- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Articles

- Economic Updates

- Coinbase reports disappointing results for Q2 – the stock is falling

- Home

- News & analysis

- Articles

- Economic Updates

- Coinbase reports disappointing results for Q2 – the stock is falling

- 1 month +61.65%

- 3 months +20.13%

- Year-to-date -65.26%

- 1 year -67.49%

- Citigroup $105

- DA Davidson $90

- Mizuho $42

- JMP Securities $205

- Atlantic Equities $54

- Goldman Sachs $45

- JP Morgan $68

News & analysisNews & analysis

News & analysisNews & analysisCoinbase reports disappointing results for Q2 – the stock is falling

10 August 2022 By Klavs ValtersCoinbase Global Inc. (COIN) released its financial results for Q2 after the market close in the US on Tuesday.

The company reported revenue that fell short of Wall Street expectations at $808.325 million for Q2 vs. $873.82 million expected.

Coinbase reported a loss per share of -$4.98 per share vs. -$2.47 loss per share expected.

”Q2 was a test of durability for crypto companies and a complex quarter overall. Dramatic market movements shifted user behaviour and trading volume, which impacted transaction revenue, but also highlighted the strength of our risk management program. We are focusing on our top business priorities and more tightly managing expenses.”

”The decline in crypto asset prices significantly impacted our Q2 financial results, which were consistent with the outlook provided in May. Net revenue was $803 million, down 31% compared to Q1, driven by lower trading volume. Total operating expenses were $1.9 billion, up 8% compared to Q1. Net loss was $1.1 billion and was heavily impacted by non-cash impairment charges. Absent non-cash impairment charges, net loss would have been $647 million. Adjusted EBITDA was negative $151 million,” the company wrote in a letter to shareholders.

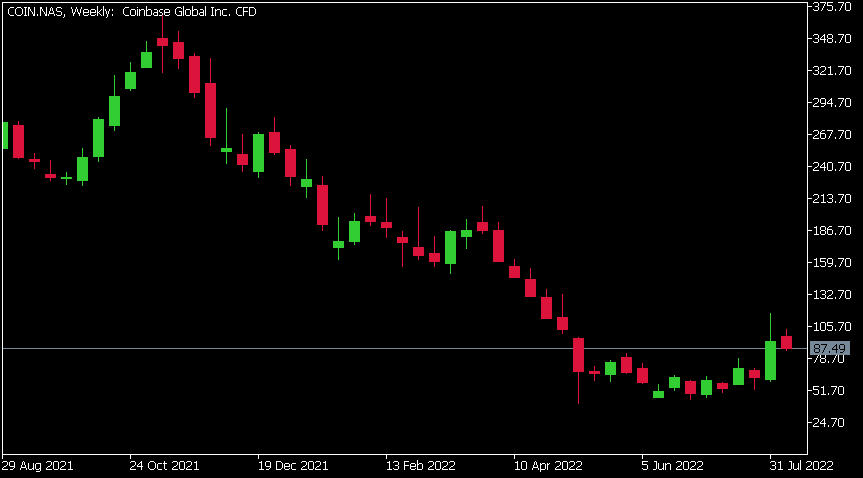

Coinbase Global Inc. (COIN) chart

Share price of Coinbase was down by 10.55% on Tuesday, trading $87.49 a share.

The stock fell further in after-hours following the release of the latest financial results, down by around 3%.

Here is how the stock has performed in the past year:

Coinbase price targets

Coinbase Global Inc. is the 754th largest company in the world with a market cap of $22.96 billion.

You can trade Coinbase Global Inc. (COIN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Coinbase Global Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Disney company tops Wall Street estimates

The Walt Disney Company (DIS) reported the latest financial results for its third fiscal quarter after the closing bell on Wednesday. World’s largest entertainment company reported revenue of $21.504 billion for the quarter (up 26% year-over-year), topping Wall Street forecast of $20.994 billion. Earnings per share reported at $1.09 per sha...

August 11, 2022Read More >Previous Article

US equities and bonds drop ahead of key US CPI figure and Rate-hike odds rise

US equities markets were jittery on Tuesday as traders await todays closely watched inflation figures out of the US. All major Indices declined with...

August 10, 2022Read More >Please share your location to continue.

Check our help guide for more info.