- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Week Ahead – CAD, AUD rate decisions ahead, Fed enters blackout period

- Home

- News & analysis

- Economic Updates

- The Week Ahead – CAD, AUD rate decisions ahead, Fed enters blackout period

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – CAD, AUD rate decisions ahead, Fed enters blackout period

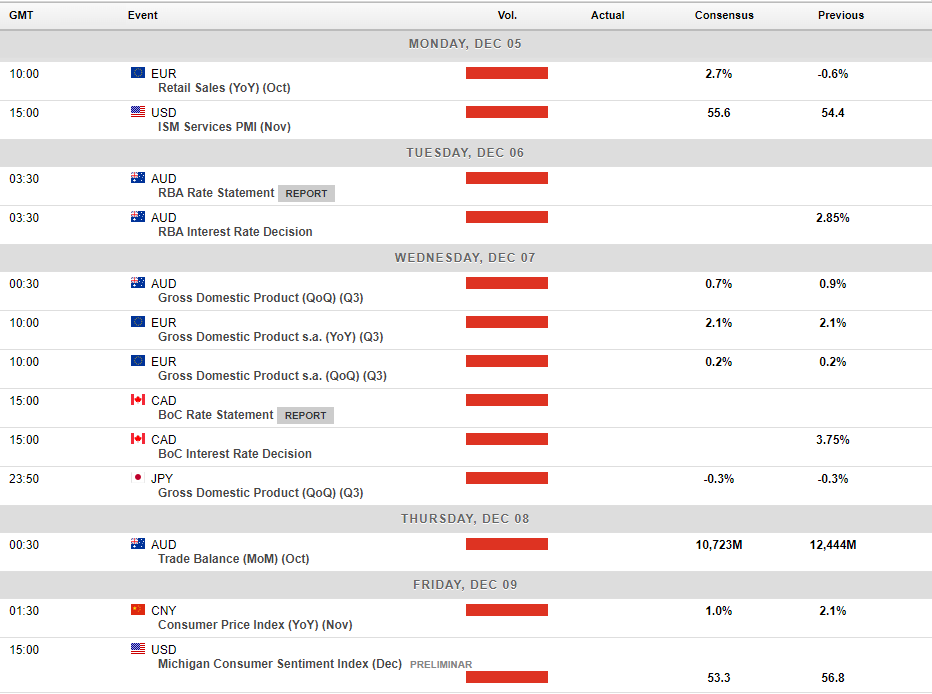

5 December 2022 By Lachlan MeakinWith US equities flip flopping recently on the market’s perception of a Fed Pivot (or not) and seemingly changing with the wind on any inflation data or jaw boning from Fed members, the week ahead might offer a welcome respite as the Fed goes into its black out period and US data is light on the ground.

The major risk events for FX traders look to be the RBA and BoC policy meetings on Tuesday and Thursday respectively, both decisions are on a knife edge with rates markets evenly spilt on the size of the hikes, or in the RBA’s case, whether they hike at all.

