ข่าวสารตลาด & มุมมองเชิงลึก

ก้าวนำตลาดด้วยมุมมองเชิงลึกจากผู้เชี่ยวชาญ ข่าวสาร และการวิเคราะห์ทางเทคนิค เพื่อเป็นแนวทางในการตัดสินใจซื้อขายของคุณ.

ตั้งแต่โครงสร้างพื้นฐาน AI ไปจนถึงการดูแลสัตว์เลี้ยง เซมิคอนดักเตอร์ และการสำรวจทองคำ ต่อไปนี้คือผู้สมัครชั้นนำห้าคนที่มีแนวโน้มที่จะอยู่ในรายชื่อมากที่สุด แอ็กซ์ ในปี พ.

การเสนอขายสาธารณะเบื้องต้น (IPO) คืออะไร?

1.เฟอร์มุส เทคโนโลยี

Firmus Technologies กำลังสร้างโครงสร้างพื้นฐานศูนย์ข้อมูลที่ขับเคลื่อนด้วย AI ในแทสเมเนีย และอาจเป็นหนึ่งในบริษัทเทคโนโลยีที่มีตำแหน่งเชิงกลยุทธ์ที่สุดในออสเตรเลียในขณะนี้

Firmus เป็นพันธมิตรคลาวด์ Nvidia และได้เข้าร่วมตลาด Lepton ของผู้ผลิต GPUบริษัท ได้ออกแบบแพลตฟอร์ม AI Factory แบบแยกส่วนที่เหลวทุกที่เพื่อพัฒนาด้วยสถาปัตยกรรมล่าสุดของ Nvidia รวมถึงเครือข่ายอีเธอร์เน็ต Nvidia Spectrum-X

การระดมทุนในเดือนกันยายน 2025 จำนวน 330 ล้านเหรียญสหรัฐปิดโดยการประเมินมูลค่าหลังการเงิน 1.85 พันล้านเหรียญสำหรับ บริษัทภายในเดือนพฤศจิกายน 2025 หลังจากเพิ่มขึ้นอีก 500 ล้านเหรียญสหรัฐ การประเมินมูลค่าดังกล่าวเพิ่มขึ้นเป็นสามเท่าโดยประมาณ 6 พันล้านเหรียญสหรัฐ.

การลงทุน A$100 ล้านต่อมาจาก Maas Group ในช่วงต้นปี 2026 ยืนยันการประเมินมูลค่าเดือนพฤศจิกายนรายงานว่า Firmus กำลังพิจารณา ASX IPO ภายใน 12 เดือนข้างหน้า และเนื่องจากการประเมินมูลค่าส่วนตัวจำนวน 6 พันล้านเหรียญสหรัฐ การเพิ่มขึ้นของสาธารณะคาดว่าจะสูงกว่ามาก เหรียญพันล้านเหรียญ

ด้วยความต้องการที่เพิ่มขึ้นของออสเตรเลียสำหรับกำลังการคำนวณ AI และความได้เปรียบด้านสภาพอากาศเย็นและพลังงานหมุนเวียนของแทสเมเนียสำหรับการดำเนินงานศูนย์ข้อมูลขนาดใหญ่ Firmus ถือเป็นหนึ่งในผู้สมัคร ASX IPO ที่มีขนาดใหญ่ที่สุดในปี 2026

อย่างไรก็ตาม แม้ว่าความสนใจของตลาดใน Firmus ดูเหมือนจะเพิ่มขึ้น แต่เวลาคือทุกอย่างเมื่อพูดถึง IPOตรวจสอบการยืนยันเวลา IPO ที่แน่นอน ความเชื่อมั่นของศูนย์ข้อมูล AI และ Nvidia ส่งสัญญาณการมีส่วนร่วมมากขึ้นในฐานะนักลงทุนเชิงกลยุทธ์หลังการจดทะเบียนหรือไม่

2.ร็อคต์

Rokt ที่ก่อตั้งขึ้นในซิดนีย์ได้กลายเป็นหนึ่งในบริษัทเทคโนโลยีเอกชนที่มีค่าที่สุดของออสเตรเลียอย่างเงียบ ๆแพลตฟอร์ม Adtech อีคอมเมิร์ซที่มีวัตถุประสงค์เพื่อช่วยให้แบรนด์สร้างรายได้จาก “ช่วงเวลาการทำธุรกรรม” มีมูลค่าอยู่ที่ ~7.9 พันล้านเหรียญสหรัฐ.

