายใต้สถานการณ์พื้นฐานเมื่อหุ้นถูกปลดปล่อยจากเงินฝากในเดือนพฤศจิกายน 2027

Rokt คาดว่าจะมีรายชื่อคู่ในสหรัฐอเมริกาและใน ASX ในปี 2026 ซึ่งอาจเป็นไปได้ทันทีในช่วงครึ่งแรกของปีIG โครงสร้างที่กล่าวถึงอย่างกว้างขวางที่สุดคือการจดทะเบียน Nasdaq หลักที่มีโครงสร้าง ASX CDI (CHESS Depository Interest) สำหรับนักลงทุนชาวออสเตรเลีย แทนที่จะเป็นรายการคู่เต็มรูปแบบ

รายได้ของ Rokt สำหรับปีสิ้นสุดเดือนสิงหาคม 2025 คาดว่าจะอยู่ที่ 743 ล้านเหรียญสหรัฐ (เพิ่มขึ้น 48% เมื่อเทียบเป็นรายปี) โดยคาดการณ์ว่า EBITDA อยู่ที่ 100 ล้านเหรียญสหรัฐและอัตรากำไรขั้นต้นประมาณ 43%ปัจจุบันคาดว่าจะข้ามก้าวข้ามรายได้ต่อปีจำนวน 1 พันล้านเหรียญสหรัฐภายในเดือนสิงหาคม 2026

Amazon, Live Nation และ Uber ล้วนรายงานว่าเป็นลูกค้า Rokt และ บริษัท ได้ขยายตัวอย่างรวดเร็วทั่วอเมริกาเหนือและยุโรป

ไม่ว่าRokt จะเลือกจดทะเบียน Nasdaq หลักที่มีโครงสร้าง ASX CDI หรือการจดทะเบียนคู่เต็มรูปแบบอาจส่งผลต่อสภาพคล่องและการเข้าถึงนักลงทุนในท้องถิ่นอย่างมีนัยสำคัญ

3.กรีนครอส

กรีนครอสซึ่งเป็นธุรกิจที่อยู่เบื้องหลัง Petbarn, City Farmers และ Greencross Vets กำลังเตรียมที่จะกลับมาใช้ ASX หลังจากถูกยึดครองส่วนตัวโดย บริษัท ไพรเวทอิควิตี้ของสหรัฐฯ TPG ในปี 2019

ปัจจุบันทีพีจี เป็นเจ้าของกรีนครอส 55% ในขณะที่ออสเตรเลียนซุปเปอร์และแผนบำนาญสุขภาพแห่งออนแทรีโอ (HOOPP) ถือหุ้นส่วนที่เหลือ 45%

บริษัท รายงานรายได้ 2 พันล้านเหรียญสหรัฐสำหรับปีการเงิน 2025 เพิ่มขึ้นเล็กน้อยจาก 1.95 พันล้านเหรียญในปี 2024TPG จ่ายมูลค่าหุ้นจำนวน 675 ล้านเหรียญสหรัฐสำหรับธุรกิจในปี 2019 ขายหุ้น 45% ในปี 2022 โดยมูลค่ามากกว่า 3.5 พันล้านเหรียญสหรัฐIPO ที่เสนอหมายถึงการประเมินมูลค่ามากกว่า 4 พันล้านเหรียญสหรัฐ.

TPG กำหนดเป้าหมายการเสนอขายสาธารณะครั้งแรกอย่างน้อย 700 ล้านเหรียญสหรัฐIPO จะทำเครื่องหมายการกลับมาที่ ASX ของ Greencross หลังจากการขาดงานแปดปีขนาดการเพิ่มขึ้นที่ค่อนข้างเล็กของ TPG แสดงให้เห็นว่าบริษัทมีผลการดำเนินงานหลังการตลาดที่แข็งแกร่งก่อนที่จะออกไปอย่างเต็มที่

