- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- Opportunities await trading the JPY

News & analysisWith central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The country is Japan, and the consequence of the Central Bank of Japan’s ultra-dovish policy has been a massive weakening of its currency. Against almost all other currencies the JPY has been depreciating aggressively. Specifically, the USD/JPY and the NZD/JPY are shaping as potentially trading opportunities. Both trading opportunities are largely based on a technical breakout as opposed to a pure fundamental breakout.

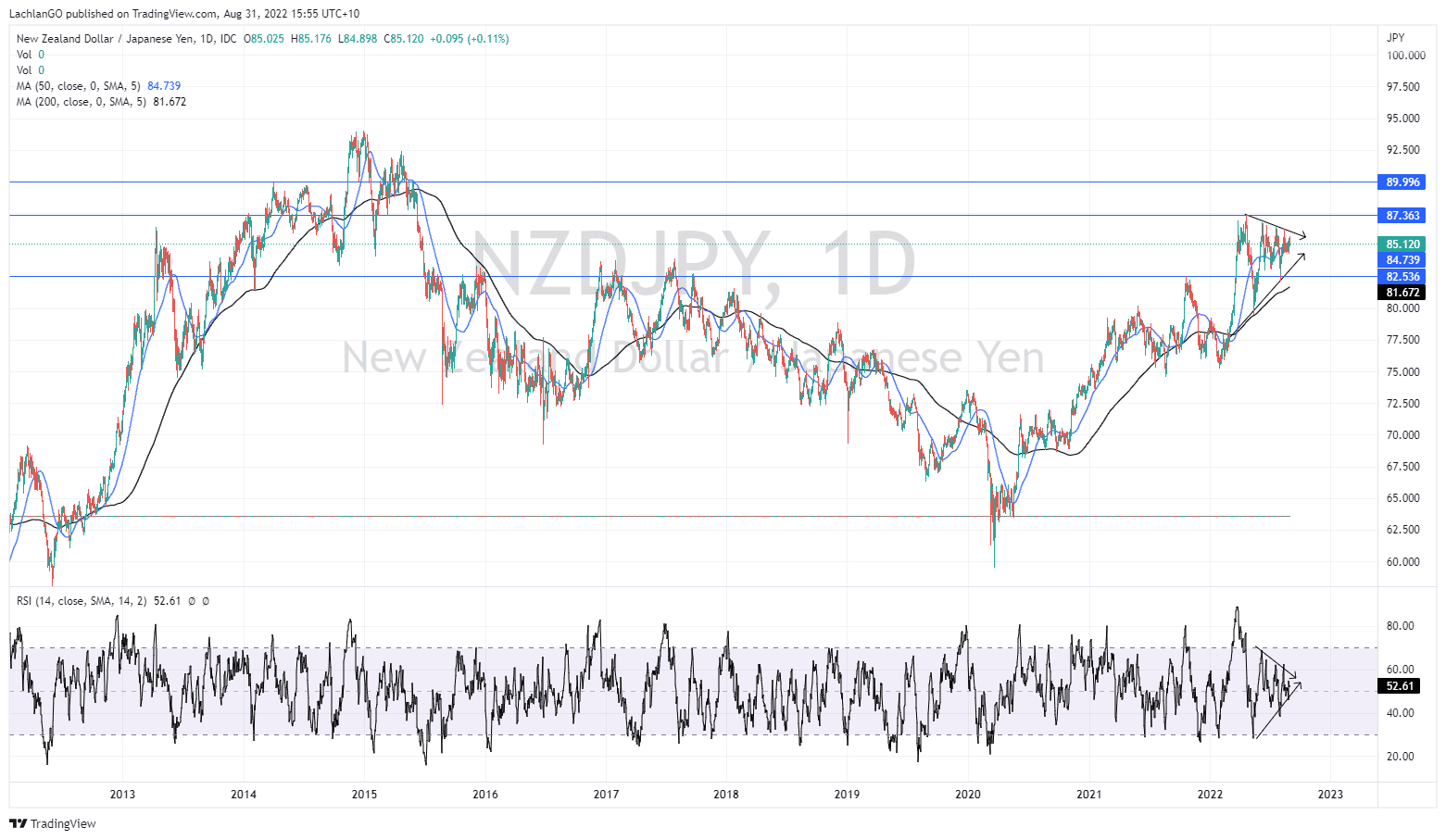

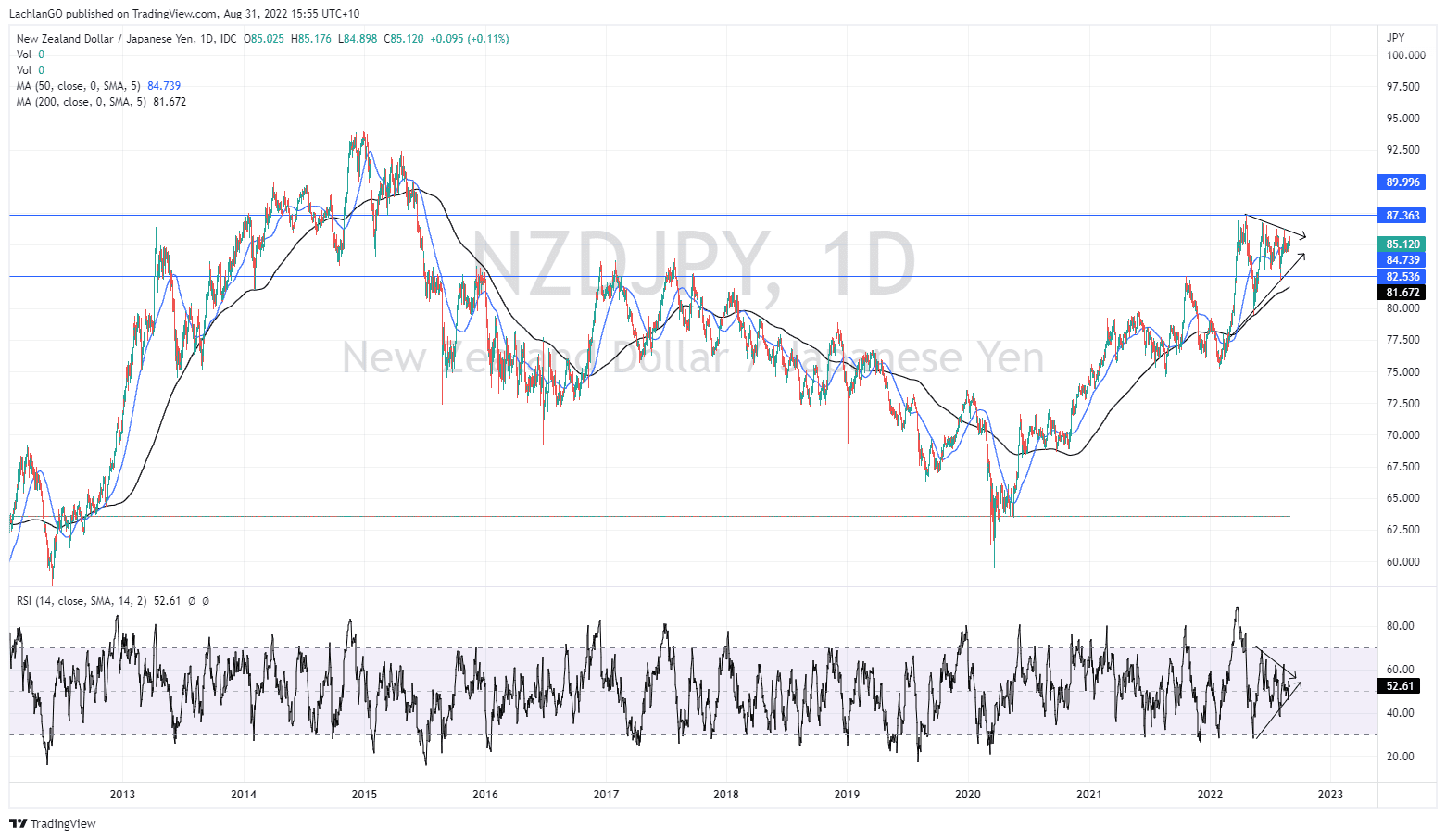

NZD/JPY

This currency pair is forming into a symmetrical triangle pattern. Importantly the price has been contracting and the range getting smaller. This shows that the price is reaching an equilibrium point between buyers and sellers. However, at some point and the price will not be able to contract further and will have to break out either to the upside or the downside. The general rule of a symmetrical triangle is to wait until the price breaks before taking a position because the price has not indicated if it will break upward or downward. In addition, the RSI indicates a similar pattern showing consolidation in the same type of triangle. Therefore, a break of this RSI triangle may correlate and support a break out on the actual price.