RBA

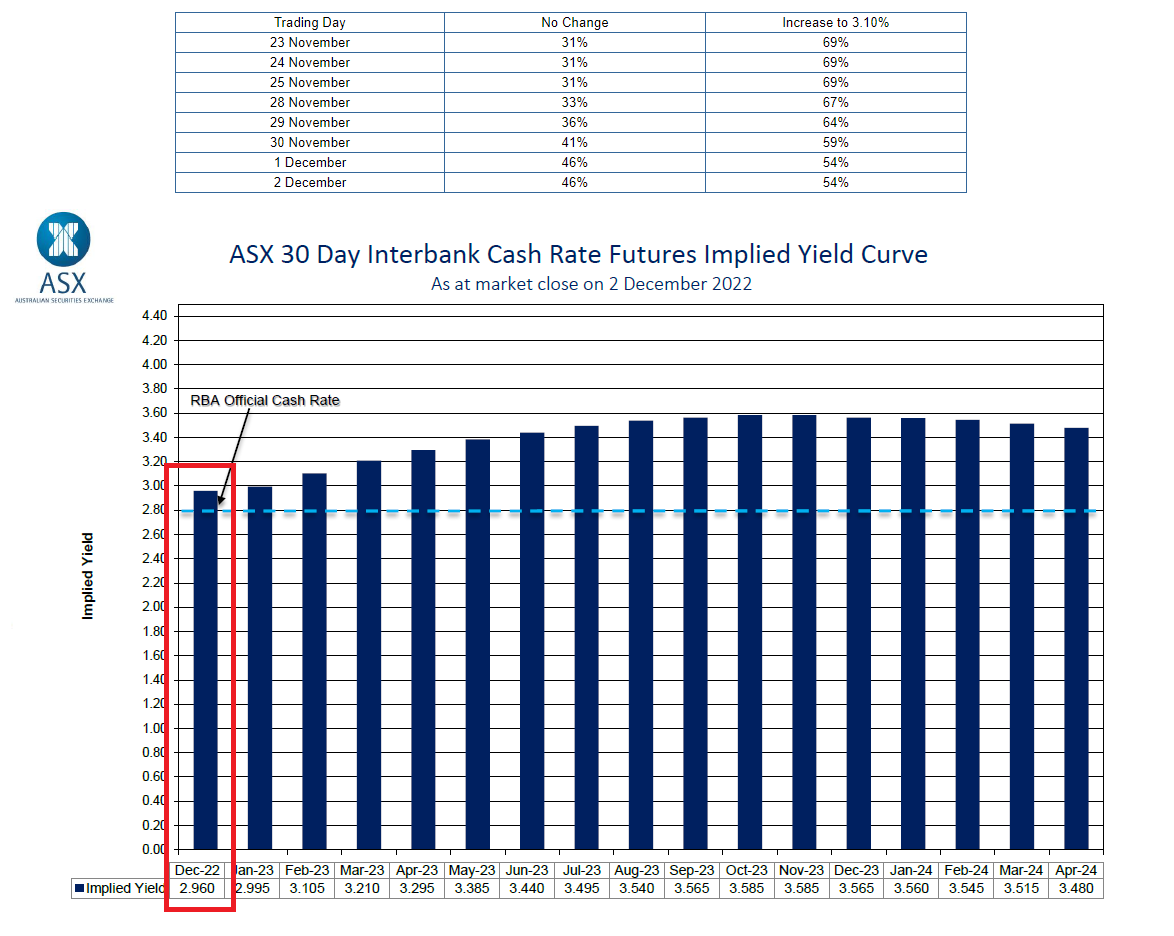

With a shock miss on the Australian CPI figure last week, coming in significantly lower than expected and fuelling hopes that inflation has peaked, unsurprisingly the odds for no hike in tomorrow’s meeting have increased dramatically in the last seven days. The week started with rates futures giving a near 70% chance of a hike, by Fridays close that has come down to a 54% chance of a 25bp hike.

This set’s up Tuesday’s meeting as a pivotal one, only a couple of short months ago 50bp hikes seemed the new norm and now there is an almost 50% chance of no hikes coming out of this meeting. Whatever the RBA does volatility in the AUD and ASX 200 are very likely.

AUDUSD has performed well in recent weeks but has seen some resistance around the 68.4c level, consolidating in a range. A hike at Tuesday’s meeting could see it break through this level and with improved risk sentiment get more traders convinced it’s on a bull run.