การประกาศไทม์ไลน์การออกของ TPG ยังคงเป็นข้อสังเกตว่าการเสนอขายหุ้นประจำปี 2026 จะมีการ์ดหรือไม่และไม่ว่าบริษัทจะดำเนินการ IPO แบบดั้งเดิมหรือการขายการค้าซึ่งยังคงเป็นทางเลือกอื่น

4.มอร์สไมโคร

Morse Micro เป็น บริษัท เซมิคอนดักเตอร์ในซิดนีย์ที่พัฒนาชิป Wi-Fi HaLow ที่ออกแบบมาสำหรับการใช้งาน IoT ในด้านการเกษตร โลจิสติกส์ เมืองอัจฉริยะ และการตรวจสอบอุตสาหกรรม

Morse Micro จัดรอบซีรีส์ C ในเดือนกันยายน 2025 โดยระดมทุน 88 ล้านเหรียญสหรัฐ ตามมาในเดือนพฤศจิกายน 2025 โดยมีการระดมทุนก่อนIPO จำนวน 32 ล้านเหรียญสหรัฐ ทำให้เงินทุนรวมสูงสุดลง 300 ล้านเหรียญสหรัฐ.

กำลังกำหนดเป้าหมายรายการ ASX ในอีก 12—18 เดือนข้างหน้าซีรีส์ C นำโดย MegaChips ยักษ์ใหญ่ชิปญี่ปุ่น และ บริษัท กองทุนฟื้นฟูแห่งชาติ

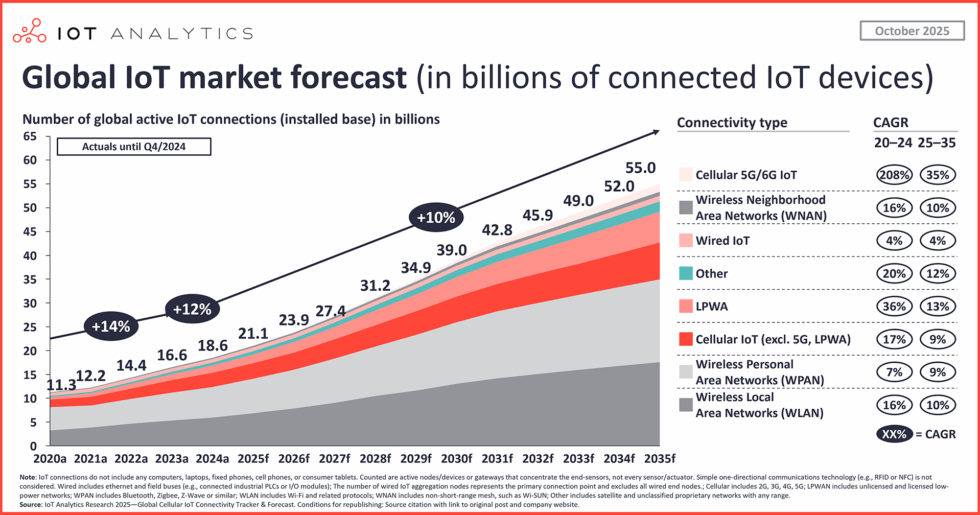

การเชื่อมต่ออุปกรณ์ IoT ทั่วโลกคาดการณ์ว่าจะเกิน 30 พันล้านภายในปี 2030 และ Morse Micro จะเป็น บริษัท เซมิคอนดักเตอร์แบบเล่นแบบแท้จริง ASX ซึ่งอาจดึงดูดความสนใจอย่างมากจากผู้จัดการกองทุนที่เน้นเทคโนโลยี

การดึงดูดรายได้ของ Morse Micro กับพันธมิตรฮาร์ดแวร์ระดับหนึ่งก่อนการลงทะเบียนเป็นสิ่งที่ต้องระวัง และบริษัทจะแสวงหาการจดทะเบียนในสหรัฐอเมริกาพร้อมกันหรือไม่ เนื่องจากความอยากของนักลงทุนเซมิคอนดักเตอร์ของสหรัฐฯ

