We have deliberately waited a few days before commenting on “Liberation Day” and the fallout that would come from President Trump’s new tariffs regime.It will go down as just another historical period of heightened volatility, uncertainty, risk, and a whole manner of market turmoil. This is why we wanted to put what is happening right now into some context. (If that is possible, considering how volatile the period is and how erratic and how quick the president's manner can change.)US markets have seen this kind of violent move only three times since the 1950s. The S&P’s over 10 per cent drop in the final two sessions of the week following President Trump's "Liberation Day" tariff announcement has it in rare company – and not in a good way - October 1987 (Black Monday), November 2008 (Global Financial Crisis), March 2020 (COVID-19).So, why such a reaction?The market reaction reflects not the ‘shock’ but the scale and brevity of the tariffs. A 10% across-the-board tariff was broadly expected. There were some calculations as much as 15 to 20% judging by the net $1 trillion in and out of the federal government revenue. (This is the impact of DOGE and other government spending cuts coupled with the tariffs now in place that will offset the promised 0% personal income tax for those earning up to US$150,000)But what markets didn’t see coming was the country-specific layer. Take China as an example; the additional 34% reciprocal tariff on Chinese goods pushed the total to 54%. With other measures factored in, the effective burden could approach 65%.Then there were the tariffs that were tied to trade deficits, hitting Japan, South Korea and most emerging markets between the eyes (i.e. Vietnam).The EU saw a 20% rate, which was within expectations, while the UK, Australia, New Zealand and others landed at 10%. Canada and Mexico were spared, as was Russia, North Korea and Belarus, interestingly enough.Energy was excluded, which is unsurprising considering Trump’s goal of getting energy down, down and staying down. Pharmaceuticals and semiconductors were also carved out, however, this is more down to the probability of more targeted action like that of steel and aluminium.Now, what is different about this market shock and risk off trading is that it would send funds flowing to the US dollar, ratcheting it higher. But not this time. The dollar weakened against the euro. Theories as to why range from Europe’s lighter tariff load to euro-based investors pulling money out of the US. The same could be said of the Swiss Franc.All this leads to an average effective tariff rate of around 22%. That number will likely climb once product-specific tariffs on areas like pharmaceuticals and lumber are formalised. Some of this may be negotiated down, but not soon, and the possibility of tit-for-tat retaliation like China has now entered into could actually see it going higher still as the President looks to outdo country responses.The broader uncertainty this introduces to the US outlook is now at its highest since early 2020 and has the markets pricing in 110 basis points of Fed rate cuts this year – a near 5 cut call shows just how unprecedented this is.In fact, in no time in living memory has a developed economy lifted trade barriers this aggressively or abruptly. What has been implemented is textbook economics 101 supply-side shock.Input costs go up, finished goods get pricier, and the ripple effects hit margins and employment. Expect to see this in the next six months.Expect core PCE inflation to finish the year at 3.5% —nearly a full percentage point higher than the consensus forecast from just a week ago.Real GDP growth is forecast to slow to 0.1% on a quarter-on-quarter basis. That path may be volatile as Q1 could look worse due to soft consumption and strong imports, with a mechanical bounce in Q2.What has been lost in the chaos of last Thursday and Friday’s trade was the March Non-farm payrolls jobs print came in at 228,000, which was above consensus, the caveat being it is less so after downward revisions to prior months.Hospitality hiring was strong, likely helped by a weather rebound that won’t repeat. Government payrolls are holding steady for now, but cuts are coming. Layoffs in defence and aerospace (DOGE) are already underway, and tariffs will act as a brake on new hiring. Expect softer reports ahead.Unemployment ticked up slightly to 4.15%, reflecting a modest rise in participation. That’s still within range, giving the Fed cover to hold off on immediate action. But if job losses build pressure on the Fed to act, it will increase quickly.The consensus now is for the first rate cut of this cycle to start in May, triggered by softer April payrolls and earlier signs of deterioration in jobless claims and business sentiment.Zooming out from just a US-centric point of view, the macro standpoint is just as bad if not worse. The scale of tariffs adds pressure on industrial production, trade volumes and cross-border investment.That’s feeding into commodity markets, where the outlook has turned more cautious.Brent is expected to fall into the low US$60s as trade frictions and oversupply build. LNG looks weaker too, with soft Asian demand and less urgency in Europe to restock. Iron ore is more exposed to China, and the reciprocal tariffs put a vulnerability into the price due to the broader global slowdown and higher prices to the US.Looking at China specifically, infrastructure remains a key policy lever that would offset the possible loss of demand in aluminium, copper, and steel. Monetary indicators are beginning to turn, suggesting the start of a new easing cycle. It also suggests that policy remains inward-facing, and a focus on domestic stability would mean a metals-heavy growth path. Thus suggesting Australia could be the ‘lucky country’ once more and could escape the full burden of the global upheaval.In short, the global reaction isn’t just about tariffs. It’s about what happens when policy shocks collide with already-fragile global demand, and central banks are forced to navigate inflation that’s driven by politics, not just price cycles.This is the question for traders and investors alike over the coming period.

Another Period For The History Books.

Related Articles

Asia starts the week with a fresh geopolitical shock that is already being framed in oil terms, not just security terms. The first-order move may be a repricing of risk premia and volatility across energy and macro, while markets wait to see whether this becomes a durable physical disruption or a fast-fading headline premium.

At a glance

- What happened: US officials said the US carried out “Operation Absolute Resolve”, including strikes around Caracas, and that Venezuela’s President Nicolás Maduro and his wife were taken into US custody and flown to the United States (subject to ongoing verification against the cited reporting).

- What markets may focus on now: Headline-driven risk premia and volatility, especially in products and heavy-crude-sensitive spreads, rather than a clean “missing barrels” shock.

- What is not happening yet: Early pricing has so far looked more like a headline risk premium than a confirmed physical supply shock, though this can change quickly, with analysts pointing to ample global supply as a possible cap on sustained upside.

- Next 24 to 72 hours: Market participants are likely to focus on the shape of the oil “quarantine”, the UN track, and whether this stays “one and done” or becomes open-ended.

