Most traders understand EA portfolio balance through the lens of traditional risk management — controlling position sizes, diversifying currency pairs, or limiting exposure per trade.

But in automated trading, balance is about deliberately constructing a portfolio where different strategies complement each other, measuring their collective performance, and actively managing the mix based on those measurements.

The goal is to create a “book” of EAs that can help diversify performance over time, even when individual strategies hit rough patches.

A diversified mix of EAs across timeframes and assets can, in some cases, reduce reliance on any single strategy. This approach reduces dependency on any single EA’s performance, smooths your overall equity curve, and builds resilience across changing market conditions.

It’s about running the right mix, identifying gaps in your coverage, and viewing your automated trading operation as an integrated whole rather than a collection of independent systems.

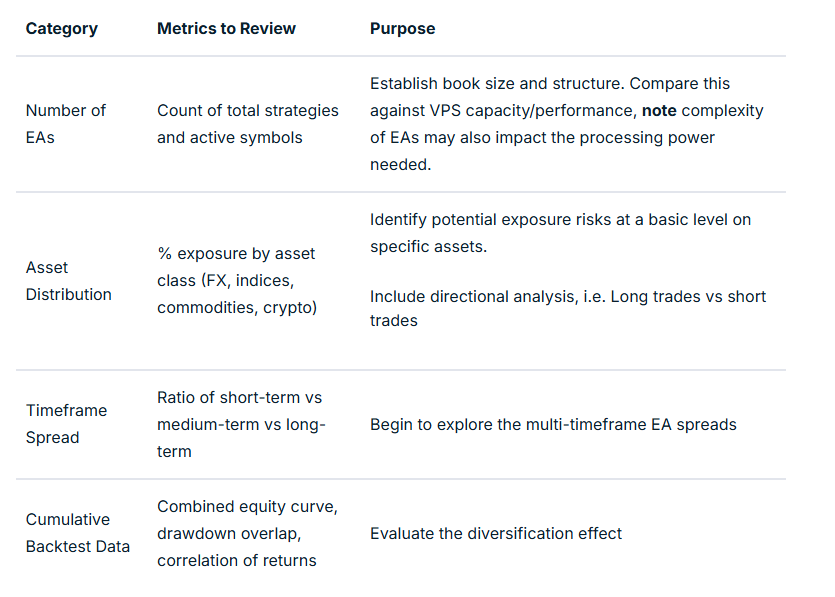

Basic Evaluation Metrics – Your Start Point

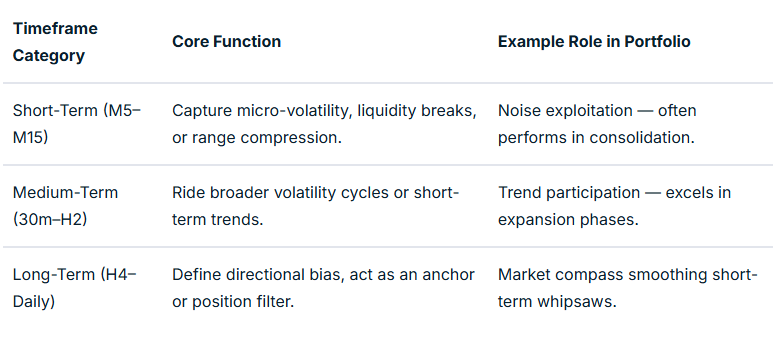

Temporal (timeframe) Balancing

When combined, a timeframe balance (even on the same model and instrument) can help flatten equity swings.

For example, a losing phase in a fast-acting M15 EA can often coincide with a profitable run in an H4 trend model.

Combining this with some market regime and sessional analysis can be beneficial.

