- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Articles

- Economic Updates

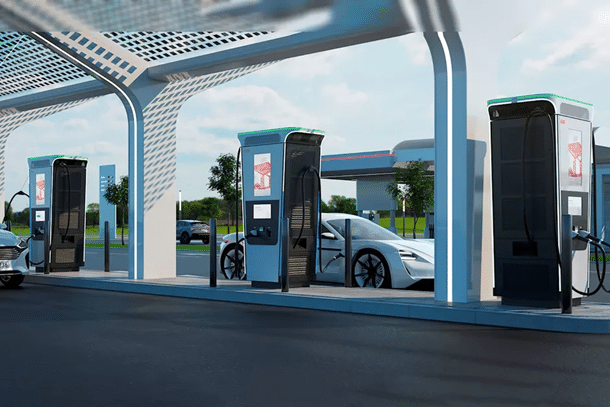

- Are EV cars inevitable?

News & analysisSince the recent crisis in Europe, you would have noticed a few things in the stock market which have directly or indirectly affected your normal day to day life, as a motorist one of the first things that you would have taken note of, is the price of fuel. Only a fortnight ago petrol prices for unleaded fuel was sold for $149.99 per litre (APCO service station Cranbourne), today’s price of $186.998 (price as of 24 hours ago) marks a clear sign that prices are rising and, in most cases, have hit above $2 per litre with people predicting that it will get worst before it gets better.

We will take a look at why the EV market may be positioned to take advantage of this economic pain. EV cars have long been in the process of becoming a cleaner alternative to combustible engine vehicles. Since climate change has been at the forefront of politicians and corporations’ agendas, companies such as Tesla have managed to carve out a large portion of the market for themselves and be the leading light into the new generations of cars. Whether that be by producing the latest car in the Roadster or providing companies with “regulatory credits” which allow the companies to reach emission targets set by governance in their respective countries. In a push to reduce carbon emissions, governments around the world have introduced incentives for automakers to develop electric vehicles in return for regulatory credits. Because Tesla only manufacturers EV cars, they get free credits and as they have a surplus amount, they can sell these credits to their competitors for them to be able to meet the latest emissions targets. That’s one way in which Tesla profits hugely from their vision as they are able to make 100% profits on these credits.

As climate change reels its head and costs of fuel soars, many believe that EVs are the best alternative to an old age problem. However for EV cars to be successfully incorporated in our communities, there has to be a few advances in infrastructure including more regular charging stations, and improved battery life, with many currently working on producing longer lasting, quicker charging and more affordable batteries. As well as this, the price of EV vehicles would need to come in line with economy combustible engine vehicles to make them more desirable.

The infrastructure for electric-vehicle charging continues to expand. In 2019, there were about 7.3 million chargers worldwide, of which about 6.5 million were private, light-duty vehicle slow chargers in homes, multi-dwelling buildings and workplaces. Convenience, cost-effectiveness and a variety of support policies (such as preferential rates, equipment purchase incentives, and rebates) are the main drivers for the prevalence of private charging.

Market Performance:

Sales of electric cars topped 2.1 million globally in 2019, surpassing 2018 – already a record year – to boost the stock to 7.2 million electric cars. Electric cars, which accounted for 2.6% of global car sales and about 1% of global car stock in 2019, registered a 40% year-on-year increase.

Companies leading the way in manufacturing of EV cars and companies working alongside in infrastructure, battery life development and electricity providers in the field are:

TESLA

Volkswagen Group

BMW

Hyundai/KIA

Jaguar

Land Rover

Schneider Electric SE

Siemens AG

ABB

Eaton Corporation

ChargePoint, Inc.

Webasto Group

EVBox B.V.

Blink Charging, Co.

EFACEC

Popular mentions to Delta Electronics, Inc. (Taiwan), Leviton Manufacturing Co., Inc. (U.S.), Alfen (Netherlands), NewMotion B.V. (Netherlands), Star Charge (China), SemaConnect (U.S.), Robert Bosch GmbH (Germany), and ClipperCreek Inc. (U.S.). Some of the key players in both car manufacturing, infrastructure and battery performance which investors are keeping a close eye on, in order to take advantage of potential opportunities within the stock market.

As we can gather from the research, figures and public opinion as well as Geopolitical issues affecting prices of energy, we can conclude that a change to EV cars is not longer just a pipedream but a very potential reality, with governments aligned with corporations and the public in wanting to have a change of direction from combustible engines to electricity charged vehicles. We would be able to see a huge increase or EV cars on our roads within the next few years.

Sources: CNBC, iea.org, Google, meticulousblog.org

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The USA and the UK ban Russian oil imports as Gold price approaches all-time high

The USA and the UK announced measures to ban Russian oil imports in order to isolate Russia from the global economy. This follows on from sanctions imposed on Russia’s top oligarchs and government officials along with its central bank in a bid to push against Russia’s war on Ukraine. The market responded to the news with a volatile trading sess...

March 9, 2022Read More >Previous Article

Nasdaq confirms a Bear market as energy prices continue to skyrocket

Energy prices have continued to soar with the US indices struggling again as the West debates placing more sanctions on Russia. The Nasdaq closed 3.62...

March 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.