热门话题

众所周知,由于特殊原因,澳洲的红酒产业在过去几年因为中国的反倾销关税,因此受到了很大的打击。作为澳洲红酒行业里的领头羊,奔富红酒的母公司财富酒业(TWE)虽然被收取稍微少一点的关税,然是依然超过了120%以上,这也使得澳洲的很多高端红酒品牌在过去几年与法国和欧洲的红酒竞争中因为价格的原因不得不拱手让出了市场。而这个情况随着中澳关系的缓和和逐渐好转。在去年10月我写过文章也做了视频说到,当时虽然中国宣布重新开始审查澳洲红酒的关税问题。但是重新开始审查,也意味着未来有很大机会这个关税会被降低,甚至取消。有兴趣的朋友可以去YouTube搜索一下我们之前的视频。

然而,如今中国已经正式宣布取消了额外关税,那是不是意味着奔富酒业就会重新开始起飞,财富酒业的股价会火箭式上涨了?从过去1周的股价来看,似乎这个情况并没有出现。事实上,财富酒业现在的股价仅仅比10月中国刚宣布开始重新审查时高了5%而已,那到底是什么原因导致投资者对于这个消息的反应没有那么激烈呢?我猜测有以下几个原因:

1.需要时间来重新构建销售体系。我们知道,由于过去几年销量的下降,导致之前很多奔富或澳洲红酒的经销商都转去了其他国家代理或者干脆转行。如今要重新搭建销售网络,重新洗牌布局,都需要时间。而这时澳洲的奔富或其他高端品牌需要从法国或其他地区的高端红酒里重新抢回市场,这和之前他们第一次去打市场有很大差别。2.中国疫情之后的消费疲软。尤其是最近在楼市表现不佳,加上很多互联网企业的裁员。使得民众对于中高端消费,尤其是非必要消费越发谨慎。而澳洲的高端红酒就属于这个可买可不买的列表里。这些商品和经济周期有着密切的联系。3.奔富宣布将会从7月1日起提高售价。虽然我们知道财富酒业希望通过提高售价来更快的赚回之前失去的3年。但是在如今中国红酒竞争激烈,消费疲软的情况下,你还加价,这是不是有点太自信了?从股价的反应来看,似乎投资者们并没有觉得提价会直接给公司带来额外利润。

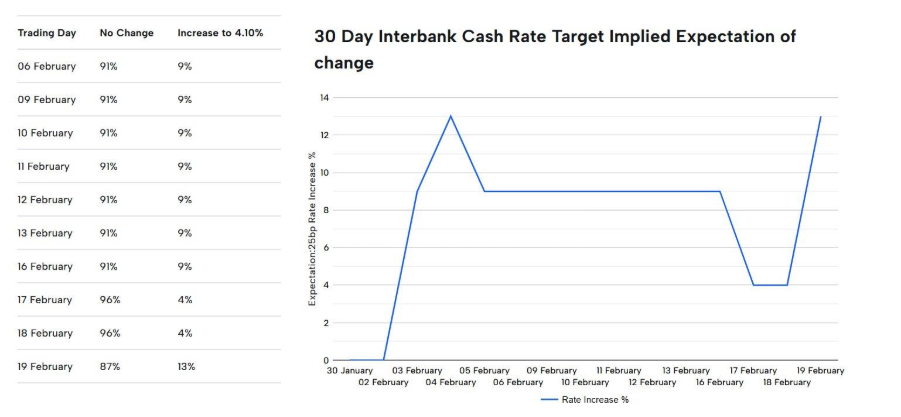

财富酒业的官方回应肯定了中国在取消额外关税后势比会对销量有所帮助。但是也很聪明的刻意降低了投资者对于这个消息的期望值。财富酒业在之前的财报里也多次提到:中国地区的销量在过去3年并没有占据集团里最高的比例,集团为了分散风险,通过开拓北美和欧洲市场来对冲中国地区的销量波动。但是根据财富酒业自己的报告显示,奔富红酒里的几个主力产品389,407以及28等依然主要是销往中国地区。因此未来加价的也主要是这几款产品。在过去的一年时间里,澳洲200指数上涨达到了9.33%,而财富酒业的股价竟然下跌了3%,这一来一去相差了12%。这说明了什么?说明在澳洲加息周期下,中高档红酒销量受到了影响,如果没有中国取消关税这个帮助,按照财富酒业去年9月11澳元左右的价格,那过去12个月的跌幅甚至可以达到10%以上。而这样的情况在未来12个月里并不会有太大的变化。主要的原因还是那两句话:1. 物价短期内很难下降。2. 降息会延迟,速度也会比之前预计的慢。所以我本人在今年依然并不看好财富酒业。