เอกสารระยะเวลาที่จัดทำโดย MA Financial คาดการณ์การออก ราคาหุ้น 72 เหรียญสหรัฐ ภายใต้สถานการณ์พื้นฐานเมื่อหุ้นถูกปลดปล่อยจากเงินฝากในเดือนพฤศจิกายน 2027

Rokt คาดว่าจะมีรายชื่อคู่ในสหรัฐอเมริกาและใน ASX ในปี 2026 ซึ่งอาจเป็นไปได้ทันทีในช่วงครึ่งแรกของปีIG โครงสร้างที่กล่าวถึงอย่างกว้างขวางที่สุดคือการจดทะเบียน Nasdaq หลักที่มีโครงสร้าง ASX CDI (CHESS Depository Interest) สำหรับนักลงทุนชาวออสเตรเลีย แทนที่จะเป็นรายการคู่เต็มรูปแบบ

รายได้ของ Rokt สำหรับปีสิ้นสุดเดือนสิงหาคม 2025 คาดว่าจะอยู่ที่ 743 ล้านเหรียญสหรัฐ (เพิ่มขึ้น 48% เมื่อเทียบเป็นรายปี) โดยคาดการณ์ว่า EBITDA อยู่ที่ 100 ล้านเหรียญสหรัฐและอัตรากำไรขั้นต้นประมาณ 43%ปัจจุบันคาดว่าจะข้ามก้าวข้ามรายได้ต่อปีจำนวน 1 พันล้านเหรียญสหรัฐภายในเดือนสิงหาคม 2026

Amazon, Live Nation และ Uber ล้วนรายงานว่าเป็นลูกค้า Rokt และ บริษัท ได้ขยายตัวอย่างรวดเร็วทั่วอเมริกาเหนือและยุโรป

ไม่ว่าRokt จะเลือกจดทะเบียน Nasdaq หลักที่มีโครงสร้าง ASX CDI หรือการจดทะเบียนคู่เต็มรูปแบบอาจส่งผลต่อสภาพคล่องและการเข้าถึงนักลงทุนในท้องถิ่นอย่างมีนัยสำคัญ

3.กรีนครอส

กรีนครอสซึ่งเป็นธุรกิจที่อยู่เบื้องหลัง Petbarn, City Farmers และ Greencross Vets กำลังเตรียมที่จะกลับมาใช้ ASX หลังจากถูกยึดครองส่วนตัวโดย บริษัท ไพรเวทอิควิตี้ของสหรัฐฯ TPG ในปี 2019

ปัจจุบันทีพีจี เป็นเจ้าของกรีนครอส 55% ในขณะที่ออสเตรเลียนซุปเปอร์และแผนบำนาญสุขภาพแห่งออนแทรีโอ (HOOPP) ถือหุ้นส่วนที่เหลือ 45%

บริษัท รายงานรายได้ 2 พันล้านเหรียญสหรัฐสำหรับปีการเงิน 2025 เพิ่มขึ้นเล็กน้อยจาก 1.95 พันล้านเหรียญในปี 2024TPG จ่ายมูลค่าหุ้นจำนวน 675 ล้านเหรียญสหรัฐสำหรับธุรกิจในปี 2019 ขายหุ้น 45% ในปี 2022 โดยมูลค่ามากกว่า 3.5 พันล้านเหรียญสหรัฐIPO ที่เสนอหมายถึงการประเมินมูลค่ามากกว่า 4 พันล้านเหรียญสหรัฐ.

