Market news & insights

Stay ahead of the markets with expert insights, news, and technical analysis to guide your trading decisions.

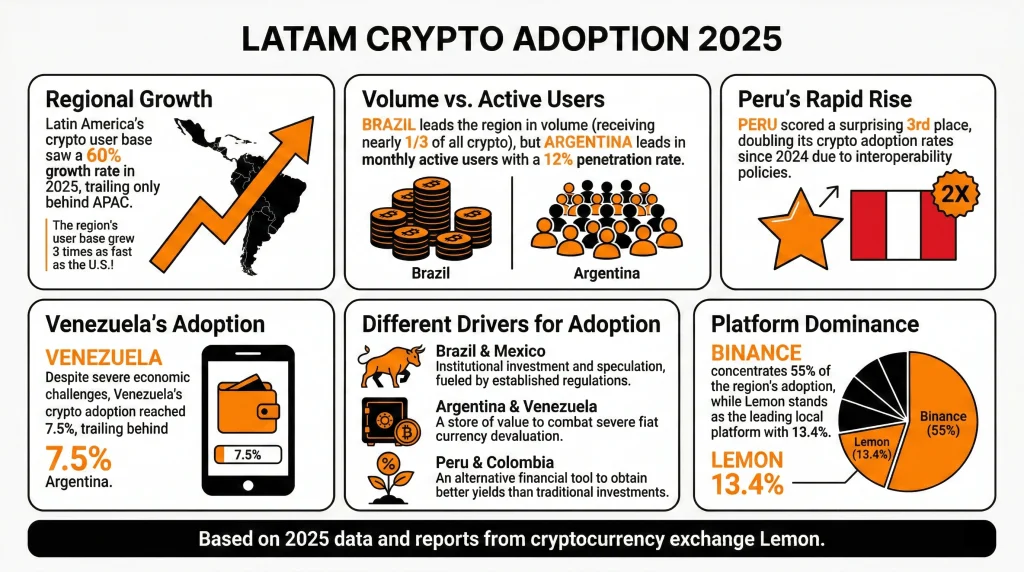

Latin America (LATAM) saw over $730 billion in crypto volume in 2025, a 60% year-on-year surge that made the region responsible for roughly 10% of global crypto activity.

In 2026, institutional players are starting to take the region seriously, regulation is crystallising, and the structural drivers from 2025 show no sign of fading. But the region is not a single story, and 2026 will test whether the current momentum is built on solid fundamentals or speculative optimism.

Quick facts

- LATAM monthly active crypto users grew 18% year-on-year (YoY), three times faster than the US.

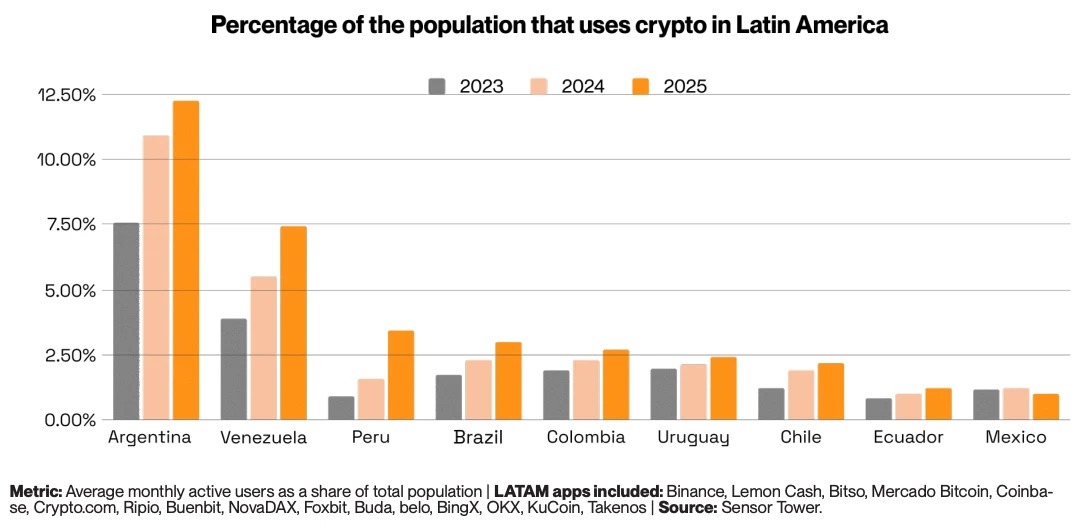

- Argentina reached 12% monthly active user penetration, accounting for over a quarter of the region's crypto activity.

