- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US equities mixed but hold post-Powell gains ahead of today’s NFP report

- Home

- News & analysis

- Economic Updates

- US equities mixed but hold post-Powell gains ahead of today’s NFP report

News & analysisNews & analysis

News & analysisNews & analysisUS equities mixed but hold post-Powell gains ahead of today’s NFP report

2 December 2022 By Lachlan MeakinAfter Wednesday’s explosive up move on what was seen as dovish comments from Fed chair Jerome Powell, Thursdays US session was more of a consolidation ahead of today’s all-important NFP figure.

Us indexes were mixed, with falling treasury yields favouring Tech and hurting banks , seeing the Nasdaq as the only index to eke out a gain for the session.

The S&P 500 did manage to hold the important 200 day Moving Average which it surged through on Wednesday, this has been stiff resistance on previous rallies and bodes well for market bulls.

US 10 year yields continued to tumble as the market dovishly re-prices Fed interest rate expectations, sinking below 3.5% at one stage in the session and putting pressure on the USD.

This drop in treasury yields saw a big win for precious metals with Gold and Silver soaring, XAUUSD breaking through the psychological 1800 level and testing the resistance from the highs set in August.

Bitcoin tested the top of its $16k – 17k range, which it has been meandering in since the FTX fraud shock in November.

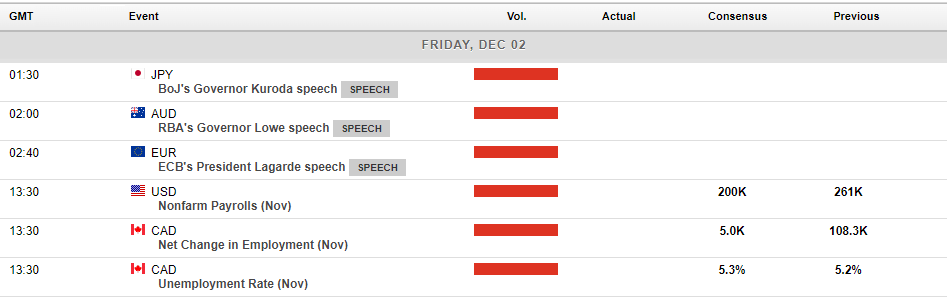

Today’s economic announcements will be dominated by the Non-Farm payroll report released an hour before the US stock market opens. A strong figure of 200k new jobs created has been forecast, but some pundits are predicting a much lower figure based on the way the rates markets are trading and other indicators, if that comes to pass expect a steep rally in equities on the “bad news is good news” narrative.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Hold up, the ASX200 is only 4% off its all-time high

It has been a tough year for the stock market in 2022 with a war in Eastern Europe and record high inflation have dominating the news. Furthermore, the drop in growth assets has been spectacular. Bitcoin has capitulated by almost 77% and the once exuberant technology sector has suffered some of its worst losses in years, with the FANG stocks droppi...

December 2, 2022Read More >Previous Article

Salesforce tops Q3 estimates, Co-CEO steps down

The world’s leading customer relationship management company Salesforce Inc. (NYSE: CRM) announced its latest financial results after the market clo...

December 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.