TPG กำหนดเป้าหมายการเสนอขายสาธารณะครั้งแรกอย่างน้อย 700 ล้านเหรียญสหรัฐIPO จะทำเครื่องหมายการกลับมาที่ ASX ของ Greencross หลังจากการขาดงานแปดปีขนาดการเพิ่มขึ้นที่ค่อนข้างเล็กของ TPG แสดงให้เห็นว่าบริษัทมีผลการดำเนินงานหลังการตลาดที่แข็งแกร่งก่อนที่จะออกไปอย่างเต็มที่

การประกาศไทม์ไลน์การออกของ TPG ยังคงเป็นข้อสังเกตว่าการเสนอขายหุ้นประจำปี 2026 จะมีการ์ดหรือไม่และไม่ว่าบริษัทจะดำเนินการ IPO แบบดั้งเดิมหรือการขายการค้าซึ่งยังคงเป็นทางเลือกอื่น

4.มอร์สไมโคร

Morse Micro เป็น บริษัท เซมิคอนดักเตอร์ในซิดนีย์ที่พัฒนาชิป Wi-Fi HaLow ที่ออกแบบมาสำหรับการใช้งาน IoT ในด้านการเกษตร โลจิสติกส์ เมืองอัจฉริยะ และการตรวจสอบอุตสาหกรรม

Morse Micro จัดรอบซีรีส์ C ในเดือนกันยายน 2025 โดยระดมทุน 88 ล้านเหรียญสหรัฐ ตามมาในเดือนพฤศจิกายน 2025 โดยมีการระดมทุนก่อนIPO จำนวน 32 ล้านเหรียญสหรัฐ ทำให้เงินทุนรวมสูงสุดลง 300 ล้านเหรียญสหรัฐ.

กำลังกำหนดเป้าหมายรายการ ASX ในอีก 12—18 เดือนข้างหน้าซีรีส์ C นำโดย MegaChips ยักษ์ใหญ่ชิปญี่ปุ่น และ บริษัท กองทุนฟื้นฟูแห่งชาติ

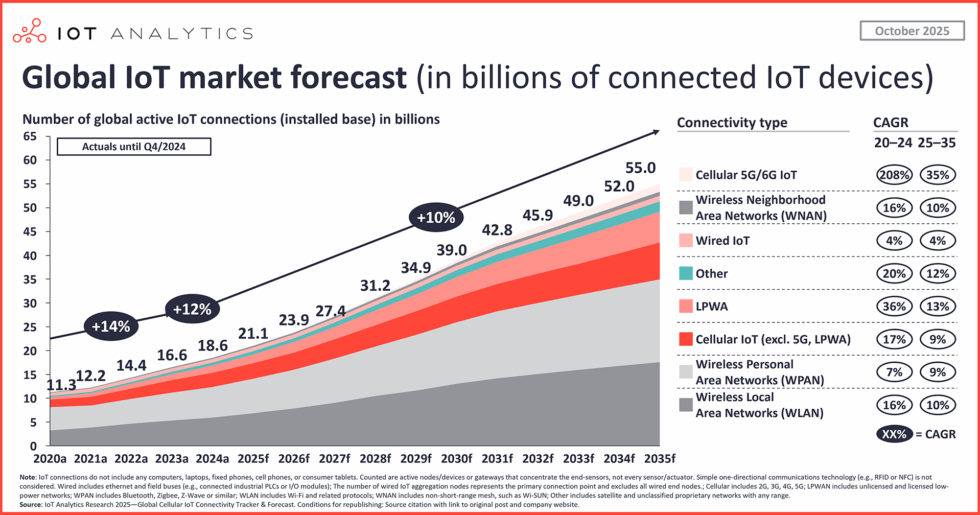

การเชื่อมต่ออุปกรณ์ IoT ทั่วโลกคาดการณ์ว่าจะเกิน 30 พันล้านภายในปี 2030 และ Morse Micro จะเป็น บริษัท เซมิคอนดักเตอร์แบบเล่นแบบแท้จริง ASX ซึ่งอาจดึงดูดความสนใจอย่างมากจากผู้จัดการกองทุนที่เน้นเทคโนโลยี

