- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

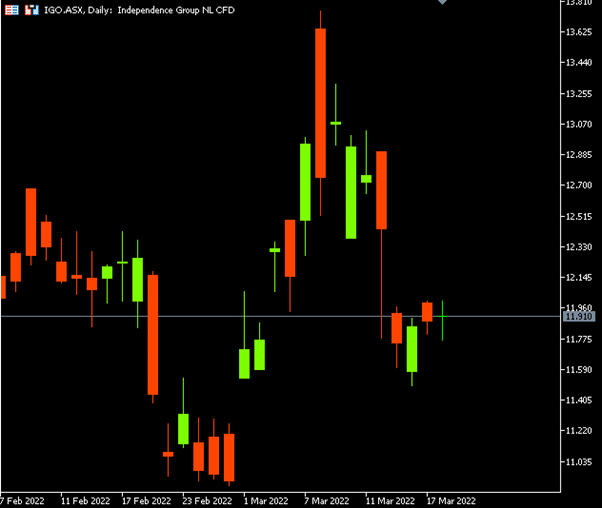

- IGO’s big buyout delayed by nickel’s current volatile prices

- Home

- News & analysis

- Economic Updates

- IGO’s big buyout delayed by nickel’s current volatile prices

News & analysisNews & analysis

News & analysisNews & analysisIGO is a Nickel, Gold and Copper-Zinc silver mining, development and exploration company. They are based in Western Australia and control an array of mining companies.

The London Metals Exchange (LME) halted nickel trading on March 8th after an unprecedented price spike. This has forced IGO to delay their $1.09 billion buyout of Western Areas. The price spike is also causing a nightmare for brokers as they struggle to pay margin calls against heavily unprofitable short positions.

Western Areas shareholders had voted to push the all cash buyout offer to May, which is a month later than expected.

In a public statement, the IGO board announced that the move was in response to “the recent significant nickel price volatility” and they expect the deal to close by May/June.

IGO’s share price ended the week at $11.91, which is a 15% drop from last week’s high of $13.75.

“The Western Areas board and the Independent Expert are continuing to consider the implications, if any, on nickel market fundamentals and expectations for medium to long-term nickel prices,” IGO said.

Western Areas shareholders will receive a scheme booklet in April. This booklet will contain an independent expert’s assessment of whether IGO’s $3.36 per share offer is fair and reasonable.

The price of nickel has spiked briefly above $100,000 USD a tonne on the exchange. This was largely due to a short squeeze that had a major Chinese Bank in hot water. The spike has also spurred on the LME’s extreme decision to halt nickel trading.

The LME’s decision was the first time it has halted trading since the collapse of an international tin cartel in 1985. The decision came as Xiang Guangda, owner of Tsingshan, made a short position on the nickel. The price spike left Tsingshan exposed to $8 billion USD of trading losses whilst struggling to meet their margin calls.

The price continued to climb higher as one of the world’s largest nickel producers, Russia decided to invade Ukraine. As the market was picking up on the short squeeze of Tsingshan, the LME had decided to intervene.

All in all, the volatility of the price of nickel coupled with the LME’s decision to halt trading has left IGO in a tricky position in regards to the Western Areas buyout. They have reassessed the situation and have made a decision to push the completion date back a month.

If you would like to take this opportunity to invest in IGO and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Source: GO Markets, IGO, ASX, Bloomberg, AFR

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

ASX’s market volatility stabilised with record setting dividends

Investors in Australian-list companies will receive a wave of cash into their bank accounts over the following months. This will provide some much needed stability for the Australian Stock Exchange as investors celebrate the richest recorded interim reporting session in corporate history. February’s earnings season had a record $36.3 billion i...

March 21, 2022Read More >Previous Article

Indices finish the week on a high as the technology sector builds momentum

Global indices ended the week on a high as the US indices all recovered some of their recent sell offs. The Nasdaq was the strongest performer risi...

March 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.