- Australia and Asia hook: AUD as a risk barometer, Asia refinery margins in diesel and heavy, and shipping and insurance where the price can show up in friction before it shows up in benchmarks.

What happened, facts fast

Before anyone had time to workshop the talking points, there were strikes, there was a raid, and there was a custody transfer. US officials say the operation culminated in Maduro and his wife being flown to the United States, where court proceedings are expected.

Then came the line that turned a foreign policy story into a markets story. President Trump publicly suggested the US would “run” Venezuela for now, explicitly tying the mission to oil.

Almost immediately after that came a message-discipline correction. Secretary of State Marco Rubio said the US would not govern Venezuela day to day, but would press for changes through an oil “quarantine” or blockade.

That tension, between maximalist presidential rhetoric and a more bureaucratically describable “quarantine”, is where the uncertainty lives. Uncertainty is what gets priced first.

Why this is price relevant now

What’s new versus known for positioning

What’s new, and price relevant, is that the scale and outcome are not incremental. A major military operation, a claimed removal of Venezuela’s leadership from the country, and a US-led custody transfer are not the sort of things markets can safely treat as noise.

Second, the oil framing is explicit. Even if you assume the language gets sanded down later, the stated lever is petroleum. Flows, enforcement, and pressure via exports.

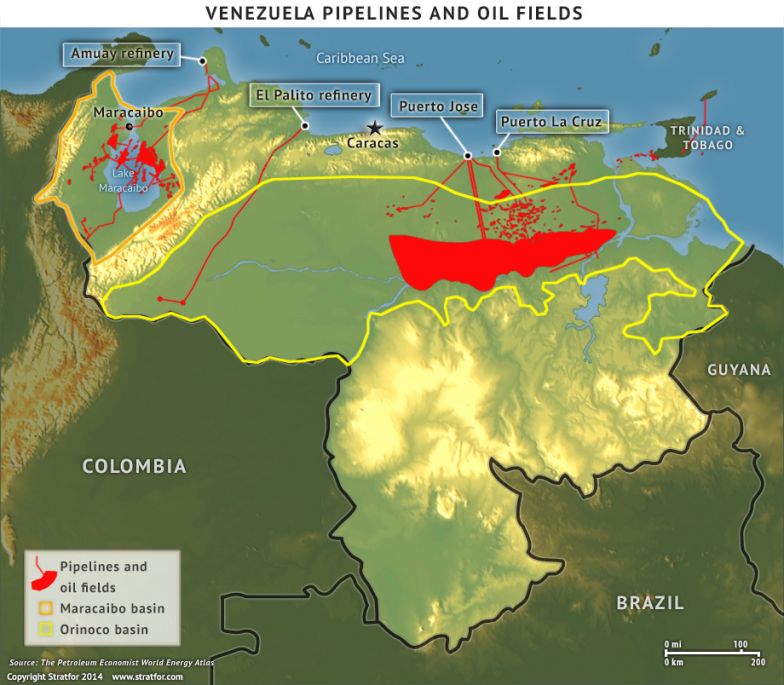

Third, the embargo is not just a talking point anymore. Reporting says PDVSA has begun asking some joint ventures to cut output because exports have been halted and storage is tightening, with heavy-crude and diluent constraints featuring prominently.

What’s still unknown, and where volatility comes from

Key unknowns include how strict enforcement is on water, what exemptions look like in practice, how stable the on-the-ground situation is, and which countries recognise what comes next. Those are not philosophical questions. Those are the inputs for whether this is a temporary risk premium or a durable regime shift.

Political and legal reaction, why this drives tail risk

The fastest way to understand the tail here is to watch who calls this illegal, and who calls it effective, then ask what those camps can actually do.

Internationally, reaction has been fast, with emphasis on international law and the UN Charter from key partners, and UN processes in view. In the US, lawmakers and commentators have begun debating the legal basis, including questions of authority and war powers. That matters for markets because it helps define whether this is a finite operation with an aftershock, or the opening chapter of a rolling policy regime that keeps generating headlines.

Market mechanism, the core “so what”

Here’s the key thing about oil shocks. Sometimes the headline is the shock. Sometimes the plumbing is the shock.

Volumes and cushion

Venezuela is not the world’s swing producer. Its production is meaningful at the margin, but not enough by itself to imply “the world runs out of oil tomorrow”. The risk is not just volume. It is duration, disruption, and friction.

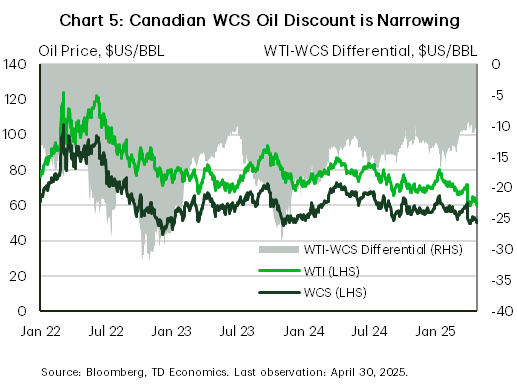

The market’s mental brake is spare capacity and the broader supply backdrop. Reporting over the weekend pointed to ample global supply as a likely cap on sustained gains, even as prices respond to risk.

Quality and transmission

Venezuela’s barrels are disproportionately extra heavy, and extra heavy crude is not just “oil”. It is oil that often needs diluent or condensate to move and process. That is exactly the kind of constraint that shows up as grade-specific tightness and product effects.

Reporting has highlighted diluent constraints and storage pressure as exports stall. Translation: even if Brent stays relatively civil, watch cracks, diesel and distillates, and any signals that “heavy substitution” is getting expensive.

Products transmission, volatility first, pump later

If crude is the headline, products are the receipt, because products tell you what refiners can actually do with the crude they can actually get. The short-run pattern is usually: futures reprice risk fast, implied volatility pops; physical flows adapt more slowly; retail follows with a lag, and often with less drama than the first weekend of commentary promised.

For Australia and Asia desks, the bigger point is transmission. Energy moves can influence inflation expectations, which can feed into rates pricing and the dollar, and in turn affect Asia FX and broader risk, though the links are not mechanical and can vary by regime.

Some market participants also monitor refined-product benchmarks, including gasoline contracts such as reformulated gasoline blendstock, as part of that chain rather than as a stand-alone signal.

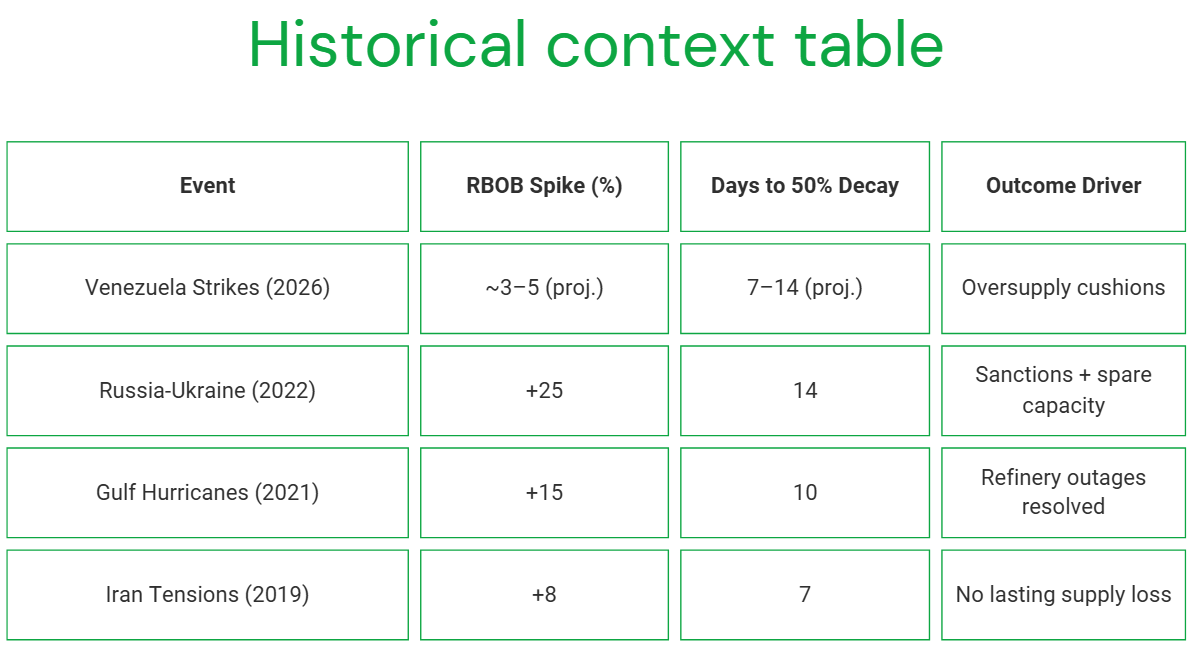

Historical context, the two patterns that matter

Two patterns matter more than any single episode.

Pattern A: scare premium. Big headline, limited lasting outage. A spike, then a fade as the market decides the plumbing still works.

Pattern B: structural. Real barrels are lost or restrictions lock in; the forward curve reprices; the premium migrates from front-month drama to whole-curve reality.

One commonly observed pattern is that when it is only premium, volatility tends to spike more than price. When it is structural, levels and time spreads move more durably.

The three possible market reactions

Contained, rhetorical: quarantine exists but porous; diplomacy churns; no second-wave actions. Premium bleeds out; volatility mean-reverts.

Embargo tightens, exports curtailed, quality shock: enforcement hardens; PDVSA cuts deepen; diluent constraints bite. Heavies bid; cracks and distillates react; freight and insurance add friction.

Escalation, prolonged control risk: “not governing” language loses credibility; repeated operations; allies fracture further. Longer-duration premium; broader risk-off impulse across FX and rates.

Australia and Asia angle

For Sydney, Singapore, and Hong Kong screens, this is less about Venezuelan retail politics and more about how a Western Hemisphere intervention bleeds into Asia pricing.

AUD is the quick and dirty risk proxy. Asia refiners care about the kind of oil and the friction cost. Heavy crude plus diluent dependency makes substitution non-trivial. If enforcement looks aggressive, the “price” can show up in freight, insurance, and spreads before it shows up in headline Brent.

Catalyst calendar, key developments markets may monitor

- US policy detail: quarantine rules, enforcement posture, exemptions.

- UN and allies: statements that signal whether this becomes a long legitimacy fight.

- PDVSA operations: storage, shut-ins, diluent availability, floating storage signals.

- OPEC+ signalling: whether the group stays committed to stability if spreads blow out.

The United States entered a government shutdown on October 1, 2025, after Congress failed to agree on full-year appropriations or a short-term funding bill. Although shutdowns have occurred before, the timing, speed, scale, and motives behind this one make it unique. This is the first shutdown since the last Trump term in 2018–19, which lasted 35 days, the longest in history.For traders, understanding both the mechanics and the ripple effects is essential to anticipating how markets may respond, particularly if the shutdown draws out to multiple weeks as currently anticipated.

What Is a Government Shutdown?

A government shutdown occurs when Congress fails to pass appropriation bills or a temporary extension to fund government operations for the new fiscal year beginning October 1.Without the legal authority to spend, federal agencies must suspend “non-essential” operations, while “essential” services such as national security, air traffic control, and public safety continue, often with employees working unpaid until funding is restored.Since the Government Employee Fair Treatment Act of 2019, federal employees are guaranteed back pay to cover lost wages once the shutdown ends, although there has been some narrative from the current administration that some may not be returning to work at all.

Why Did the Government Shutdown Happen?

The 2025 impasse stems from partisan disputes over spending levels, health-insurance subsidies, and proposed rescissions of foreign aid and other programs. The reported result is that around 900,000 federal workers are furloughed, and another 700,000 are currently working without pay.Unlike many past standoffs, there was no stopgap agreement to keep the government open while negotiations continued, making this shutdown more disruptive and unusually early.

Why an Early Shutdown?

Historically, most shutdowns don’t occur immediately on October 1. Lawmakers typically kick the can down the road with a “Continuing Resolution (CR)”. This is a stopgap measure that can extend existing funding for weeks or months to allow time for an agreement later in the quarter.The speed of the breakdown in 2025, with no CR in place, is unusual compared to past shutdowns. It suggests it was not simply budgetary drift, but a potentially deliberate refusal to extend funding.