การดึงดูดรายได้ของ Morse Micro กับพันธมิตรฮาร์ดแวร์ระดับหนึ่งก่อนการลงทะเบียนเป็นสิ่งที่ต้องระวัง และบริษัทจะแสวงหาการจดทะเบียนในสหรัฐอเมริกาพร้อมกันหรือไม่ เนื่องจากความอยากของนักลงทุนเซมิคอนดักเตอร์ของสหรัฐฯ

5.ทรัพยากรไบสัน

Bison Resources เป็นนักสำรวจทองคำและโลหะมีค่าที่เน้นสหรัฐฯที่เพิ่งเข้าจดทะเบียนใหม่ซึ่งปัจจุบันอยู่ในช่วงกลางของการเสนอขายหุ้นสามัญของ ASX

ข้อเสนอปิดในวันที่ 20 มีนาคม 2026 โดยมีเป้าหมายการลงทะเบียน ASX ในช่วงกลางเดือนเมษายน 2026ในฐานะการลงทุนทางการตลาดที่บ่งชี้ของ 13.25 ล้านเหรียญสหรัฐ เมื่อสมัครสมาชิกเต็มรูปแบบ Bison เป็นชื่อเก็งกำไรมากที่สุดในรายการนี้โดยมีส่วนต่างที่สำคัญ

บริษัทมีโครงการสำรวจสี่โครงการในภาคตะวันออกเฉียงเหนือของเนวาดาภายใน Carlin Trend (หนึ่งในสายพานที่ผลิตทองคำที่อุดมสมบูรณ์ที่สุดในโลก) ซึ่งรับผิดชอบในการผลิตทองคำประมาณ 75% ของสหรัฐฯ

IPO พยายามระดมทุน A$4.5 เป็น 5.5 ล้านเหรียญสหรัฐ (22.5 ถึง 27.5 ล้านหุ้น ที่ 0.20 เหรียญสหรัฐต่อหุ้น)ทีมนี้มีประสบการณ์ก่อนหน้านี้ที่ Sun Silver (ASX: SS1) และ Black Bear Minerals ทำให้มีประวัติการแข่งขันในรายชื่อเหมืองแร่เยาวชน ASX จากเนวาดา

IPO ทั่วโลก: IPO ที่ใหญ่ที่สุดที่เกิดขึ้นทั่วโลกในปี 2026 คืออะไร

บรรทัดล่าง

ปฏิทิน IPO 2026 ของออสเตรเลียครอบคลุมถึงสเปกตรัมความเสี่ยงเต็มรูปแบบการเล่นโครงสร้างพื้นฐาน AI ที่รองรับ NVIDIA แพลตฟอร์มอีคอมเมิร์ซมูลค่าพันล้านดอลลาร์ และนักสำรวจทองคำรุ่นเยาวชนที่มีการเสนอขายหุ้น IPO อยู่แล้ว

ผู้สมัครแต่ละคนสะท้อนถึงระยะเวลาที่แตกต่างกันและโปรไฟล์นักลงทุนที่แตกต่างกันพวกเขาร่วมกันแนะนำว่า ASX สามารถเห็นการฉีดรายการใหม่ที่มีความหมายในทุกภาคส่วนที่ส่วนใหญ่ขาดจากตลาดท้องถิ่นในช่วงไม่กี่ปีที่ผ่านมา

The outlook for the Australian equities market is one of the best globally and is set up to cope with a potential recession. The Australian market showed itself to be robust in much of the volatility and downturn of last year being one of the more solid economies. This relative strength has carried so far into 2023 and has largely been due to the resource heavy nature of the ASX with most companies on the index being large resource and mining.

