Market news & insights

Stay ahead of the markets with expert insights, news, and technical analysis to guide your trading decisions.

February opens with a policy-heavy tone led by Australia’s RBA decision, while Japan provides the core macro anchors through GDP and inflation updates. In contrast, China’s calendar lightens due to the Spring Festival, shifting attention to liquidity and policy headlines. Across the region, a firmer USD and softer metals continue to frame cross-asset performance, especially for commodity-linked currencies.

Australia: RBA

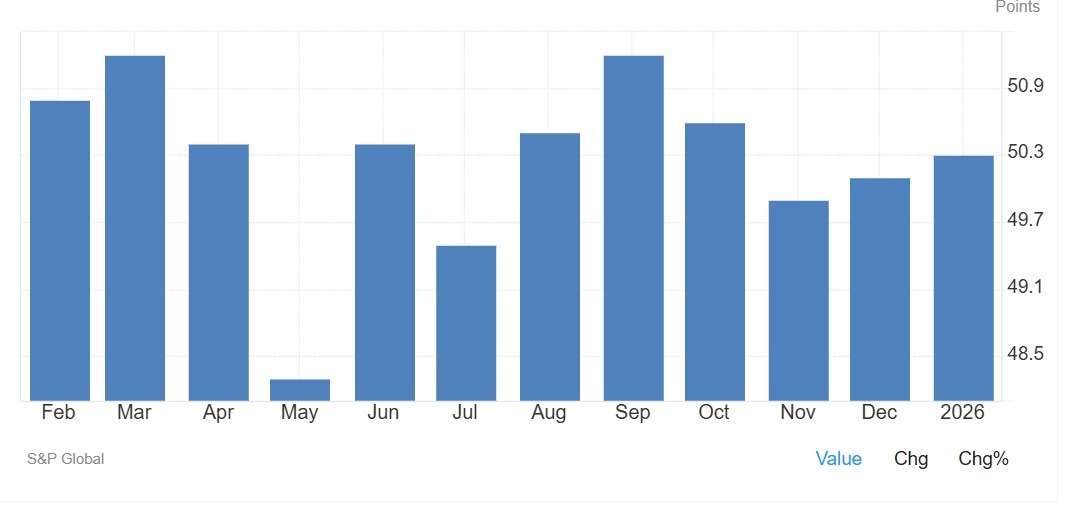

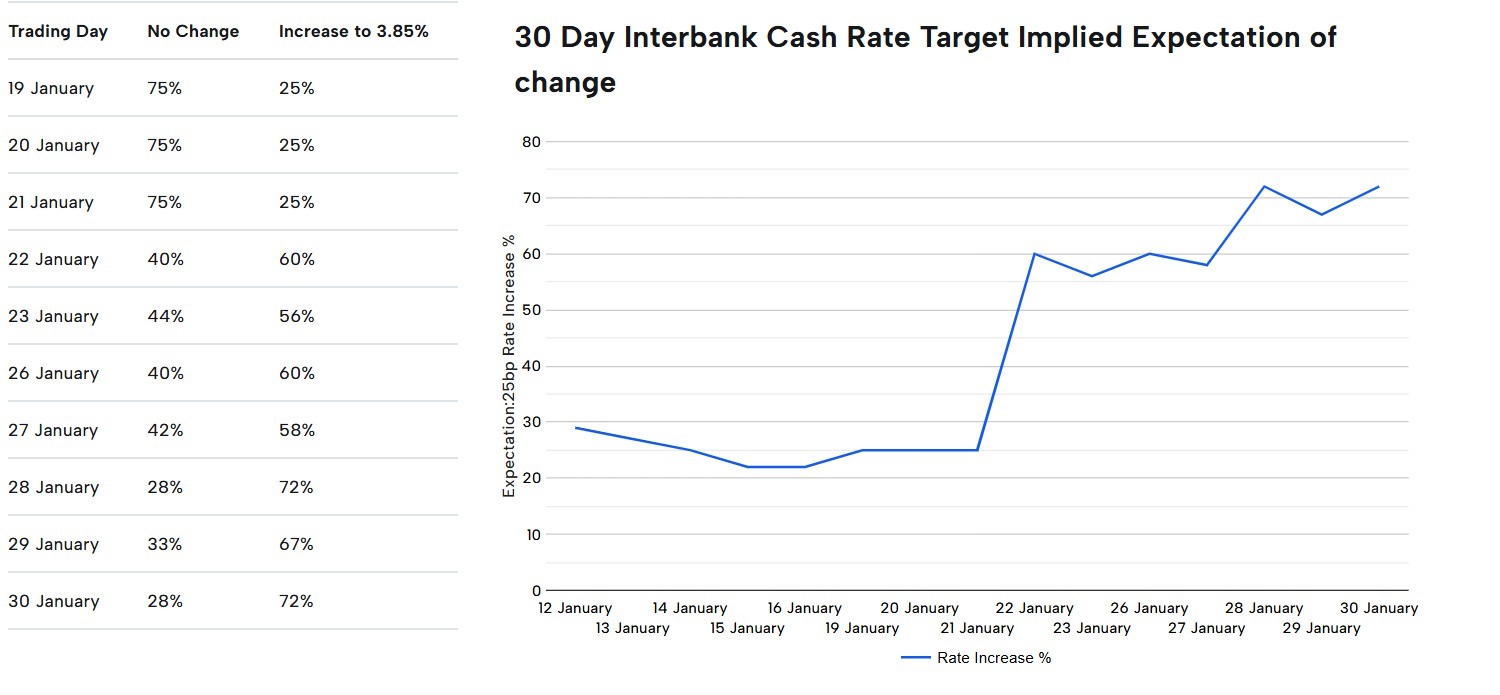

Australia begins February with a policy-driven focus as the Reserve Bank of Australia (RBA) delivers its monetary policy decision, setting the month’s initial tone for rates, currency, and equities. While markets had priced around a 70% chance of a hike as of 30 January, expectations remain highly sensitive to evolving data and RBA commentary.

Key dates

- RBA Monetary Policy Decision: 2:30 pm, 3 February (AEDT)

- Wage Price Index (WPI): 11:30 am, 18 February (AEDT)

- Labour Force: 11:30 am, 19 February (AEDT)

What markets look for

Aussie traders will gauge whether the RBA reinforces a data‑dependent stance or shifts more decisively toward tightening.

Wage and labour data will be central in testing inflation persistence, while the next CPI reading anchors positioning heading into March. A balanced or mildly hawkish tone could keep short‑term yields elevated and limit downside in the AUD.

Market sensitivities

AUD and ASX performance will primarily reflect the RBA’s policy tone and broader USD momentum, while resource‑linked sectors should continue to track metals and bulk commodity trends.

The February earnings season, highlighted by CBA and CSL (11 Feb), BHP (17 Feb), and Rio Tinto (19 Feb), is also set to reintroduce stock‑specific drivers once the initial policy focus fades.

Australia: CPI

Australia’s February Consumer Price Index (CPI) release will be a key post‑RBA event, offering the clearest read on whether domestic inflation pressures are easing in line with the central bank’s expectations.

The data following the RBA’s February policy decision and could quickly reset rate path probabilities reflected in ASX futures pricing.

Key dates

- Consumer Price Index (CPI): 11:30 am, 25 February (AEDT)

What markets look for

Markets will focus on whether trimmed‑mean and services inflation components show further moderation.

Persistent strength in non‑tradables or wage‑related sectors could reinforce expectations for additional tightening later in Q1, while a softer headline would support the view that policy rates have peaked.

Market sensitivities

A stronger‑than‑expected CPI print would likely lift front‑end yields and support the AUD, while a downside surprise could weigh on the currency and flatten the yield curve.

Equity sentiment may diverge and financials could find relief from a pause bias, whereas rate‑sensitive sectors like real estate and consumer discretionary would benefit most from a cooler inflation read.

Japan: Q4 GDP

Japan’s Q4 GDP release will be a key reference point for how firmly the recovery is progressing after recent quarters of uneven growth momentum. Arriving ahead of the Tokyo CPI print, it helps shape expectations for domestic demand, external trade performance, and how much scope policymakers have to adjust their stance without derailing activity.

Key dates

- Q4 GDP: 11:50 pm, 15 February (GMT)/ 10:50 am, 16 February (AEDT)

What markets look for

Investors pay close attention to the balance between consumption, business investment, and net exports to judge whether growth is broad‑based or narrowly supported.

A stronger‑than‑expected print tends to reinforce confidence in Japan’s expansion story, while a weaker outcome can revive concerns about stagnation and delay expectations for any meaningful policy shift.

Japan: Tokyo CPI

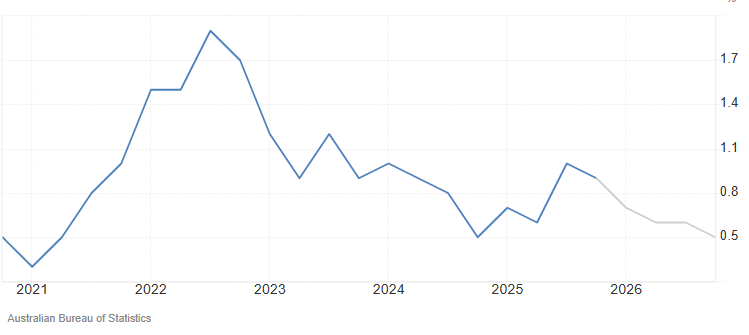

Tokyo’s latest inflation reading shows headline CPI easing to 1.5% year‑on‑year in January from 2.0% in December 2025, dipping further below the recent peaks seen during the post‑pandemic upswing.

The CPI release offers one of the timeliest reads on Japan’s inflation pulse and is closely watched as a lead indicator for nationwide price trends.

Coming late in the month, it serves as a check on whether the recent inflation upswing is sustaining at levels consistent with policymakers’ many objectives.

- Tokyo CPI: 11:30 pm, 26 February (GMT)/ 10:30 am, 27 February (AEDT)

What markets look for

Attention centres on core measures that strip out volatile components, alongside services prices, to see whether underlying inflation is holding near target or drifting lower.

A firmer profile strengthens the case that Japan is exiting its low‑inflation regime, while softer readings suggest that price pressures remain fragile and dependent on external factors.

Market sensitivities

A hotter‑than‑expected Tokyo CPI print can push Japanese yields higher and lend support to the yen, often translating into pressure on exporter‑heavy equity names.

Conversely, a softer outcome tends to ease yield pressures, weaken the yen, and provide some relief to equity sectors that benefit from a more accommodative policy backdrop.

China

China’s February macro calendar is structurally lighter due to Spring Festival timing.

The National Bureau of Statistics of China notes that some releases are adjusted around Spring Festival timing, with the February PMI scheduled for early March leaving markets without major domestic data anchors for much of the month.

Key dates

- Spring Festival: 17 February to 3 March

What markets look for

Markets turn their focus to policy signals out of Beijing — think targeted stimulus or liquidity injections, as well as shifts in funding conditions and flows responding to global risk sentiment or USD moves.

Trade and tariff rhetoric, or surprise consumption measures like expanded trade-in subsidies and festive spending incentives recently flagged by the Ministry of Commerce, often spark sharper reactions than the usual data releases.

Market sensitivities

CNH and CNY pairs turn more reactive to USD flows and external headlines, often amplifying volatility in regional equities, commodity currencies like AUD, and China-exposed EM assets.

Holiday-thinned liquidity elevates headline risk, particularly in materials (iron ore, copper), tech hardware supply chains, and regional financials, where policy surprises or US tariff updates can trigger 1–2% daily index swings.