Alternative Theories Behind the Early Shutdown

While the main narrative coming from the U.S. administrators points to budget deadlock, several other theories are being discussed across the media:

- Executive Leverage – The White House may be using the shutdown as a tool to increase bargaining power and force structural policy changes. Health care is central to the debate, funding for which was impacted significantly by the “one big, beautiful bill” recently passed through Congress.

- Hardline Congressional Factions – Small but influential groups within Congress, particularly on the right, may be driving the shutdown to demand deeper cuts.

- Political Messaging – The blame game is rife, despite the reality that Republican control of the presidency, House, and Senate, as well as both sides, is indulging in the usual political barbs aimed at the other side. As for the voter impact, Recent polls show that voters are placing more blame on Republicans than Democrats at this point, though significant numbers of Americans suggest both parties are responsible

- Debt Ceiling Positioning – Creating a fiscal crisis early could shape the terms of future negotiations on borrowing limits.

- Electoral Calculus – With midterms ahead, both sides may be positioning to frame the narrative for voters.

- Systemic Dysfunction – A structural view is that shutdowns have become a recurring feature of hyper-partisan U.S. politics, rather than exceptions.

Short-Term Impact of Government Shutdown

AreaImpactFederal workforceHundreds of thousands have been furloughed with reduced services across various agencies.Travel & aviationFAA expects to furlough 11,000 staff. Inspections and certifications may stall. Safety concerns may become more acute if prolonged shutdown.Economic outputThe White House estimates a $15 billion GDP loss per week of shutdown (source: internal document obtained by “Politico”.Consumer spendingFederal workers and contractors face delayed income, pressuring local economies. Economic data releaseKey data releases may be delayed, impacting the decision process at the Fed meeting later this month.Credit outlookScope Ratings and others warn that the shutdown is “negative for credit” and could weigh on U.S. borrowing costs.Projects & researchInfrastructure, grants, and scientific initiatives are delayed or paused.

Medium- to Long-Term Impact of Government Shutdown

1. Market Sentiment

Shutdowns show some degree of U.S. political dysfunction. They can weigh on confidence and subsequently equity market and risk asset sentiment. To date, markets are shrugging off a prolonged impact, but a continued shutdown into later next week could start to impact.Equity markets have remained strong, and there has been no evidence of the frequent seasonal pullback we often see around this time of year.Markets have proved resilient to date, but one wonders whether this could be a catalyst for some significant selling to come.

2. Borrowing Costs

Ratings downgrades could lift Treasury yields and increase debt-servicing costs. The Federal Reserve is already balancing sticky inflation and potential downward pressure on growth. This could make rate decisions more difficult.

3. The Impact on the USD

Rises in treasury yields would generally support the USD. However, rising concerns about fiscal stability created by a prolonged shutdown may put further downward pressure on the USD. Consequently, it is likely to result in buying into gold as a safe haven. With gold already testing record highs repeatedly over the last weeks, this could support further moves to the upside.

4. Credibility Erosion

Repeated shutdowns weaken the U.S.’s reputation as the world’s most reliable borrower. With some evidence that tariffs are already impacting trade and investment into the US, a prolonged shutdown could exacerbate this further.

What Traders Should Watch

For those who trade financial markets, shutdowns matter more for what they could signal both in the short and medium term. Here are some of the key asset classes to watch:

- Equities: Likely to see volatility as political risk rises, and the potential for “money off the table” after significant gains year-to-date for equities.

- U.S. Dollar: With the US dollar already relatively weak, further vulnerability if a shutdown feeds global doubts about U.S. fiscal stability.

- Gold and other commodities: May continue to gain as hedges against political and credit risk. Oil is already threatening support levels; any prolonged shutdown may add to the bearish narrative, along with other economic slowdown concerns

- Outside the US: With the US such a big player in global GDP, we may see revisions in forward-looking estimates, slingshot impacts on other global markets and even supply chain disruptions with impact on customs services (potentially inflationary).

Final Word

The 2025 shutdown is unusual because of its scale and because it started on Day 1 of the fiscal year, without even a temporary extension. That speed points to a deeper strategic and political contribution beyond the usual budget wrangling that we see periodically.For traders, the lesson is clear: shutdowns are not just what happens in Washington, but may impact confidence, borrowing costs, and market sentiment across a range of asset classes. In today’s world, where political credibility is a form of capital, shutdowns have the potential to erode the very foundation of the U.S.’s role in global finance and trade relationships.

The US has entered the Israel-Iran war. However, despite an initial 4 per cent surge on the open, oil has settled where it has been since the conflict began in early June — around US$72 to US$75 a barrel.Trump claims the attacks from the US on Iranian nuclear facilities over the weekend are a very short, very tactical, one-off. This is something his base can get behind — some really big conservative players do not want a long-contracted war that sucks the US into external disputes.Whether this will be the case or not is up for debate, but there is a precedent from Trump's first presidency that we can look to. Iran had attacked several American bases in 2019, as well as attacking Saudi Arabia's most important oil refinery with Iranian drones. There wasn't a huge amount of damage; it was more a symbolic movement and display of capabilities by Iran.Initially, Trump didn't react — it took pressure from Gulf allies like the UAE and Israel for him to respond, which saw him order the assassination of the head of the Iranian Defence Force, Qasem Soleimani. This led to an Iranian response of ‘lots of noise’ and ‘cage rattling’, but minimal real action events, just a few drone attacks. Trump is betting on the same reaction now.If Iran follows the same patterns from the previous engagement, the geopolitical side of this is already at its peak.As of now, Iran is not going after or destroying major Gulf energy capabilities. Nor have there been any disruptions to the shipping traffic through the Strait of Hormuz. In fact, apart from a posturing vote to block the Strait, Iran has not made any indication that it is going to disrupt oil in any way that would lead to price surges.Additionally, despite the U.S. military equipment buildup in the region being its highest since the Iraq war, critical Iranian energy infrastructure is running largely unscathed.This all suggests that the geopolitics and the physical and futures oil markets remain disconnected. Oil will spike on news rumours, but the actual impacts in the physical realm to this point remain low. Of course, this could change in future. But, for now, the risk of seeing oil move to US$100 a barrel is still a minority case rather than the majority.