5.ทรัพยากรไบสัน

Bison Resources เป็นนักสำรวจทองคำและโลหะมีค่าที่เน้นสหรัฐฯที่เพิ่งเข้าจดทะเบียนใหม่ซึ่งปัจจุบันอยู่ในช่วงกลางของการเสนอขายหุ้นสามัญของ ASX

ข้อเสนอปิดในวันที่ 20 มีนาคม 2026 โดยมีเป้าหมายการลงทะเบียน ASX ในช่วงกลางเดือนเมษายน 2026ในฐานะการลงทุนทางการตลาดที่บ่งชี้ของ 13.25 ล้านเหรียญสหรัฐ เมื่อสมัครสมาชิกเต็มรูปแบบ Bison เป็นชื่อเก็งกำไรมากที่สุดในรายการนี้โดยมีส่วนต่างที่สำคัญ

บริษัทมีโครงการสำรวจสี่โครงการในภาคตะวันออกเฉียงเหนือของเนวาดาภายใน Carlin Trend (หนึ่งในสายพานที่ผลิตทองคำที่อุดมสมบูรณ์ที่สุดในโลก) ซึ่งรับผิดชอบในการผลิตทองคำประมาณ 75% ของสหรัฐฯ

IPO พยายามระดมทุน A$4.5 เป็น 5.5 ล้านเหรียญสหรัฐ (22.5 ถึง 27.5 ล้านหุ้น ที่ 0.20 เหรียญสหรัฐต่อหุ้น)ทีมนี้มีประสบการณ์ก่อนหน้านี้ที่ Sun Silver (ASX: SS1) และ Black Bear Minerals ทำให้มีประวัติการแข่งขันในรายชื่อเหมืองแร่เยาวชน ASX จากเนวาดา

IPO ทั่วโลก: IPO ที่ใหญ่ที่สุดที่เกิดขึ้นทั่วโลกในปี 2026 คืออะไร

บรรทัดล่าง

ปฏิทิน IPO 2026 ของออสเตรเลียครอบคลุมถึงสเปกตรัมความเสี่ยงเต็มรูปแบบการเล่นโครงสร้างพื้นฐาน AI ที่รองรับ NVIDIA แพลตฟอร์มอีคอมเมิร์ซมูลค่าพันล้านดอลลาร์ และนักสำรวจทองคำรุ่นเยาวชนที่มีการเสนอขายหุ้น IPO อยู่แล้ว

ผู้สมัครแต่ละคนสะท้อนถึงระยะเวลาที่แตกต่างกันและโปรไฟล์นักลงทุนที่แตกต่างกันพวกเขาร่วมกันแนะนำว่า ASX สามารถเห็นการฉีดรายการใหม่ที่มีความหมายในทุกภาคส่วนที่ส่วนใหญ่ขาดจากตลาดท้องถิ่นในช่วงไม่กี่ปีที่ผ่านมา

Going into the month’s last day of trading, Global markets have performed well despite a sell off this week. Continued hopes that we’re on a path to economic recovery, with COVID vaccines rolling out and the subsequent drop in cases, have supported markets and drawn in investors. Global Equities Major US Indices all saw record highs, with the Dow and S&P500 finishing the month strongly.

The tech heavy NASDAQ also hit all-time highs before selling off as investors rotated into traditional cyclical stocks. Tech stocks such as Amazon, Peloton and DocuSign, which all performed well during COVID lockdown measures, dragged down the index as lockdowns started to ease all over the world. European, UK, Asian and Australian equity markets also performed strongly.

Source: Bloomberg US Markets February saw record highs earlier in the month as COVID vaccinations rolled out out and the Federal Reserve re-iterated its commitment to accommodative conditions until employment and inflation targets are met. Despite these assurances from the Fed there's been a spike in bond yields which has caused concern for investors in the last days of the month, resulting in a significant sell off in US markets overnight. Investors will be watching this coming into March as any continuation of rising yields will be a negative for equities.

Asian Markets Asian markets performed strongly in February with the Nikkei being the strongest performer, breaking above 30000 - a level not seen since the bubble era of the 80s/90s. Source: Bloomberg Hong Kong’s Hang Seng also continued its impressive run. HKEX has seen record volumes on Chinese firms finding a new home there over concerns they'd be booted from US exchanges.

