Ahead of the US nonfarm payrolls (NFP) release (Friday, 9 January, 8:30 am ET/ Saturday, 10 January, 12:30 am AEDT), major US equity indices have been trading near recent highs (as at 9 January 2026).

Next week, attention is likely to shift to inflation data, any change in expectations for Federal Reserve (Fed) policy, and the start of US earnings season. Together, these may support or challenge current valuations.

Quick facts:

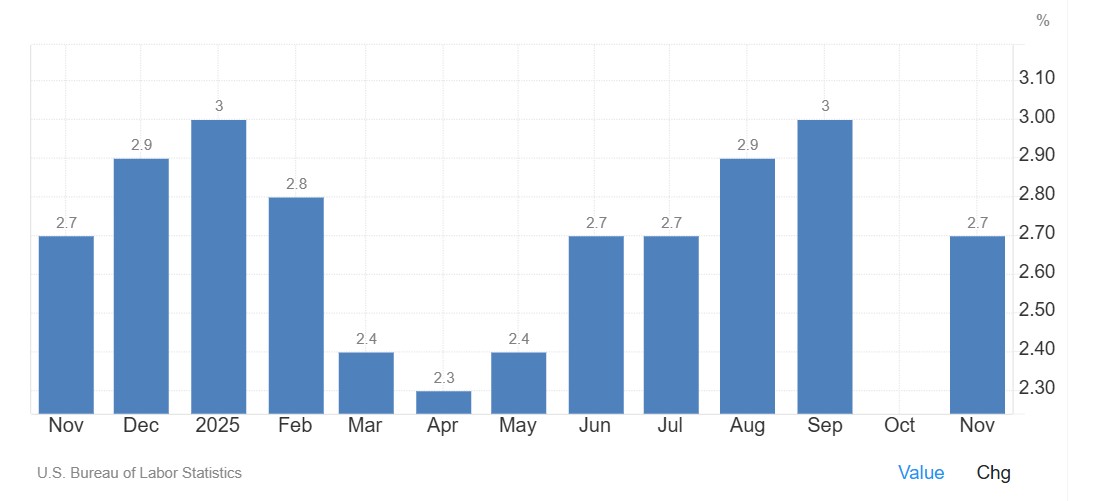

US inflation: The consumer price index (CPI) and producer price index (PPI) releases will test whether inflation is showing signs of persistence.

Earnings season: Major US banks report first, providing an early read on financial conditions and whether current valuations can hold up.