Recent Articles

市场将进入未来一周,澳大利亚和日本的通货膨胀数据,以及地缘政治紧张局势的加剧,继续影响能源价格和更广泛的风险情绪。

- 澳大利亚居民消费价格指数(CPI): 通货膨胀数据可能会影响 澳大利亚储备银行(RBA))政策路径,澳元(AUD)和当地收益率对任何意外都很敏感。

- 日本数据集群: 东京消费者价格指数(初值)加上工业生产和零售销售提供了通货膨胀和活动脉冲,可能会影响日本银行(BoJ)的正常化预期。

- 欧元区和德国居民消费价格指数: 通胀速率数据将考验反通货膨胀的说法,并影响欧洲央行的降息时机预期。

- 石油和地缘政治: 由于中东紧张局势再起,布伦特原油创下2025年8月8日以来的最高收盘价,这加剧了能源驱动的通胀风险。

澳大利亚消费者价格指数:澳大利亚央行的预期会发生变化吗?

澳大利亚即将发布的消费者价格指数将受到密切关注,以了解通货膨胀是否稳定或超过预期的持续性。

随着利率预期的调整,强于预期的印刷量可能与更高的收益率和更高的澳元走强有关。较软的结果可能会支持人们对更稳定的政策立场的预期。

关键日期

- 通货膨胀率(MoM): 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

- CPI: 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

监视器

- 澳元在发布前后波动。

- 地方债券收益率反应。

- 利率定价变化。

日本通货膨胀和增长数据

日本周末发布的公告将东京消费者价格指数(初值)与工业生产和零售销售相结合,为价格压力和国内需求提供了更广泛的解读。

东京消费者价格指数通常被视为全国通胀动态和日本央行辩论的及时信号。工业产出和零售支出增加了活动的背景。

整个集群的意外情况可能会推动日元的急剧波动,特别是如果结果改变了人们对日本央行正常化步伐和持续性的看法。

关键日期

- 东京居民消费价格指数: 2月27日星期五上午 10:30(澳大利亚东部夏令时间)

- 工业生产: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

- 零售销售: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

监视器

- 日元对通胀意外敏感度

- 债券收益率因活动数据而变动

- 如果增长势头预期发生变化,股市的反应

能源和避险流动

在中东紧张局势再次爆发的情况下,油价已攀升至2025年8月8日以来的最高收盘价。

最近关于霍尔木兹海峡附近地区军事活动加剧和航运风险头条的报道加强了能源安全作为市场关注的焦点。霍尔木兹海峡仍然是全球能源流动受到广泛关注的阻塞点。

油价上涨会刺激通胀预期并影响债券收益率。同时,地缘政治的不确定性可以通过避险需求和相对利率定位来支撑美元。

监视器

- 布伦特原油价格水平

- 美元兑主要货币走强

- 随着通货膨胀风险溢价的调整,收益率变动

欧元区和德国的通货膨胀

德国和整个欧元区(HICP)的快速通胀数据将测试该地区的反通货膨胀趋势是否保持不变。

德国的发布可能会影响欧元区总体数据之前的预期。如果核心通胀被证明是棘手的,那么对欧洲央行可能放松政策的时机和步伐的预期可能会发生变化。

关键日期

- 德国通货膨胀率: 2月28日星期六上午12点(澳大利亚东部夏令时间)

监视器

- 欧元围绕通胀数据波动

- 欧洲主权债券收益率

- 降息概率调整

关键经济事件

从科技颠覆者到国防承包商,一些市场上最受关注的公司开始了首次公开募股(IPO)的公开征程。对于交易者来说,这些首次公开上市可能代表一个独特的交易环境,但也是一个不确定性加剧的时期。

事实速览

- 首次公开募股是指私人公司首次在公共证券交易所上市其股票。

- 首次公开募股可以让交易者尽早进入高增长的公司,但波动性较大,价格历史有限。

- 上市后,交易者可以通过直接购买股票或衍生品获得对IPO股票的敞口,例如 差价合约(CFD)。

什么是首次公开募股(IPO)?

首次公开募股是指公司首次向公众发行股票。

在进行首次公开募股之前,公司的股票通常仅由创始人、早期员工和私人投资者持有。上市使任何人都可以购买股票。

根据公司的规模,它通常会在当地证券交易所上市其公开股票(例如 ASX 在澳大利亚)。但是,一些大估值公司选择只在纳斯达克等全球证券交易所上市,无论其主要总部位于何处。

对于交易者而言,首次公开募股通常是获得公司股票敞口的第一个机会。鉴于价格历史的有限和对情绪波动的敏感性,它们可以创造一个波动性和流动性增加的独特环境,但也会带来更高的风险。

公司为什么要上市?

进行首次公开募股的最大推动力是获得更多资金。在公共交易所上市意味着公司可以通过出售股票筹集大量资金。

它还为现有股东提供流动性。创始人、早期员工和私人投资者经常在公开市场上出售其现有资产的一部分,从而实现他们多年支持的回报。

除了金钱收益外,上市还意味着公司可以使用股票作为收购的货币,并提供股权薪酬以吸引人才。公开估值提供了透明的基准,这对于战略定位和未来筹资很有用。

但是,它确实需要权衡取舍。上市公司必须遵守持续的披露和报告义务,如果许多公司专注于短期业绩,来自公众股东的压力可能会成为长期进展的障碍。

首次公开募股流程如何运作?

