- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Stocks tumble again as BoE inspired rally fizzles

- Home

- News & analysis

- Economic Updates

- Stocks tumble again as BoE inspired rally fizzles

News & analysisNews & analysis

News & analysisNews & analysisUS stocks again were heavily pressured, selling off hard into the last day of the month and quarter as Wednesdays rare BoE inspired positive session proved to be a dead cat bounce thus far.

Tech led the sell-off after a rare downgrade of Apple (AAPL) from Bank of America added to tech woes with many of the heavyweights underperforming as Microsoft (MSFT) and Alphabet (GOOG) set 52 week lows, the Nasdaq index was down over 2.8% on the session before finding support around the June lows.

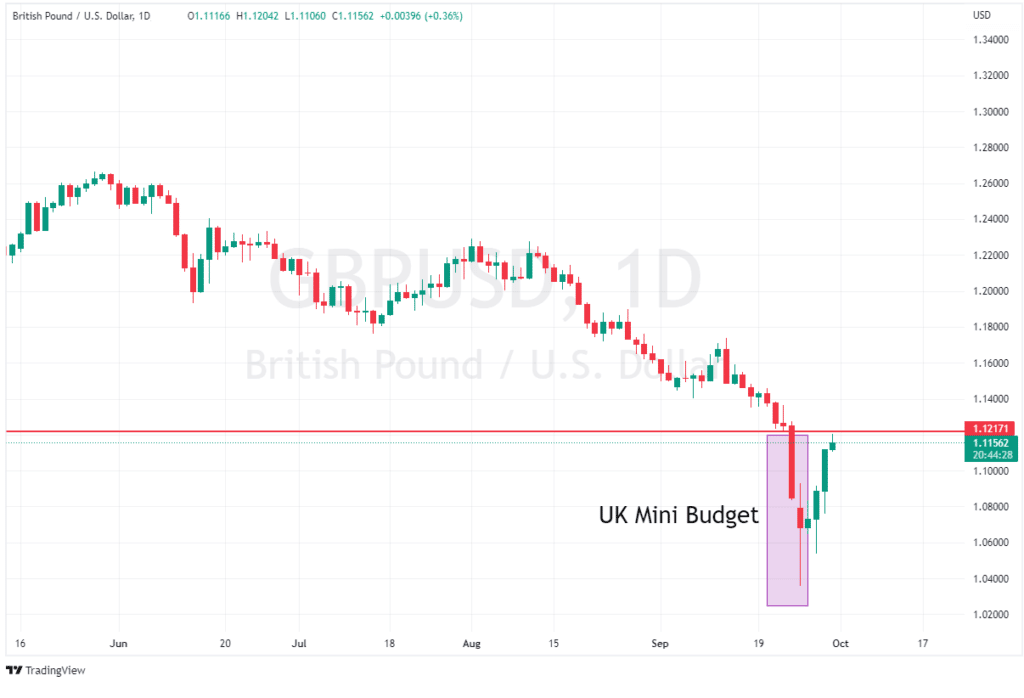

But unlike recent selloffs which were mostly catalysed by surging yields, or a soaring US dollar, we saw neither in this session, as both 10Y US Treasury yields and 30Y UK gilts went nowhere. The USD also sold off, with a surging GBP almost erasing all of the UK mini budget inspired flash crashes of Friday and Monday on the back of the Bank of England’s actions to calm a tumultuous domestic bond market.