HKEX is now the world's biggest bourse by market value, easily beating rival bourses in London and the US. Australia The ASX 200 has rallied over 3% to date in February. Persistently high commodity prices, an extension in the RBA’s QE bond buying program, and a recovering labour market all supported Aussie equities.

COVID vaccinations starting also gave investors optimism for a continuing economic recovery. Source: tradingeconomic.com FX market February saw a mostly weaker US dollar, with the greenback only outperforming safe haven currencies the Swiss Franc and Japanese yen. With equity markets rallying and record commodity prices, risk and commodity backed currencies outperformed, with the AUDUSD breaking decisively through its 2021 resistance level of 78c US.

Source: Bloomberg British Pound Despite being neither a risk on nor commodity currency the British pound strongly rallied this month on impressive COVID vaccination progress. The pound hit its highest level against the US dollar in nearly three years, amid rising optimism about an end to lockdown in the UK. Australian Dollar The Australian Dollar was the top performing major currency in February.

This despite a dip at the start of the month, when the RBA somewhat surprised the market with an announcement of the extension of the 100 billion bond buying program. Strong signs of recovery in the local labour market, Chinese demand for commodities which are near record highs, and the status of AUD being a 'risk on' currency all helped AUDUSD break through the 78c US level. Analysts at ANZ and CBA expect the Australian dollar to trade as high as 82 US cents by the end of the year.

Source: GO MT4 Bitcoin Bitcoin again proved how volatile it can be with wild swings during the month. The cryptocurrency gyrated wildly from 32k USD at the start of the month, hitting an all-time high above 57K before selling off to be around 47k at the time of writing. Increased optimism in the institutionalising of Bitcoin as big players such as Morgan Stanley, Bridgewater capital, BNY Mellon and Tesla announced Bitcoin investments drove the price higher as momentum traders jumped on board.

The party was somewhat spoilt by comments from Treasury secretary Janet Yellen who labelled Bitcoin “an “inefficient” digital currency and one that is often used for illegal transactions” Government regulation and banning of Bitcoin is the biggest fear of traders in this market. Source: GO MT4 Gold Spot Gold prices dropped around 5% in February to date as the precious metal came under serious selling pressure. This drop is despite US dollar weakness; as the economic recovery progresses globally, gold's appeal is waning.

With inflation reportedly low in developed economies gold's other function as an inflation hedge has also waned. XAUUSD is now testing critical support levels that were set late in 2020. Source: GO MT4 Monday, 22 February 2021 Indicative Index Dividends Dividends are in Points ASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 10.832 8.224 0.097 0.029 0 0 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 0 0 0 0 0 0.718

XAUUSD Analysis 3 – 7 April 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the closing of the Doji bar and last week's sell pressure bar indicate market hesitation. Although the previous week, gold has had strong buying momentum and has continued since the beginning of March.

But even so, the gold price has not yet clearly shown strong selling momentum. In addition, last week's closing of the Doji bar and selling pressure bar was a close of the candlestick above the 1960 support, the latest high of gold prices on the Weekly timeframe level, so it can be expected that the price of gold will still hold. Opportunity to rise to test resistance 2070, which is an important resistance in the weekly timeframe level or the price that gold has ever done the most in history.

And in the event that gold prices cannot continue to rise A retracement to support at the time frame level of 1880 is the next target to watch. But regardless of whether the price will rise or fall Short-term forecasts on the time frame day can be seen as the possibility of a sideways or consolidation between the 1960 support and the 2000 resistance until the price direction is clear. AUDUSD Analysis 3 – 7 April 2023 The AUDUSD price sideways and swings within the 0.67750 resistance and 0.6560 support levels as seen from the H4 timeframe and Daytime timeframe.

Also, last week's close on the Weekly timeframe level has wicked as much as half of the candle even when it closed with a buying bar. The buying momentum of the price is not yet clearly seen compared to the selling momentum. forecasting that price May have a more negative direction. As the price of AUDUSD continues to be in a downtrend in both the short and medium term.