The XJO was also geographically protected from much of the geopolitical conflict in Europe that many European markets had to suffer through. The XJO is currently just 300 points off its all time high and with improving commodity prices it is well placed to weather a recessionary storm. A reopening of China may further support growth of the Australian market because growth in China may help various sectors such as travel, construction, manufacturing, and resources.

Lastly, as the Central banks across the world look at lowering interest rates it will only help growth economies such as Australia. Risk assets such as the Technology sector and growth economies should benefit as the cost of borrowing comes down. Although Banks will have to balance the need to lower rates with the need to tame inflation and the fight between which is a worse evil to fight will be much of the talking point of 2023.

Technical Analysis As stated above the XJO is currently just about 300 points below its all-time highs and is trending towards that target. Firstly, on the weekly chart the XJO has been able to maintain a tight range over the last 2 years. Once the dust had settled after the Covid 19 pandemic the price developed a range between 6412 and 7634.

The price also bounced of 6412 its long-term support twice in 2022 before pushing higher. Importantly, since October 2022, the XJO has been able to stay above the 50-week moving average as it has gained momentum. On the daily chart the price has broken to level not seen since April 2022.

Therefore, it is likely that the price may face some significant resistance as it approached 7600. Another positive sign is that the short term 50 day moving average has crossed back over the longer term 200 day moving average. This indicates that momentum is beginning to shift towards the bulls.

With more information still to come out, the Australian equities market is as well placed as any to deal with any potential macroeconomic factors that come its way.

TSMC posts strong Q4 results – the stock is rising Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) reported Q4 financial results before the market open in the US on Thursday. The Taiwanese company reported revenue of $20.554 billion for Q4, falling slightly short of Wall Street estimate of $20.574 billion. TSMC reported earnings per share (EPS) of $1.875% for the quarter, higher than $1.795 EPS expected.

CFO commentary ''Our fourth quarter business was dampened by end market demand softness, and customers’ inventory adjustment, despite the continued ramp-up for our industry-leading 5nm technologies,'' Wendell Huang, VP and CFO said after the results. ''Moving into first quarter 2023, as overall macroeconomic conditions remain weak, we expect our business to be further impacted by continued end market demand softness, and customers’ further inventory adjustment,'' Huang looked ahead. The company expects the revenue of between $16.7 billion and $17.5 billion for Q1. Stock reaction Shares of TSMC were up by over 7% on Thursday at $88.07 a share.

Stock performance 1 month: 3 months: Year-to-date: 1 year: TSMC price targets Susquehanna: $88 Atlantic Equities: $170 Cowen & Co.: $120 Argus Research: $150 Goldman Sachs: $55 Taiwan Semiconductor Manufacturing Company Limited is the 10 th largest company in the world with a market cap of $454.97 billion. You can trade Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Taiwan Semiconductor Manufacturing Company Limited, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

What is going on with Tesla’s share price? Tesla is now one of the world’s most recognisable brands and companies. A leader in technology and pioneer of the electric vehicle space.

The company has become a beacon of hope for the charge against climate change and move towards a more a carbon friendly future. At the centre of the company is its CEO, South African born billionaire, and visionary Elon Musk. Musk, who famously took over Twitter last year and has a list of other ventures including SpaceX, the Boring project and Starlink is a polarising figure with his controversial tweet comments and stances.

This at times has hurt Tesla’s share price and reputation. However, he has been bold and aggressive in his plans and hopes for Tesla. However, the company’s share price has taken a massive hit in the prior 18 month after peaking at $414.

The price has now fallen back to $117 and is down 71.5% from those highs. The reason for the drop is due to various reason, Musk’s own hubris, a tough environment for growth company’s and missed deadlines. However, is the current state a once in a lifetime opportunity to enter a generational company at a heavy discount or a sign of big change in fortunes for the company.

