- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Central Banks

- Bank of England hikes again

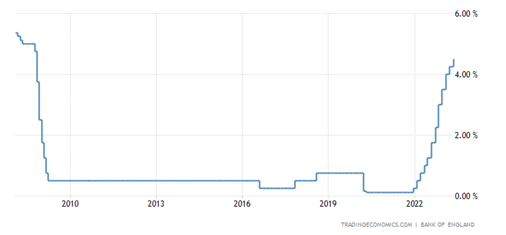

News & analysisBank of England announced the latest policy decision on Thursday, raising interest rates for the 12th consecutive time from 4.25% to 4.5%, which was in line with expectations.

Bank of England’s Monetary Policy Committee voted by a majority of 7-2 to raise interest rates to 4.5%.

Two members voted to maintain the interest rate unchanged at 4.25%.

The current interest rate is at its highest level since October 2008.

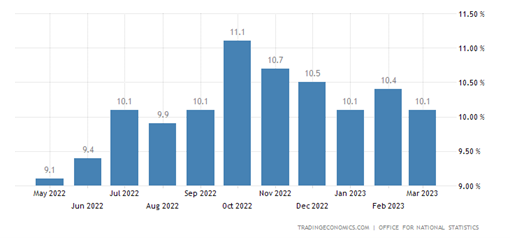

Inflation

UK’s annual inflation rate decreased from 10.4% to 10.1% in April and remains high. The bank expects inflation to continue falling in Q2 and in the near term.

”CPI inflation is expected to fall sharply from April, in part as large rises in the price level one year ago drop out of the annual comparison. In addition, the extension in the Spring Budget of the Energy Price Guarantee and declines in wholesale energy prices will both lower the contribution from household energy bills to CPI inflation. However, food price inflation is likely to fall back more slowly than previously expected. Alongside news in other goods prices, this explains why the Committee’s modal expectation for CPI inflation now falls back more slowly than in the February Report.”

Economic outlook

As for the economy, the central bank expects it to remain flat but there are signs potential growth.

”UK GDP is expected to be flat over the first half of this year, although underlying output, excluding the estimated impact of strikes and an extra bank holiday, is projected to grow modestly. Economic activity has been less weak than expected in February, and the Committee now judges that the path of demand is likely to be materially stronger than expected in the February Report, albeit still subdued by historical standards. The improved outlook reflects stronger global growth, lower energy prices, the fiscal support in the Spring Budget, and the possibility that a tight labour market leads to lower precautionary saving by households.”

The unemployment is expected to remain below 4% until the end of next year.

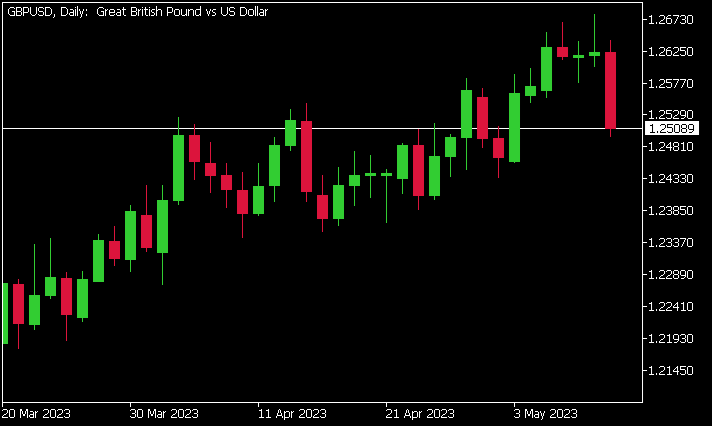

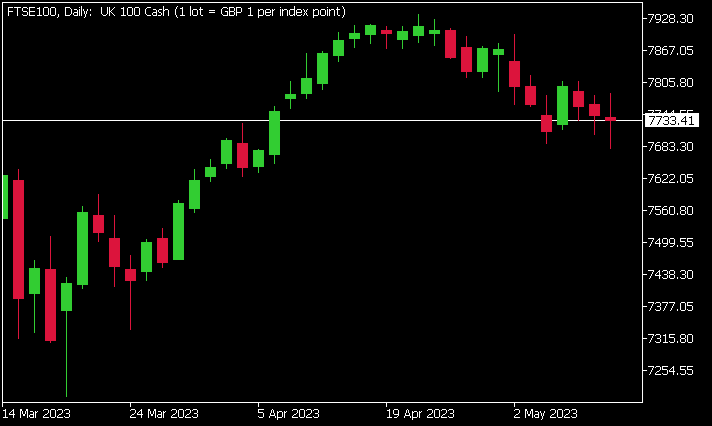

Market reaction

The Pound was weaker against the US dollar on Thursday, down by around -0.93% at 1.25089.

FTSE100 was down by -0.14% at 7733.41.

The next Bank of England rate decision will be on 22nd June.

Source: Bank of England, Trading Economics, MetaTrader 5

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

US stocks mostly lower as bank woes sour risk sentiment, BoE hikes rates

US indices closed the session mixed with outperformance in Nasdaq, propped up by Google(GOOG) as their continuing I/O event bolstered their stock price. However, other major indices finished solidly in the red, with the Dow down over 200 points, dragged down by Disney, and the S&P500 and Russell 2000 suffering from further banking woes after Pa...

May 12, 2023Read More >Previous Article

GBPUSD analysis – Is the Bank of England approaching peak rates?

The Bank of England (BoE) is due to release its interest rate decision today, with markets expecting a 12th consecutive hike to take interest rates to...

May 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.