- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Is the Gold Run Over?

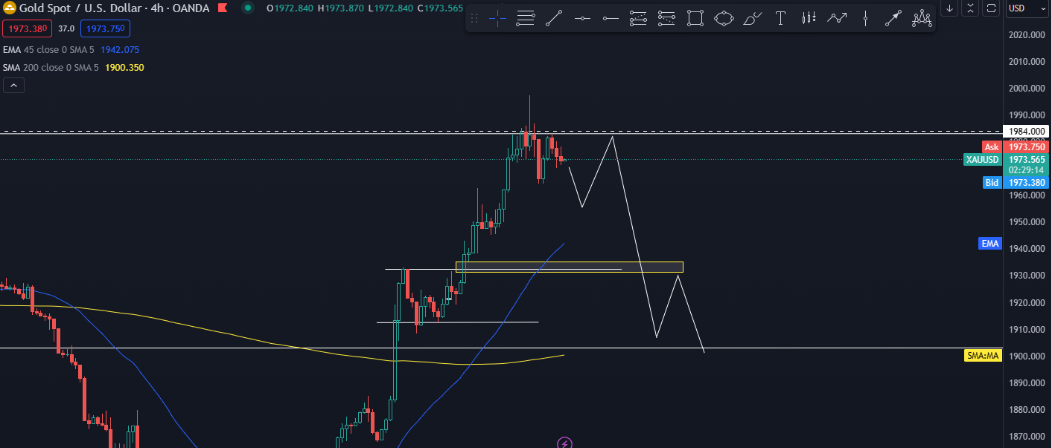

News & analysisThe recent surge in gold prices, following recent events in the Middle East and the declining US Dollar (DXY), raises the question: Is this the end of the bull run for Gold (XAU/USD)?

Gold started rising earlier this month after rejecting the price level of 1815.00. Since then, it has steadily climbed back to its previous peak of 1984.00, a resistance point that was notably challenging to breach in July.

This recent surge in gold prices, due in part to recent events in the Middle East, is attracting more bullish activity in the gold market. Simultaneously, the declining value of the US Dollar (DXY) has contributed to the upward movement of gold prices.

Where can we see gold go in the near future?

In the market, assets tend to move in one of three directions: up, down, or sideways, often referred to as consolidation. Given that gold has reached its previous peak, it may seek potential support, which appears to be around 1930-1931. Concurrently, the US Dollar is experiencing a decline in value.

If gold manages to surpass the resistance at 1984.00, the next hurdle could be at 2060.00. This level is evident on the daily timeframe, where the price has approached 2060 on multiple occasions, only to be rejected.

What about the DXY and XAU/USD?

The relationship between DXY (Dollar Index) and gold (XAU/USD) is intricate. Sometimes, when the dollar index is declining, the price of gold tends to move sideways or increase. However, examining larger time frames like the 4-hourly or daily charts reveals an inverse pattern of rejection and price rise between these two markets.

It’s important to note that gold’s movements are not solely dependent on the USD; other significant factors, including news, social and geo-political events can also play a substantial role in influencing its price fluctuations.

Why is gold so important?

Apart from its physical shine and the enduring symbolic connection with wealth seen throughout human history, gold holds significance as a historically reliable store of value and a means of exchange. Unlike many other commodities, gold does not diminish or get depleted, giving it a timeless sense of worth. It can act as a safeguard against the erosion of currency value caused by inflation, prompting numerous investors to view gold as an alternative asset and a method of preserving their wealth.

How can I trade gold?

At GO Markets, we provide Metal CFDs for trading, offering not only gold but also silver and copper futures. Our goal is to deliver an exceptional trading experience to our clients. We take pride in offering one of the best online trading platforms for gold, silver, and copper futures, in addition to providing access to FX, Soft Commodities, Shares, and Indexes, enabling our clients to diversify their investments across various financial markets.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Bitcoin to reach $45,000? Bitcoin ETF anticipation growing

Bitcoin displayed strong momentum yesterday, with a notable increase of over 10% and approaching a 15% gain within the day. Price surged and has breached the previous resistance level at 31,000. This level has historically acted as a significant barrier, causing the price to retreat to around 25,000 after multiple attempts to surpass it. How...

October 25, 2023Read More >Previous Article

FX Analysis – Yield spike on hot retail sales fails to lift USD, AUD outperforms, JPY , NZD.

USD traded in a tight range on Tuesday despite a big move higher in treasury yields after a beat in US retail sales figures, the headline rising 0.7% ...

October 18, 2023Read More >Please share your location to continue.

Check our help guide for more info.