The numbers The company’s share price has been dropping rapidly as production has slowed worries over the company’s ability to keep up with demand or worse the slowing of demand has spooked the market to the ability for the company to continue to grow. Furthermore, concern has developed over whether its first mover advantage is starting to fall away. Other car manufacturers are beginning to develop and get to market their own electric vehicles threatening Tesla’s market share.

In saying this, Tesla still managed to sell 1.3 million vehicles last year short of the Musk’s 50% growth target. The company also manufactured 1.37 million cars for the 2022 calendar year. The company also increased its revenue to 74.836 billion dollars from 53.823 billion for the prior financial year.

Tesla also has a notoriously high Price/Earnings ratio even when compared to most other car manufacturers. Top car manufacturers such as Toyota, Volkswagen and Ford have much more modest PE ratios then Tesla has. Therefore, it is possible that the market is just valuing the company alongside the industry standard.

In addition, the company still has a market capitalisation of almost double that of Toyota and significantly higher than other manufacturers. Company PE Ratio BMW 3.11 Volkswagen 4.14 Toyota 9.19 Ford 5.70 Tesla 31.3 Price Action analysis The price chart for Tesla is not particularly encouraging. The price is at levels not seen in more than 2 and a half years.

The price is currently at $120 USD and has not yet made a bottom. In fact, the price has fallen below its 200-week moving average a bearish sign. It is resting on a support region at 110-120 dollars and if it fails its next support is at $65.

The volume of selling has been quite aggressive. At this stage until, there is some sort of support or buying volume it remains a more favorable short then long. However, if the price can find support at $110 it may bounce and begin a reversal.

Ultimately, Tesla remains an intriguing opportunity for traders and investors. With high volatility and a high growth runway, Tesla may provide a rare opportunity for a long time.

Many traders early on in their trading journey may jump into trading without knowing if their system or edge can be profitable. The most important metric that a trader should measure their system on is by using expected value. This essentially wors out the average return that the system will return for every trade that it makes, considering both winning trades and losing trades.

The formular for the expected value is written below. Expected Value = (Probability of winning trade X Average Winning Trade Value) – (Probability of a Losing trade X Average Loss) For example, Trader A - Wins 40% of their trades - Loses 60% of their trades - Average win = $20 - Average Loss = $10 Therefore, Expected Value = (0.4x20) – (0.6x10) = $2 This means over the long run the system will return $2.00 per trade made. This relationship describes any trading strategy or edge’s average performance per trade.

Therefore, by determining the expected value a trader can see how effective their edge will be excluding slippage and transaction costs in the long term. Risk and Return The relationship also shows that a strategy does not need to necessarily win every single trade to be profitable. The rule of risk and reward is that they are inversely correlated.

This means that the more a trader is willing to risk, whether it be size or distance to a stop loss the higher potential reward. Alternatively, the less risk a trader takes the lower potential reward. It doesn’t matter which type of trader you are often different personality types will gravitate to either more frequent winning and smaller winnings or larger winnings, but a smaller number of wins.

In fact, a trader may only need to be profitable on 20% of their trades if they can ensure that their average winning trades are more profitable by a factor of 5:1. A strategy that wins more frequently may only need a smaller average win vs its average loss. When testing a system, it is important that there is sufficient data to ensure the inputs for the above formula is accurate.

This means using data from various time periods and potentially across a range of markets to measure the Expected Value of the system. See below for the required a=Average Winning trade/Average Loss trade per Average win rate for a breakeven trading system. Ultimately it is vital that when assessing the performance of a trading strategy or edge to be able to measure the profitability of the system.

The best way to do this is by using expected value. Profitable trading strategies can be made with either a high win rate and low average W/L ratio or a low winning strategy with a high W/L ratio.

The USDJPY has dropped more than 400 pips in just a few minutes after the Bank of Japan brought adjusted its intervention criteria. The bank did not change its official rate, which are -0.10%, an extremely low figure compared to almost every other country. Japan has been a show of dovishness in a sea of hawkishness.

