- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Amazon on Track to Become a $1 Trillion Company

- Home

- News & analysis

- Shares and Indices

- Amazon on Track to Become a $1 Trillion Company

News & analysisNews & analysis

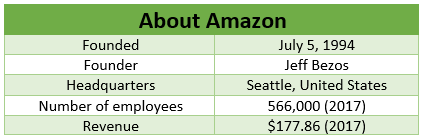

News & analysisNews & analysisAmazon on Track to Become a $1 Trillion Company

By Klavs Valters

With Apple close to becoming the first company in the world to reach $1 trillion market cap, Amazon is also closing in. As one of the world’s largest online retailers it is on track to reach the milestone by 2022, according to Jefferies analyst Brent Thill. Thill sees the expansion of their digital advertising business as a key driver bringing in a potential revenue of $22 billion by 2022, up from $4 billion in 2017.

Amazon offers a range of products and services through its websites. The company operates through three segments: North America, International and Amazon Web Services (AWS). The company’s products include merchandise and content that it purchases for resale from vendors and those offered by third-party sellers. It also manufactures and sells electronic devices.

In 2017, we saw Amazon acquire 11 companies, further accelerating their growth. One of the most notable acquisitions was Whole Foods Markets, a supermarket chain that specialises in selling food products without artificial preservatives, colours, flavours, sweetener and hydrogenated fats. The deal cost Amazon around $13.7 billion and shows the company’s plans to expand into different sectors. Whole Foods has 473 stores in the United States, Canada and United Kingdom.

We are barely three months into the new year and we have seen Amazon already make their first acquisition. Last month, the tech giant purchased the Ring (formerly Doorbot) – a global home security company. The deal is rumoured to be worth between $1.2 to $1.8 billion.

Amazon are also planning to bid for the rights to stream major sporting events such as, the English Premier League, NFL (National Football League), MLB (Major Baseball League) and NHL (National Hockey League) to attract more people to subscribe to the Prime membership. With the American league (NFL, MLB and NHL) deals set to expire in 2021, it will be the first time for Amazon and other major tech streaming platforms to bid for the rights against the traditional media companies.

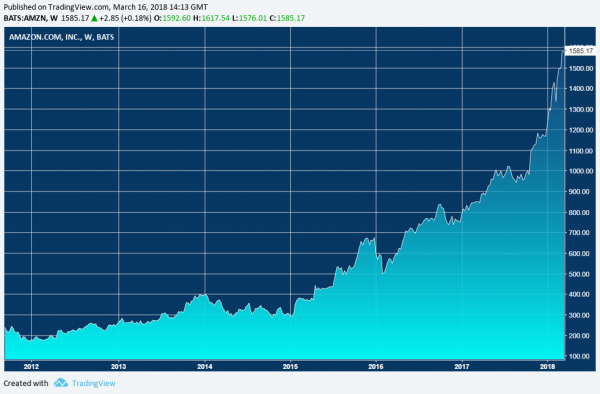

In 2017, we saw the Amazon share price rise about 53% and this year we have already seen the price rise by 28%. Further expansion into different sectors will certainly help Amazon’s performance moving forward and reach the $1 trillion market cap sooner rather than later.

Amazon

Source: TradingviewReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

First Quarter Overview – Massive Swings and Volatility in Stock Markets

First Quarter Overview - Massive Swings and Volatility in Stock Markets First quarter of the year ended with markets experiencing massive swings and volatility. Higher bond yields, revised inflation expectations and a potential trade war brought fears to the markets, making investors very sensitive to any economic data releases or changes ...

April 17, 2018Read More >Previous Article

Time Ticking for Brexit

Time Ticking for Brexit By Klavs Valters In just over a year – on 29th March 2019 to be exact – Britain is scheduled to leave the European Union...

March 18, 2018Read More >Please share your location to continue.

Check our help guide for more info.