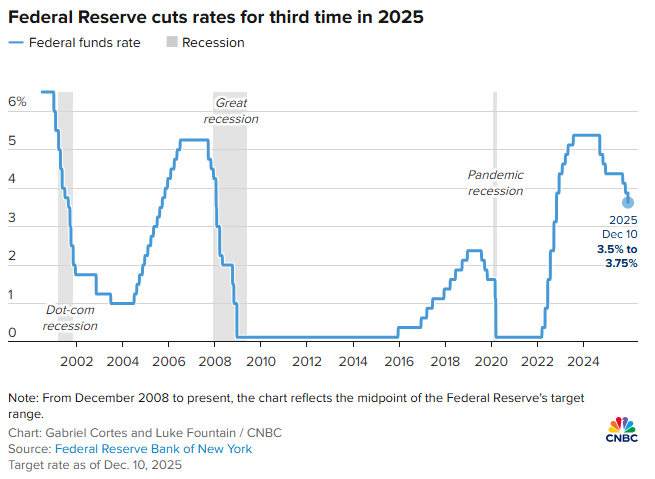

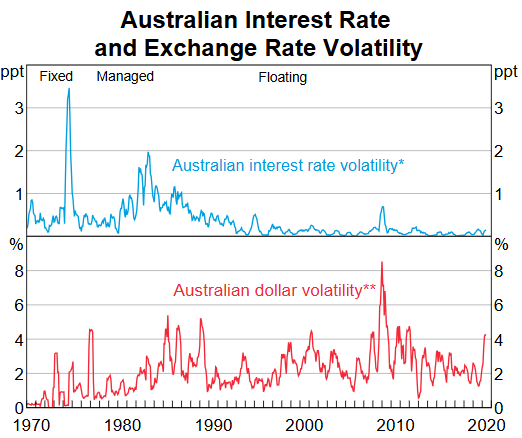

The Federal Reserve delivered its third consecutive rate cut this morning, lowering rates 25 basis points to 3.5%-3.75% after a 9-3 vote in favour.

The three dissents were the most seen since September 2019. Governor Stephen Miran pushed for a steeper 50bp cut while regional presidents Jeff Schmid and Austan Goolsbee wanted to hold steady.

Four additional non-voting participants also preferred no cut at all, exposing deep disalignment on the best policy path going forward.

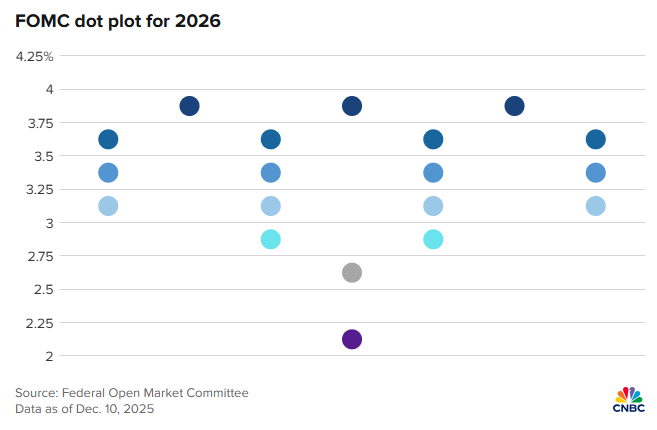

The updated Federal Reserve dot plot maintained projections for just one cut in 2026 and another in 2027, unchanged from September despite three cuts delivered since then.

Seven officials now see no cuts needed next year, while three believe rates are already too low, suggesting the divide between members is set to continue growing in 2026.

In his post-meeting press conference, Fed chair Jerome Powell explicitly stated, "We are well positioned to wait and see how the economy evolves." — phrasing last used when the Fed paused cuts for nine months.

However, with Powell's tenure ending in January and Trump publicly demanding deeper cuts, the Fed continues to face mounting pressure, further clouding 2026 projections.

Markets are currently pricing Kevin Hassett as the next chair, thanks to his apparent accommodation to Trump’s preferences.