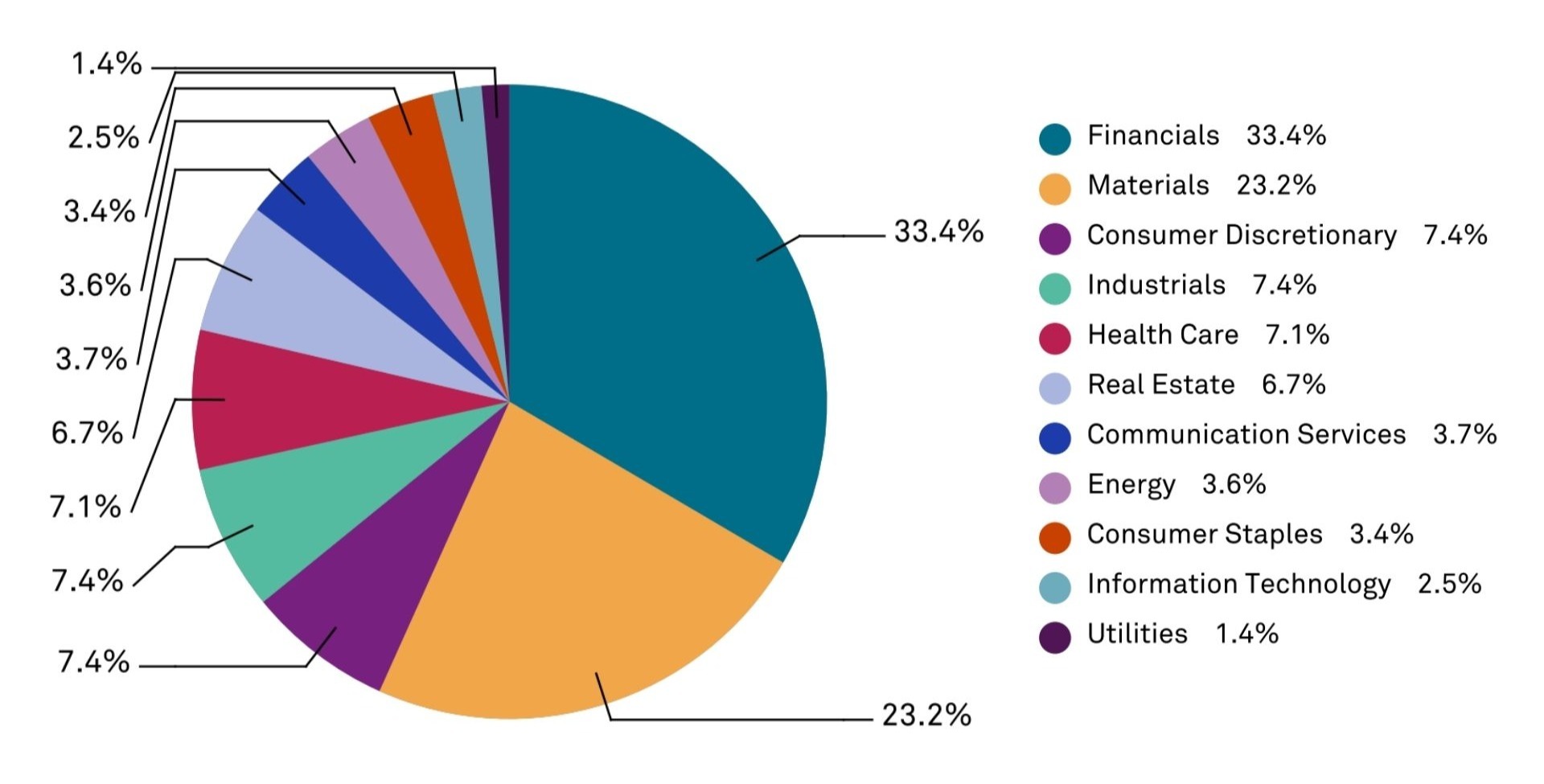

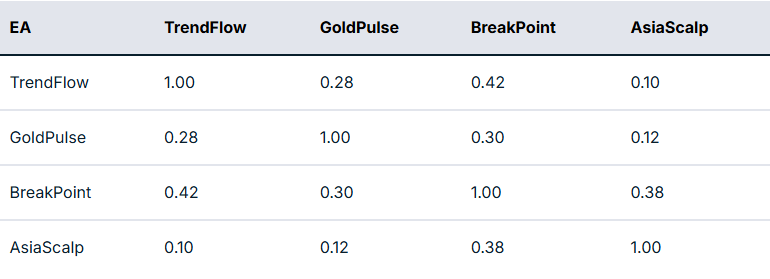

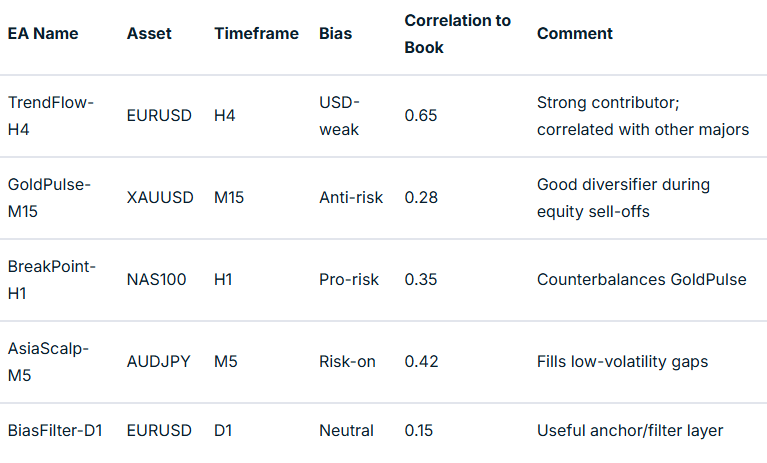

Asset Balance: Managing Systemic Correlation Risk

Running five different EAs on USDJPY might feel diversified if each uses different entry logic, even though they share the same systemic market driver.

But in an EA context, correlation measurement is not necessarily between prices, but between EA returns (equity changes) relating to specific strategies in specific market conditions.

Two EAs on the same symbol might use completely different logic and thus have near-zero correlation.

Conversely, two EAs on a different symbol may feel as though they should offer some balance, but if highly correlated in specific market conditions may not achieve your balancing aim.

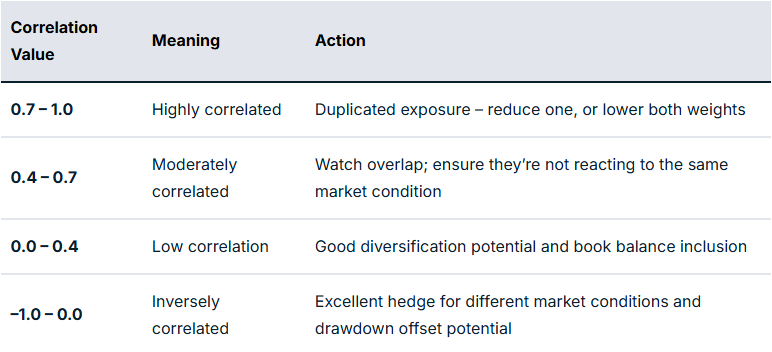

In practical terms, the next step is to take this measurement and map it to potential actionable interventions.

