- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Australian Housing Market

- The current state of the housing market

- How the recent cycle is unprecedented

- The impact on the macroeconomy.

News & analysis“Australians watch housing markets carefully, perhaps more so than citizens of any other country.”

Speaking at the Australian Financial Review’s annual business summit, RBA Governor Philip Lowe talked about the Housing Market and the Economy. The Governor spoke about:

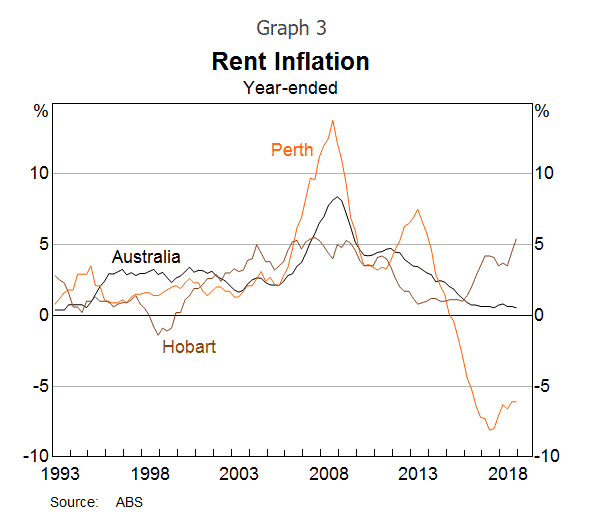

The Housing sector remains a worrying factor for the Australians and the RBA. The Governor commented on how the nationwide housing prices increased by almost 50% from 2013 to 2017. The declines have been more pronounced in Sydney and Melbourne because the increase in prices was also more prominent in those two areas. He also stated how rent inflation has been weak in most places to the exception of Hobart.

The interesting takeaway from the speech is how the subsequent decline in the housing markets was unprecedented. Despite an increase in mortgage rates by the big four, borrowing costs remain relatively low. The unemployment rate is also going down which means that the falling prices are not directly related to interest rate and unemployment.

Philip Lowe provided some insights on the factors driving the housing market at the moment:

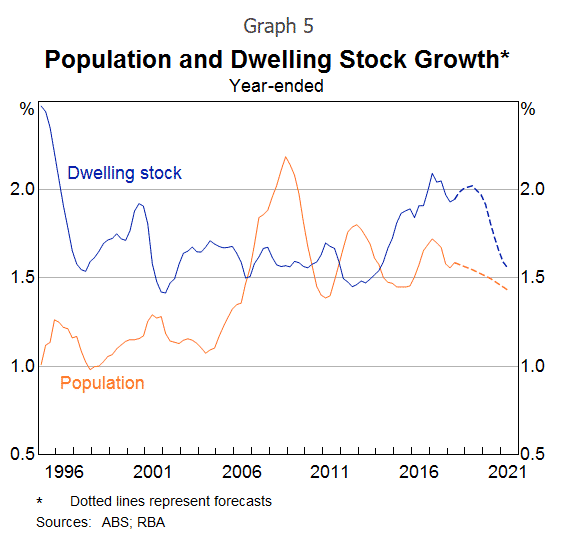

“It is useful to start with the national picture (Graph 5). Australia’s population growth picked up noticeably in the mid-2000s, and it took the better part of a decade for the rate of home building to respond. It took time to plan, to obtain council approvals, to arrange finance and to build the new homes. Not surprisingly, housing prices went up. Eventually, though, the supply response did take place. Over recent times, the number of dwellings in Australia has been increasing at the fastest rate in more than two decades. Again, not surprisingly, prices have responded to this extra supply.”

Another critical factor is that the foreign demand coming from China has waned.Lenders became more risk averse impacting the credit availability.

The housing sector is having a rippling effect on the macroeconomy. Wage growth adds another layer of uncertainty because expectations of future income growth have been revised down and coupled with falling home values, consumer spending is taking a hit. Investment in real estate is also likely to be sidelined.

However, the RBA is still expecting “that as the labour market tightens, wages growth will increase further. In turn, this should boost household income and spending and provide a counterweight to the fall in housing prices. The pick-up in spending is, in turn, expected to put upward pressure on inflation. Of course, it is possible that inflation could move higher for other reasons, although the likelihood of this at the moment seems low. This means that a lot depends upon the labour market.”

The Governor concluded that they have the flexibility to adjust monetary policy in either direction as required.

*Full Speech available on www.rba.gov.au

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk .

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Margin Call Podcast – S1 E8: Adam Taylor | Head of GO Markets London

Adam Taylor (Linkedin) is a Director of GO Markets London. Adam has a brilliant ability to see patterns, whether it’s playing Chess, or using Point & Figure Analysis to better understand the sentiment in the market. This chat was a great insight into what makes a GO Markets London Director tick, plus how things are looking within the UK. ...

March 6, 2019Read More >Previous Article

Know the Score: Holding Costs of Daily Fx Positions

Many traders consider trading daily timeframes but when used to trading the shorter timeframes, overnight holding costs of positions may not be someth...

March 5, 2019Read More >Please share your location to continue.

Check our help guide for more info.