Bank of Canada

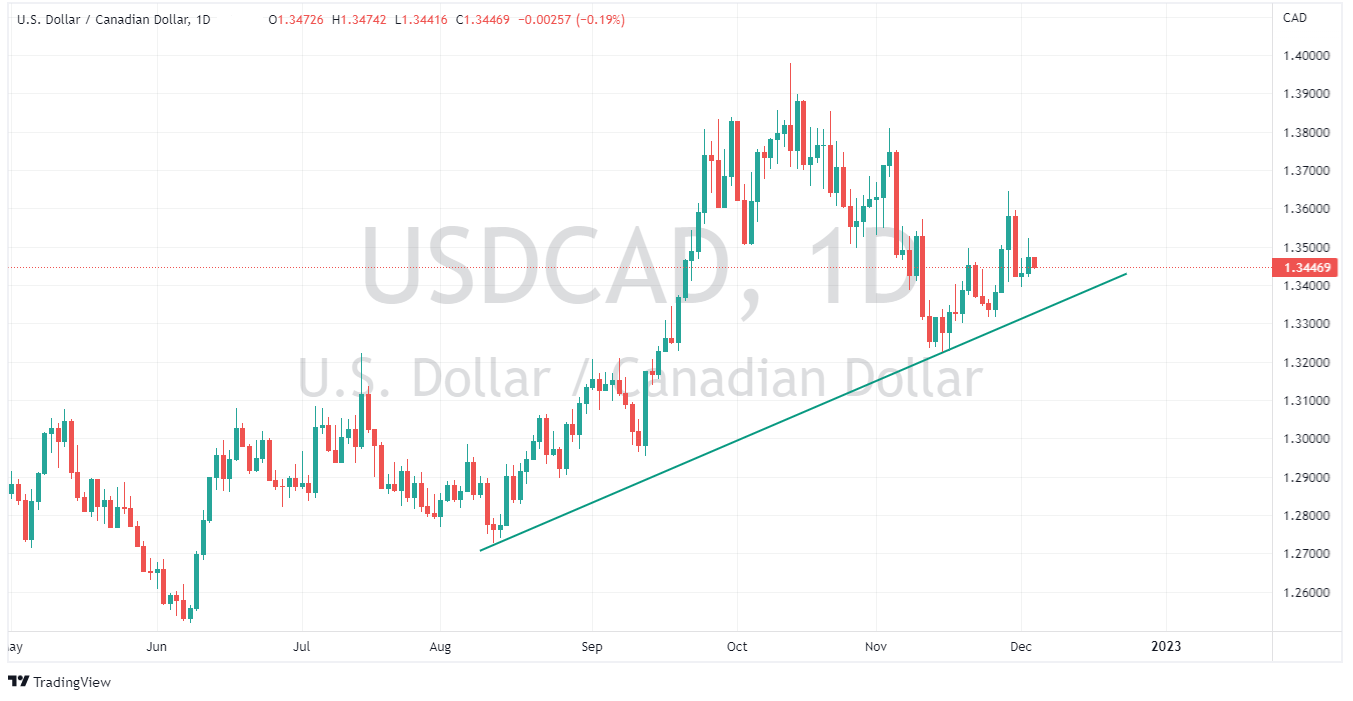

This will be another interesting Central Bank meeting with both markets and economists split down the middle on whether it will be a 25bp or 50bp hike. There is good arguments for both options. with the 25bp camp arguing there are signs of softening in the economy and the housing market looking vulnerable, whilst a robust 3Q GDP outcome, a tight job market and elevated inflation readings having the hawks predicting a 50bp hike.

The CAD has struggled against the USD in recent weeks, even though the greenback has been under pressure and underperformed most other currencies, CAD traders will be watching this BoC rate decision closely as it will likely drive the pair in the week ahead.

Other figures of note this week include Eurozone, Australia and Japan GDP figures which will show how the global economy is recovering along with US consumer sentiment figures later in the week.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

How to use a trading a journal to reduce your learning curve

As a new trader, riding the emotional ups and downs can be a very difficult task. It is human nature to feel the pain of a losing trade. The losing often outweighs the positive feeling of any winning trade. Dealing with the emotion of trading can be an incredibly difficult task. It can cause even the best system to fail. A trading journal especiall...

December 6, 2022Read More >Previous Article

Hold up, the ASX200 is only 4% off its all-time high

It has been a tough year for the stock market in 2022 with a war in Eastern Europe and record high inflation have dominating the news. Furthermore, th...

December 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.