- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- The Week Ahead – Jobs, CPI and Retail Sales – the Charts to watch

- Home

- News & analysis

- Forex

- The Week Ahead – Jobs, CPI and Retail Sales – the Charts to watch

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – Jobs, CPI and Retail Sales – the Charts to watch

15 January 2024 By Lachlan MeakinFX traders come into the new week with an uptick in tier one economic releases to look forward to after a very slow start to the year volatility-wise. Australian and US employment figures, UK CPI and US retail sales look to headline from Tuesday onwards (Monday is a US public holiday)

The Charts to watch:

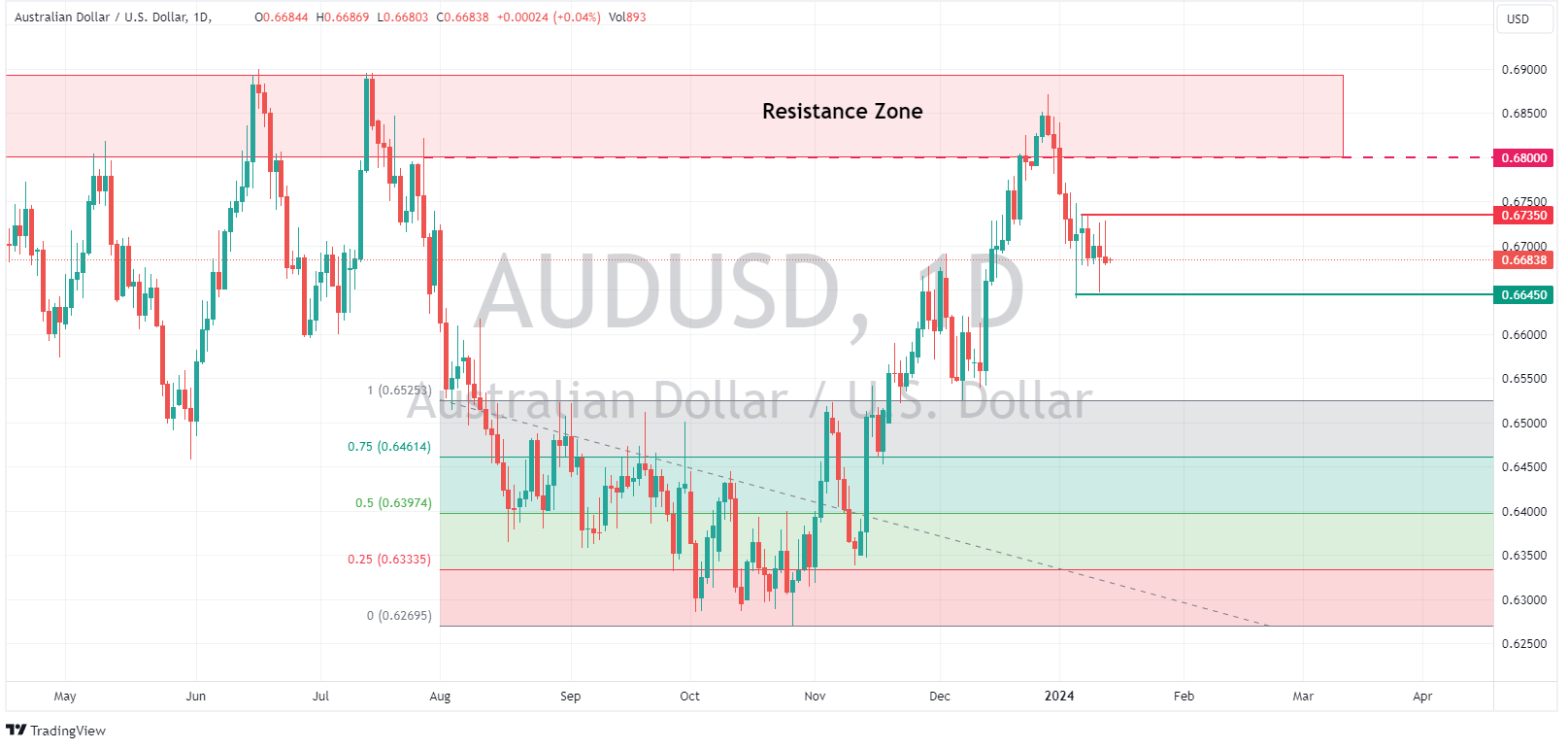

AUDUSD

AUDUSD has struggled to find any real direction in the last week of trading after a marked decline to start the year. The pair has whipsawed in a tight range from 0.6735 to the upside with a lower range boundary of 0.6645. With the market still undecided on the RBA’s moves going forward (peak rates? cuts?) Thursday’s job report could see the Aussie find some direction, with the above range levels the key levels to watch. After November’s bumper figure a surprise to the downside this time round could be on the cards.

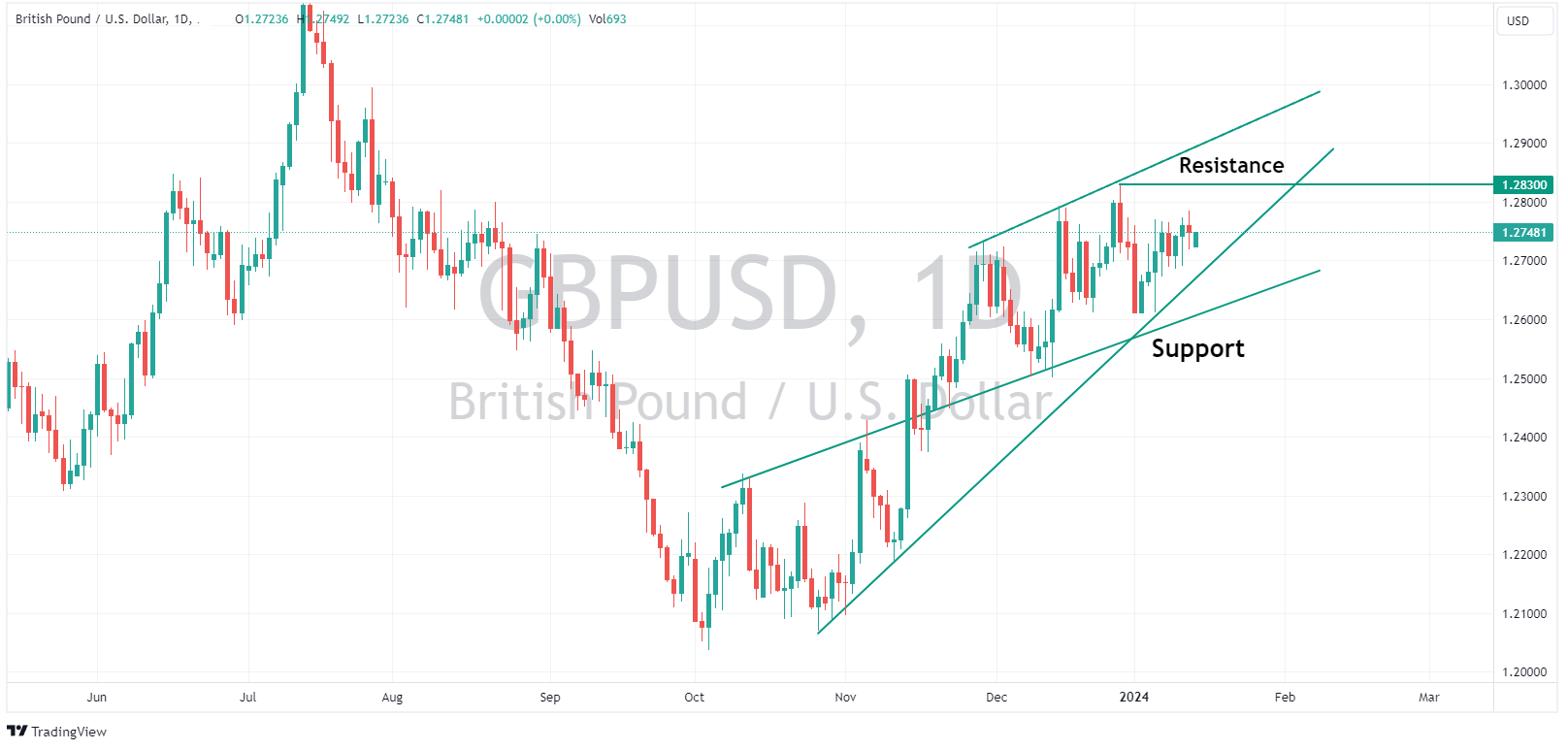

GBPUSD

The uptrend GBPUSD has travelled in since October has petered out somewhat in 2024 to date with Cable also trading in a directionless range for the last week. For chartists there is a multitude of important levels to watch coming into the new week. Upper trendline and cycle high resistance along with lower trendline and cycle low support being the key levels to watch this week. To add to the mix for fundamental traders we have UK CPI and retail sales along with another speaking engagement for BoE governor Bailey.

USDJPY

Bucking the trend of the low volatility of other pairs, USDJPY has had s harp rally so far in 2024, following US10-JP10 yield differentials higher. Last weeks move higher in the pair saw a disconnect in the relationship and USDJPY could struggle to push much higher unless this differential turns around. US economic releases this week will play a big part in where those yields go, with retail sales, employment and consumer sentiment all due to hit the wires from Wednesday onwards. 146 to the upside and 144 to the downside the key levels to watch for the chartists.

Full weeks calendar at the link below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Middle East conflict & US interest rates send Gold back towards all-time highs.

Since reaching a local bottom in October of last year, XAUUSD has experienced a strong uptrend of over 13%. Closing its third consecutive positive session, Gold is inching closer to its all-time high, now sitting just above $2,050 USD per ounce. From a technical standpoint, Gold is following a well-defined rising channel that has been predominan...

January 16, 2024Read More >Previous Article

UnitedHealth tops estimates but the stock is down

World’s largest healthcare company, UnitedHealth Group Inc. (NYSE: UNH), reported fourth quarter and 2023 full-year financial results on Friday. ...

January 15, 2024Read More >Please share your location to continue.

Check our help guide for more info.