- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Wall St tumbles on recession fears, the Fed in focus

- Home

- News & analysis

- Economic Updates

- Wall St tumbles on recession fears, the Fed in focus

News & analysisNews & analysis

News & analysisNews & analysisUS equities sold off throughout the session in risk-off trading with a backdrop of corporate warnings from heavyweights Walmart (WMT) and McDonalds (MCD) , weak economic figures and a downbeat tone from Europe as their gas squeeze continues.

A larger than expected decline in U.S consumer confidence, down for a third straight month, saw the narrative of the strong U.S consumer take a hit and saw investors trimming equity exposure ahead of todays closely watched FOMC policy meeting.

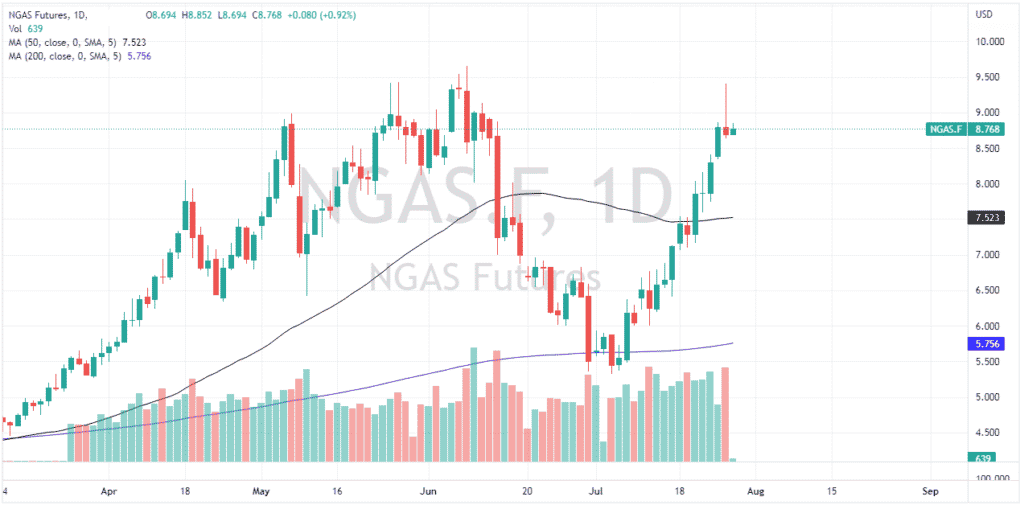

News out of Europe where news that the Nordstream 1 pipeline will only run at minimal levels due to technical difficulties added to the sombre market tone, the Euro took a hit being the worse performing G10 currency against the USD, Nat Gas surged to test it’s 14 year highs set in June, breaking above $9 before pulling back later in the session.

The USD benefitted from Euro weakness and the risk off tone to the market with the US Dollar index retaking the 107 handle and the Euro pushing back down to the 1.01 level.

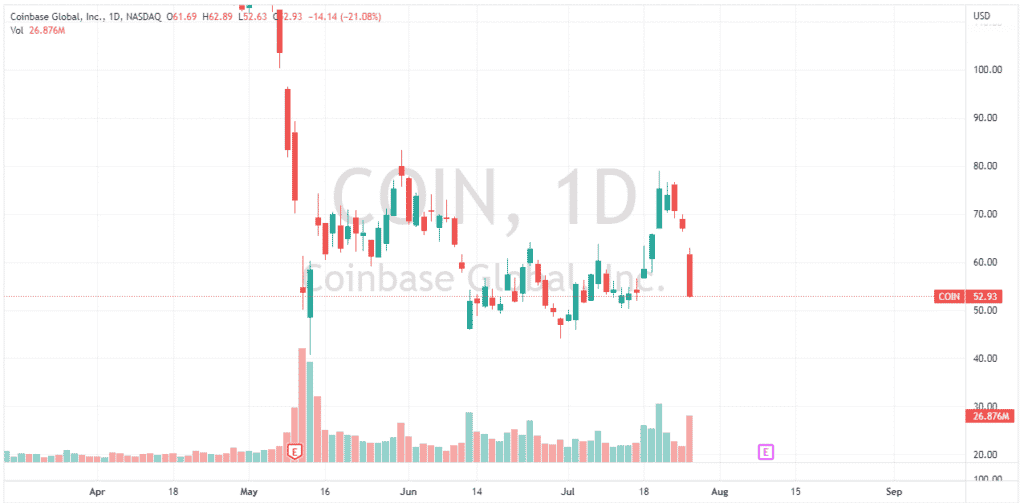

Cryptos extended yesterday’s losses overnight after a report that Coinbase is facing a SEC probe and insider trading allegations. Bitcoin fell back below $21k and Ethereum back below $1400, this also saw the Coinbase (COIN.NAS) stock price tumble over 20% on big volume.

Economic announcements

The big one today will be the FOMC policy meeting at 2pm New York time where the Federal Reserve is widely expected to hike rates by 75bps, with the US bond futures pricing in a 13% of a 100bp hike and the guidance the FOMC provides on future tightening increments, volatility in USD FX crosses is almost a certainty.

Australian Q2 CPI figures will also be released today at 11:30am Sydney time, an elevated reading is expected, how elevated (or not) should see the market re-pricing it’s prediction of the size of the RBA’s next hike at its meeting next week.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Coca-Cola tops estimates in the second quarter – the stock gains

The Coca-Cola Company (KO) reported its latest financial results for the second quarter before the opening bell in the US on Tuesday, beating Wall Street expectations for the quarter. World’s largest beverage producer reported revenue of $11.325 billion (up by 12% year-over- year) vs. $10.565 billion expected. Earnings per share reported at...

July 27, 2022Read More >Previous Article

Wheat Trading Opportunities

Wheat Trading Opportunities Wheat is a well-known soft commodity that is vital for any kind of bread product. It also has important uses fo...

July 26, 2022Read More >Please share your location to continue.

Check our help guide for more info.