For example, if you have a EURUSD Trend EA and a GBPUSD Breakout EA with a correlation of 0.85, they are behaving like twins in performance related to specific market circumstances. And so you may want to limit exposure to some degree if you are finding that there are many relationships like this.

However, if your gold mean reversion EA correlates 0.25 compared to the rest of your book, this may offer some balance through reducing portfolio drawdown overlap.

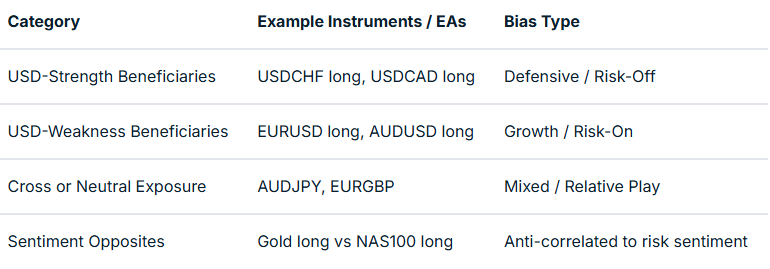

Directional and Sentiment Balance

Markets are commonly described as risk-on or risk-off. This bias at any particular time is very likely to impact EA performance, dependent on how well balanced you are to deal with each scenario.

You may have heard the old market cliché of “up the staircase and down the elevator shaft” to describe how prices may move in alternative directions. It does appear that optimisation for each direction, rather than EAs that trade long and short, may offer better outcomes as two separate EAs rather than one catch-all.