虽然具体情况因司法管辖区而异,但从私营公司到公开上市通常涉及以下阶段:

1。准备

公司首先选择承销商(通常是投资银行)来管理此次发行。他们共同评估公司的财务状况、公司结构和市场定位,以确定最佳的上市方法。这是确保公司真正做好上市准备的繁重规划阶段。

2。注册

一切准备就绪后,承销商将进行彻底的尽职调查,然后向相关监管机构提交所需的披露文件。这些文件向监管机构详细披露了该公司、其管理层及其拟议的发行情况。在澳大利亚,这通常是向澳大利亚证券投资委员会提交的招股说明书;在美国,这是向美国证券交易委员会提交的注册声明。

3.路演

然后,公司的高管和承销商将在 “路演” 中向机构投资者和市场分析师介绍投资案例。该展示旨在评估对股票的需求并帮助激发兴趣。机构投资者可以登记首次公开募股的利息和估值,这有助于为初始定价提供信息。

4。定价

根据路演的反馈和当前的市场状况,承销商设定了最终股价并确定了要发行的股票数量。股票在 “初级市场” 上分配给参与要约的投资者(股票在二级市场公开上市之前)。该过程设定了上市前价格,这有效地决定了公司的初始公开估值。

5。清单

上市当天,该公司的股票开始在所选证券交易所交易,正式开放二级市场。对于大多数交易者来说,这是他们可以直接或通过衍生品交易股票的第一点,例如 股票差价合约。

6。首次公开募股后

上市后,公司将受到严格的报告和披露要求的约束。它必须定期与股东沟通,公布其财务业绩,并遵守其上市交易所的治理标准。

交易者的首次公开募股风险和收益

交易者如何参与首次公开募股?

对于大多数交易者来说,一旦股票上市并开始在二级市场上交易,就可以参与首次公开募股。

股票在交易所上线后,投资者可以直接通过经纪人或在线交易所购买实物股票,也可以使用衍生品,例如 股票差价合约 在不拥有标的资产的情况下持有价格头寸。

首次公开募股交易的前几天往往波动很大。交易者应确保他们已采取适当的风险管理措施,以帮助防范潜在的价格剧烈波动。

底线

首次公开募股标志着一家公司可以向公众投资。他们可以为高增长公司的早期准入提供机会,并在波动性和市场兴趣的增加的推动下创造独特的交易环境。

对于交易者而言,在持仓之前,了解流程是如何运作的,是什么推动了定价和首次公开募股后的表现,以及如何权衡潜在回报和交易新上市股票的风险。

2026年并没有给投资者太多的喘息空间。看来市场可能已经基本摆脱了降息指日可待的观念,进入了通货膨胀可能比许多人预期更难控制的一年。

商品通胀有所回升,而由于持续的劳动力成本压力,服务业通货膨胀仍然相对稳定。住房成本,尤其是租金,也仍然是通货膨胀压力的关键来源。

澳洲联储正努力在通货膨胀问题上保持可信度,而不会反过来推动经济走得太远。

关键数据

消费者价格指数仍在附近 3.8% (高于目标),工资仍在上涨约为 本季度增长0.8%,失业率也在附近 4.1%。

根据市场隐含的定价,预计不会很快加息,因此澳大利亚央行解释其决定的方式可能与决定本身一样重要。如果基调改变了预期,这些预期可能会推动市场。

这本剧本涵盖了什么

这是一本2026年澳洲联储密集型几周的剧本。它涵盖了各行各业的关注点,列出了关键触发因素,并解释了哪些指标可能会改变市场情绪。

1。银行和金融:澳洲联储的决策如何传递给贷款和借款人

银行是澳大利亚央行在澳大利亚经济中表现最快的地方。利率可以迅速打击借款人,并影响融资成本和情绪。

在较紧的阶段,利润率起初可以提高,但如果融资成本上升得更快或信贷质量开始减弱,利润率可能会发生变化。这些力量之间的平衡是最重要的。

如果银行进入澳洲联储决策周,则可能意味着市场认为在更长的时间内走高将支撑收益。如果他们抛售,则可能意味着市场在更长的时间内走高会伤害借款人。你可以从同一个标题中得到两种不同的读物。