另外今天我们再说一个澳洲的股票,四大银行之一的西太银行(Westpac):西太银行,全称是西太平洋银行,其前身是1817年成立的新南威尔士州立银行。是澳洲最老的一家本地银行之一。经历200多年之后,目前旗下有多个银行品牌,包括:Westpac, St George, Bank of Melbourne, Bank of SA, Adelaide and Bendigo Bank等等。是不是看上去很厉害?其实它的股价道出了它目前遇到的巨大问题: Westpac拥有者澳洲几乎一半的银行品牌,但是其股价却是四大银行里最差的一家。就算按照上涨比例排列,其股价在过去3年和联邦银行的股价涨幅相比也慢了25%以上。换而言之,其股价就是又低,涨的又慢。对比过去5年的股价表现,CBA的价格上涨了70%,而Westpac的股价几乎原地不变,如果去掉通胀,就是贬值至少20%。简直就是一塌糊涂。

那到底是什么原因导致拥有这么多银行的大集团企业,却无法做到与其规模相等的资产回报率呢?三个原因:1. 多个品牌相互之间势比难免有重复竞争以及市场经费和人员的重叠。2. 之前多个品牌使用的技术都不同,因此要合并所有子品牌银行到统一的银行系统是一个巨大,长期,而且非常费钱的工程,这个事全世界能做好的银行集团也没几个。如果是两个系统,还好说,但是西太集团下有5套不同的银行系统,这个要完全统一,真的很难。因此在IT系统上的劣势是其股价弱势的另一个原因。3. 过多的品牌,导致其不得不维持庞大的实体分行的存在。因为各大品牌必须在核心地区都有自己的分行,就算要减少,在商业集中地区也不得不开设每个品牌自己的分行,这样一来固定开支也会大幅增加。因此导致西太集团的综合运行成本大大高于了其他三个对手。

那要怎么做,Westpac才会改善其目前面临的问题呢?首先,我不是西太的CEO,但是我读了其CEO上任以后发表的几次重要发言和其财报里的总结,我猜测,Westpac会在以下方面做出改变:一句话:去繁化简。相比于同时维持5个品牌线下和线上同时运行的巨大开支和重复消耗,要想提高效率,就要最大程度的简化品牌重复所带来的开支和人员重复,换而言之,就是要:1.裁撤重复岗位员工,比如,在每个品牌都配备的重复岗位有些就可以去掉。2.合并或关闭线下分行。在过去3年,Westpac集团几乎每年都在关闭旗下某几个品牌的分行。但是依然还是太多。如果要最终简化,最好的办法就是几个品牌共同使用一个分行的服务。例如,Bank of Melbourne或者阿德莱德银行的客户可以去Westpac的分行进行存取款和贷款申请业务。3.修改某些子品牌为线上银行。最终要想削减成本的做法,就是和联邦银行的子品牌,西澳银行一样,关闭所有分行,改为线上银行。4.最大的挑战也是潜在巨大的机会就是合并所有品牌的银行系统到一个系统。这将会极大的简化流程,节约开支,增加效率。也会极大的增加投资者对其股价的信心。以上几点,都是Westpac目前的CEO在过去几年屡次强调也在积极行动的。我相信在未来,西太集团的几个子品牌里肯定会出现一个或几个成为纯网上银行的形式。未来实体分行也将会越来越少。对于我们散户来说,以下两点只要出现一个,就意味着Westpac的效率会增加,或者说其股价会好:1. 把某一个子品牌线下分行全部关闭改为线上银行。2. 宣布所有子银行的系统完成统一。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

.jpg)

.jpg)

%20(1).jpg)