- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US equities sink for 4th straight session as Santa Claus rally fizzles

- Home

- News & analysis

- Economic Updates

- US equities sink for 4th straight session as Santa Claus rally fizzles

News & analysisNews & analysis

News & analysisNews & analysisUS equities sink for 4th straight session as Santa Claus rally fizzles

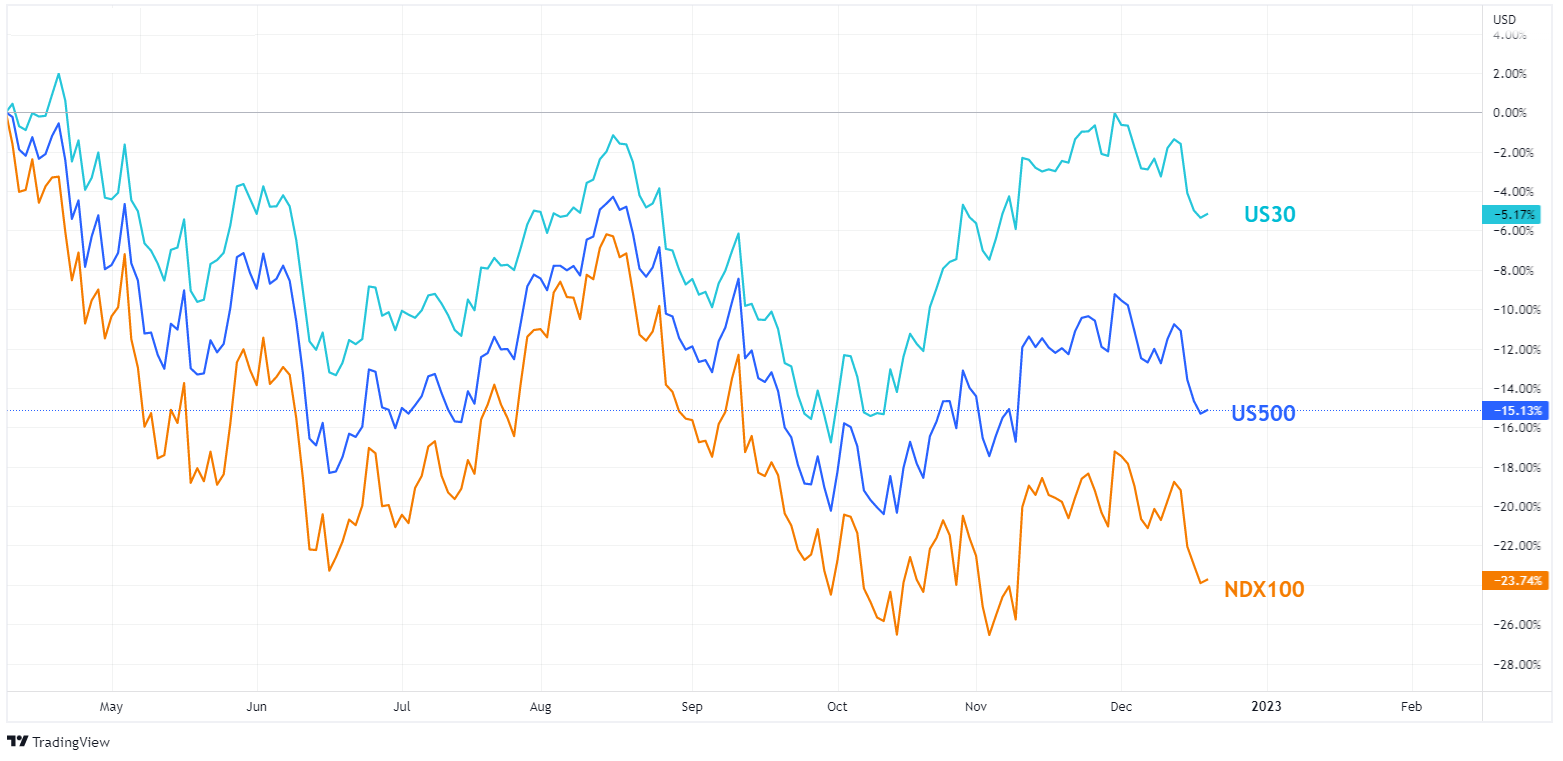

20 December 2022 By Lachlan MeakinUS Stocks continued the sell-off from last week with the Tech heavy Nasdaq leading losses on rate and growth jitters with all three major US indexes hitting 6-week lows.