- Over 90% of Brazilian crypto flows are now stablecoin-related.

- Three LATAM countries rank in the global top 20: Brazil (5th), Venezuela (18th), Argentina (20th).

- Peru's crypto app downloads grew 50% in 2025, with 2.9 million downloads.

From survival tool to financial infrastructure

Latin America did not embrace cryptocurrency because of speculation. It embraced it because traditional financial systems repeatedly failed ordinary people. Over the past 15 years, average annual inflation across the region's five largest economies ran at 13%, compared to just 2.3% in the US over the same period.

In Venezuela, it reached 65,000% in a single year. In Argentina, it exceeded 220% in 2024. For millions of people, holding savings in local currency was a slow act of self-destruction. Stablecoins became the natural response. Digital assets pegged to the US dollar offered a reliable store of value, borderless transferability, and access without a bank account.

Unlike in the West, where crypto is seen more as a speculative instrument, in LATAM it has become a necessary financial tool. However, adoption drivers are not entirely uniform across the region. Brazil and Mexico are institutional stories, driven by regulated market participation and established financial players.

Argentina and Venezuela remain store-of-value plays, with crypto serving as a direct hedge against fiat collapse. And Peru and Colombia are more yield-seeking markets, where crypto offers returns that traditional savings accounts cannot match.

How fast is LATAM adopting crypto?

LATAM’s on-chain crypto volume rose 60% year-on-year in 2025. The region has recorded nearly $1.5 trillion in cumulative volume since mid-2022, peaking at a record $87.7 billion in a single month in December 2024.

Monthly active crypto users across LATAM also grew 18% in 2025, three times faster than the US.

Stablecoins are the primary vehicle driving this adoption. Of the $730 billion received in 2025, $324 billion moved through stablecoin transactions, an 89% year-on-year surge. In Brazil, over 90% of all crypto flows are stablecoin-related, and in Argentina, stablecoins account for over 60% of activity.

Looking ahead, the Latin America cryptocurrency market is forecast to reach $442.6 billion by 2033, growing at a compound annual rate of 10.93% from 2025, according to IMARC Group.

For traders, the speed of adoption matters less as a headline than what is driving it: a region of 650 million people building parallel financial infrastructure in real time, with stablecoins as the foundation.

The institutional turn

For most of LATAM’s crypto history, adoption was bottom-up. Unbanked or underbanked retail users drove volumes through local exchanges. That picture is now changing at the top end of the market.

In February 2026, Crypto Finance Group, part of the leading global exchange operator Deutsche Börse Group, announced its expansion into Latin America, targeting banks, asset managers, and financial intermediaries seeking institutional-grade custody and trading infrastructure.

Traditional banks and fintechs are following suit. Nubank now rewards customers for holding USDC. Brazil's B3 exchange approved the world's first spot XRP and SOL ETFs, ahead of the US, in 2025. Centralised exchanges, including Mercado Bitcoin, NovaDAX, and Binance, have collectively listed over 200 new BRL-denominated trading pairs since early 2024.

In March 2025, Brazilian fintech Meliuz became the first publicly traded company in the country to launch a Bitcoin accumulation strategy, now holding 320 BTC.

“Crypto adoption in LatAm is already global-scale. What the market needs now is institutional-grade governance, and that’s exactly why we’re here,” — Stijn Vander Straeten, CEO of Crypto Finance Group

Crypto remittance use case

Latin America receives hundreds of billions of dollars annually from workers abroad, making remittances one of the most concrete and measurable crypto use cases in the region. Traditional transfer services charge an average of 6.2% per transaction. On a US$300 transfer, that is roughly US$20 in fees.

Blockchain-based infrastructure more broadly offers dramatic fee reductions. Bitcoin brings costs to around US$3.12 per US$100 transferred. While cheaper alternatives like XRP or Ethereum layer-2 infrastructure can reduce that to less than US$0.01.

For a migrant worker sending US$1,500 home to Peru, switching from a legacy bank saves more than the average Peruvian weekly wage in fees alone.

LATAM’s crypto regulatory environment

The variable that will most determine whether LATAM lives up to its 2026 potential is crypto regulation. And here, the picture is genuinely mixed.