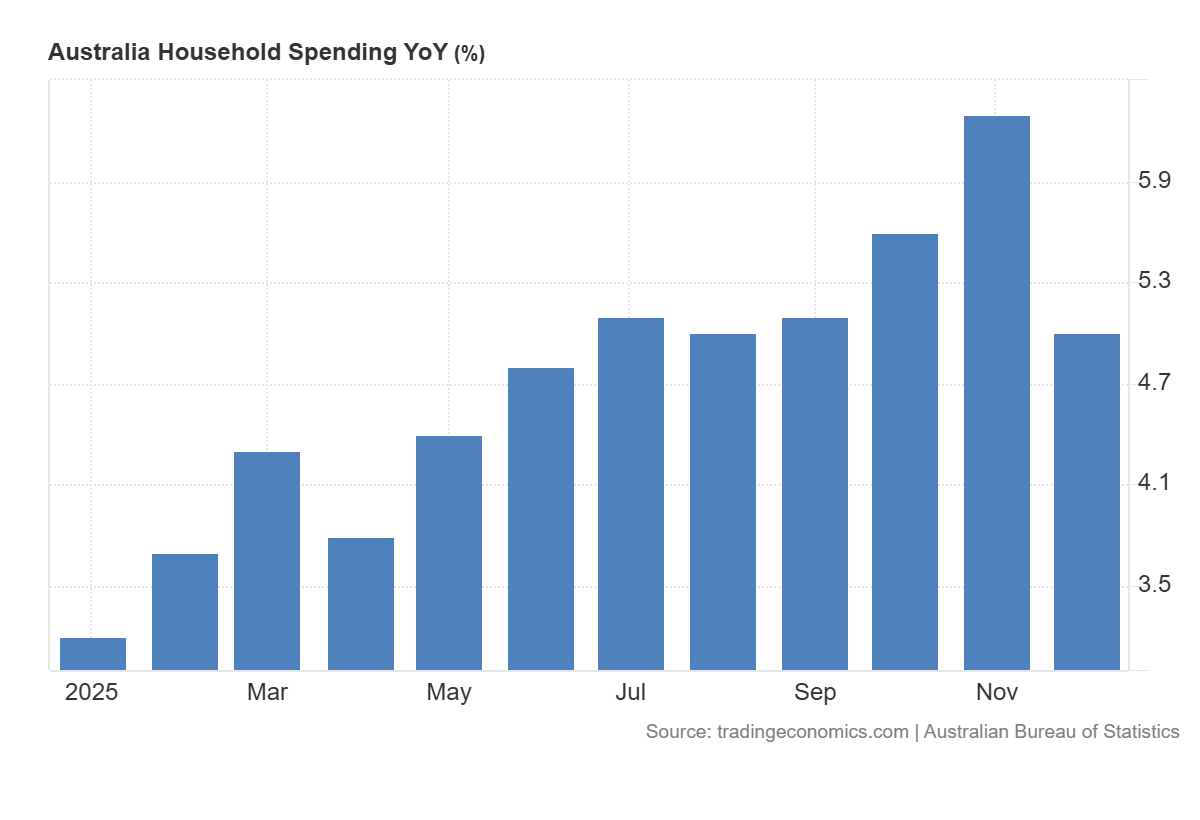

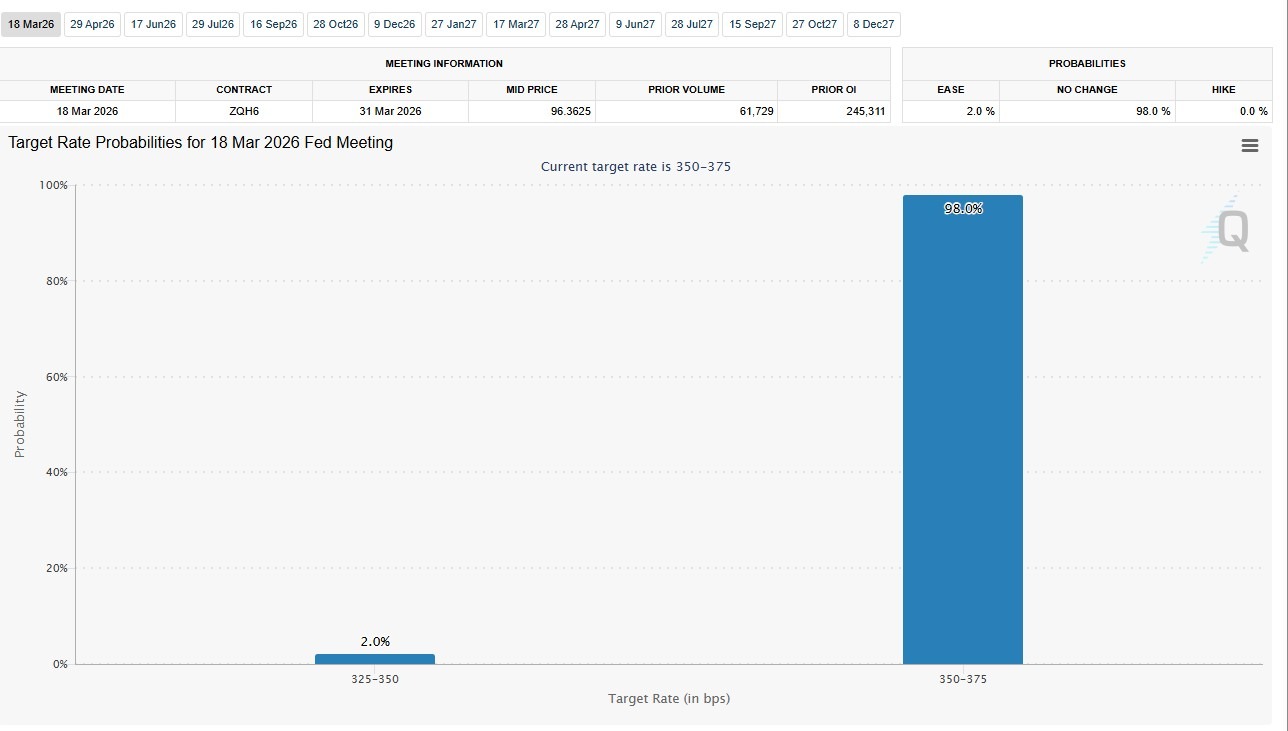

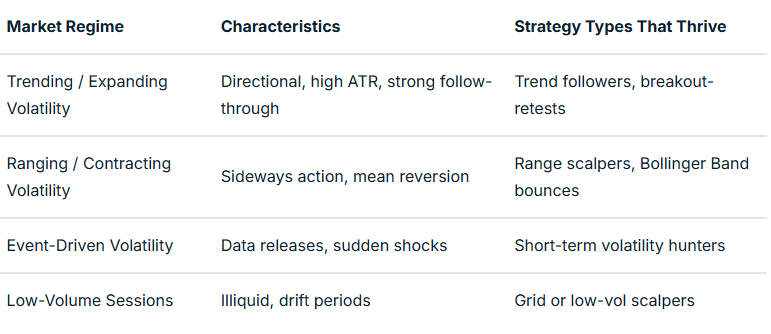

Market Regime and Volatility Balance

Trend and volatility states can have a profound impact on price action, whether as part of a discretionary or EA trading system. Much of this has a direct relationship to time of day, including the nature of individual sessions.

We have a market regime filter that incorporates trend and volatility factors in many EAs to account for this. This can be mapped and tested on a backtest and in a live environment to give evidence of strategy suitability for specific market conditions.

For example, mean reversion strategies may work well in the Asian session but less so in strongly trending markets and the higher volatility of the early part of the US session.

As part of balancing, you are asking questions as to whether you actually have EA strategies suited to different market regimes in place, or are you using these together to optimise book performance?

The table below summarises such an approach of regime vs market mapping:

Multi-Level Analysis: From Composition to Interaction

Once your book is structured, the challenge is to turn it into something workable. An additional layer of refinement that turns theory and measurement into something meaningful in action is where any difference will be made.

This “closing the circle” is based on evidence and a true understanding of how your EAs are behaving together. It is the step that takes you to the point where automation can begin to move to the next level.

Mapping relationships with robust and detailed performance evaluation will take time to provide evidence that these are actually making a difference in meeting balancing aims.

To really excel, you should have systems in place that allow ongoing evaluation of the approaches you are using and advise of refinements that may improve things over time.

What Next? – Implementing Balance in Practice

Theory must ultimately translate into an executable EA book. A plan of action with landmarks to show progress and maintain motivation is crucial in this approach.

Defining classification tags, setting risk weights, and building monitoring dashboards are all worth consideration.

Advanced EA traders could also consider a supervisory ‘Sentinel’ EA, or ‘mothership’ approach, to enable or disable EAs dynamically based on underlying market metrics and external information integrated into EA coding decision-making.

Final Thoughts

A balanced EA portfolio is not generated by accident; it is well-thought-out, evidence-based and a continuously developing architecture. It is designed to offer improved risk management across your EA portfolio and improved trading outcomes.

Your process begins with mapping your existing strategies by number, asset, and timeframe, then expands into analysing correlations, directional bias, and volatility regimes.

When you reach the stage where one EA’s drawdown is another’s opportunity, you are no longer simply trading models but managing a system of EA systems. To finish, ask yourself the question, “Could this approach contribute to improved outcomes over time?”. If your answer is “yes,” then your mission is clear.

If you are interested in learning more about adding EAs to your trading toolbox, join the new GO EA Programme (coming soon) by contacting [email protected].