Therefore, the correction to further down is very eye-catching, especially the 0.6560 time frame support is expected to be the next target for the AUDUSD price. EURUSD Analysis 3 – 7 April 2023 The EURUSD has started to lose buying momentum noticeably as the weekly and previous weekly timeframes have dipped as much as half of the candlestick. (Significantly) as last week's closing price was lower than last week's high. After rising to test the timeframe resistance 1.08800.

Then it broke up to the price level of 1.09300, which was the price that could move up the most last week. Before there was a continuous sell down like this for two weeks in a row. forecasting that price May have both upward direction (but probably not much) and a downtrend in the medium term like time frame day. Due to the loss of buying momentum over the past week and the previous week, the trend of the price has become less pronounced.

The important price line to watch in the day frame is support 1.05250 (latest low) and resistance 1.08800 (latest high).

XAUUSD Analysis 27 – 31 March 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the close of last week's Doji bar indicates hesitation in the market. Although the previous three weeks, gold has had strong and consistent buying momentum since the beginning of March.

But even so, the gold price has not yet clearly shown strong selling momentum. Also, last week's close of the Doji bar was a candle close above the 1960 support, the latest high of gold prices on the Weekly timeframe. The bull rose to test the resistance 2070, which is an important resistance at the weekly timeframe level or the price line that gold has ever done the most in history. and in the event that gold prices cannot continue to rise A retracement to support at the time frame level of 1880 is the next target to watch.

But regardless of whether the price will rise or fall Short-term forecasts on the time frame day can be seen as the possibility of a sideways or consolidation between the 1960 support and the 2000 resistance until the price direction is clear. GBPUSD Analysis 27 – 31 March 2023 The GBPUSD outlook is bullish in the short and medium term, as the pair is currently moving sideways on the daily time frame and H4 (support 1.19140 and resistance 1.21460) rises above them. 1.21460 plus continued buying momentum based on the weekly nighttime buy candlestick, although last week's closing price has retraced. Still, the price has yet to show a strong sell candle on the Weekly timeframe, indicating a clear uptrend in both the short and medium term. forecasting that price There is a tendency for the price to rise to test the resistance of 1.24470, which is a key resistance at the time frame, which in the past the price has previously tested and formed a Double Top pattern, with the key support being 1.21460, a key support at the Tai level.

Timeframe predicts that the price may be shortened or sideways. Corrected to rebound to test the resistance of 1.24470, which is the price target of GBPUSD. EURUSD Analysis 27 – 31 March 2023 The EURUSD started to lose its buying momentum significantly as the weekly timeframe was bullish as much as half of the candlestick. (Significantly) as last week's closing price was lower than last week's high.

After rallying to test the 1.08800 time frame resistance and then breaking up to the 1.09300 level, which was the strongest upside of the week. Before there is a continuous sell down forecasting that price There may be both upward and downward directions in the medium term, such as the time frame day. Due to the loss of buying momentum last week, the trend or trend of the price becomes less clear.

The important price line to watch in the day frame is support 1.05250 (latest low) and resistance 1.08800 (latest high).

Leading online broker GO Markets has hired ex-Pepperstone Head of Market Risk, Peter Spanos. Peter has joined GO Markets as Head of Risk & Product Development, flagging a new era of growth for the Australian-founded broker. Spanos said of his new position, “It’s exciting to work at a company with a supportive culture.

GO Markets has big plans for the future, with some notable key hires recently. I look forward to helping the company on that journey. It’s a great place to be, surrounded by lots of very talented people.” Spanos started out at IG 15 years ago, as Senior Quoting Dealer / Market Maker.

He then moved to CMC Markets as Volatility Risk Manager, and most recently Head of Market Risk at Pepperstone, a role he’d held since 2018. GO Markets Director, Khim Khor said, “It’s great to have Peter on board. He has a wealth of experience and fits well into the culture at GO Markets.