Brazil leads the region with its Virtual Assets Law, which covers asset segregation, VASP licensing, AML/KYC requirements, and capital standards. It also implemented the Travel Rule for domestic VASP transfers, which came into force in February 2026. However, some more controversial proposals, including a US$100,000 cap on cross-border stablecoin transactions and a ban on self-custody wallet transfers, remain under active consultation.

Mexico's 2018 Fintech Law remains one of the world's earliest formal recognitions of virtual assets. Chile's 2023 Fintech Law established licences for exchanges, wallets, and stablecoin issuers, formally recognising digital assets as 'digital money.'

Bolivia reversed a decade-long crypto ban in June 2024 by authorising regulated digital asset transactions. Argentina introduced mandatory exchange registration in 2025. And El Salvador continues to expand tokenised economic initiatives despite removing Bitcoin's legal tender status.

Ten countries across the region now have formal crypto frameworks of some kind. But for traders, regulatory divergence remains a live risk, and given Brazil receiving nearly one-third of all LATAM crypto volume, any significant policy reversal there could have outsized consequences.

What traders should watch

Brazil's institutional momentum is the most significant structural trend. With $318.8 billion in on-chain volume in 2025, Brazil effectively is the LATAM market.

The outcome of the Brazil stablecoin consultation could have a big influence. A restriction on foreign stablecoins in domestic payments would directly impact the most traded asset class in the region's dominant market.

Argentina is the volatility play. Monthly active user penetration of 12% and 5.4 million crypto app downloads in 2025 signal deep and growing retail engagement.

Colombia is an early-warning market to watch. The peso's 5.3% depreciation in 2025 and deepening fiscal crisis are driving stablecoin inflows in a pattern that mirrors Argentina's trajectory in earlier years. If Colombia's macro situation deteriorates further, crypto adoption could accelerate.

There is also an exchange concentration risk at play. Binance crypto exchange is the primary exchange for over 50% of LATAM crypto users. If the exchange faces any regulatory action, operational disruption, or competitive shock, it could have an outsized market impact.

Bottom line

Latin America's crypto market has entered a new phase. The structural drivers that caused initial crypto-demand in the region have not gone away: inflation, remittances, financial exclusion, and currency instability are all still at play.

What has changed is the layer being built on top of them. Institutional infrastructure, regulatory frameworks, corporate treasury adoption, and global exchange capital flowing into a region that was, until recently, largely self-contained.

Brazil's near-250% volume growth in 2025 and its position receiving nearly one-third of all LATAM crypto are the defining market developments. Its regulatory trajectory, stablecoin policy decisions, and ETF pipeline will effectively set the tone for the region in 2026.

For traders, the headline growth figures are real, but so are the concentration risks, regulatory uncertainties, and country-level divergences that sit beneath them.

The US Dollar Index (DXY) is a popular tool used by forex traders to assess the value of the US dollar relative to a basket of other major currencies. The DXY is calculated using the weighted average of six major currencies: the euro, yen, pound sterling, Canadian dollar, Swedish krona, and Swiss franc. To use the DXY to trade forex, you can follow these steps: 1.

Monitor the DXY: Keep an eye on the movements of the DXY to get a sense of the overall strength or weakness of the US dollar. You can use technical analysis tools, such as moving averages or trend lines, to identify the direction of the trend. 2. Analyse currency pairs Look for forex pairs that are inversely correlated to the DXY.

This means that when the DXY goes up, the currency pair goes down, and vice versa. For example, the EUR/USD pair is negatively correlated to the DXY, which means that as the DXY goes up, the EUR/USD pair goes down. Plan your trades Once you have identified a currency pair that is inversely correlated to the DXY, you can plan your trades accordingly.

For example, if the DXY is showing signs of weakness, you may want to consider going long on a negatively correlated currency pair, such as the EUR/USD. Manage your risk As with any trading strategy, it's important to manage your risk when using the DXY to trade forex. Make sure to use stop-loss orders to limit your losses in case the market moves against you.

Currency pairs may be influenced by other factors besides the DXY, which may not be a perfect indicator of the US dollar's value. To make informed trading decisions, it is important to combine the DXY with other technical and fundamental analysis tools.

Bollinger Bands are one of the most popular indicators that FX and CFD traders use, invented in the 1980’s they are a technical analysis tool that are widely used by short and long term traders. The main uses for Bollinger Bands is determining turning points in the market at oversold and overbought levels and also as a trend following indicator. Like any technical indicator Bollinger Bands should be used with your own analysis to confirm trades and help set entry and exit levels, they are a fairly simple indicator that focuses on price and volatility only and shouldn’t, in my opinion be used in isolation.

