ปี 2026 ไม่ได้ทำให้นักลงทุนมีพื้นที่หายใจมากนักดูเหมือนว่าตลาดอาจขยับไปเกินแนวคิดที่ว่าการลดอัตราดอกเบี้ยใกล้เข้ามาและเข้าสู่ปีที่อัตราเงินเฟ้ออาจพิสูจน์ได้ยากกว่าที่หลายคนคาดหวัง

อัตราเงินเฟ้อสินค้าเพิ่มขึ้น ในขณะที่เงินเฟ้อบริการยังคงค่อนข้างเหนียวเนื่องจากแรงกดดันต้นทุนแรงงานอย่างต่อเนื่องต้นทุนที่อยู่อาศัยโดยเฉพาะค่าเช่า ยังคงเป็นแหล่งที่สำคัญของแรงกดดันเงินเฟ้อ

RBA พยายามรักษาความน่าเชื่อถือเกี่ยวกับเงินเฟ้อโดยไม่ผลักดันเศรษฐกิจไปทางอื่นเกินไป

ข้อมูลที่สำคัญ CPI ยังคงอยู่ใกล้ ร้อยละ 3.8 (เหนือเป้าหมาย) ค่าจ้างยังคงเพิ่มขึ้นประมาณ ร้อยละ 0.8 ในช่วงไตรมาส และการว่างงานก็อยู่ใกล้ ๆ 4.1 เปอร์เซ็นต์ .

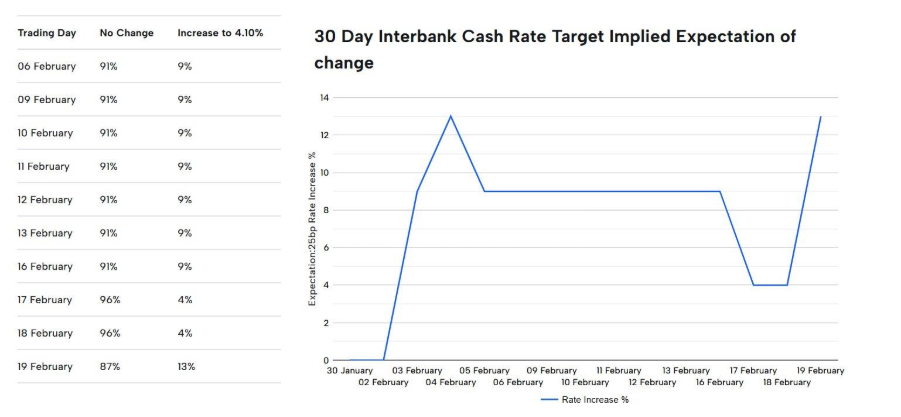

ขึ้นอยู่กับการกำหนดราคาโดยนัยตามตลาด คาดว่าจะมีการเพิ่มอัตราดอกเบี้ยในไม่ช้า ดังนั้นวิธีที่ RBA อธิบายการตัดสินใจอาจมีความสำคัญเกือบเท่ากับการตัดสินใจเองหากโทนเปลี่ยนความคาดหวังความคาดหวังเหล่านั้นสามารถเคลื่อนไหวตลาดได้

หนังสือเลย์บุ๊คนี้ครอบคลุมอะไร นี่คือหนังสือเลย์บุ๊คสำหรับสัปดาห์หนักของ RBA ในปี 2026มันครอบคลุมสิ่งที่ต้องดูในทุกภาคส่วน แสดงรายการทริกเกอร์ที่สำคัญ และอธิบายว่าตัวบ่งชี้ใดที่อาจเปลี่ยนความรู้สึกได้

ตัวชี้วัดทางเศรษฐกิจหลัก กุมภาพันธ์ 2026 | ABS/RBA

1.ธนาคารและการเงิน: การตัดสินใจของ RBA ไหลไปสู่การให้กู้ยืมและผู้กู้อย่างไร ธนาคารเป็นที่ที่ RBA แสดงให้เห็นได้เร็วที่สุดในเศรษฐกิจออสเตรเลียอัตราดอกเบี้ยสามารถส่งผลกระทบต่อผู้กู้ได้อย่างรวดเร็วและนำไปสู่ต้นทุนและความเชื่อมั่นในการระดมทุน

ในระยะที่เข้มงวด อัตรากำไรสามารถปรับปรุงได้ในตอนแรก แต่ก็สามารถพลิกกลับได้หากต้นทุนการระดมทุนเพิ่มขึ้นเร็วขึ้นหรือหากคุณภาพเครดิตเริ่มอ่อนลงความสมดุลระหว่างกองกำลังเหล่านั้นเป็นสิ่งที่สำคัญที่สุด

หากธนาคารรวมตัวเข้าสู่สัปดาห์การตัดสินใจ RBA อาจหมายความว่าตลาดคิดว่าสูงขึ้นเพื่อรองรับรายได้นานขึ้นหากขายหมดอาจหมายความว่าตลาดคิดว่าสูงขึ้นเป็นเวลานานทำให้ผู้กู้ส่งผลเสียหายต่อไปคุณสามารถอ่านที่แตกต่างกันสองครั้งจากหัวเรื่องเดียวกัน

สิ่งที่ต้องดู รูปร่างเส้นโค้งผลตอบแทน: เส้นโค้งที่สูงขึ้นสามารถช่วยอัตรากำไรได้ ในขณะที่เส้นโค้งกลับสามารถส่งสัญญาณความเครียดในการเติบโตได้การแข่งขันเงินฝาก: มันสามารถกดอัตรากำไรได้อย่างเงียบ ๆ แม้ว่าอัตราส่วนต้นจะดูสนับสนุนก็ตามคำพูด RBA เกี่ยวกับเสถียรภาพทางการเงิน บัฟเฟอร์ครัวเรือน และความยืดหยุ่นวลีเล็ก ๆ สามารถเปลี่ยนเรื่องราวความเสี่ยงได้ทริกเกอร์ที่อาจ หากดัชนี RBA ฟังดูน่ากลัวมากกว่าที่คาดไว้ ธนาคารอาจตอบสนองเร็ว เนื่องจากตลาดประเมินความคาดหวังการเติบโตและความเสี่ยงด้านเครดิตอีกครั้งการเคลื่อนไหวครั้งแรกบางครั้งสามารถตั้งค่าโทนสำหรับเซสชัน

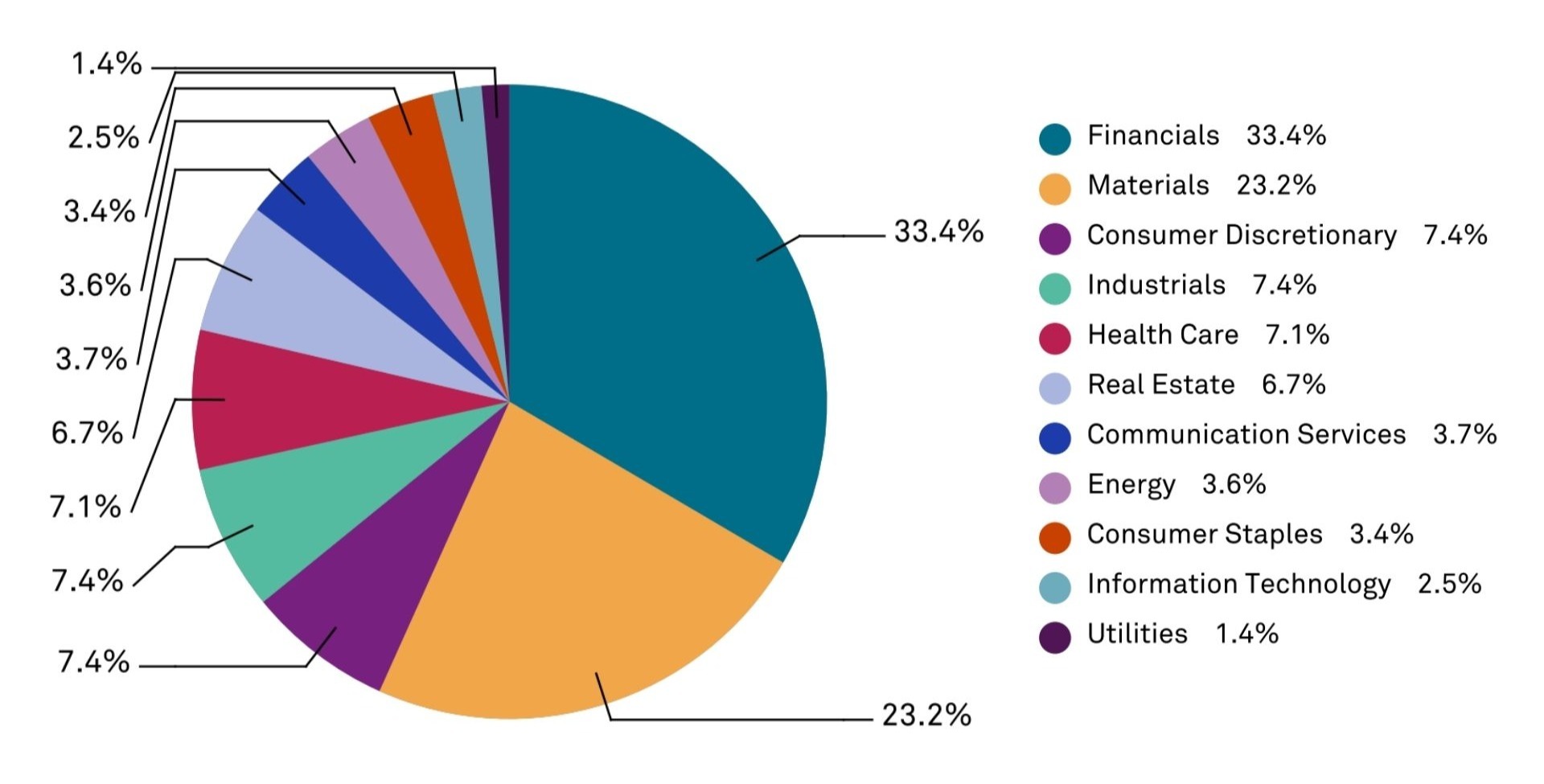

ความเสี่ยงที่สำคัญ ต้นทุนการระดมทุนเพิ่มขึ้นเร็วกว่าผลตอบแทนสินเชื่อ: อาจชี้ไปที่แรงดันอัตรากรเงื่อนไขเครดิตเข้มงวดอย่างชัดเจน: การค้างชำระที่เพิ่มขึ้นหรือความเครียดในการรีไฟแนนซ์สามารถเปลี่ยนการเล่าได้อย่างรวดเร็วการเงินเป็นภาคส่วนที่ใหญ่ที่สุดในดัชนี S&P/ASX 200 | เอส เอส แอนด์ พี

2.ดุลยพินิจของผู้บริโภคและการค้าปลีก: อัตราที่สูงขึ้นส่งผลกระทบต่อการใช้จ่าย เมื่อนโยบายเข้มงวด ดุลยพินิจของผู้บริโภคจะกลายเป็นแบบทดสอบความยืดหยุ่นของครัวเรือนนี่คือจุดที่ค่าใช้จ่ายในชีวิตประจำวันที่สูงขึ้นมักปรากฏเร็วที่สุด

การโทรขนาดใหญ่เกี่ยวกับผู้บริโภคอาจดูชัดเจนจนกว่าข้อมูลจะหยุดสำรองข้อมูลเมื่อสิ่งนั้นเกิดขึ้นการบรรยายสามารถเปลี่ยนแปลงได้อย่างรวดเร็ว

สิ่งที่ต้องดู ค่าจ้างเทียบกับอัตราเงินเฟ้อ: ผลักหรือลากรายได้จริงสัญญาณแรงงานในช่วงต้น: ชั่วโมงการทำงานสามารถอ่อนตัวลงก่อนที่การว่างงานเพิ่มขึ้นเบาะแสฤดูกาลรายงาน: การลดราคา การส่งผ่านต้นทุน และแรงกดดันมาร์จิ้นสามารถบ่งชี้ว่าความต้องการที่ขยายตัวจริงแค่ไหนทริกเกอร์ที่อาจ หากเสียงจาก RBA มีค่ามากกว่าที่คาดไว้ ภาคส่วนนี้อาจมีความอ่อนไหวต่ออัตราความคาดหวังการเคลื่อนไหวครั้งแรกอาจไม่เกิดขึ้นและการดำเนินการราคาที่ตามมาอาจขึ้นอยู่กับข้อมูลที่เข้ามาและการวางตำแหน่ง

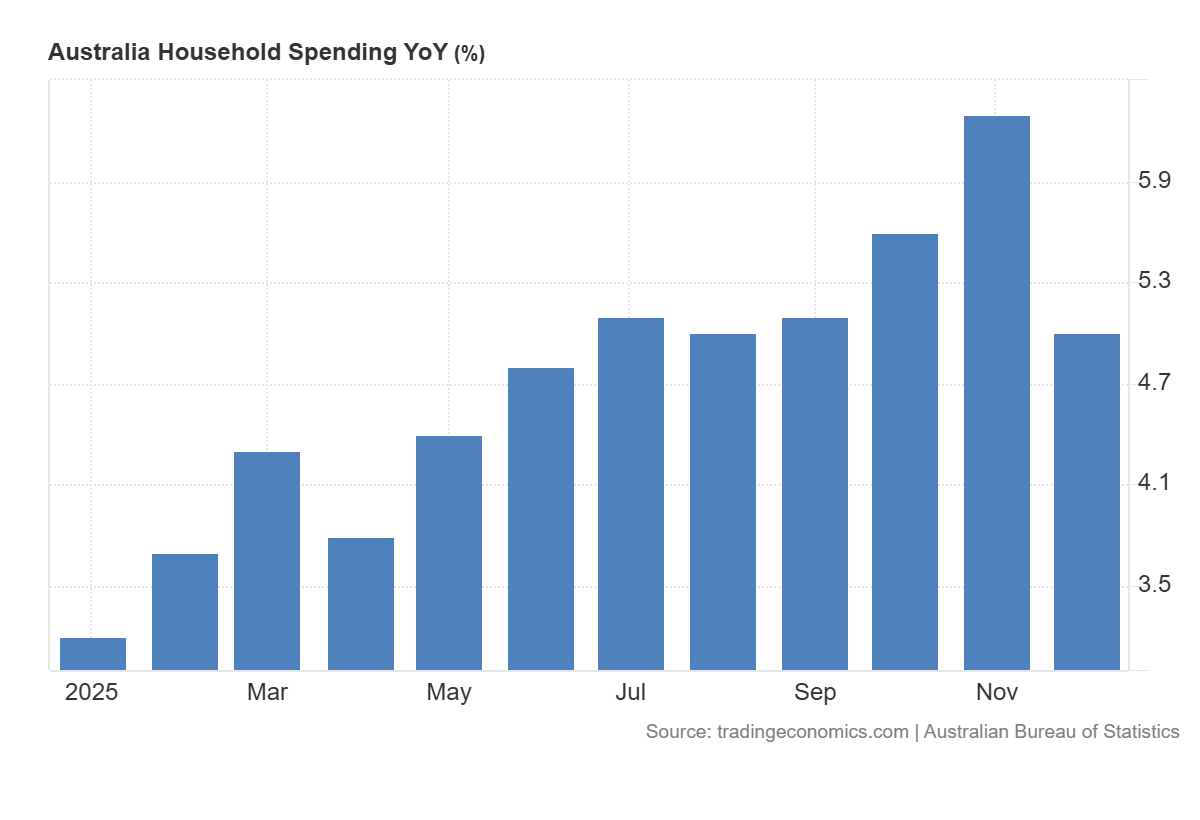

ความเสี่ยงที่สำคัญ การเปลี่ยนแปลงอย่างรวดเร็วในตลาดแรงงาน แรงกระแทกต้นทุนการครองชีพใหม่ โดยเฉพาะพลังงานหรือที่อยู่อาศัย ซึ่งส่งผลกระทบต่อการใช้จ่ายอย่างรวดเร็ว การใช้จ่ายของครัวเรือนของออสเตรเลีย YoY | เศรษฐศาสตร์การซื้อขาย/สำนักงานสถิติออสเตรเลีย

3.แหล่งข้อมูล: สิ่งที่ควรระวังเมื่อภาษีการเมืองทางภูมิศาสตร์และการเปลี่ยนแปลงนโยบาย ทรัพยากรสามารถทำหน้าที่เป็นการอ่านเกี่ยวกับการเติบโตของโลกได้ แต่การเคลื่อนไหวของสกุลเงินและเสียงของธนาคารกลางสามารถเปลี่ยนวิธีที่เรื่องราวนั้นเกิดขึ้นในออสเตรเลีย

ในปี 2026 อัตราภาษีและการเมืองทางภูมิศาสตร์ยังสามารถสร้างการเคลื่อนไหวของหัวข้อที่คมชัดกว่าปกติ ดังนั้นความเสี่ยงช่องว่างจึงสามารถอยู่เหนือวงจรปกติ

RBA ยังคงมีความสำคัญผ่านสองช่องทาง ได้แก่ ดอลลาร์ออสเตรเลียและความอยากเสี่ยงโดยรวมทั้งสองสามารถคืนราคาภาคได้อย่างรวดเร็วแม้ว่าราคาสินค้าโภคภัณฑ์จะไม่เคลื่อนไหวมากก็ตาม

สิ่งที่ต้องดู ชีพจรการเติบโตทั่วโลก: ความคาดหวังความต้องการของอุตสาหกรรมและสัญญาณที่เชื่อมโยงกับจีนดอลลาร์ออสเตรเลีย: การเคลื่อนไหวหลังการตัดสินใจอาจกลายเป็นตัวขับเคลื่อนที่สองสำหรับภาคส่วนนี้ความเป็นผู้นำภาคส่วน: การซื้อขายทรัพยากรเทียบกับตลาดที่กว้างขึ้นสามารถส่งสัญญาณถึงระบอบการปกครองปัจจุบันได้อย่างไรทริกเกอร์ที่อาจ หากโทนเสียง RBA เปลี่ยนเป็นข้อ จำกัด มากขึ้นในขณะที่การเติบโตของโลกยังคงที่คงที่ ทรัพยากรอาจคงตัวได้ดีกว่าส่วนอื่น ๆ ของตลาดกระแสเงินสดที่แข็งแกร่งอาจมีความสำคัญมากขึ้นและมุมสินทรัพย์จริงสามารถดึงดูดผู้ซื้อได้

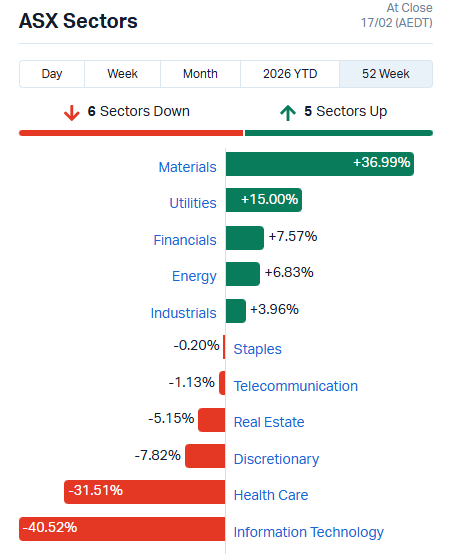

ความเสี่ยงที่สำคัญ ในเหตุการณ์ความเครียดที่แท้จริง ความสัมพันธ์สามารถกระโดดได้ และการวางตำแหน่งป้องกันอาจล้มเหลวได้ หากนโยบายเข้มงวดให้กลัวการเติบโต วงจรสามารถเข้าครอบงำ และภาคส่วนก็สามารถจางหายไปได้อย่างรวดเร็ว วัสดุ (ทรัพยากร) มีประสิทธิภาพเหนือกว่าภาคส่วน ASX อื่น ๆ YoY | ดัชนีตลาด

4.อุปกรณ์ป้องกัน ลวดเย็บกระดาษ และการดูแลสุขภาพที่มีคุณภาพ การป้องกันมีไว้เพื่อเป็นมุมที่สงบกว่าของตลาดเมื่อทุกอย่างรู้สึกยุ่งเหยิงในปี 2026 พวกเขายังคงมีจุดอ่อนใหญ่หนึ่ง: อัตราส่วนลด

การป้องกันที่มีคุณภาพสามารถดึงดูดการไหลเข้าได้เมื่อการเติบโตดูสั่นสะเทือน แต่หุ้นที่เติบโตด้านการป้องกันบางส่วนยังคงซื้อขายเหมือนสินทรัพย์ระยะยาวพวกเขาสามารถได้รับผลกระทบเมื่อผลตอบแทนเพิ่มขึ้น แม้ว่าธุรกิจจะดูแข็งแกร่งก็ตามนั่นหมายความว่ารายได้อาจคงที่ในขณะที่การประเมินค่ายังคงเคลื่อนที่

สิ่งที่ต้องดู ความแข็งแรงสัมพัทธ์: การป้องกันทำงานอย่างไรในช่วงสัปดาห์ RBA เทียบกับตลาดที่กว้างขวางภาษาแนะนำ: ความคิดเห็นเกี่ยวกับแรงกดดันด้านต้นทุน พลังการกำหนดราคา และปริมาณคงอยู่หรือไม่พฤติกรรมผลตอบแทน: ผลตอบแทนที่เพิ่มขึ้นสามารถเอาชนะการเสนอราคาคุณภาพและผลักคูณลดลงทริกเกอร์ที่อาจ หาก RBA ฟังดูเป็นเหยี่ยวและวัฏจักรเริ่มสั่นสะเทือน สารป้องกันสามารถดึงดูดการไหลเข้าสัมพัทธ์ได้ แต่นั่นอาจขึ้นอยู่กับผลตอบแทนที่ยังคงมีอยู่หากผลตอบแทนเพิ่มขึ้นอย่างรวดเร็ว การป้องกันระยะยาวยังคงลดอัตราได้

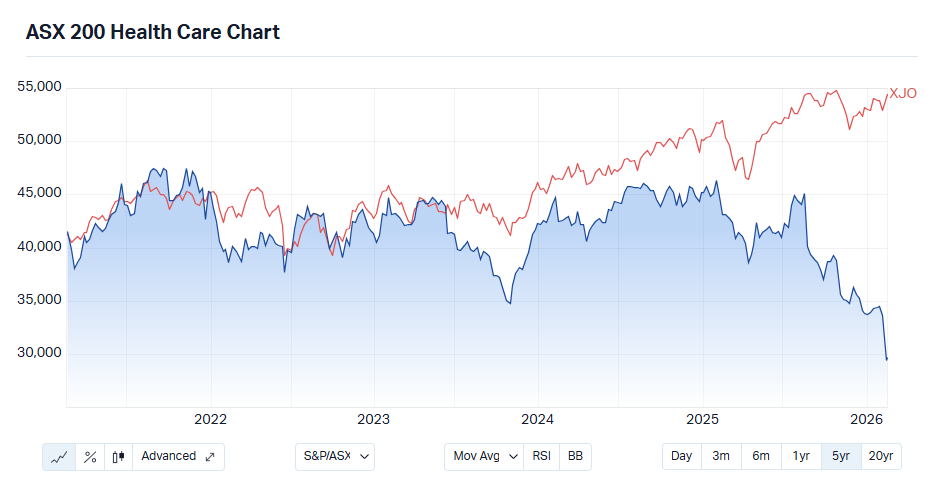

ความเสี่ยงที่สำคัญ อัตราเงินเฟ้อต้นทุนที่บีบอัตรากำไรและทำให้เรื่องราวการป้องกันอ่อนแอลง การดูแลสุขภาพมีประสิทธิภาพต่ำกว่าเทียบกับ S&P/ASX 200 นับตั้งแต่สิ้นสุดการระบาดใหญ่ | ดัชนีตลาด

5.สินทรัพย์แข็ง ทองคำ และหุ้นทอง ในปี 2026 สินทรัพย์แข็งอาจน้อยลงเกี่ยวกับเรื่องราวป้องกันความเสี่ยงเงินเฟ้ออย่างง่าย และมากขึ้นเกี่ยวกับความเสี่ยงด้านท้ายและความไม่แน่นอนของนโยบาย

เมื่อความเชื่อมั่นอ่อนลง สินทรัพย์ที่แข็งมักจะได้รับความสนใจมากขึ้นพวกเขาไม่ได้ขับเคลื่อนด้วยปัจจัยใดปัจจัยหนึ่ง และทองคำยังคงลดลงได้หากผู้ขับขี่หลักวิ่งกับมัน

สิ่งที่ต้องดู ทิศทางผลตอบแทนจริง: กำหนดต้นทุนโอกาสในการถือทองคำทิศทางดอลลาร์สหรัฐ: ช่องทางการกำหนดราคาหลักสำหรับทองคำหุ้นทองคำเทียบกับสปอตโกลด์: นักขุดเพิ่มเลเวอเรจในการดำเนินงาน และยังเพิ่มความเสี่ยงด้านต้นทุนทริกเกอร์ที่อาจ หากตลาดเริ่มตั้งคำถามเกี่ยวกับการควบคุมอัตราเงินเฟ้อหรือความน่าเชื่อถือของนโยบาย การเล่าเรื่องสินทรัพย์ที่ยากจะแข็งแกร่งขึ้นได้หาก RBA ยังคงมีข้อ จำกัด ในขณะที่เงินเฟ้อยังคงดำเนินต่อไป ทองคำอาจสูญเสียความเร่งด่วนและเงินสามารถหมุนเวียนไปสู่การซื้อขายอื่นได้

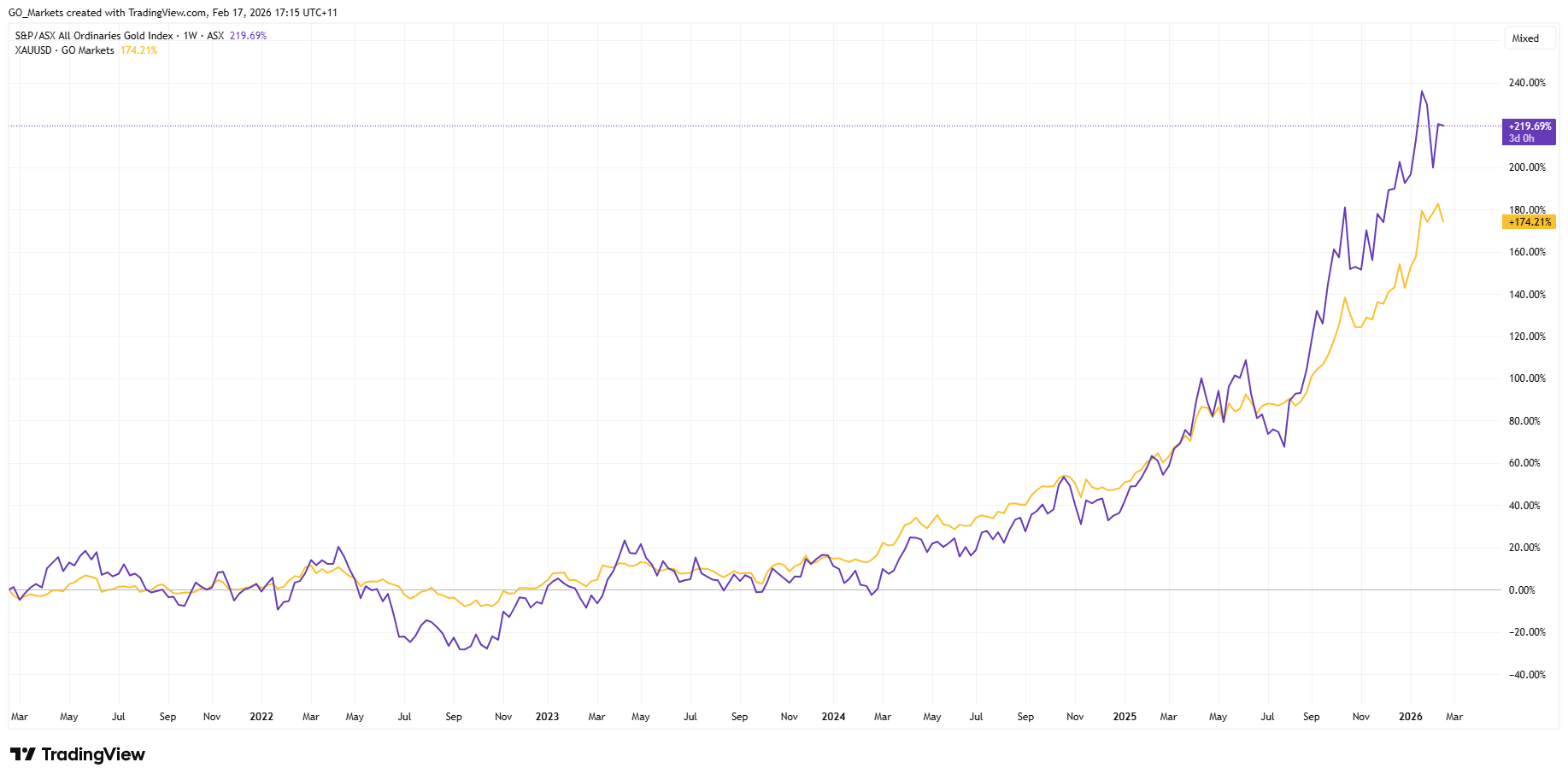

ความเสี่ยงที่สำคัญ ผลตอบแทนที่แท้จริงเพิ่มขึ้นอย่างมีนัยสำคัญ ซึ่งสามารถกดดันทองคำ ความแออัดและการวางตำแหน่งที่อาจทำให้เกิดการดึงกลับอย่างรวดเร็ว แผนภูมิ S&P/ASX ทั้งหมด โกลด์เทียบกับสปอตโกลด์ (XAUUSD) 5Y | เทรนด์วิว

6.ระบบประปาของตลาด FX ความผันผวนของอัตราและการกระจายตัว ในบางสัปดาห์ RBA การเคลื่อนไหวครั้งแรกปรากฏขึ้นในอัตราและดอลลาร์ออสเตรเลีย และหุ้นตามมาผ่านการหมุนเวียนของภาคส่วนมากกว่าการเคลื่อนไหวของดัชนีที่สะอาด

เมื่อแนวทางเปลี่ยนแปลง RBA สามารถเปลี่ยนแปลงวิธีการเคลื่อนไหวของตลาดด้วยกันคุณสามารถจบลงท้ายด้วยดัชนีแบนในขณะที่เซกเตอร์แกว่งอย่างแข็งในทิศทางตรงกันข้าม

สิ่งที่ต้องดู อัตราส่วนหน้า: ความเร็วในการปรับราคาทันทีหลังจากการตัดสินใจสามารถเปิดเผยความประหลาดใจที่แท้จริงได้ปฏิกิริยา AUD: ทิศทางและการติดตามมักจะเป็นตัวกำหนดการเคลื่อนไหวครั้งต่อไปในหุ้นและทรัพยากรความผันผวนโดยนัยเทียบกับที่เกิดขึ้นจริง: สามารถแสดงให้เห็นว่าตลาดจ่ายเงินมากเกินไปหรือน้อยเกินไปสำหรับงานดังกล่าวตัวเลือกเอียงตัว: สามารถสะท้อนความต้องการด้านการป้องกันด้านลบกับการไล่ล่าตัวลงได้พฤติกรรมเทปในช่วงต้น: 5 ถึง 15 นาทีแรกอาจยุ่งเหยิงและสามารถเปลี่ยนแปลงทริกเกอร์ที่อาจ หากคาดว่าจะมีการตัดสินใจ แต่คำชี้แจงจะเอียงไปอย่างหนึ่ง ส่วนด้านหน้าอาจเปลี่ยนราคาก่อน และ AUD สามารถเคลื่อนไหวไปพร้อมกับมันได้ความผันผวนที่เกิดขึ้นสามารถกระโดดได้แม้ว่าดัชนีแทบจะไม่เคลื่อนไหวแม้ว่าตลาดจะเขียนเส้นทางใหม่และหมุนตำแหน่งใต้พื้นผิว

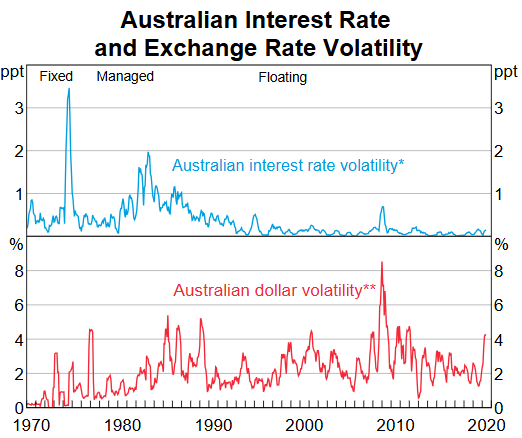

ความเสี่ยงที่สำคัญ ความประหลาดใจที่แท้จริงที่ครอบงำตัวเลือกที่นัยและสร้างการเคลื่อนไหวของช่องว่าง หัวข่าวมาโครที่แข่งขันกันที่ครอบงำเทปและทำให้สัญญาณ RBA จมลง สภาพคล่องบางที่สร้างสัญญาณเท็จ Whipsaw และการดำเนินการที่เลวร้ายกว่าที่โมเดลสันนิษฐาน อัตราดอกเบี้ยออสเตรเลียและความผันผวนของอัตราแลกเปลี่ยน 1970-2020 | อาร์บีเอ