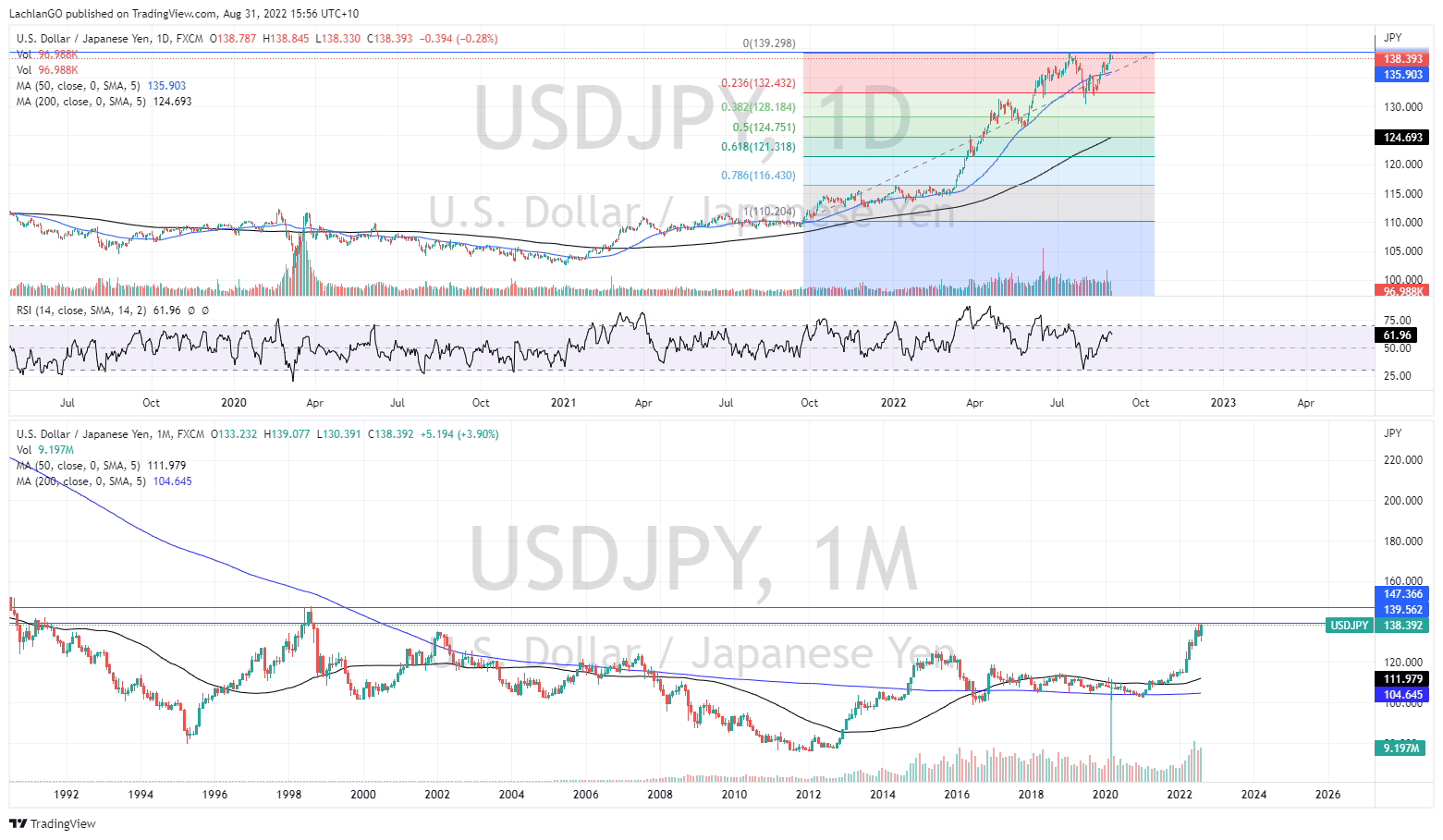

USD/JPY

This pair has seen an even more extreme move upward. After pulling back to the recent support at the 23.6% Fibonacci retracement level, the price has risen again and is looking to test the highs at 139.5 JPY. In order to find a new target the chat needs to be zoomed out to the monthly in order to see the next resistance point which is at 145JPY. This would also take the price to almost 25 year highs. With more economic data to come out of the USA later this week.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Brent testing critical level again

Brent Crude oil much like many other commodities has seen its value drop on the back of a strong US dollar and weaker demand forecasts. With the tail wind of the Russia and Ukraine crisis fading, Brent has struggled to maintain its highs of $125 a barrel in the last few months. In addition, the price has dropped to the point where it is r...

September 2, 2022Read More >Previous Article

What is Fundamental Analysis, News and Fundamental Trading?

Have you ever heard the saying, “70% of trading is in the head”? This is because the markets are mostly moved with sentiment, a good barometer...

August 31, 2022Read More >Please share your location to continue.

Check our help guide for more info.