- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Articles

- Economic Updates

- Is Germany on the Brink of a Technical Recession?

- Home

- News & analysis

- Articles

- Economic Updates

- Is Germany on the Brink of a Technical Recession?

- US-China trade war

- Brexit

- A major shift in the Automobile industry

News & analysisNews & analysis

News & analysisNews & analysisIs Germany on the Brink of a Technical Recession?

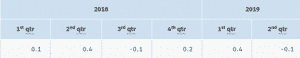

Europe’s largest economy and the world’s fourth-largest economy is at risk of going into a technical recession. Such recession arises after two consecutive quarters of economic decline. In the second quarter of 2019, the German’s economy had contracted by 0.1% compared to a growth of 0.4% in the first quarter.

Source: Statistisches Bundesamt DeutschlandAfter a decade of economic expansion, some cooling off was expected. However, Germany is currently being hit by several headwinds:

Trade wars and Brexit are geopolitical risks that are impacting the overall global growth. However, since the automotive industry is a key economic factor that contributes to the success of the country, car industry woes are probably the core domestic challenges that the German’s economy is facing.

Automotive Crisis

Climate Change, Self-driving cars and the changing needs of customers are the deep and fundamental challenges that are reshaping the automotive industry in Germany.

The switch to electric cars and rigid European regulations on carbon dioxide are weighing on the auto industry. The electromobility era has arrived to help halt climate change and we are seeing global sales of electric cars rising significantly.

Self-driving cars are becoming popular which has forced German carmakers and suppliers to embark on an unprecedented collaboration in exploring the industry of autonomous cars. In the face of fierce competition, German high-end carmakers- BMW and the maker of Mercedes-Benz have joined hands to tackle the expensive self-driving car industry and catch up with American and Chinese rivals. Yet, all German companies are still lagging behind their competitors.

Uber and other ridesharing companies have also caused a shift in demand. The auto industry is finding itself in the midst of tectonic shifts. Companies like Uber are not only a threat to taxi companies but also to car companies. In many western countries, consumers are weighing the cost-benefit relationship and are moving away from car ownership.

Germany’s Economy

The services sector and the jobs market are flaring up well in Germany. We have seen robust growth in the services sector in recent quarters. However, for the month of September, Germany’s Services PMI Index came at 51.2 which marks a 37-month low and fuelled fears that the crisis in the manufacturing sector has spilled over to the services sector.

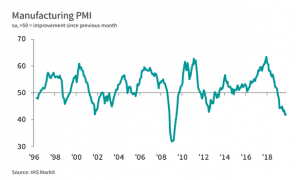

Also, the industrial sector led by autos and factory machinery has seen a decline in activity. The Manufacturing sector remains deep in the contractionary level. Even though the Manufacturing PMI ticked up from 41.7 to 42.1 in October, it remains close to a decade-low.

The rate of decline has eased which is providing a glimpse of hope but the manufacturing sector remains in a recession and there are concerns that the slowdown will spread across other sectors of the economy.

Exports to the Rescue

German’s exports have surprised in September with a stronger-than-expected increase. Exports rose to 1.5% and provided some relief that Europe’s largest economy will avoid a recession in the third quarter.

Even if the third-quarter growth figures scheduled to be released this week confirmed that a technical recession has been avoided, the German’s economy remains in stagnation. In the face of the global trade war especially threats of crippling tariffs on German cars, a shift in consumer trends, rising number of factory job losses, a slowdown in the manufacturing industry and Brexit uncertainties, the German government need to rethink the export-led growth model to revive growth.

The German government has room in the fiscal space to counter slower economic growth. However, the government has strived for fiscal soundness over the years and have been reluctant to run a budget deficit despite concerns over a growth slowdown.

This week figures will be able to provide more insights if there will be considerations for an increase in fiscal stimulus and whether the German’s government will abandon the zero-deficit policy.

For more resource on Forex trading check out our Forex Trading For Beginners introduction, Forex Trading Courses, open a Forex Demo Account or open a live Forex Trading Account.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

10 Ways to Manage Your Trading Psychology – a Blueprint for Development

Experts suggest that 80% of your trading outcomes can be attributed to your behavioural and psychological interactions with the market. It is your mindset that determines how well you comply with good trading, even if you are sufficiently disciplined to adhere to a written trading plan, have the motivation to even write such a plan in the fi...

November 13, 2019Read More >Previous Article

6 Practical Steps to Improve Trading Discipline: #3 Create the motivation to consider change

In our previous articles we introduced the SIX steps to improving your trading discipline, offered some guidance on developing “awareness�...

November 6, 2019Read More >Please share your location to continue.

Check our help guide for more info.