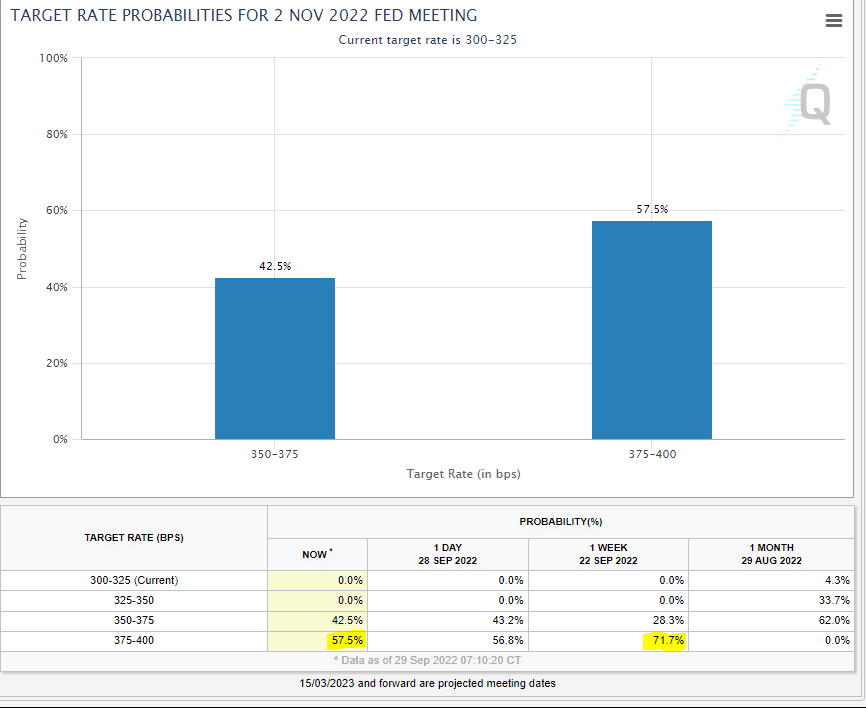

Another catalyst for the USD drop in recent sessions is Fed rate hike expectations moderating. A 75bp hike at their next meeting has dropped from 71.7% priced in from a week ago to 57.5% today.

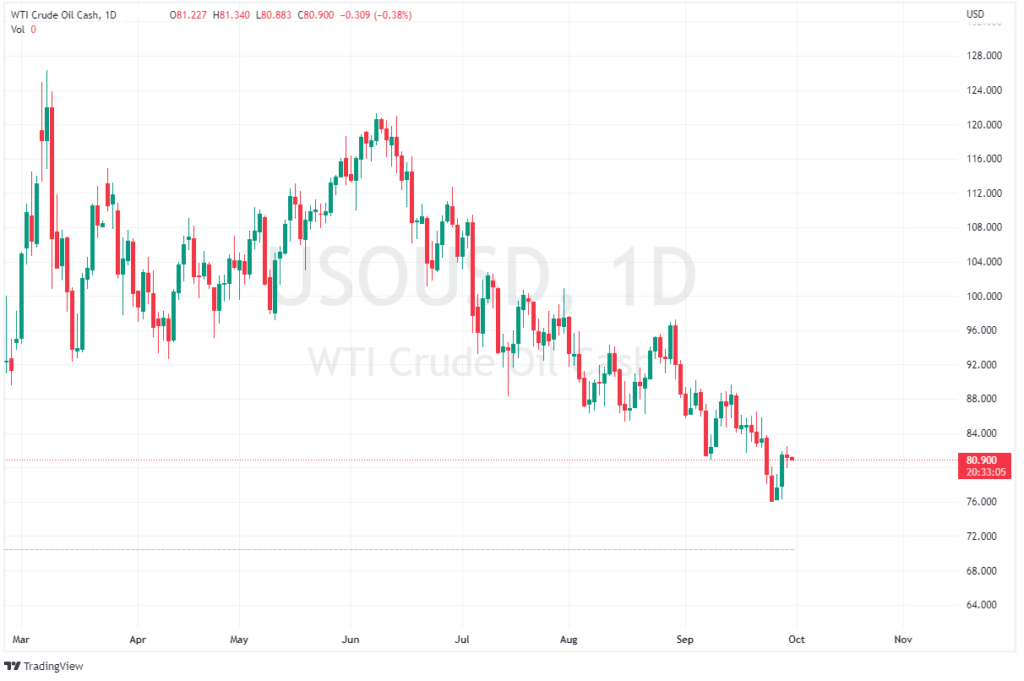

Despite global growth concerns which have weighed on the price of oil recently, a weaker US dollar and a report that OPEC+ would cut output by 500K-1MMb/d next week saw support for US crude oil.