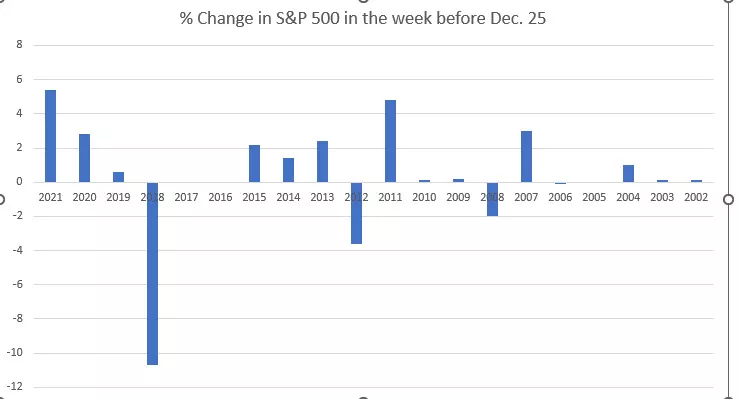

Equity bulls were hoping to see the traditional end of year rally materialise, with the week running up to Christmas being positive or unchanged 15 of the last 20 years, but carry over concerns from the hawkish FOMC meeting last week dampened the markets mood. Traders also seem to be sitting on the sidelines to some extent ahead of the Feds preferred inflation gauge released on Friday.

The Nasdaq slide was led by routs in Amazon (AMZN) (-3.35%) , tumbling to its lowest level since March 2020, and Meta (META) (-4.14%) as a higher rate environment weighed on these growth stocks. Meta also having issues with an antitrust suit in the EU.

The US dollar drifted marginally higher over the session, with the US Dollar index back to levels before the soft CPI plunge from last week.

Bitcoin followed Tech lower , slipping below 16300 USD and back to 3 week lows on broad crypto weakness reflecting renewed fears over Binance.

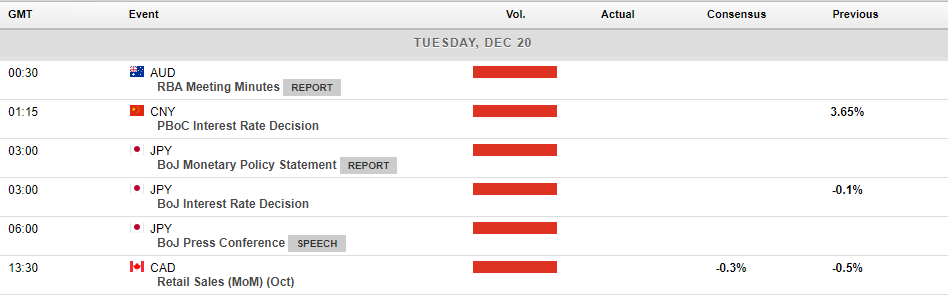

The day ahead is fairly quiet on the news front, with no surprises expected from Chinese or Japanese rate decisions (though the JPY will be one to watch in the new year with a change or leadership at the BoJ). RBA minutes from their last meeting are also set to be released but rarely have an impact on AUD.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

USDJPY tanks as Bank of Japan adjusts its threshold for intervention

The USDJPY has dropped more than 400 pips in just a few minutes after the Bank of Japan brought adjusted its intervention criteria. The bank did not change its official rate, which are -0.10%, an extremely low figure compared to almost every other country. Japan has been a show of dovishness in a sea of hawkishness. However, this latest move has be...

December 20, 2022Read More >Previous Article

Is the EUR ready for its next leg down?

The EUR look to be turning after an impressive run. The pair has risen by 12.57%since it hit the bottom in September. At the time the price fell to 0....

December 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.