要看什么

- 收益率曲线的形状: 较陡的曲线可以帮助提高利润,而倒置的曲线可以预示增长压力。

- 存款竞赛: 即使总体利率看起来具有支撑性,它也可以悄悄地挤压利润。

- 澳洲联储措辞 关于金融稳定、家庭缓冲和弹性。小短语可以改变风险故事。

潜在的触发因素

如果澳洲联储听起来比预期更鹰派,那么随着市场重新评估增长和信用风险预期,银行可能会尽早做出反应。第一步有时可以为会议定下基调。

主要风险

- 融资成本的增长速度快于贷款收益率: 可能表明利润压力。

- 明确收紧信贷条件: 欠款增加或再融资压力会迅速改变说法。

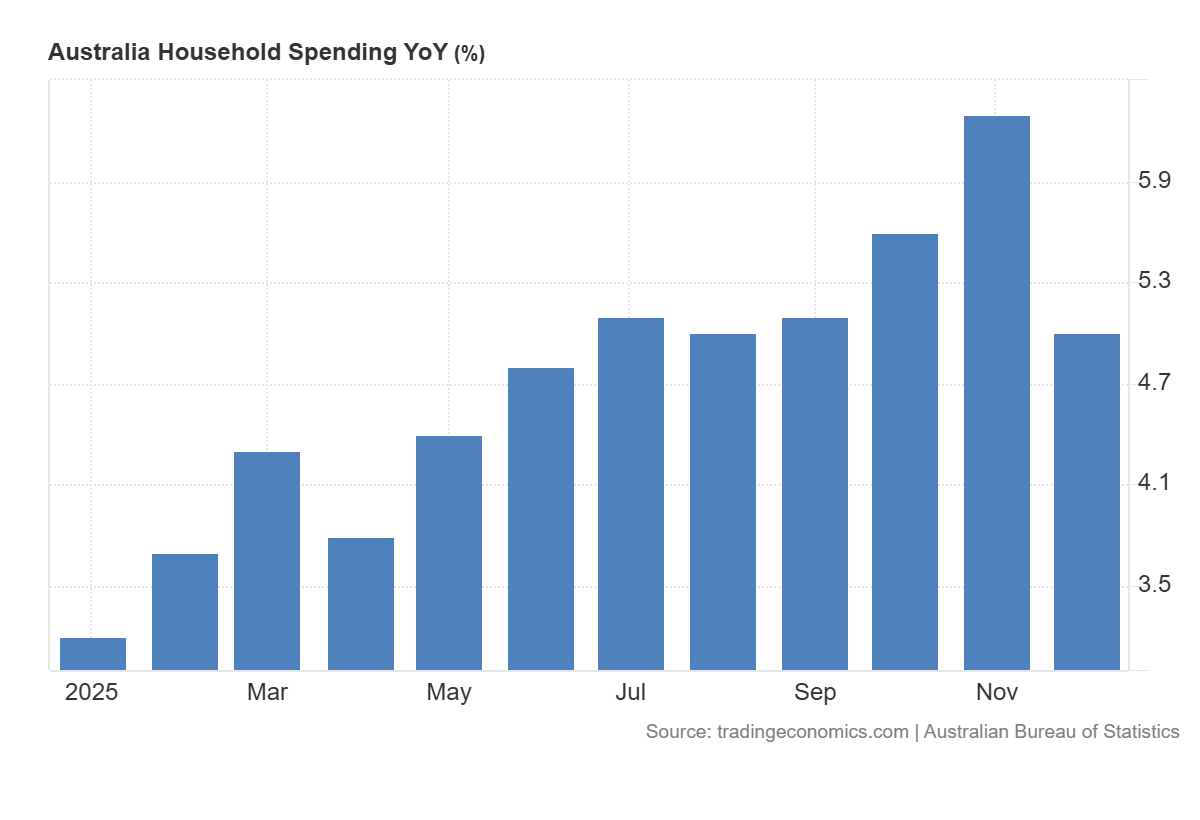

2。非必需消费品和零售:更高的利率会打击家庭支出

当政策紧缩时,消费自由裁量权成为对家庭弹性的实时考验。这是较高的日常成本通常最快出现的地方。

在数据停止备份之前,有关消费者的大肆呼叫可能显而易见。当这种情况发生时,叙事可能会迅速改变。

要看什么

- 工资与通货膨胀: 实际收入的推动或拖累。

- 早产信号: 在失业率上升之前,工作时间可能会有所减弱。

- 报道赛季线索: 折扣、成本转嫁和利润压力可以表明需求的实际紧张程度。

潜在的触发因素

如果澳洲联储的基调比预期的更为鹰派,则该行业可能会对利率预期敏感。任何最初的走势都可能不会持续下去,随后的价格走势可能取决于传入的数据和定位

主要风险

- 劳动力市场的快速转变。

- 新的生活成本冲击,尤其是能源或住房,迅速打击了支出。

3.资源:关税、地缘政治和政策转变时需要注意什么

资源可以作为全球增长的解读,但货币走势和中央银行的基调可以改变澳大利亚的故事走向。

在2026年,关税和地缘政治也可能带来比平时更尖锐的总体走势,因此差距风险可能会处于正常周期的首位。

澳洲联储仍然通过两个渠道发挥重要作用:澳元和整体风险偏好。即使大宗商品价格没有太大波动,两者都可以快速对该行业进行重新定价。

要看什么

- 全球增长脉冲: 工业需求预期和与中国相关的信号。

- 澳元: 决策后的举措可能成为该行业的第二个驱动力。

- 行业领导力: 资源与大盘的交易方式可以预示当前的制度。

潜在的触发因素

如果澳洲联储的基调变得更加严格,而全球增长保持稳定,则资源的表现可能会好于市场其他部分。强劲的现金流可能更重要,而实际资产的角度可以吸引买家。

主要风险

- 在真正的压力事件中,相关性可能会跳跃,而防守定位可能会失败。

- 如果政策收紧演变为增长恐慌,周期可能会占上风,该行业可能会迅速衰退。

4。防御、必需品和优质医疗保健

当其他一切都让人感到混乱时,防御性武器注定是市场上比较平静的角落。在2026年,他们仍然有一个很大的弱点:贴现率。

当增长不稳定时,高质量的防御性股票可以吸引资金流入,但一些防御性成长型股票仍然像长期资产一样交易。即使业务看起来稳健,收益率上升也会受到打击。这意味着收益可能保持稳定,而估值仍在波动。

要看什么

- 相对强度: 澳洲联储周内防御性股票相对于大盘的表现如何。

- 指导语言: 关于成本压力、定价能力以及销量是否保持不变的评论。

- 收益行为: 收益率的上升可能会压倒质量出价并压低倍数。

潜在的触发因素

如果澳洲联储听起来很鹰派,周期性股开始摇摆不定,那么防御措施可以吸引相对的资金流入,但这可能取决于收益率的控制。如果收益率急剧上升,长期防御措施仍然可以降低利率。

