- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The week ahead – ECB, RBA, BoC and Fed headline a data heavy calendar

- Home

- News & analysis

- Economic Updates

- The week ahead – ECB, RBA, BoC and Fed headline a data heavy calendar

News & analysisNews & analysis

News & analysisNews & analysisThe week ahead – ECB, RBA, BoC and Fed headline a data heavy calendar

5 September 2022 By Lachlan MeakinGlobal equities saw a steep sell-off last week as economic concerns, the European energy crunch and increasingly hawkish Central banks weighed on market sentiment and saw investors paring back on risk assets.

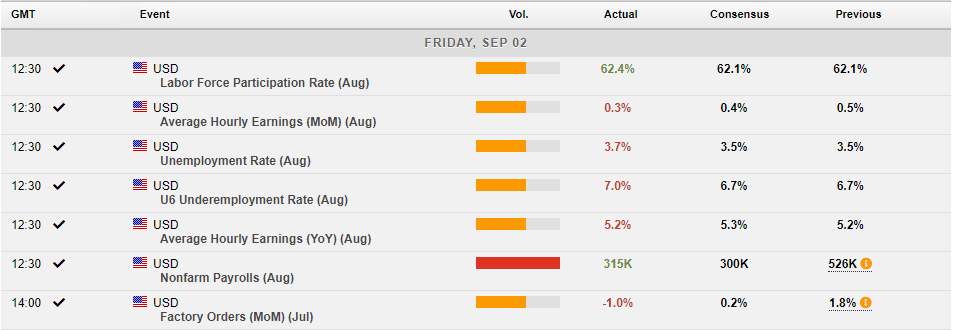

Friday’s session saw a mixed Non-farm payroll announcement, with a beat on the headline figure offset by weaker than expected wage growth and an unexpected increase in the unemployment rate causing some volatility in the markets. Overall the cooling wage growth had traders rethinking the perceived Fed rate path and saw an initial rally in equities, which faded strongly later in the session on European energy concerns and traders squaring up before the Labor day holiday weekend in the US.

The upcoming week is all about Central banks, with the RBA, ECB and BoC releasing rate decisions and Fed chair Jerome Powell set to give a speech at the Cato Institute’s Annual Monetary Conference on Thursday.

FOMC

Rates markets are favouring a 75bp hike from the Fed at their 21st September meeting, though after Fridays NFP figure showing a slowing down in wage growth, the odds shifted slightly to the dovish side, with bond traders now pricing in a 56% chance of a 75 hike, down from 61% at the start of the trading week.

Despite this repricing, The US dollar continued to rally breaking big psychological levels on the Euro (under parity) and the JPY (breaking through the 140 level) as it’s safe haven status continued to play out.

Jerome Powell’s comments on Thursday will be his last before the Fed enters its blackout period, so will be especially watched for any clues as to the Feds move later in the month.

Canada – BoC

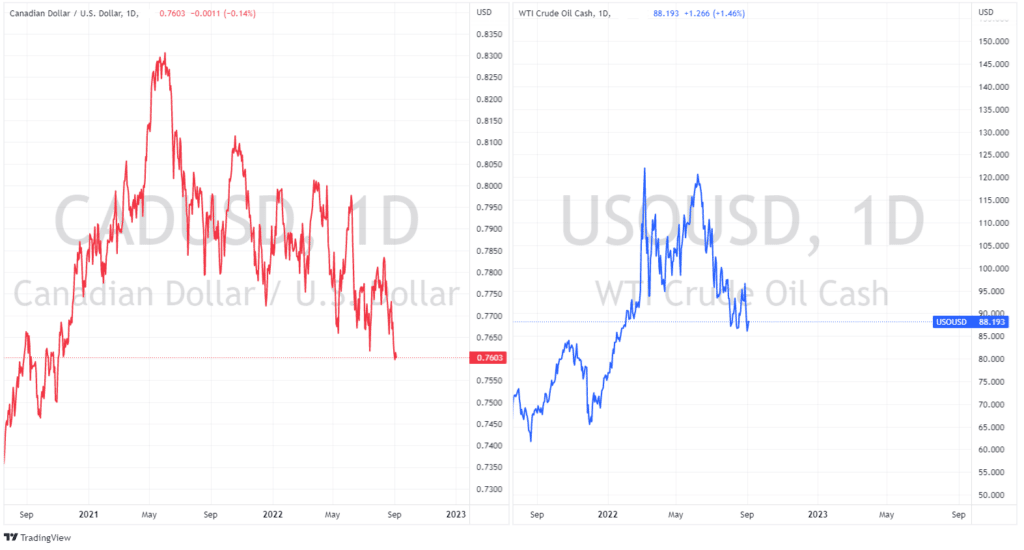

After Julys supersized 100bp hike, the BoC looks set to hike another 75bp on Wednesday, with inflation still well above target and a relatively strong economy should see it unlikely the BoC will switch back to a more modest 50bp move. This should see the CAD catch some support after a drop in oil prices last week put some pressure on it.