We are very optimistic about what the future holds.” Several key personnel from Pepperstone have moved to GO Markets in the last 3 years, including GO Markets’ current Chief Marketing Officer, Head of Design, and their recently hired Senior Premium Client Manager.

Australia’s biggest lender has suffered a dropped in price the last few days. Shares in the bank fell as much as 5.7% in early trading in Sydney while the broader market (.AXJO) fell 1.0%, amid concerns of a weaker mortgage business in the high interest rate environment and the bank's lending margins peaking. Key points Brokers think that CBA’s margins can benefit from higher interest rates, however bad debts could rise CBA shares are down approximately 5%, which is a similar fall to the ASX 200 Morgans thinks that there’s more declines to come for CBA shares, though the dividend is expected to rise However, is not all doom and gloom when you peel back the layers as long-term shareholders would testify that while CBA shares have dropped 15% over the past week, it only registers an 8.5% drop in the last 6 months.

They are also sitting at the same price it was before the COVID-19 crash of 2020. Morgans is expecting a growing dividend from the big bank in the future. The estimated grossed-up dividend yield is 5.7% in FY22 and 6.25% in FY23.

After 8 rate hikes in 2022 and a further quarter-basis point raise last week, the central bank has indicated more tightening ahead to stamp out inflation. Soaring rates have cooled off the housing market and added to rising cost of living. "We expect business credit growth to moderate and global economic growth to slow during 2023," said Chief Executive Officer Matt Comyn. "However, we remain optimistic that a soft landing for the Australian economy can be achieved." "We are conscious that many of our customers are feeling significant strain from rising interest rates, alongside the rising costs of electricity, groceries and other household items,” Comyn said in an analyst and investor briefing. Comyn said some customers have drawn down savings and reduced spending, but they have not fallen behind on repayments yet.

To conclude the RBA interest rate hike was always going to affect the markets and cost of living, this much was advised at the Jackson Hole meeting last year. Many analysts and bankers hope that Australia has enough about them to have a soft landing and avoid a recession coming into 2023. GO Markets provides access to a range of Securities in the ASX, NASDAQ, NYSE and LSE and other additional major markets, by providing our clients with access to a platform, where you can either build a diverse portfolio of ASX Shares, or alternatively you can trade these markets as a CFD, visit us here for more information www.gomarkets.com/au or call us on 03 8566 7680 to speak to one of our Account Managers.

Sources: https://www.fool.com.au/, https://www.reuters.com/

US telecommunications giant Cisco Systems Inc. (NASDAQ:CSCO) announced the latest earnings results for the fiscal Q2 ending January 28, 2023, after market close in the US on Wednesday. Cisco beat revenue and earnings per share estimates for the quarter, sending the stock higher. The company reported revenue of $13.592 billion (up by 7% year-over-year) vs. the $13.419 billion estimate.

EPS reported at $0.88 per share (up by 5% year-over-year) vs. $0.855 EPS expected. Cisco also announced a quarterly dividend of $0.39 a share. CEO commentary ''With Cisco's strong Q2 performance, our fiscal 2023 is shaping up to be a great year," Chuck Robbins, CEO of the company said in a press release. "The modern, highly secure networks we are building serve as the backbone of our customers' technology strategy.

This, combined with the success of our ongoing business transformation and operational discipline gives me confidence in our future," Robbins added. Stock reaction The latest results had a positive impact on the share price. The stock was up by 5.24% at market close on Thursday in the US, trading at $50.96 a share.

Stock performance 1 month: +10.99% 3 months: +10.68% Year-to-date: +8.24% 1 year: -7.54% Cisco stock price targets Loop Capital: $66 Piper Sandler: $53 UBS: $51 Cowen & Co.: $64 JP Morgan: $55 Credit Suisse: $69 Rosenblatt: $53 Wells Fargo: $57 Raymond James: $63 Morgan Stanley: $55 Cisco is the 46 th largest company in the world with a market cap of $211.81 billion. You can trade Cisco Systems Inc. (NASDAQ:CSCO) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Cisco Systems Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap