Market news & insights

Stay ahead of the markets with expert insights, news, and technical analysis to guide your trading decisions.

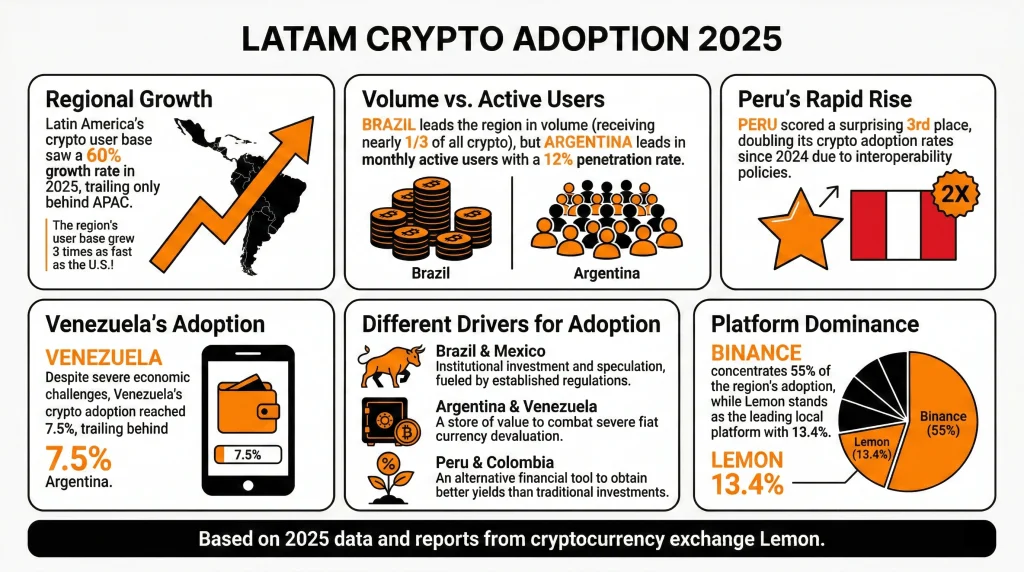

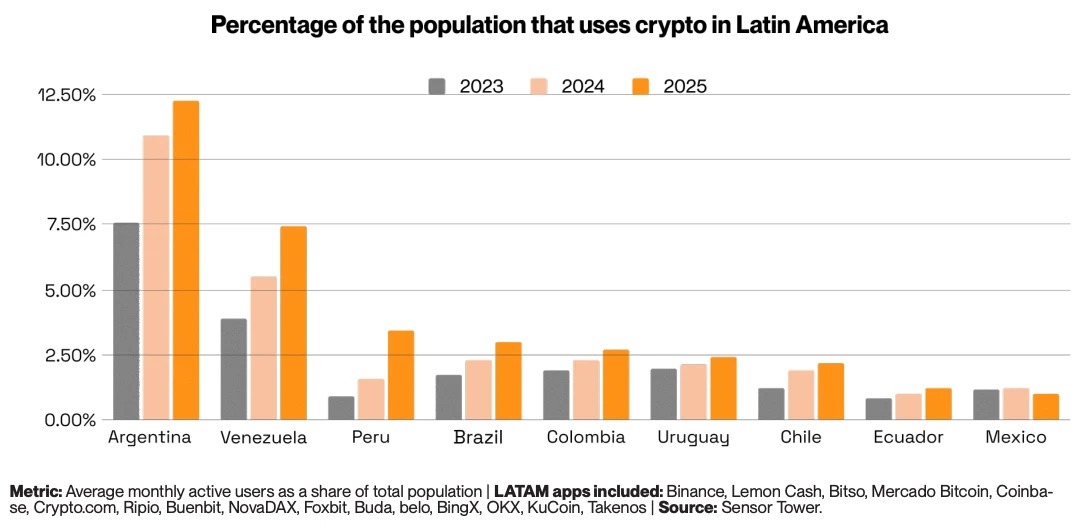

Latin America (LATAM) saw over $730 billion in crypto volume in 2025, a 60% year-on-year surge that made the region responsible for roughly 10% of global crypto activity.

In 2026, institutional players are starting to take the region seriously, regulation is crystallising, and the structural drivers from 2025 show no sign of fading. But the region is not a single story, and 2026 will test whether the current momentum is built on solid fundamentals or speculative optimism.

Quick facts

- LATAM monthly active crypto users grew 18% year-on-year (YoY), three times faster than the US.

- Argentina reached 12% monthly active user penetration, accounting for over a quarter of the region's crypto activity.

- Over 90% of Brazilian crypto flows are now stablecoin-related.

- Three LATAM countries rank in the global top 20: Brazil (5th), Venezuela (18th), Argentina (20th).

- Peru's crypto app downloads grew 50% in 2025, with 2.9 million downloads.

From survival tool to financial infrastructure

Latin America did not embrace cryptocurrency because of speculation. It embraced it because traditional financial systems repeatedly failed ordinary people. Over the past 15 years, average annual inflation across the region's five largest economies ran at 13%, compared to just 2.3% in the US over the same period.

In Venezuela, it reached 65,000% in a single year. In Argentina, it exceeded 220% in 2024. For millions of people, holding savings in local currency was a slow act of self-destruction. Stablecoins became the natural response. Digital assets pegged to the US dollar offered a reliable store of value, borderless transferability, and access without a bank account.

Unlike in the West, where crypto is seen more as a speculative instrument, in LATAM it has become a necessary financial tool. However, adoption drivers are not entirely uniform across the region. Brazil and Mexico are institutional stories, driven by regulated market participation and established financial players.

Argentina and Venezuela remain store-of-value plays, with crypto serving as a direct hedge against fiat collapse. And Peru and Colombia are more yield-seeking markets, where crypto offers returns that traditional savings accounts cannot match.

How fast is LATAM adopting crypto?

LATAM’s on-chain crypto volume rose 60% year-on-year in 2025. The region has recorded nearly $1.5 trillion in cumulative volume since mid-2022, peaking at a record $87.7 billion in a single month in December 2024.

Monthly active crypto users across LATAM also grew 18% in 2025, three times faster than the US.

Stablecoins are the primary vehicle driving this adoption. Of the $730 billion received in 2025, $324 billion moved through stablecoin transactions, an 89% year-on-year surge. In Brazil, over 90% of all crypto flows are stablecoin-related, and in Argentina, stablecoins account for over 60% of activity.

Looking ahead, the Latin America cryptocurrency market is forecast to reach $442.6 billion by 2033, growing at a compound annual rate of 10.93% from 2025, according to IMARC Group.

For traders, the speed of adoption matters less as a headline than what is driving it: a region of 650 million people building parallel financial infrastructure in real time, with stablecoins as the foundation.

The institutional turn

For most of LATAM’s crypto history, adoption was bottom-up. Unbanked or underbanked retail users drove volumes through local exchanges. That picture is now changing at the top end of the market.

In February 2026, Crypto Finance Group, part of the leading global exchange operator Deutsche Börse Group, announced its expansion into Latin America, targeting banks, asset managers, and financial intermediaries seeking institutional-grade custody and trading infrastructure.

Traditional banks and fintechs are following suit. Nubank now rewards customers for holding USDC. Brazil's B3 exchange approved the world's first spot XRP and SOL ETFs, ahead of the US, in 2025. Centralised exchanges, including Mercado Bitcoin, NovaDAX, and Binance, have collectively listed over 200 new BRL-denominated trading pairs since early 2024.

In March 2025, Brazilian fintech Meliuz became the first publicly traded company in the country to launch a Bitcoin accumulation strategy, now holding 320 BTC.

“Crypto adoption in LatAm is already global-scale. What the market needs now is institutional-grade governance, and that’s exactly why we’re here,” — Stijn Vander Straeten, CEO of Crypto Finance Group

Crypto remittance use case

Latin America receives hundreds of billions of dollars annually from workers abroad, making remittances one of the most concrete and measurable crypto use cases in the region. Traditional transfer services charge an average of 6.2% per transaction. On a US$300 transfer, that is roughly US$20 in fees.

Blockchain-based infrastructure more broadly offers dramatic fee reductions. Bitcoin brings costs to around US$3.12 per US$100 transferred. While cheaper alternatives like XRP or Ethereum layer-2 infrastructure can reduce that to less than US$0.01.

For a migrant worker sending US$1,500 home to Peru, switching from a legacy bank saves more than the average Peruvian weekly wage in fees alone.

LATAM’s crypto regulatory environment

The variable that will most determine whether LATAM lives up to its 2026 potential is crypto regulation. And here, the picture is genuinely mixed.

Brazil leads the region with its Virtual Assets Law, which covers asset segregation, VASP licensing, AML/KYC requirements, and capital standards. It also implemented the Travel Rule for domestic VASP transfers, which came into force in February 2026. However, some more controversial proposals, including a US$100,000 cap on cross-border stablecoin transactions and a ban on self-custody wallet transfers, remain under active consultation.

Mexico's 2018 Fintech Law remains one of the world's earliest formal recognitions of virtual assets. Chile's 2023 Fintech Law established licences for exchanges, wallets, and stablecoin issuers, formally recognising digital assets as 'digital money.'

Bolivia reversed a decade-long crypto ban in June 2024 by authorising regulated digital asset transactions. Argentina introduced mandatory exchange registration in 2025. And El Salvador continues to expand tokenised economic initiatives despite removing Bitcoin's legal tender status.

Ten countries across the region now have formal crypto frameworks of some kind. But for traders, regulatory divergence remains a live risk, and given Brazil receiving nearly one-third of all LATAM crypto volume, any significant policy reversal there could have outsized consequences.

What traders should watch

Brazil's institutional momentum is the most significant structural trend. With $318.8 billion in on-chain volume in 2025, Brazil effectively is the LATAM market.

The outcome of the Brazil stablecoin consultation could have a big influence. A restriction on foreign stablecoins in domestic payments would directly impact the most traded asset class in the region's dominant market.

Argentina is the volatility play. Monthly active user penetration of 12% and 5.4 million crypto app downloads in 2025 signal deep and growing retail engagement.

Colombia is an early-warning market to watch. The peso's 5.3% depreciation in 2025 and deepening fiscal crisis are driving stablecoin inflows in a pattern that mirrors Argentina's trajectory in earlier years. If Colombia's macro situation deteriorates further, crypto adoption could accelerate.

There is also an exchange concentration risk at play. Binance crypto exchange is the primary exchange for over 50% of LATAM crypto users. If the exchange faces any regulatory action, operational disruption, or competitive shock, it could have an outsized market impact.

Bottom line

Latin America's crypto market has entered a new phase. The structural drivers that caused initial crypto-demand in the region have not gone away: inflation, remittances, financial exclusion, and currency instability are all still at play.

What has changed is the layer being built on top of them. Institutional infrastructure, regulatory frameworks, corporate treasury adoption, and global exchange capital flowing into a region that was, until recently, largely self-contained.

Brazil's near-250% volume growth in 2025 and its position receiving nearly one-third of all LATAM crypto are the defining market developments. Its regulatory trajectory, stablecoin policy decisions, and ETF pipeline will effectively set the tone for the region in 2026.

For traders, the headline growth figures are real, but so are the concentration risks, regulatory uncertainties, and country-level divergences that sit beneath them.

Trading terms glossary A - B - C - D - E - F - G - H - I - J - K - L - M - N - O - P - Q - R - S - T - U - V - W - X - Y - Z - C Cable Cable in forex is the nickname of the GBP/USD currency pair, which is one of the most popular currency pairs on the market. Calendar Spread A calendar spread is a trading technique, which involves buying a derivative of an asset in one month and selling a derivative of the same asset in another month. The calendar spread represents the difference in the price of the same asset from one futures contract to another.

Call option A call option is an option to buy an asset at a given price by a specific date. Learn more about Call Options Capital expenditure Funds spent on physical assets. Capital gains Capital gains are the profits made from the buying and selling of assets, when the sale of an asset exceeds the original cost.

Capital gains tax Capital gains tax (or CGT), is the tax levied by the government on the profits made from selling any financial assets. Capital loss Opposite of capital gains. When the sale of an asset is less than the original cost to the owner.

Cash flow Cash flow is the amount of money coming into and going out of a company, and the resulting availability of cash. It can refer to a single project or the entire business. Cash Price Not to be confused with Prompt or Spot price, the cash price refers the price paid or received for immediate delivery of a good or asset.

The cash price and spot futures price should converge the closer you get to the spot futures contract expiry. Cash rate Also known as a bank rate or base interest rate, the cash rate is the interest rate charged by a central bank for loans to other banks. Chartist A chartist trader relies predominantly on charts to help them understand historical data in order to better speculate on future price movements.

Also commonly known as technical analysts, or technical traders. Closing price The price of a security on a financial market at the end of the trading day. Closing prices can be used as a marker when looking at long-term historical movements, or they can be compared to the opening price to review the movement over a single day.

Commission Commission is a service charge by an investment broker for making trades on a client's behalf. Commodity A commodity is a basic physical asset, which can be bought and sold. Commodities can often be categorised as a raw material, used in the production of other goods or services.

Contracts for difference Contracts for difference (CFDs) are a type of financial derivative where your gain or loss is based on the price of the asset when the contract opens and closes. It is an arrangement made where the differences in the settlement between the open and closing trade prices is cash settled and there is no delivery of physical goods or securities. Learn more about CFDs Contract (Lot) A Lot is a trading unit, representing a set amount of a particular asset.

A standard lot in the forex market is $100,000. A mini lot is $10,000. Convexity Bond convexity is a measure of the "degree of the curve" or difference, between a bond’s price and a bond's yield.

It is a risk management tool used to assess the impact that a rise or fall in interest rates can have on a bond’s price – which highlights a bond holder’s exposure to risk. Contango Typically seen when the market is well supplied, contago is when the futures price of a commodity or security is higher than the spot price (present price). Here we would expect the higher price of the futures contract to reflect the commodity cost of carry.

Cost of carry Cost of carry is the amount of additional money you need to hold a position. This can include overnight funding charges, interest payments, or the costs of storing any commodities on the delivery of a futures contract. These charges are an important consideration when trading, as they will affect your net return.

Covered call A covered call is a call option trading strategy, where you hold an existing long position on a tradeable asset and write (sell) a call option against the same asset to generate extra income. The aim is to increase the overall profit that a trader will receive. Learn more about Covered Calls CPI CPI stands for consumer price index, which measures the change in average prices paid by US consumers, month to month.

Learn more about CPI Crystallisation Crystallisation is the act of realising a profit or loss, by selling a position and immediately reopening it again. Currency appreciation The increase in value of one currency compared to another. The 'strengthening’ of a currency in Forex trading means that it would cost more to buy, or that it can buy more of another currency when sold.

Learn more about currency appreciation Currency depreciation A decrease in a specific currency's value, relative to another currency in a floating exchange rate system. In a floating exchange rate system, a currency’s value is set by the forex market, based on supply and demand. Learn more about currency depreciation Currency peg A fixed exchange rate of its currency, set by a national government or central bank.

It can sometimes also be referred to as a fixed exchange rate or 'pegging'. Learn more about Currency Pegs Currency Swap Sometimes referred to as a cross-currency swap, this is an agreement between two parties to exchange principal and fixed rate interest payments in two different currencies to an agreed rate of exchange. Learn more about Currency Swaps.

Trading terms glossary A - B - C - D - E - F - G - H - I - J - K - L - M - N - O - P - Q - R - S - T - U - V - W - X - Y - Z - A Acquisition (mergers and acquisitions) When one company purchases or 'takes over' either the majority or the entirety of the ownership stake of another company. American Depositary Receipt (ADR) The ADR represents securities of a foreign company and enables American investors to own shares in foreign corporations. ADRs trade on the US stock exchange and the sponsoring bank collects dividends, pays local taxes and converts them to dollars for distribution to American shareholders.

American Option An options contract which can be exercised at any time prior to expiration. Aggregate demand The overall demand for goods and services in the economy, showing how current price relates to GDP (gross domestic product). Aggregate supply The total supply of goods and services that can be sold in a national economy - at a particular time and during a particular period.

Alpha The measurement of the performance of an investment portfolio, against a certain benchmark. Measuring the "success" of a portfolio over a period of time. The alpha can be positive or negative, depending on its proximity to the market.

Learn more about Alpha Amortisation Paying off a loan or obligation over a period of time in installments or transfers. Amortisation will often incur interest payments, at the discretion of the lender. Annual general meeting (AGM) A yearly meeting of the shareholders of a company and its board of directors.

Generally, the directors to present the company’s annual report to shareholders at this meeting. Arbitrage Arbitrage is simultaneously buying and selling an asset, in order to take advantage of a temporary difference in price. The asset will usually be bought and sold in different markets.

It can also be the calculation of the relative value of stocks, bonds or funds at the same time, in two or more places. Learn how to use Arbitrage trading to increase profits. Ask (Offer) price The asking price from the seller, at which you can buy an asset or security.

Asset classes Physical assets or financial assets grouped into a category. The instruments are grouped based on whether they have similar characteristics, behave in the same way on the market, or follow the same laws and regulations. Assets In trading, an asset refers to what is being traded or exchanged on the market, for example stocks, bonds, commodities or currencies.

It is an economic resource which can be owned or exchanged to return a profit or held for a future benefit. At the money At the money (ATM) is a term used to describe the relationship between an option's strike price and the underlying securities price. The term describes a strike price that is the same as the market price.

Learn more about At the Money Auction An auction market facilitates competition between buyers and sellers, where buyers indicate the maximum price they will pay for an asset, while sellers express the lowest price they will sell at. Automated trading (to be expanded) Automated trading - sometimes known as algorithmic trading – is the use of algorithms for making trade orders. It allows traders to set specific rules and parameters for making trades, which will be executed automatically once triggered.

Averaging down When a stock owner purchases additional assets when the asset’s price drops, it is referred to as averaging down. The purpose of the second purchase is to decrease the average price at which the investor purchased the stock. Learn more about Averaging Down

The World Business Outlook Awards are among the most distinguished recognitions in the global business landscape, celebrating excellence, innovation, and outstanding performance across various sectors. GO Markets' remarkable win in this category underscores its commitment to providing exceptional services and building trust among its clientele. Founded in 2006 and headquartered in Melbourne, Australia, GO Markets specialises in Forex and CFD trading.

The broker provides 1000+ tradable CFD instruments, including forex, shares, commodities, indices, metals, cryptocurrencies and bonds. GO Markets is regulated by ASIC in Australia, CySEC in Cyprus, FSC in Mauritius, and FSA in Seychelles. As a globally recognised forex broker, they remain committed to pushing the boundaries of excellence and innovation in the financial services industry.

GO Markets clients can access a wide range of trading platforms like MetaTrader 4, MetaTrader 5, cTrader, cTrader copy trader, PAMM, MetaTrader copy trading, mobile trading and more. As GO Markets continues to expand its global footprint and enhance its product offerings, the company remains dedicated to providing education to novice traders. GO Markets provides educational materials and resources necessary to perform seamless trading.

There are various forex learning courses, video tutorials, and frequently held seminars and webinars included in the educational programmes that are free to use for all traders. Shashank M, CEO of World Business Outlook, commented, "We are delighted to extend our sincerest congratulations to the well-deserving winner. GO Markets' Journey to Success has been nothing short of inspiring, marked by unwavering dedication and utmost commitment to showcasing excellence in every facet of its operations.

With their exceptional services for trading forex, shares, commodities, and indices available to investors around the world, it is no surprise that they emerged as leaders in their field." Soyeb Rangwala, Director of GO Markets expressed his gratitude after winning the title and commented, "We are proud of our dedicated and expert customer service team who have garnered several accolades from across the globe. GO Markets is committed to maintaining its global leadership for customer service and education programmes. After receiving the top ratings for trading ideas and strategies, margin requirements, and account funding/withdrawals, this new recognition from World Business Outlook further boosts our teams’ morale and inspires us to dedicate a whole new level of experience for our clients." About GO Markets GO Markets is a regulated and multi-award-winning online global CFD trading provider, offering 1000+ tradable CFD instruments.

GO Markets began in Australia in 2006 and is widely recognised as Australia’s first MT4 broker. GO Markets has since added MT5, cTrader, cTrader copy trader, PAMM, MetaTrader copy trading, mobile trading, and a web-based solution to its trading platform suite. The clients’ trading journey is of the utmost importance, and as such, GO Markets is committed to continually refining its technology, client support, and education. https://www.gomarkets.com/au/ About World Business Outlook World Business Outlook is a Singapore-based print and online magazine providing comprehensive coverage and analysis of the financial industry, international business, and the global economy.

It offers a nuanced perspective on global economic trends, business strategies, and market insights. In a world where interconnectedness is the norm, the magazine provides a platform for thought leaders, industry experts, and policymakers to share their views on navigating the complex web of international business dynamics.

GO Markets proudly announces its achievement of ISO 27001 certification. This milestone underscores GO Markets' unwavering commitment to safeguarding its clients’ information assets and affirms its commitment to maintaining information security at an industry-leading level. This standard, part of the ISO 27000 series, sets out the specifications for an effective Information Security Management System (ISMS), offering a comprehensive framework for organisations to manage their information security adeptly.

An ISMS, as per ISO 27001, employs a systematic approach to ensuring the Confidentiality, Integrity, and Availability (CIA) of corporate information assets, providing a robust defence against evolving cyber threats. GO Markets' ISO 27001 certification is a significant milestone in its ongoing pursuit of information security. By adhering to the highest standards of data protection, GO Markets reaffirms its dedication to maintaining the trust and confidence of its clients while setting a benchmark for security excellence in the financial services sector.

About the International Organisation for Standardisation (ISO) Created in 1946 to establish best practices spanning from product manufacturing to process management, the ISO has 25,297 International Standards covering nearly all facets of technology, management, and manufacturing. ISO fosters international trade and cooperation among its 170 member countries, each represented by a single member. Through 830 technical committees and subcommittees, ISO ensures meticulous standards development, adhering to its inclusive, value-driven, independent, can-do, and global ethos.

Its consensus-based approach integrates feedback from diverse stakeholders, fostering trust and collaboration. About DNV DNV is a global leader in assurance, risk management, and classification services, dedicated to safeguarding life, property, and the environment. They provide expertise and innovative solutions across various industries, ensuring the performance and safety of organisations and their assets worldwide.

They are one of the world’s leading certification bodies, delivering world-renowned testing, certification and technical advisory services.

Public Wi-Fi hotspots are found everywhere in places like your local shops, cafes, hotels, and even at some parks. They can be a convenient way to access the internet when you are out, have poor reception, or are travelling overseas. Learn more about public Wi-Fi and using it securely.

Like many things online, there are risks involved when using public Wi-Fi hotspots. They can be accessed by anyone, and are often free and unsecured. These hotspots can be an attractive target for cybercriminals, who may try to use them to steal your passwords or sensitive information.

Case Study A NSW man recently became aware that he was a victim of identity theft. He was told he owed over $7000 in fees to a company, for the purchase of gift cards and digital subscriptions that were sent to unknown email addresses. On investigation, he found there were multiple inquiries on his credit report around the same time.

The first credit inquiry happened not long after travelling overseas, where he had used his laptop. While connected to a public Wi-Fi hotspot during his trip at the airport, he had sent ID documents to his parents, including his passport and birth certificate. It turns out he had connected to a fake Wi-Fi hotspot which was set up by a cybercriminal.

The cybercriminal was able to intercept his ID documents, and use them to steal the man’s identity. It is important to be aware of the risks, and to develop secure habits when making use of these hotspots. Follow these tips the next time you are thinking about connecting to a public Wi-Fi hotspot: 1.

Check you are connecting to the right hotspot Anyone can create a free Wi-Fi hotspot, including cybercriminals. Wi-Fi and hotspot names are not unique, and they can be reused by anyone. A cybercriminal may try to take advantage of this by copying and posing as a legitimate hotspot.