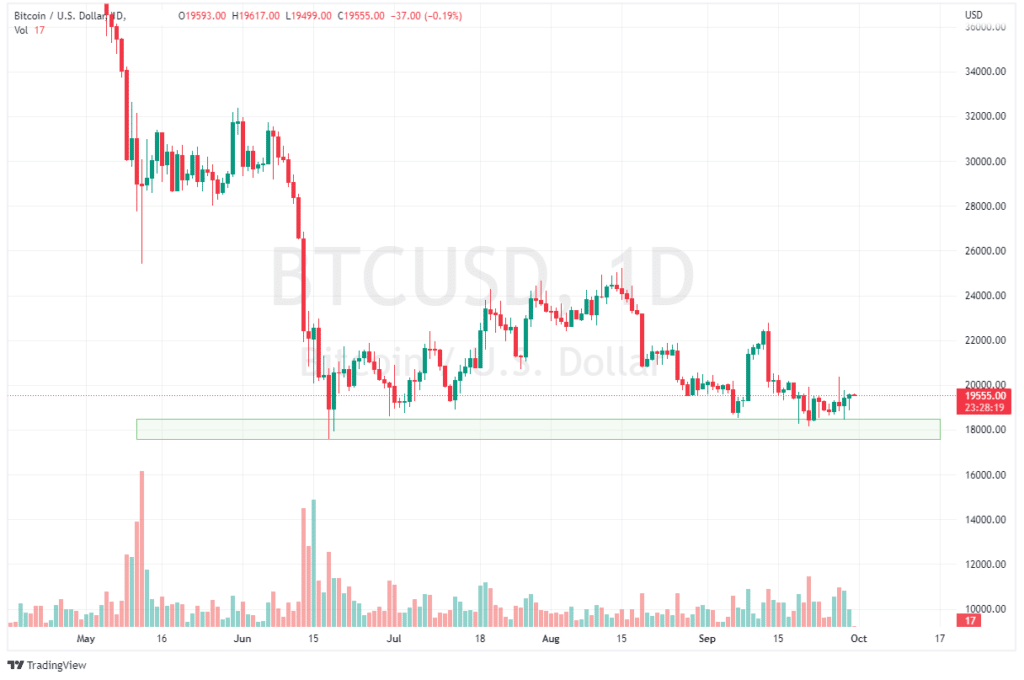

In Crypto, Bitcoin has found strong support at around 18500 USD, despite heavy tech losses in recent sessions which have previously been a driver in BTCUSD declines.

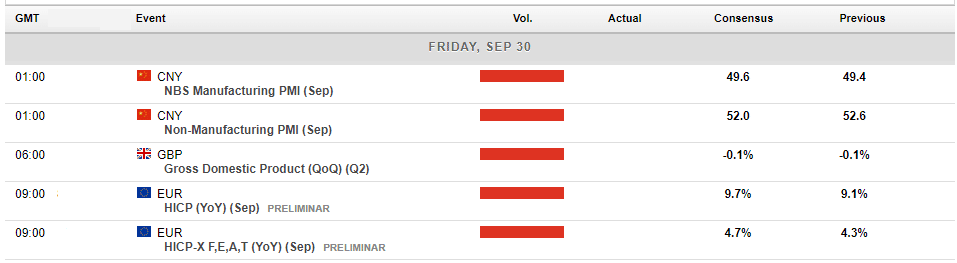

In economic releases today, Chinese PMI figures will be an important one to watch for AUD and CNH traders, whilst those brave enough to be trading the Pound have UK GDP figures released.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Natural Gas getting ready to test important level

Natural Gas prices have had a volatile year to say the least. After finding multi decade highs on the back of geo-political volatility and record high inflation levels the price has seen an aggressive retracement. With the overall commodities market suffering a big drop as recessionary pressures have taken over and a resilient USD, Natural gas has ...

September 30, 2022Read More >Previous Article

Bank of England, Stuck between a rock and hard place

The UK financial system has been under extreme pressure from rising inflation and recessionary pressures. It culminated in the GBP reaching record low...

September 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.