- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Articles

- Central Banks

- AUD drops on Employment Figures

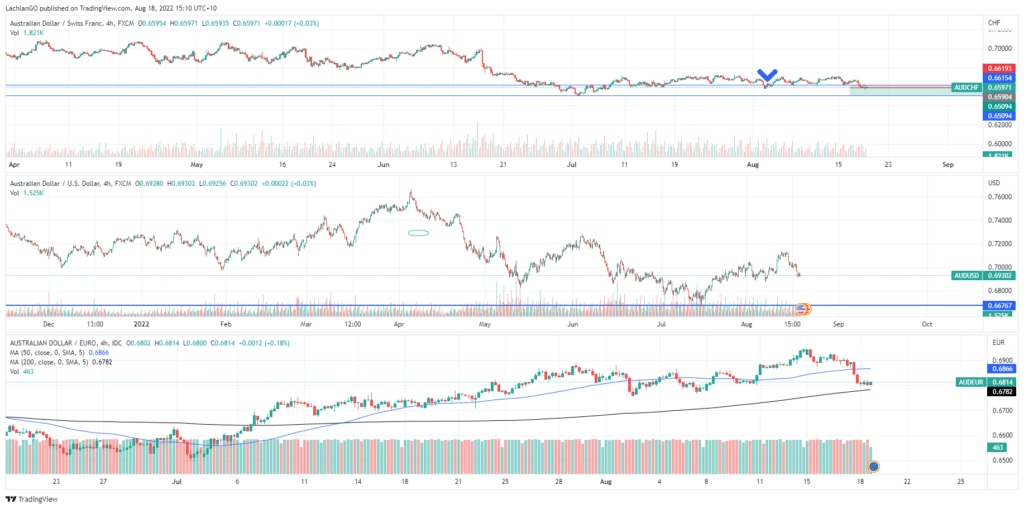

News & analysisThe Aussie Dollar has seen a drop in its price due to wage and unemployment data released over the past day and a half. The economic data shows that unemployment has fallen to its lowest level in nearly 50 years with the jobless rate at 3.4% compared to analysts expecting the figure to remain at 3.5%. Wages also rose modestly in the last quarter to 2.7%, however this is still a far cry from the 6.1% inflation figure. The AUD’s weakness came on the removal of 40,900 roles from the economy vs the previous month as opposed to expectations of a gain of 25,000. The report indicates that the labour market might just be starting to feel the pinch and that growth is beginning to slow. These figures give the RBA more flexibility in its next cash rate decision with the option for a 25 bps rise instead of 50 bps now being a realistic possibility after 3 consecutive 50 bps raises.

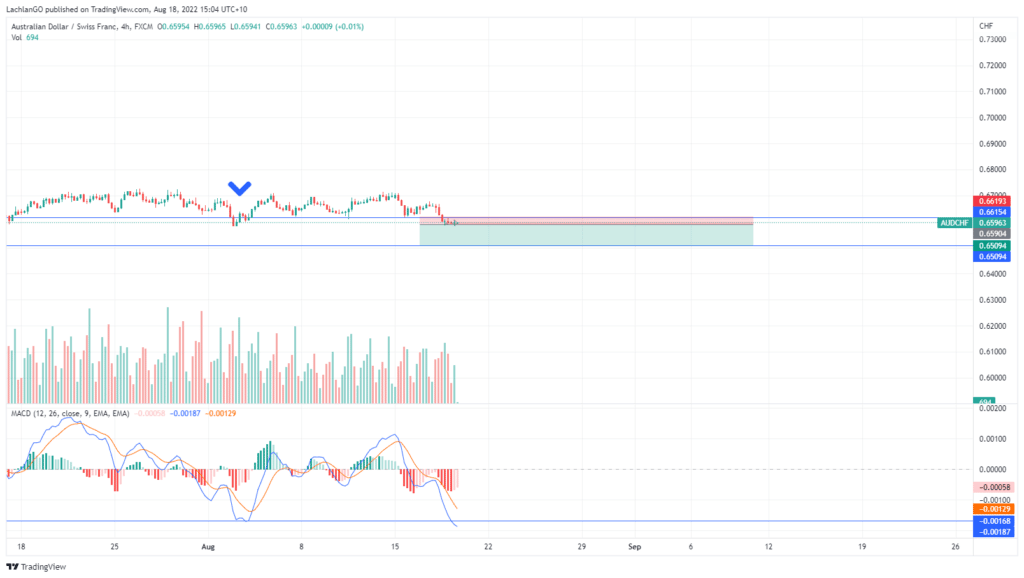

In response the Aussie dollar dipped against most of the main currencies. It fell back below 0.70 USD after a recent rally, to 0.6801 Euros and to 0.659 CHF. With the currency experiencing negative sentiment due to the employment figures and recessionary fears pushing commodity prices lower, there is an opportunity for a short trade. Specifically with the recent strength of the CHF compared to the general weakness s of the AUD, it represents the best opportunity for a trade.

The current price is sitting just near the last level of support at 0.6584 CHF, providing a potential entry point. If this level fails to hold then it is possible that the price may drop to 0.6509, which is the first price target. The current pattern of the MACD also supports this trade. The last time the price was at this level of support the MACD Moving Averages had already found support. However, on this occasion, the Moving Averages are still accelerating to the downside indicating that there may be more selling to be done. The trade involves placing a stop loss just above 0.66 CHF to reduce the potential loss if the trade does go as expected for a Risk Reward of close to 3.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Qantas outlook report

Overview Qantas is Australia’s national carrier and the largest and oldest airline in the country. With the Qantas group comprising of Jetstar, Qantas, QantasLink, its frequent flyer service and a freight service, the airline is the sector leader domestically and a global competitor in the international aviatio...

August 19, 2022Read More >Previous Article

Dive Into a Music Streaming Giant

By now Spotify is hugely synonymous with providing music to the masses. We have all either, in one shape or form, listened to a song on Spotify or...

August 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.