Ensure you are connecting to the hotspot you intend. You can do this by: Checking the hotspot’s name on signage, or directly with staff at the venue. Preventing your device from automatically connecting to the hotspot.

Disable features such as “auto-join” or “auto connect” for public hotspots. Where possible, choose hotspots that require a password. Try to avoid “open” or “unsecure” networks.

As an extra precaution, ‘forget’ the network in your Wi-Fi settings after you have finished using it. This will prevent your device automatically reconnecting in the future. If in doubt, do not connect to the hotspot.

Instead, wait until you can use a trusted network such as your home, office or mobile connection. 2. Check you are visiting secure webpages When a webpage is secure, the information that you send to it is encrypted and cannot be intercepted and read by cybercriminals. You can check that a webpage is secure by: Looking for ‘https’ and the lock symbol in the address bar on your web browser.

Ensure that the webpage is what you expect. If your browser displays a warning message when you try to visit a website, do not continue. Stop using the hotspot, disconnect, and ‘forget’ it on your device. 3.

Disable file sharing Some devices may allow your files to be shared over Wi-Fi, which can be useful when you are at home or work. When connecting to public Wi-Fi, ensure you switch off file sharing. This will prevent a cybercriminal from potentially accessing your files, or putting malicious files on your device.

These features can vary depending on your device. To learn more about the different types of sharing options on your device, see Microsoft’s guidance for Windows and Apple’s guidance for Mac. When joining a new Wi-Fi hotspot, you may be asked to select if a network is public or private, ensure you select public.

This will also automatically disable file sharing. 4. Think twice about what you access Public Wi-Fi hotspots cannot always be trusted. Reconsider your need to access sensitive information, such as your online banking.

If possible, wait until you are using a secure home, office or mobile connection. 5. Use a VPN A virtual private network (VPN) is a service that encrypts and secures your data when using the internet. It acts as an extra layer of protection when using public Wi-Fi hotspots.

If you use public Wi-Fi hotspots frequently, install and use a reputable VPN service on your device. When considering which VPN service to use, research each product and its company. VPN providers have access to a large amount of their user’s data, so it is important to know about their privacy policy, how they store information, and if they share it.

Look at independent reviews online to make an informed, secure decision. Source: Australian Signals Directorate. Original article available here.

Tom Williams ( @TomW_GOMarkets ) is the GO Markets Head of Trading. He started out as a dealer and broker in the excitement-driven city of London across equities, fixed income and foreign exchange. Learning the technical aspects of what is now a software-driven business has allowed Tom to lead all trading operations at GO Markets, literally keeping the show on the road.

Old Scouse loves a laugh and a pint and is always affable enough to show you the bright side of life (as Monty Python says). In this episode we'll cover: What brought Tom to Australia and what he misses about the UK His role as head of trading at GO Markets The Swiss National Bank Crisis The GFC and Brexit - Transcript Disclaimer: Go Markets is a derivatives broker and Jordan Michaelides is the managing director of Neuralle Media. All opinions expressed by Jordan and podcast guests are solely their own and do not reflect the opinions of Go Markets, an AFSL license holder.

This podcast is for informational purposes only and should not be relied upon as a basis for financial decisions nor as an indication of future performance. Clients of Go Markets may hold positions in the derivatives mentioned. A financial services guide and product disclosure statement for our products are available at the www.gomarkets.com website.

Jordan Michaelides: In this episode we spoke with Tom Williams. Tom is Go Markets head of trading and he started out as a dealer and broker in the excitement driven city of London across equities, fixed income and foreign exchange. Learning the technical aspects of what is now very a software driven business has allowed Tom to lead all trading operations at Go Markets, keeping the show literally on the road.

Tom loves a laugh and a pint, is always affable enough to show you the bright side of life, as Monte Python would say. This is a fascinating episode where we cover what brought him here to Australia and what he misses about the UK. His role as head of trading at Go Markets, particularly examples or crises like the Swiss national bank crisis, the GFC and Brexit, as well as what sitcom best portrays the Go Markets office.

If you enjoy this episode, subscribe on your podcast app and share with one of your friends, particularly those who want to get an understanding of the more technical aspects when it comes to trading and what goes on behind the scenes. With that being said, let's get into the episode with Tom Williams. Tom, thanks for joining me on me what has turned into a rather miserable Friday afternoon in the Go Markets office.

First question for you, how was the wedding? Tom Williams: The wedding was stressful, but, it was great fun. We went up to Queensland and got the families from New Zealand, from Queensland, from England, all over, and a lot of them met for the first time which was great, but stressful being centre of attention and having to entertain that many people for a few days.

Jordan Michaelides: How long had you guys been planning this wedding? How much time do you spend typically on a wedding planning? Tom Williams: For me, a lot less than my wife *laughs*.

I'd say I had a passive involvement in the organization of the wedding. Jordan Michaelides: I like that. I like that you're aware of that too.

Tom Williams: I mean, my wife's a florist, as you know, so from the events side of it she's got way more experienced than I have, I would have just messed the whole thing up if I had anything to do with it. Jordan Michaelides: Now, I want to get into how I guess a liver Puglian made his way here to Australia, but I'll give people a little bit of a background first. So, obviously you were born and bred in Liverpool.

From looking at your past history you spent about five years in the business in the city of London before you made your way out here, working in many different roles, but primarily as a dealer. Equities, fixed income, eventually CFDs as well, which is what Go Markets focuses on now. What was the catalyst that drew you out to Australia?

Tom Williams: The catalyst to go to Australia was and event that happened in 2012 when the company I was working for at the time went into administration, and there was a moment where I could either continue the daily grind in London, or take some time out and go and see the world a bit, which is what I did. I took nearly a year off and ended up in South America, which is where I met my now wife, in Peru. She was from Australia and I had to come over here to, you know, seal the deal.

Jordan Michaelides: So really it was like love that the drew you out here, you could say. Tom Williams: Well, I had no intention of moving away from the UK, you know, I never considered what it'd be like not working in the UK. I guess the opportunity was there and it seemed like the right thing to do and it's worked out pretty well.

Jordan Michaelides: Yeah, I would definitely say that. And it's so fascinating. I just look at it from your position and I don't think you would have ever expected to be in this situation five, six years ago.

Tom Williams: Absolutely. I couldn't have even imagined it to be honest. Jordan Michaelides: Also, it's interesting because of just where the UK is at and what Australia offers.

The other day I was looking at like immigration numbers the UK is still the biggest source in terms of growth through immigration, I'm pretty sure next to China. I think it's still the biggest because a lot of millennials like yourself come out here and there's just so much opportunity. You can speak the language, you get sun.

Tom Williams: Yeah. I mean the UK is a great place to live, but we just, we don't have the weather. I'm not saying that I'm much of a beach goer, but we just don't have the sorts of lifestyle that good, consistent, good weather brings.

We have long winters and miserable rainy days. Melbourne winter is considered a bad winter in Australia, but you still get lovely sunny days and it's just a more positive place to be, that people are more positive as a result of the lifestyle that Australia offers. Jordan Michaelides: And apart from your family, what do you miss the most about home?

Tom Williams: This is a question I get asked quite frequently and it's a struggle to answer it because there's not a lot that I do miss from the UK really, except family and friends to be honest. Jordan Michaelides: Not even football? Tom Williams: The football side of it, you just learn to live with it.

Thanks to Optus, you can catch up on demand pretty easily. So, to be honest, I don't miss a lot in terms of lifestyle or anything like that. Jordan Michaelides: Well, that’s good to hear.

And, eventually citizenship for yourself, like one of the other poms that we have in the office here would be good to see. I'm thinking about your family in particular, and I'm curious as I like to know from a lot of guests, if you can think back to your own childhood, and about your parents, is there a particular lesson or principle that you maybe hold with you today that you saw directly or indirectly from them, and you later realized it's a core tenant of your personality. Tom Williams: I suppose hard work, and discipline as well.

Growing up in a city like Liverpool, you could be led astray in a number of different directions. My father is a policeman, so he was always very strict and perhaps, saw me going in the wrong direction when I was younger. Nothing crazy, I'm talking just normal teenage stuff that you kind of get yourself involved in, but obviously he didn't turn a blind eye to that.

He put me on the right tracks. So, yeah, discipline, hard work. My father retired as a superintendent in the police, which is a pretty senior role to get to, and he worked very hard for it.

I guess that's always resonated with me. Jordan Michaelides: Now thinking about work, your role here is head of trading, which is a thing that people see a lot on different roles for people in different CFD and equity organizations, but they don't really know what it is. I thought maybe we'll just get into the nuts and bolts of that.

What does that look like? I'm trying to give people the context of 2003 to 2005, you would have still been on the phones a lot, taking orders. Now most systems are quite automated and electronic.

So what does your role of head and trading involve? Tom Williams: So, we try and focus on the overall client experience with the trading platform, whether that be from a cost perspective in terms of the spreads that they're paying, the commissions that they're paying, the overnight financing, all the way through to the quality of execution, so, how quickly are these clients able to execute? Are they able to execute during fast markets?

Are they able to execute around news, and we try to control the overall cost of trading to make the whole experience better for the client. Jordan Michaelides: So basically you make sure the shit doesn't hit the fan in a way. Tom Williams: Pretty much.

That's one element of it, for sure. As you touched on before, a lot of it is automated. All of our hedging algorithms, everything is automated.

It very much becomes autopilot to make sure that nothing goes wrong. And when stuff does go wrong, the most important thing that our team can do is make sure it's put right as quickly as possible. Jordan Michaelides: Are there any particular crazy stories that come to mind?

I know that in my time here we had some pretty stunning events where the markets were more than wild. I know in our last interview with Chris Gore, he spoke about dealing with the Swiss bank, taking away that peg from the Euro. I'm just curious, are there any crazy stories that you have in memory of the market just going absolutely nuts.

Tom Williams: There's definitely a few. There were a couple after the Swiss national bank crisis. Since then we've had a UK referendum.

We've had the election of Donald Trump. There's been a number of associated issues like a Sterling flash crash, which just came out of absolutely nowhere. Jordan Michaelides: When was that?

Tom Williams: That was soon after the referendum on Brexit. The market started to settle down and then out of nowhere there was a huge liquidity drain. Markets these days are so dictated by algorithms and high frequency trading systems that if there's a liquidity drain, it happens immediately.

It's not something that happens over time. So, yeah, we have witnessed a few occasions like that, but most notable is definitely the Swiss banking crisis, when the Swiss national bank just… leading up to the events, decided that they were going to tell the market that they were going to maintain this peg of 120 against the Euro and that they were committed to doing this, and Thomas Jordan, the chairman of the SNB at the time came out a week prior and said we're committed to holding this peg, then all of a sudden shocked the market and said that this is not something that we can feasibly do. I think it was the 15th of Jan 2015, so it was soon after the Christmas break, everybody was just getting back into the swing of things and all of a sudden, a phone call at 10:00 PM at night saying get into the office, the shit’s hit the fan.

So, there were a number of us in the office at the time, it was all hands on deck. Nobody really knew what was going on. The news was out, we knew what happened, but we didn't know how markets were going to react.

Nobody could really price where they thought the Swiss Frank was, banks in particular. There was a lot of uncertainty around where things actually traded, where the market is, where it should be. This went on for a week after the event, which markets have never seen before.

It was a crazy time. Jordan Michaelides: To me that’s very interesting. I mean, I've read about it, but we don't see behind the scenes, you know.

The things that you guys see. If you were to think of the most crucial aspect of your role, you spoke before about execution, liquidity, supervising, all that sort of stuff, what do you think is the most important? The number one aspect of being head of trading.

Tom Williams: I think without a doubt it's going to be attention to detail, being observance and not missing things. At the same time, it's important to remember what everybody's working towards and what the end goal is, which essentially for an online FX broker is to have a product which is efficient for the clients. The competition amongst the FX brokers these days is so… There's so many brokers out there, everybody's trying to compete on cost and these discount pricing models.