7.กระเช้าธีม กระเช้าธีมอาจอนุญาตให้เทรดเดอร์แสดงระบอบการปกครองแบบมาโครในขณะที่ลดความเสี่ยงที่มีชื่อเดียวพวกเขายังแนะนำความเสี่ยงของตนเองโดยเฉพาะอย่างยิ่งเกี่ยวกับเหตุการณ์

สิ่งที่ต้องดู ตะกร้ามีอะไรบ้าง: วิธีการกฎการปรับสมดุลความเข้มข้นที่ซ่อนอยู่สภาพคล่องและสเปรด: โดยเฉพาะบริเวณหน้าต่างกิจกรรมการติดตามกับการบรรยาย: “ธีม” ทำงานเหมือนไดรเวอร์มาโครหรือไม่ทริกเกอร์ที่อาจ หากภาษา RBA เสริมระบอบระบอบการปกครอง “จำกัด และไม่แน่นอน” ตะกร้าธีมที่เชื่อมโยงกับมูลค่า คุณภาพ หรือสินทรัพย์แข็งอาจดึงดูดความสนใจ โดยเฉพาะอย่างยิ่งหากดัชนีกว้างขวางลดลง

ความเสี่ยงที่สำคัญ การพลิกกลับธีมเมื่อความคาดหวังของมาโครเปลี่ยนไป ความเสี่ยงด้านสภาพคล่องรอบหน้าต่างเหตุการณ์ ซึ่งสเปรดสามารถขยายตัวได้อย่างมีนัยสำคัญ

จุดเด่นของหนังสือเลย์บุ๊คนี้ไม่ใช่การคาดการณ์หัวเรื่องที่แน่นอน มันคือการรู้ว่าเอฟเฟกต์ลำดับสองมักจะมาที่ไหน และต้องเตรียมรายการตรวจสอบสั้น ๆ ก่อนที่การตัดสินใจจะเกิดขึ้น

การรักษาทริกเกอร์และความเสี่ยงเหล่านี้อาจช่วยให้เทรดเดอร์บางรายจัดโครงสร้างการตรวจสอบตามการตัดสินใจ RBA ตลอดปี 2026

คำถามที่พบบ่อย ทำไม “เสียง” จึงมีความสำคัญมากในปี 2026? เพราะตลาดมักจะทำการตัดสินใจล่วงหน้าข้อมูลที่เพิ่มขึ้นคือคำแนะนำเกี่ยวกับว่า RBA ฟังดูสะดวกสบาย กังวล หรือเปิดให้เคลื่อนไหวอีกครั้ง

อะไรคือสิ่งที่เร็วที่สุดหลังจากการตัดสินใจ เทรดเดอร์บางคนมองว่าอัตราส่วนหน้า AUD และการเป็นผู้นำของภาคส่วนเป็นตัวบ่งชี้เริ่มต้น แต่สัญญาณเหล่านี้อาจมีเสียงดังและมีอิทธิพลจากตำแหน่งและสภาพคล่อง

ทำไม REIT จึงเรียกว่าการซื้อขายระยะเวลา เนื่องจากการประเมินมูลค่าส่วนใหญ่อาจมีความอ่อนไหวต่ออัตราส่วนลดและต้นทุนการระดมทุนเมื่อผลตอบแทนเคลื่อนที่ การประเมินราคาสามารถคืนราคาได้อย่างรวดเร็ว

การป้องกันปลอดภัยกว่าอยู่รอบ RBA เสมอหรือไม่? ไม่เสมอไปหากผลตอบแทนเพิ่มขึ้น ระบบป้องกันระยะยาวยังสามารถปรับราคาต่ำลงแม้จะมีรายได้ที่มั่นคง

ทำไมสินทรัพย์ฮาร์ดจึงปรากฏขึ้นอย่างต่อเนื่องในเรื่องราวปี 2026? เพราะพวกเขาสามารถทำหน้าที่เป็นการป้องกันความเสี่ยงเมื่อความไว้วางใจในนโยบายความน่าเชื่อถือของนโยบายสั่นลง แต่พวกเขายังมีความเสี่ยงจากความแออัดและความเสี่ยงจากผลตอบแทนที่แท้จริงด้วย