While effective, to use them successfully you will need to be aware of the fundamentals and other technical indicators such as major support or resistance levels. How Bollinger Bands are calculated Bollinger Bands are composed of three lines. The middle line is a simple moving average (SMA), the default period being 20.

The upper and lower bands are the SMA plus or minus 2 standard deviations by default, the SMA period and Deviations can be adjusted in the settings of the indicator if desired, but the standard settings are the most popular settings among traders. When the price hits the upper band the market could be seen as “overbought” when it hits the lower band it could be seen as “oversold”, they can also be used as levels where trends are confirmed, e.g. hitting upper band could be seen as the start of a strong uptrend and vice versa. Day Trading strategies using Bollinger Bands Bollinger Bands are used mainly in two different trading styles, for contrarians looking for overbought and oversold levels to enter fade trades, or confirmation of trend for trend following systems. Both systems have their pros and cons, as with most indicators it will depend on the market “fee” for the time used, a choppy whipsawing market will see the fading system work very well, a strong trending market will see the trend following system work very well.

As with any technical system, the selection of the market to trade and being aware of the fundamentals driving the FX market at that time are critical.. Just had a Fed meeting where they surprised with a 100bp rate hike? Don’t use the fade system on USD pairs!

A good technical system I have found is useful is a mixture of both of these strategies, using the Bollinger Bands to confirm a trend, then using the fading strategy to trade pullbacks of this trend. Lets look at the example below from the AUDNZD – 5 minute chart from the 23 rd March 2023 In the above example, which is a common price action across all FX pairs, you would be using the Bolling Bands to confirm a down trend after a close below a major low. Once the possible trend is confirmed, we will be using the “overbought” level of the upper band to enter a short trade, with a take profit exit on 2 closes below the lower band, indicating the market may have gone into “oversold” territory and was time to take some money off the table.

This process would be repeated while lower highs were being made, a close above a major recent high along with a close above the upper Bollinger Band would indicate the trend may have come to an end. This can be seen on the chart below, later in the session on the same pair. At this point you would exit the short selling of the down trend and reverse to a long bias, or if your analysis on fundamentals were negative for this pair, wait for a new downtrend to form for another shorting run.

The Bollinger Squeeze Strategy Another strategy popular with FX traders is known as the Bollinger squeeze strategy. A squeeze occurs when the price has a big move, then consolidates in a tight range, this also sees the Bollinger bands go from wide to “squeeze” in a much narrower range, hence the name of the strategy. A trader would be looking for a breakout and close below or above the Bollinger bands of this squeezed range for a trade entry, see the example below from the EURUSD 5 Minute chart on 23 rd of March 2023 When the price breaks through the upper or lower band after this period of consolidation a buy or a sell signal is generated.

An initial stop is traditionally placed just above (or below in a long position) the range of the consolidation. TP rules could be similar to the previous strategy, i.e. multiple closes below the lower Bollinger Bans in the case of a short, or using the middle Bollinger Band as a trailing stop in the move is explosive and looks to continue. Summary As you can see there are multiple uses for Bollinger Bands in a FX day traders toolbox, including using them for overbought and oversold trade signals in a trending market and the Squeeze strategy where an explosive move often follows a period of consolidation.

There are also many more strategies using this indicator which I encourage you to research for yourself.

Options trading offers a multitude of strategies that cater to various market conditions and risk appetites. One such strategy that traders often employ is the "Long Butterfly Spread." In this article, we will delve into the intricacies of the Long Butterfly Spread, exploring its components, mechanics, and potential advantages. At its core, the Long Butterfly Spread is a neutral options strategy that traders utilize when they expect minimal price movement in the underlying asset.

It involves using a combination of long and short call or put options with the same expiration date but different strike prices. This strategy is particularly useful when you anticipate that the underlying asset will remain relatively stable within a specific range. To construct a Long Butterfly Spread, you'll need to execute three transactions with options contracts.

Let's break down the components: Buy Two Options: The first step involves buying two options contracts. These contracts should be of the same type, either both calls or both puts, and share the same expiration date. One of these options should be an "in-the-money" option, while the other should be an "out-of-the-money" option.

Sell One Option: The next step is to sell one options contract, which should be positioned between the two contracts purchased in the previous step. This sold option should have a strike price equidistant from the two bought options and, like them, should also have the same expiration date. Now, let's understand the mechanics of the Long Butterfly Spread and how it can generate profits: Profit Potential: The Long Butterfly Spread is designed to profit from minimal price movement in the underlying asset.

It thrives in a scenario where the underlying asset closes at the strike price of the options involved in the strategy at expiration. In such a case, the trader reaps the maximum profit, which is the difference between the two middle strike prices minus the initial cost of the strategy. Limited Risk: One of the key advantages of the Long Butterfly Spread is its limited risk profile.

The maximum potential loss is capped at the initial cost of establishing the strategy, making it a prudent choice for risk-averse traders. This risk limitation is due to the fact that the trader is simultaneously long and short options, which mitigates the potential for substantial losses. Breakeven Points: In a Long Butterfly Spread, there are two breakeven points.

The first breakeven point is below the lower strike price of the strategy, and the second breakeven point is above the higher strike price. As long as the underlying asset closes within this range at expiration, the trader will either realize a profit or minimize their loss. Implied Volatility Impact: Implied volatility plays a crucial role in the Long Butterfly Spread.

When implied volatility is low, it reduces the cost of the strategy, making it more attractive. Conversely, when implied volatility is high, the strategy's cost increases, potentially affecting the risk-reward ratio. Therefore, traders should carefully assess implied volatility before implementing this strategy.

Time Decay: Time decay, also known as theta decay, can work in favor of the Long Butterfly Spread. As time passes, the value of the options involved in the strategy erodes. This erosion can benefit the trader if the underlying asset remains within the desired range.

However, if the asset moves significantly, it may offset the time decay benefits. Scenario Analysis: Let's consider a practical example to illustrate the Long Butterfly Call Spread. Suppose you are trading Company XYZ's stock, which is currently trading at $100 per share.

You anticipate that the stock will remain stable in the near future and decide to implement a Long Butterfly Call Spread. Buy 1 XYZ $95 Call option for $6 (in-the-money). Sell 2 XYZ $100 Call options for $3 each (at-the-money).

Buy 1 XYZ $105 Call option for $1 (out-of-the-money). The total cost of this strategy is $1 (6 - 3 - 3 + 1). Now, let's examine the potential outcomes: If Company XYZ's stock closes at $100 at expiration, you will achieve the maximum profit of $4.

The $105 call option will expire worthless so you will lose the $1 you paid, the $95 call option will make a net loss of $1 ($6 cost -$5 profit) and two $100 call options will be worth $3 each. If the stock closes below $95 or above $105, the strategy will result in a maximum loss of $1, which is the initial cost. Any closing price between $95 and $105 will yield a profit or loss within this range, depending on the precise closing price.

In conclusion, the Long Butterfly Spread is a versatile options trading strategy that offers limited risk and profit potential in stable market conditions. It is a strategy that requires careful consideration of strike prices, implied volatility, and time decay. Traders should always conduct thorough analysis and risk management before implementing any options strategy, including the Long Butterfly Spread.

When used judiciously, this strategy can be a valuable addition to a trader's toolkit for capitalizing on low-volatility scenarios.

In the intricate realm of financial markets, options trading stands as a dynamic and multifaceted approach to profiting from market dynamics. Among the diverse range of options instruments, the call option emerges as a fundamental tool. In this article, we will delve into the concept of call options, examining their definition, mechanics, and significance in the context of options trading.

A call option fundamentally operates as a financial contract, conferring a valuable right upon the holder. This right, however, is not accompanied by any obligation to purchase a predetermined quantity of an underlying asset at a specific price known as the strike price, within a predetermined timeframe known as the expiration date. This underlying asset can encompass a wide array of financial instruments, including but not limited to stocks, bonds, commodities, or currencies.

The primary attraction of call options stems from their potential for substantial leverage. In contrast to direct ownership of the underlying asset, which necessitates the full market price, obtaining a call option requires the payment of a premium. This premium constitutes only a fraction of the actual asset cost, thereby allowing traders to control a more substantial position size with a relatively modest upfront investment.

Nevertheless, it is crucial to acknowledge that leverage can magnify both gains and losses, underscoring the critical importance of prudent risk management when trading call options. To comprehend the concept of call options fully, one must dissect their key components. At the core of a call option lies several essential elements: Underlying Asset: Call options derive their value from an underlying asset.

This asset could encompass anything from stocks to indices, commodities, or other financial instruments. Strike Price: The strike price serves as the anchor point for a call option. It represents the price at which the call option holder can exercise their right to purchase the underlying asset.