Oracle Stock Plummets as Revenue Falls Short of Estimates

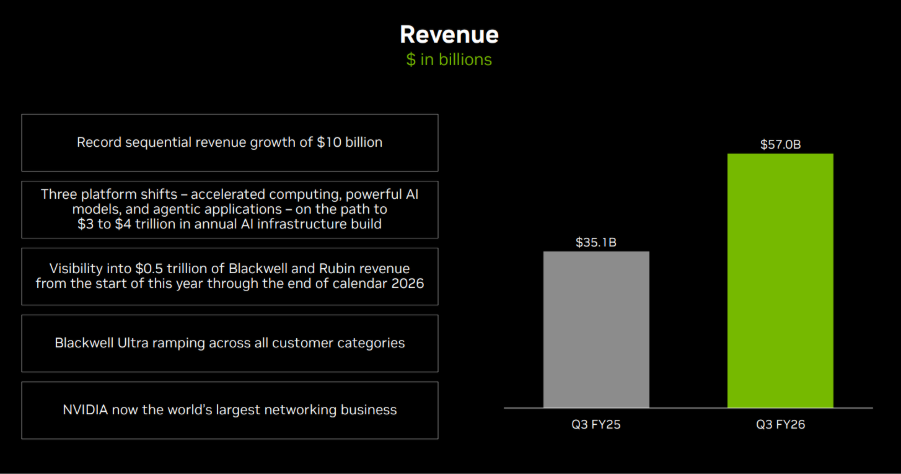

Oracle Corporation suffered a 10%+ after-hours selloff today, following fiscal second-quarter results that exposed mounting risks beneath its ambitious AI infrastructure buildout.

Revenue of $16.06 billion fell short of the $16.21 billion Wall Street consensus, triggering a sharp reassessment of one of the most leveraged bets in the AI sector.

The company's total debt now exceeds $105 billion, and the cost of insuring Oracle's debt against default reached its highest level since March 2009, rising to about 1.28 percentage points per year.

Further investor anxiety lies in Oracle's dependence on its contract with OpenAI, which is estimated to account for about 58% of Oracle's future order backlog.

The contract requires OpenAI to pay approximately $60 billion annually to Oracle starting in 2027. However, OpenAI currently only generates around $20 billion in annualised revenue, exposing Oracle to massive counterparty risk if OpenAI doesn’t meet its revenue projections.

Bitcoin Price Narratives Get Murkier

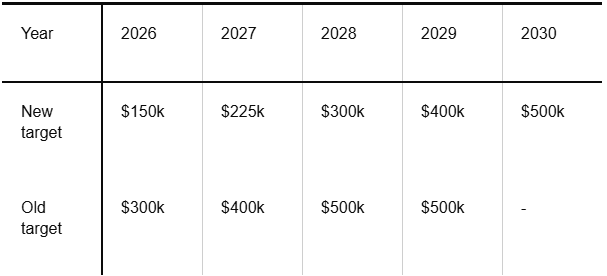

Standard Chartered slashed its 2026 Bitcoin price target from $300,000 to $150,000 yesterday.

Attributed to the apparent end of aggressive corporate Bitcoin accumulation and slower-than-expected institutional adoption through ETFs, it is one of the most dramatic forecast reductions this year.

The bank's updated forecasts project $100,000 by end-2025, $150,000 for end-2026, $225,000 for end-2027, $300,000 for end-2028, and $400,000 for end-2029.

Despite the revision, Standard Chartered explicitly rejects the notion that we have entered a new crypto winter, characterising the current phase as "a cold breeze" rather than structural weakness.

Broader market predictions for 2026 suggest a bearish scenario at $95,241, an average estimate of $111,187, and a bullish case of $142,049.

InvestingHaven forecasts Bitcoin trading between a minimum of $99,910 and a maximum of $200,000 in 2026.

And some bullish analysts like Cardano founder Charles Hoskinson have suggested Bitcoin could reach $250,000 in 2026 if tech giants increase their crypto exposure, indicating considerable divergence in expectations.

.jpg)