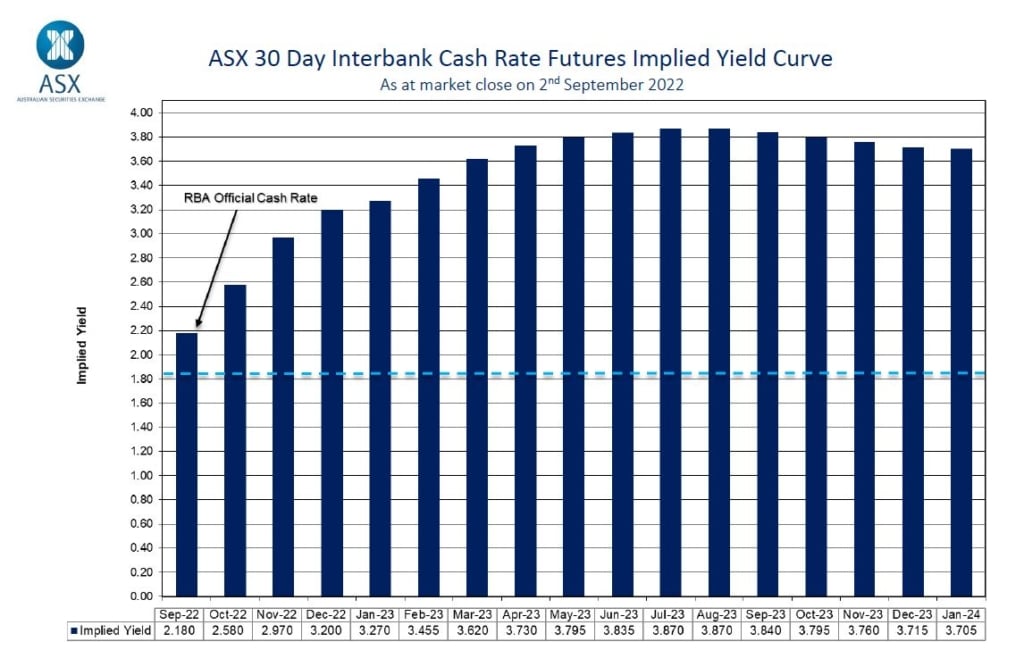

Australia – RBA

Tuesday’s meeting is set to an interesting one, with markets fairly split on whether the RBA will hike 25 bp or 50bp in their September meeting. The RBA would have taken comfort in the 2Q22 wages price index, which showed a growth rate of only 2.6% year-on-year, softer than had been expected, but with inflation still well above their target band coupled with a weakened AUD will probably see them deliver a 50bp hike. Rates markets are still predicting Australia hits a 3.2% by the end of the year, a 25bp hike at this meeting would risk putting the RBA behind the curve, again.

Europe – ECB

Septembers ECB meeting on Thursday is also sure to produce some fireworks with a real battle between the hawks and the doves being evident among ECB members. A 5obp hike seems to be the most likely, being a compromise and with evidence of a real slowdown in the European economy is easier to justify. Saying that 75bp is on the table as the ECB may want front load rates now, before the predicted winter recession is in full effect. Either way, it is bound to see some volatility in the EUR and European indices. Another factor is the dramatic collapse in the EURUSD rate, with it trading consistently below parity and having some of the ECB hawks calling for higher rates to support it.

All in all, a very interesting week in global markets is ahead and should set the tone for trading for the rest of Q3.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Energy crunch a weak GBP and a Recession, what is going on?

The World and the European region are amid an energy crisis. With, the remnants of Ukraine and Russian crisis still lingering countries such as Germany and England are suffering as they struggle to keep up with the prices. The price of Natural Gas is nearly 5 times the price of what it was a year ago and Coal Prices soaring to all-time highs. ...

September 6, 2022Read More >Previous Article

Brent testing critical level again

Brent Crude oil much like many other commodities has seen its value drop on the back of a strong US dollar and weaker demand forecasts. With...

September 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.