However, this latest move has been seen by the market as hawkish as the USDJPY dropped to its lowest levels since August and sent the equity market falling. The Bank of Japan committed to widening its yield curve control. Prior to the announcement the bank had allowed for movement of -0.25% to 0.25% before interviewing by way of buying and selling government bonds.

However, the latest move has seen the bank change the threshold to -0.5% to 0.5% before intervening. This allows the Bank of Japan to lessen its intervention going forward. The largest move was in the USDJPY which crashed below its 200-day moving average to fall by more than 400 pips.

On the 15-minute chart, the price is currently consolidating as it decides what to do next. A break of the lows at 133.1 may bring the next support at 131.245 into play. On the contrary, if the price can bounce at this level it may move to 134.5.

With the US trading session still to play out tonight there may be some trading opportunities that arise.

Corporate actions are activities that material effect an organisation and impacts the key stakeholders including shareholders and creditors. They can affect the stock price both in good and bad ways. Corporate actions are most often determined and voted on by the board of directors of the company.

Although sometimes, shareholder will be given the chance to either vote or participate in these actions such as placements. Why are they important? Corporate actions materially affect the share price are highly important to understand.

This means that the actual value of the company or the share price will change due to one of these actions. This also means that they can be great catalysts for volatile trade opportunities Examples of Common Corporate Actions Dividends Mature companies or companies who record consistent profits may issue dividends to their ordinary shareholders. It is important to understand what a dividend is.

It is a company distributing a share of its profits to give back to investors. This dividend is paid to investors and means that once the dividend has been returned the share price must be adjusted to reflect the reduction in future cashflow. Dividends may also be issued via a reissuing of shares or a reinvestment plan.

Stock Split A stock split is when a company decides to split each of its shares by a certain ratio for example 1:5 or 1:10. The reason that companies will split stocks are usually for liquidity purposes. When a company has small number of outstanding shares it often leads to low liquidity and volatile prices due to large spreads between the bid and ask prices.

Therefore, by splitting stocks the company can improve the liquidity of its share price. The results of this action will increase liquidity but also lower the share price and volatility of the security. Reverse stock split or consolidation The process of a stock consolidation is just the reverse of a stock split.

This occurs when a company’s share price is too low or is too easily manipulated because there are too many shares available to trade. It is also important to note that most exchanges have rules that will strike out company’s trading on their exchange if the share price drops too low. Therefore, a stock consolidation may occur may have to happen out of necessity.

Mergers and Acquisitions Mergers and acquisitions are probably the most complex corporate action to understand. They generally involve one company buying or taking over another company. This process can take some time and is not as generic as the other actions.

There are multiple ways in which the buying company can purchase the other company. It may involve payment of cash, debt, shares, option, or a combination of these and other financing options. Most often the company buying, will have to pay a premium to cover the goodwill from the company being acquired.

The initial bid therefore provides a valuation for the company being acquired. To further complicate matters, a bid especially an initial bid is not always the final offer which makes finding a fair value for the share price difficult and provides great opportunities for trading as the market tries to find the fair value. Rights Issuing or share placements Companies for a variety of reasons need to raise money.

They can do this by selling new shares to existing shareholders or even private institutions. This enables the company to increase its equity. At the same time this dilutes the shares outstanding which will most likely reduce the price of the company’s shares.

In addition, these placements or new issues are often prices that are already discounted to the price at the time of the placement. A company may raise capital for a variety of reasons which include, increasing cash at hand, dealing with liquidity problems, purchasing of new equipment, purchasing of another company. Share Buyback A share buyback is when a company decides to purchase its own shares from the float to reduce the number available for trade.

Companies may do this to either regain control of some of the shares or also to increase the value of their shares for its holders. Whilst it is a different mechanism it has a similar effect to a dividend. This is because as the company buys back the shares the supply reduces, and the purchasing of the shares increases the market price.

Corporate actions are an important part of the capital markets and as catalysts for price changes for shares. Therefore, traders should be aware of the different types of corporate actions and the effect they can have on the price of a company’s share price.