主要风险

- 成本通胀挤压了利润率并削弱了防御力。

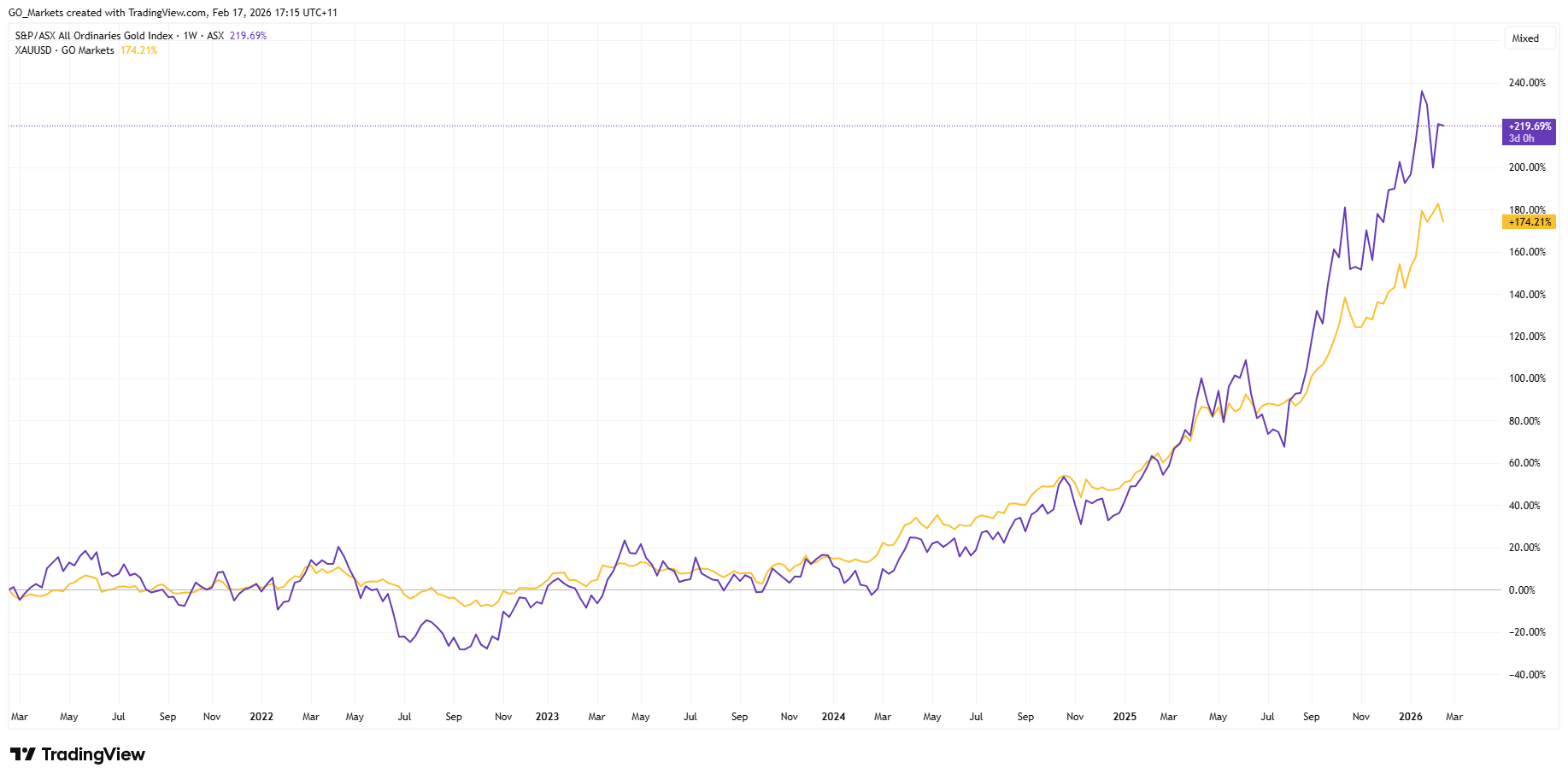

5。硬资产、黄金和黄金股票

2026年,硬资产可能与其说是简单的通胀对冲故事,不如说是尾部风险和政策不确定性。

当信心减弱时,硬资产通常会受到更多关注。它们不是由一个因素驱动的,如果主要驱动因素与之背道而驰,黄金仍可能下跌。

要看什么

- 实际收益方向: 决定持有黄金的机会成本。

- 美元走向: 黄金的主要定价渠道。

- 黄金股票与现货黄金: 矿商增加了运营杠杆,也增加了成本风险。

潜在的触发因素

如果市场开始质疑通胀控制或政策可信度,那么硬资产的说法可能会得到加强。如果澳洲联储在持续反通货膨胀的同时保持限制性,黄金可能会失去紧迫感,资金可能会流向其他交易。

主要风险

- 实际收益率大幅上升,这可能会给黄金带来压力。

- 拥挤和定位会导致急剧回调。

6。市场管道、外汇、利率波动和分散

在澳洲联储的某些周内,利率和澳元出现了第一波动,股市随后是板块轮动,而不是指数走势。

当指导方针发生变化时,澳洲联储可以改变市场的共同走势。您最终可能会获得持平指数,而板块则朝相反的方向大幅波动。

要看什么

- 前端费率: 决定后立即重新定价的速度可以揭示出真正的惊喜。

- 澳元的反应: 方向和后续行动通常决定股票和资源的下一步走势。

- 隐含波动率与已实现波动率: 可以显示市场为该活动支付的费用是过高还是过少。

- 选项偏差: 可以反映对下行保护的需求与上行追逐的需求。

- 早期的磁带行为: 最初的 5 到 15 分钟可能很混乱,可能会出现均值回归。

潜在的触发因素

如果该决定在预料之中,但声明偏向鹰派,则前端可能首先重新定价,澳元可以随之变动。随着市场重写路径并在表面之下轮换头寸,即使指数几乎没有波动,已实现的波动率仍可能上升。

主要风险

- 这确实令人惊讶,它压倒了期权所暗示的内容,并造成了差距波动。

- 相互竞争的宏观头条新闻占据主导地位,淹没了澳洲联储的信号。

- 流动性薄弱,会产生错误的信号、鞭子和比模型假设的更差的执行力。

7。主题篮

主题篮子可以让交易者表达宏观制度,同时降低单名风险。他们还会引入自己的风险,尤其是在事件发生之前。

要看什么

- 篮子里装了什么: 方法论,再平衡规则,隐藏的注意力。

- 流动性和点差: 特别是在活动窗口周围。

- 追踪与叙事: “主题” 的行为是否像宏驱动程序。

潜在的触发因素

如果澳洲联储的措辞强化了 “限制性和不确定性” 制度,那么与价值、质量或硬资产相关的主题篮子可能会引起人们的关注,尤其是在总体指数波动的情况下。

主要风险

- 宏观预期变化时主题反转。

- 活动窗口周围的流动性风险,利差可能会大幅扩大。

这本剧本的目的不是预测确切的标题;而是要知道二阶效应通常落在哪里,并在决定来临之前准备好一份简短的清单。

考虑到这些触发因素和风险可能有助于一些交易者围绕2026年澳大利亚央行的决策进行监控。

常见问题解答

为什么 “语气” 在 2026 年如此重要?

因为市场通常会对决策进行预先定价。增量信息可以指导澳洲联储对再次采取行动是否感到满意、担忧或持开放态度。

做出决定后最快的说法是什么?

一些交易者将前端利率、澳元和行业领先地位视为早期指标,但这些信号可能很噪音,并受定位和流动性的影响。

为什么房地产投资信托基金被称为期限交易?

因为他们的估值的很大一部分可能对贴现率和融资成本敏感。当收益率变动时,估值可以迅速重新定价。

澳洲联储周围的防守派总是更安全吗?

并非总是如此。如果收益率上升,即使收益稳定,长期防御措施仍可以重新定价。

为什么硬资产不断出现在2026年的叙事中?

因为当对政策信誉的信任度动摇时,它们可以充当对冲工具,但它们也带来了拥挤和实际收益率的风险。