- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US stocks see mild gains, Yen surges, dollar dumps after BoJ surprise

- Home

- News & analysis

- Economic Updates

- US stocks see mild gains, Yen surges, dollar dumps after BoJ surprise

News & analysisNews & analysis

News & analysisNews & analysisUS stocks see mild gains, Yen surges, dollar dumps after BoJ surprise

21 December 2022 By Lachlan MeakinUS indices managed to finish in the green after breaking a four-day losing streak despite the BoJ roiling risk markets with an unexpected change to their YCC mechanism. US Dow futures were down over 250 points in the pre-market but after an impressive come back the Dow eked out a 92 point gain (+0.28%)

A notable mover on in the US stock market today was Tesla (TSLA) tumbling over 7% to its lowest level since November 2020 (down 6 of the last 7 sessions and 10 of the last 12)

BoJ action

The big news of the day was the unexpected adjustment by the Bank of Japan to their Yield Curve Control (YCC) mechanism. Previously the yield on 10-year JGB bonds was allowed to fluctuate from -0.25% – 0.25%, this meant the BoJ was continuously intervening in the bond market to hold this band, printing money to buy their own bonds in basic terms, this has been a major reason that the Yen has been so weak in 2022. In Tuesdays scheduled meeting the BoJ announced a widening of this band to -0.50% – 0.50%, the market took this to mean that the BoJ would now need to intervene less (less money printing) and subsequently the Yen surged, having its biggest positive move against the USD since 1998.

JGB yields jumped higher with the 10 year up 15bps to its highest level since 2015, the biggest daily rise in yields since 2003.

This move in the Yen also saw the USD take a hit, with gold capitalising, surging back above $1800 and looking to test the resistance high of 1825 that was set earlier in the month.

Bitcoin spiked on the BoJ news, then spiked again as the cash equity market breaking back above 17000 before pulling back somewhat.

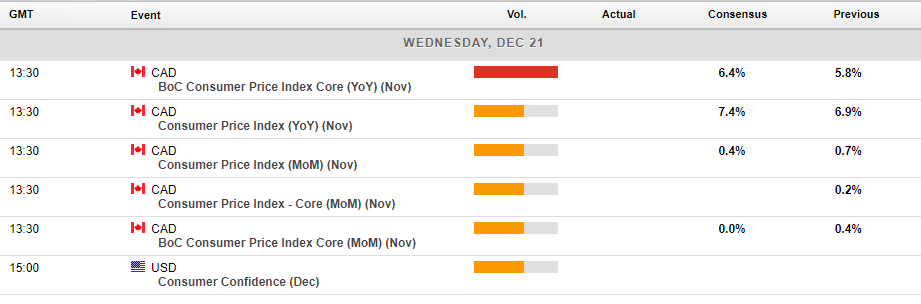

In economic release ahead in today’s session, the Canadian CPI figure and US consumer confidence will headline, though with both US and Canadian Central banks out of action until February little impact is expected from either figure.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Why you need to know about Expected Value

Many traders early on in their trading journey may jump into trading without knowing if their system or edge can be profitable. The most important metric that a trader should measure their system on is by using expected value. This essentially wors out the average return that the system will return for every trade that it makes, considering both wi...

December 21, 2022Read More >Previous Article

USDJPY tanks as Bank of Japan adjusts its threshold for intervention

The USDJPY has dropped more than 400 pips in just a few minutes after the Bank of Japan brought adjusted its intervention criteria. The bank did not c...

December 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.