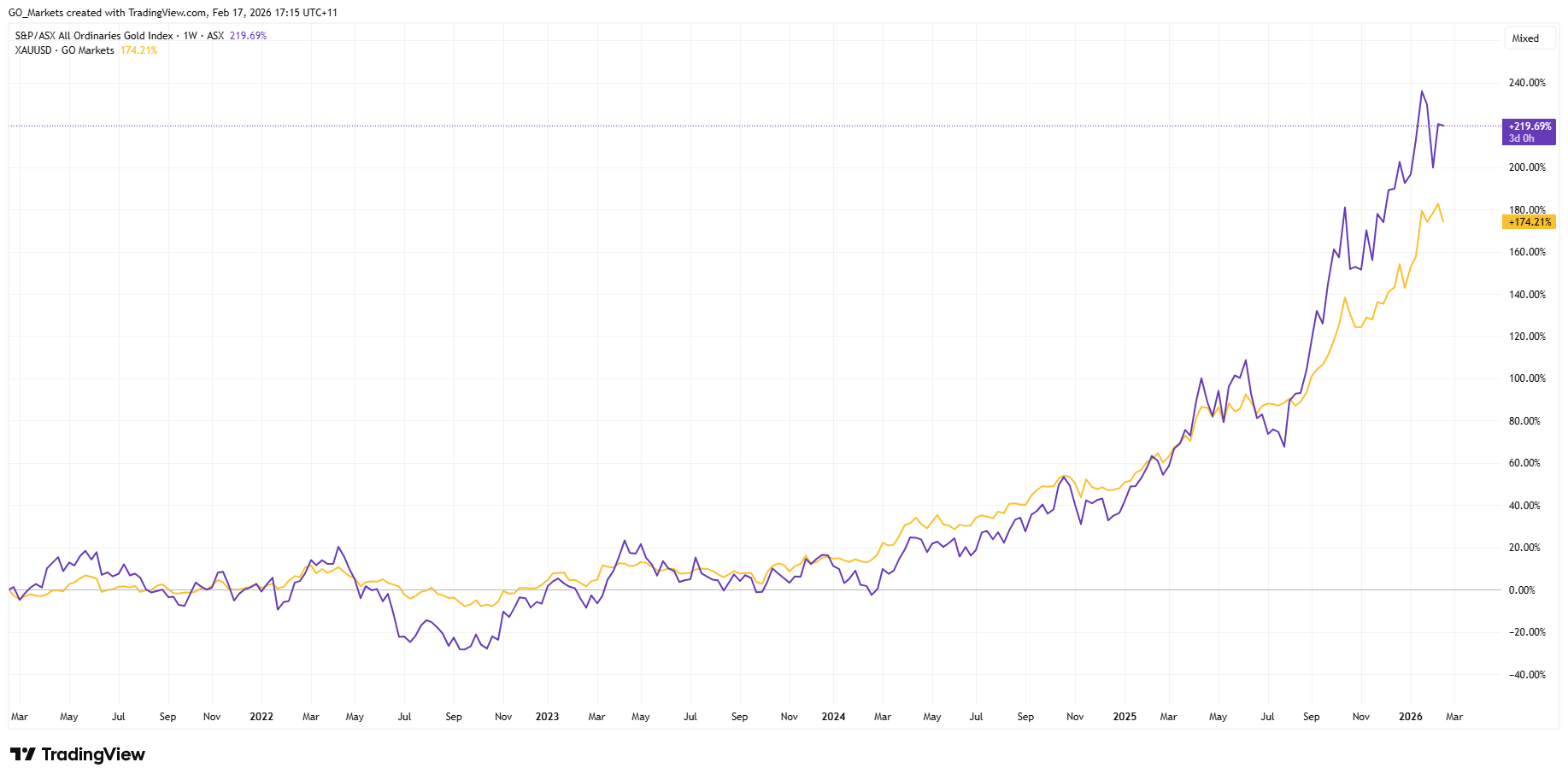

Gold futures: Gold futures remain close to record levels, with US dollar (USD) moves after key data a potential swing factor.

Geopolitics: Ongoing tensions remain on the radar and could influence risk sentiment.

US inflation data: could CPI and PPI shift rate-cut expectations?

Timing:

- CPI: Wednesday 14 January, 12:30 am AEDT

- PPI: Thursday 15 January, 12:30 am AEDT

CPI and PPI are the major scheduled macro events for the week. The updated inflation prints across consumer and producer prices will help markets assess whether disinflation is continuing or whether inflation is showing signs of persistence.

Market impact:

- A softer outcome could support risk sentiment and weigh on Treasury yields and the USD. However, reactions can vary depending on positioning and broader macro headlines, including how confidently markets price a March Fed rate cut.

- A stronger-than-expected reading may pressure equities and reinforce caution in bond markets.

US earnings season begins with the banks

Timing:

- JPMorgan Chase (JPM): Tuesday, 6:35 am ET

US earnings season begins with results from major banks, providing an early snapshot of financial conditions and economic momentum. Investor attention is likely to extend beyond headline earnings to guidance and management commentary.

Market impact

- Strong results versus earnings per share (EPS) and revenue expectations could support sentiment, particularly within financials.

- Cautious forward guidance may pressure share prices and could weigh on broader indices if it becomes a common theme.

- Early bank prints can shape expectations for the wider season. Watch how the first reporters in each sector influence related stocks.

Gold futures to retest record highs?

After a recent pullback, gold futures are trading within striking distance of record highs again. The backdrop remains a mix of geopolitical uncertainty and the potential for data-driven moves in the USD.

Market impact

- Continued strength could support a retest of late December highs around US$4,585.

- The short-term US$4,500 area may act as a short-term technical resistance in determining whether upside momentum can hold.

- Another pullback may occur if yields rise or the USD strengthens following key data releases.

Geopolitics remains in focus

Geopolitics remains a background market consideration, with headlines and broader policy messaging sometimes influencing risk sentiment. Markets have shown resilience to date, but sensitivity may rise if developments escalate.

Market impact

- Escalation could influence energy prices, defence stocks, and hedging assets such as gold.

- A cooling in the narrative may reduce volatility and allow markets to refocus on macro data and earnings.

Economic calendar

All dates and times may be subject to change.