If you fall behind the wolf-pack you're going to struggle to get in front again. It's very important for us to just remember the end goal of what we're trying to achieve, which is to create this superior platform to our competitors. Jordan Michaelides: I think Chris Gore spoke about that last week that because it's so competitive now, the main advantage you have is just being trusted and people know that a company like Go Markets has been around for a while and can be trusted to maintain certain best practices or expectations through the market prices, or, the spreads that people get as an example.

I find it interesting that you said the most crucial component is attention to detail because if you think about the principles that you took away from your dad, it's working hard and discipline. And that is like the perfect thing for attention to detail. We were chatting before about what we want to talk about in this session and you spoke before about Brexit.

I feel like you would have had a bit of experience, just from memory. we had a chat years ago about the Lehman brothers collapsed and the 10 year anniversary of the GFC. The effect on the UK was pretty similar, although a bit different. The governments seemed to offer this money to these banks, but they wanted shares in return and I'm pretty sure the government did pretty well buying a large portion of Lloyd's.

I'm just curious, you got into the industry around ’09, what memory do you have of that period? Tom Williams: I was in the industry prior to ’09, I was in the industry from ’07, so I was around when all this happened but I was very young, and I wasn't in a responsible position, but I remember sheer, um, fear and. In the UK there were customers queued up at banks trying to withdrawal their cash, which obviously doesn't work because banks don't hold that amount of cash.

There were banks going into administration, there was footage all over the TVs of people packing boxes up, like Lehman brothers for example, was a huge tower in Canary Wharf which was just down the road from where I was working at the time. It was just like Armageddon, you know, people didn't really know what was going to go on after that, but things worked out okay. But you know, who paid for that whole crisis in the end, it was probably not the banks.

It was probably the people. Jordan Michaelides: Going back to that point I made about the banks basically having shares purchased by the government, it was the taxpayer's money. It went back to the government and then the UK went through a massive austerity process because it was part of the EU.

That's what you had to do. Tom Williams: Exactly. There were huge welfare cuts.

Jordan Michaelides: I reckon that’s actually why we've seen so many poms immigrated out here, simply because the opportunities dried up. It's easier to come to Australia as an Englishman and the opportunities are pretty great. There’s also a lot of family connections for a lot of people as well.

Tom Williams: It’s also quality of life. If you're a plumber or a carpenter, an electrician, a welder in the UK, your quality of life is dictated by the amount you’re able to earn in those roles in the UK. Whereas you come to Australia and everybody has a good quality of life.

There's a good sort of minimum earning for any role in. It turns out that the tradies in Australia probably do better than anyone else better. I've always loved that about Australia, the fact that there are equal opportunities no matter what sorts of road you chose to go down.

Jordan Michaelides: I'd definitely agree with that. Why Brexit came along, which I want to chat about, is because you know, you have all this immigration, austerity processes in the UK, combine that all together and you’ve got yourself the perfect storm for what happened with Brexit because if you're a plumber living in the Midlands and you're getting paid by the hour, and some guy from Eastern Europe has immigrated over and he's happy to work for 10 or 15 bucks an hour then life’s going to be pretty average, I'd say. Tom Williams: Yeah.

Brexit highlights some fundamental problems with the Eurozone, doesn't it? The Eurozone has always been criticized for being this huge block of very different economies which all governed by a single interest rates and it's always been a, a complex system from day one. The funny thing about Brexit was the lefties got behind Europe and they wanted solidarity with Europe, the city of London, which is a huge part of GDP obviously got behind Brexit because the lack of borders in financial markets is very important, but then it was the exact sort of demographic that you just highlighted, the guys who don't fit into those two baskets that I've just spoke about.

They think ‘what's in this for me?’ I suppose as with any of these decisions, it depends on what newspaper you read. If you're buying a tabloid for a pound with a page three girl and you're basing your political votes on a tabloid then that might be what happens. Jordan Michaelides: It’s interesting.

My view on it initially was this isn't a great thing, they've going backwards here. But then I've had the time to sort of process it, and, I like Nigel Farage a speaker, but, when you actually watch him in interviews he goes a lot deeper into some of the reasons why, and having been involved in similar industries such as Forex and Cryptocurrencies, we've now seen the city of London actually come out here. My own view is that the UK seems to be pivoting itself towards Asia.

And we've got these FinTech bridge, which is sort of like a compliance bridge through Australia. There's the free trade agreement which they gunning on. My own view is that actually it's probably going to turn out better for them, simply because they can use Australia as a stepping stone to the biggest market in the world, I think Asia now, without the Indian sub-continent I think is about 46% of world GDP.

So, it's the biggest market in the world, bigger than North America. How do you view it now? In hindsight?

Tom Williams: Day to day, it's purely the uncertainty surrounding how this Brexit is actually going to happen. Long-term it will work itself out, as all these things always do. It's not a case of the UK leaving the Eurozone and all of a sudden nobody wants to trade with the UK, it’s just ridiculous to think that.

I suppose it depends on the negotiating powers of the UK government, whoever's there at the time to be able to go and strike these agreements with Asia, as you've just suggested. Jordan Michaelides: It's going to be interesting. They’re not getting very far at the moment, I think it's March or something that it finishes up.

Going back to the industry now and then, last week we spoke about trends, obviously cryptocurrencies have been a big thing, I guess for the business here. There's also the fact that, like I was saying before, the role that you would have as head of trading being on a phone versus it more around automation now, I was chatting to Khim Khor before, who's one of the directors here, in charge of the Asia business, and we were speaking about the institutional side of things and APIs. I'm curious as to what you guys have done around that because he was telling me that you led something in that area in particular.

Tom Williams: So, as you know we've got a lot of retail clients in Australia and overseas and we've managed to, over the years, generate great relationships with the wholesale market in terms of liquidity providers, prime brokers, prime of primes, and, we also have a very healthy balance sheet which enables us to go and strike good liquidity terms with these counterparts. Our business has changed somewhat in that it's not completely retail led. We are approached by a lot of wholesale type clients these days, including funds, other brokers who are maybe smaller than us, who don't carry the same sorts of balance sheet, who want to be able to get access to very tight pricing, commercial terms that they might not be able to achieve elsewhere, so, we've transitioned from this purely retail driven model to now be able to compete as a liquidity provider ourselves.