Importantly, the strike price remains constant throughout the option's lifespan. Expiration Date: Every call option carries a predetermined expiration date. Beyond this date, the option becomes void if not exercised.

These options can have varying expiration periods, ranging from a matter of days to several months or even longer. Premium: To acquire a call option, the buyer must pay a premium to the seller, also known as the option writer. The premium serves as the cost of obtaining the right to buy the underlying asset at the strike price.

To illustrate the mechanics of a call option, consider the following example: Suppose an investor believes that XYZ Company's stock, currently trading at $50 per share, will experience an upswing in the next three months. They decide to purchase a call option on XYZ with a strike price of $55 and a premium of $3. This call option grants the investor the right to buy 100 shares of XYZ Company at $55 per share at any point before the option's expiration date, set three months from the present.

Now, let's explore two possible scenarios: Scenario 1 - The Stock Price Rises: Should the price of XYZ Company's stock surge to $60 per share before the option's expiration, the call option holder can opt to exercise their option. This allows them to purchase 100 shares of XYZ at the agreed-upon strike price of $55 per share, despite the current market price of $60. This transaction yields a profit of $5 per share ($60 - $55), minus the initial premium of $3.

The investor ultimately realizes a net gain of $2 per share ($5 - $3), amounting to a total profit of $200 ($2 x 100). Scenario 2 - The Stock Price Stays Below the Strike Price: Conversely, if XYZ Company's stock price remains at or below the $55 strike price, or even declines, the call option holder is under no obligation to exercise the option. In such cases, the option expires worthless, and the maximum loss for the investor is limited to the premium paid, which in this instance amounts to $300 ($3 x 100).

It is essential to note that not all call options are exercised. In fact, many call options expire without being exercised, especially when the underlying asset does not move favorably or when exercising the option would result in a loss exceeding the premium paid. The decision to exercise or not to exercise a call option lies entirely with the option holder, adding a layer of flexibility to this financial instrument.

Call options find utility across a spectrum of investment strategies. Beyond speculative trading, they can serve as effective hedging tools. For instance, an equity investor concerned about a potential market downturn might purchase call options on an index to offset potential losses in their portfolio.

This strategy allows them to profit from the call options if the market experiences an upswing while limiting their losses if it takes a downturn. In conclusion, call options represent a pivotal component of options trading, offering traders and investors a powerful mechanism to capitalize on upward price movements in various assets. By grasping the fundamental elements of call options, including the underlying asset, strike price, expiration date, and premium, individuals can make informed decisions and implement strategies to align with their financial goals.

However, it's imperative to bear in mind that options trading involves inherent risks, necessitating proper education and risk management strategies before venturing into these markets.

The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset (the bid) and the lowest price a seller is willing to accept to sell it (the ask or offer). This spread is a fundamental element of market liquidity and represents the transaction cost that traders need to consider when entering and exiting positions. For example, if there is a spread of 1 pip between buyers and sellers, this represented the cost of trade taken.

It is worth pointing out at this stage the much is made of the “spread” in comparison between the value that one broker may offer versus another. However, there are far more influential factors that determine the success or otherwise of trading such as determining high probability entries, effective risk management and appropriate profit taking exits. This is particularly the case for retail investors who trade smaller contract sizes, as opposed to institutional traders, who often trade much larger sizes of trade ad so small differences in spread will have more impact.

Nevertheless, some understanding of the bid/ask spread, and how this may alter at various points during the trading day is important. Factors influencing bid-ask spread Although there are more, we have focused on the top eight factors we think are of not only most influential but have trader relevance. Asset Liquidity: A highly liquid market usually has a smaller bid-ask spread.

When there are more market participants interested in trading a specific asset, there are more bids and asks available, which narrows the spread. In essence, the abundance of buyers and sellers in a liquid market reduces the difference between the buying and selling prices. Trading Volume: Similar to liquidity, higher trading volume often leads to a narrower spread.

Increased trading activity means more frequent transactions, which can reduce the spread. Active markets tend to have more competitive pricing due to the large number of transactions taking place. Asset Volatility: Increased volatility usually results in a wider spread.

When an asset's price exhibits rapid and unpredictable movements, market makers and traders face higher risk. To compensate for this risk, they set wider spreads. This is often observed when major economic data or news is released, causing abrupt market movements.

Market Hours: Spreads might be wider during market open and close due to uncertainty and reduced liquidity. This phenomenon is often seen toward the end of market hours and the beginning of new trading sessions. Additionally, some assets may have wider spreads when traded outside their primary market hours, such as futures contracts associated with indexes that are closed during specific times.

Asset Popularity: Well-known assets usually have tighter spreads compared to less popular instruments. For example, in the Forex market, currency pairs are categorised by liquidity. Major pairs like EUR/USD tend to have tighter spreads because they are highly popular among traders.

Exotic pairs, on the other hand, have wider spreads due to their lower trading activity e.g., US Dollar/Polish Zloty (USDPLN) Regulatory Environment: The level of regulation in a market can influence the spread. Forex markets, for instance, are less regulated compared to stock markets with centralized exchanges. This can lead to comparatively wider spreads in forex trading, as there is no central authority to standardize pricing.

Transaction Size: Large orders can impact the spread, making it wider, especially in less liquid markets. When a trader places a substantial order, it can temporarily disrupt the supply and demand balance in the market, causing a wider spread until the order is executed. Technological Factors: Faster trading systems and networks can lead to tighter spreads.

Advanced technology allows for more efficient matching of buyers and sellers, reducing the spread. High-frequency trading and electronic communication networks (ECNs) contribute to this efficiency by facilitating quicker trade executions. Other factors to consider with the bid-ask spread Slippage and Spread: A significant aspect to consider in trading is slippage, which refers to the difference between the expected price of a trade and the actual price at which it is executed.

A wider spread, indicating a larger gap between the bid and ask prices, can increase the risk of slippage. This happens because, in volatile markets or with wider spreads, it becomes more challenging to execute trades at the precise desired price. Traders may experience slippage when their orders are filled at a different, often less favourable, price due to market fluctuations.

Therefore, traders should be acutely aware of the potential impact of spread size on the likelihood and extent of slippage, especially when trading in fast-moving markets. Stop Placement and Spread: As spreads widen, it's crucial to consider their influence on stop-loss orders. Stop-loss orders are designed to limit potential losses by automatically triggering a trade closure when the asset's price reaches a specified level.

However, an increasingly wider spread introduces the possibility that the spread alone could trigger the stop-loss order. This is particularly relevant when the stop level is set close to the current market price or price has moved towards the stop. Traders need to strike a balance between setting stop levels that provide adequate protection and avoiding premature triggering due to spread fluctuations.

Having a good understanding of the typical range of spreads for the assets they are trading can help traders make more informed decisions when placing stop orders to manage risk effectively. Alternative accounts and differing spreads Some brokers offer different types of platforms that may offer tighter than the spread associated with a standard account. Often, there is a small brokerage payable for such accounts and the trader must decide which is the best option for them.

If you are interested in looking at different account types with different spread at GO Markets then drop our support team an email at [email protected] and we would be delighted to walk you through the options that are available to you. Summary Understanding the bid-ask spread is important for traders as it has the potential to affect many aspects of trading including costs, strategy, risk management, and perhaps even market interpretation. Although there are significantly more influential factors on your potential trading outcomes than the width of the spread, if treating your trading as a business, which arguably is the right approach to have, then knowing about such factors and their impact would seem prudent.

A rights issue, also known as a “rights offering”, is a method that companies use to raise additional capital from their existing shareholders. It involves offering the right to purchase additional shares of the company's stock at a discounted price while maintaining their proportional ownership in the company. This is how the rights issue process typically works: Announcement: The company announces its intention to conduct a rights issue, often through an exchange announcement.

It may, or may not, involve a temporary trading halt by the exchange prior to the announcement for a specified period of time. The rights issue announcement includes details such as the number of additional shares being offered, the price at which these shares can be purchased (usually at a discount to the current market price), and the ratio of shares offered for each share held. Subscription Period: During a specified subscription period, existing shareholders can decide whether to exercise their rights to purchase the additional shares.

The number of additional shares each shareholder is entitled to purchase is determined based on the ratio specified in the announcement. Discounted Purchase Price: The purchase price for the additional shares is typically lower than the current market price of the company's stock. This discount serves as an incentive for shareholders to participate in the rights issue.

For example, assume you already own 100 shares in Company A. Shares in Company A are currently trading at $25. The company wants to raise money, so it announces a rights issue at $20 a share, with the offer open for 30 days.

It sets a conversion rate of one for five. This means eligible shareholders can buy one additional share for every five shares they currently own. The result is you can buy 20 new equity shares for $400, a discount of $100 on the current market price.

Proportional Ownership: By participating in the rights issue, shareholders can maintain their proportional ownership in the company. If they choose not to participate, their ownership percentage might decrease as the total number of shares outstanding increases. The Rights Issue Discount The discount offered in a rights issue can vary widely depending on various factors, including the company's objectives, current market conditions, and the urgency to raise capital.

There is no standard discount that applies to all rights issues, and the discount offered can vary considerably, ranging potentially from around 10% to 40% below the current market price of the stock. Factors impacting the level of the discount offered include: Company's Financial Situation: If the company urgently needs to raise capital, it may offer a larger discount to incentivize participation. Market Conditions: Prevailing market sentiment and volatility can influence the discount.

In a bearish or uncertain market, a more significant discount might be required to attract investors. Investor Sentiment: If the company is well-regarded and the rights issue is perceived positively, a smaller discount might suffice. Purpose of Raising Capital: The reason behind the capital raise (e.g., funding an exciting growth opportunity versus covering debt) can impact investor interest and, therefore, the required discount.

Size of the Issue: The number of shares being issued can affect the discount. A larger issue might require a bigger discount to ensure full subscription. Regulatory Considerations: In some jurisdictions, regulations might set guidelines or limitations on the discount that can be offered.

Recent examples of ASX rights issues Rights issues are common. Here are a few examples from 2022 including the discount offered and purpose. Atlas Arteria Group (ASX: ALX) conducted a 1 for 1.95 non-renounceable rights offer to raise $3,098 million to fund its acquisition of a 66.67% interest in the Chicago Skyway toll road.

Domain Holdings Australia Ltd (ASX: DHG) conducted a 1-for-12.33 non-renounceable rights offer to raise $180 million needed to acquire Realbase Pty Ltd, a real estate campaign management technology platform. Regal Partners Ltd (ASX: RPL) conducted a 1-for-5 non-renounceable rights issue to increase the free float and shareholder base and fast-track the execution of its diversified growth strategy. Healthia Limited (ASX: HLA) conducted a 1-for-12.5 non-renounceable rights issue to provide additional cash reserves to fund near-term acquisition opportunities and provide financial flexibility.

GUD Holdings Limited (ASX: GUD) conducted a 1 for 3.46 non-renounceable rights issue in conjunction with an institutional placement in late 2021, raising $405 million to acquire AutoPacific Group, a designer and manufacturer of automotive and lifestyle accessories. The Market Response to a Rights Issue: The market's view of a rights issue can be influenced by several factors and can vary widely based on individual investor perspectives, market conditions, and the specific details of the rights issue. As part of the announcement and as previously referenced, it is in the company’s interest to effectively communicate the purpose and potential benefits of the rights issue to address investor and market concerns, so creating positive sentiment in an attempt to both support the current share price and encourage participation.

Positive Views: Opportunity to Increase Ownership: Investors who believe in the company's growth prospects might view a rights issue as an opportunity to increase their ownership at a discounted price. This can be seen as a way to acquire more shares at an attractive valuation level. Capital Injection: A rights issue can provide the company with additional capital that it can use to fund expansion, invest in new projects, or reduce debt.

If the market sees these moves as value-enhancing, it could view the rights issue positively. Strengthened Financial Position: If the company uses the proceeds from the rights issue to improve its balance sheet or address liquidity concerns, the market may see it as a positive step toward financial stability. Neutral Views: Dilution Concerns: Existing shareholders might be concerned about potential dilution of their ownership if they choose not to participate in the rights issue.

However, this concern might be mitigated if the discount offered in the rights issue is attractive enough to compensate for the dilution. Market Conditions: The market's overall sentiment and conditions can impact how a rights issue is perceived. In a bullish market, investors might be more willing to participate, while in a bearish market, they might be more cautious.

Negative Views: Sign of Financial Difficulty: In some cases, a rights issue might be interpreted as a sign that the company is facing financial challenges and needs to raise capital urgently. This could lead to concerns about the company's stability and future prospects. Misallocation of Funds: If investors perceive that the proceeds from the rights issue are being misused or not being deployed in a value-accretive manner, it could lead to scepticism about the company's management decisions.

Stock Price Reaction: The announcement of a rights issue can lead to a significant decline in the company's stock price, especially if investors are concerned about potential dilution or question the company's motives. Summary: Participation in a rights issue is a strategic decision that must take into account multiple factors, and there is no one-size-fits-all answer. Shareholders considering participating in a rights issue should evaluate the discount in the context of their understanding of the company's value and prospects, possibly in consultation with a financial professional.