Jordan Michaelides: Wow. I didn't know that. So, now if you had to break down the percentage of the clients, or let's say the amount of sales and volume of transactions between wholesale and retail, what do you reckon the percentages are?

Tom Williams: In terms of monthly turnover I'd say it's around 66% retail, 33% wholesale. I mean, the sheer volume that a wholesale client can do is obviously the reason behind that. They can have good months, they can have terrible months, but retail is still the majority of our business and that's where we try to differentiate ourselves away from competitors because it ties in with the whole online marketing and… Jordan Michaelides: It’s interesting to hear how the trading desk is changing in that regard.

It's one of those things you have to keep growing somehow. You got to keep doing new things. Tom Williams: Diversification of flow is becoming very important for us as well, because, retail tends to go completely one way and the whole retail market all read the same news so everybody kind of trades in a similar fashion, and for us to be able to reduce costs by internalization, we need to be able to see different types of flow from different demographics.

Jordan Michaelides: And put it put the opposing way out essentially. Tom Williams: Exactly. Jordan Michaelides: Interesting.

Now, what I'd like to ask each guest is, I'm giving the audience an idea of what the office here is like. I was saying to Chris last week that it’s a pretty impressive company, there's a lot of staff, I think there's like 40 or so staff now, a big office, nice officers. I just want to give people an idea of what the team is like and how… because we're so removed from seeing the people behind the business are actually like, and so I'm curious, if you were to choose one sitcom that represents the go market office, do you have one in mind or what would it be?

Tom Williams: Should I ask what Chris's answer to this was? Jordan Michaelides: Hmm. You don't want to know.

Tom Williams: Okay, well, my answer would definitely be the UK version of the office. I think we've think we've definitely got a David Brent character. Jordan Michaelides: Yes, and that would be Chris who claimed that last week.

Tom Williams: Did he claim it? Really? I must have drilled into him.

I like that. But no, the office, it's a great environment. It’s a fairly young demographic, it's not a load of old-boys sat there, it's new, educated, friendly people to work with.

It's a good place to be. Jordan Michaelides: We're running at a time, so I want to switch to some short fast, questions for you. What does your morning routine look like?

Tom Williams: My morning routine is very straight forward. I've just moved house, so my tram route to work has train changed slightly. I get into the office at around 7:00am and get in touch with what's gone on overnight. 7:00am is New York close, so there's not really a lot going on after that, markets have settled down.

Time to read some news, the ASX has still got a couple of hours to open, so, get to work, have some breakfast, get ready for the day. Jordan Michaelides: And the evening? How do you sort of decompress at night?

What's your go to for relaxing? Tom Williams: Go to the gym, go boxing, kickboxing, I do that three or four times a week. I head home, dinner will be on the table… no, I wish! *laughs* You know my wife, but no, she's good, she is good.

I just kick back most of the time. Most of the time during the week, it's an early night. Jordan Michaelides: What’s the most influential book on your life.

Let's say if you had to gift it to someone at Kris Kringle this year at Go Markets, what would you gift? Tom Williams: God, this could be controversial, couldn’t it. One that's always struck a chord with me is ‘The God Delusion’.

Have you read it? Jordan Michaelides: I just bought it. I go through this heavy process of building a list of books every year and then I buy them all at once after I cull that list.

I just got that one. Tom Williams: Well, being brought up in a predominantly Irish Catholic background in Liverpool, if you were seen walking around the streets with ‘The God Delusion’ in your hands in Liverpool you'd definitely get a few funny looks, but cosmopolitan Melbourne you can get away with it. Jordan Michaelides: Can you just give a quick little explain explainer for the audience what it's about.

Tom Williams: It's about the scientific approach to life rather than the religious approach, and how it’s completely different. They say never talk about politics or religion, so let's not go too far into it. Jordan Michaelides: *laughs* Yeah, it's a good book.

I bought that with ‘The Selfish Gene’ by Richard Dawkins which is pretty good too. They're good reads, I reckon. Another one for you, any favourite documentaries or movies, if you had to list your top three or five.

Tom Williams: I go through phases with documentaries in particular where I just binge watch something about a random topic. Jordan Michaelides: Are you a Netflix guy? Tom Williams: Yes, but, I find sometimes Netflix can just get sour, and there’s not a lot going on.

I move in trends from watching documentaries about guerrilla warfare in the democratic Republic of Congo to becoming completely fascinated with World War Two and all the things associated with it. Auschwitz is one of my most recent ones, which is a fairly morbid topic. Jordan Michaelides: Have you been there at all?

Tom Williams: I have not been, but I'd like to go. Jordan Michaelides: I'm actually in that stage again right now. I mean, I've had it over the years many times, you find a few good movies that really shows what it was like.

Schindler's, there was one called one the Wannsee conference with a brilliant English actor, Colin Firth was in it as well, just little films like that which are underrated. I'd think Schindler's list is a pretty well-known film, but just really gives you that perspective. Tom Williams: They’re completely eye, you just cannot fathom what went on.

So, to answer your question, a diverse range of documentaries. Jordan Michaelides: Last question for you, what has been the best purchase for you under $200 bucks? Tom Williams: Well, let's not talk about a purchase that I've made, what about a purchase that I'm going to make, that I'm on the verge of making?

Jordan Michaelides: It could also be a purchase that is an experience. It doesn't have to be a specific object Tom Williams: Well, we’re organizing, Fran and I, have started to organize a couple of life-size impressions of ours to send over to the UK for Christmas so we can sit them down at the Christmas dinner table and enjoy a bit of an over cook Turkey with the family. Jordan Michaelides: Wow, that's good.

I really like that. Tom Williams: So yeah, for a couple of hundred bucks, I think that will probably be the purchase of the year. Jordan Michaelides: You should start a little business like that for other experts.

Say, hey, you don’t have to go home… Tom Williams: I could be the go-to guy for life-size models. Jordan Michaelides: Tom, it's been a pleasure. We've already hit 30 minutes.

Thank you very much for joining us. Tom Williams: Thanks very much.