- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US markets break winning streak after post CPI exuberance, cryptos down again

- Home

- News & analysis

- Economic Updates

- US markets break winning streak after post CPI exuberance, cryptos down again

News & analysisNews & analysis

News & analysisNews & analysisUS markets break winning streak after post CPI exuberance, cryptos down again

15 November 2022 By Lachlan MeakinThe US equity post CPI rally of last week ran out of steam in Mondays session as consumer inflation expectations rose and mixed messages from Federal Reserve members saw a choppy first half of the session only to see a steep decline into the close with the Dow Jones ultimately finishing down 211 points (-0.63%)

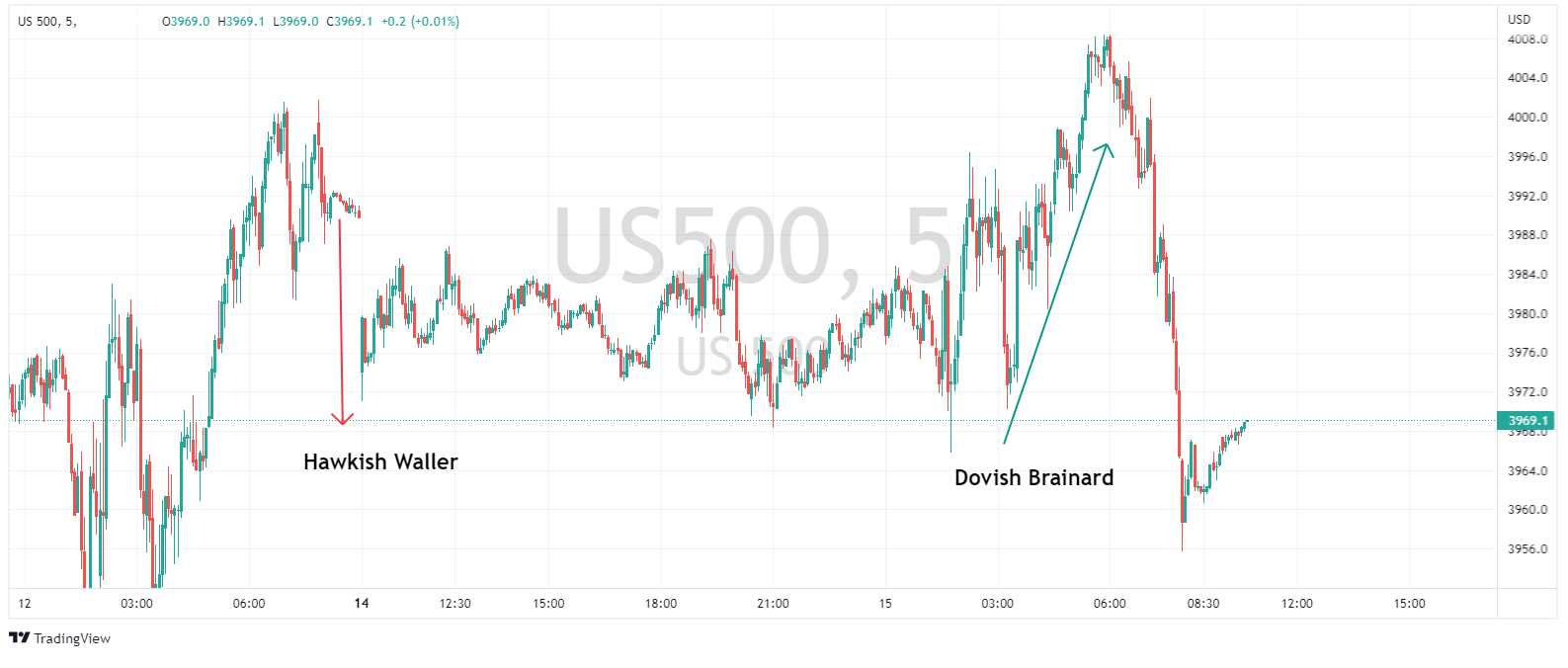

Futures opened Monday with a gap down after hawkish comments on Sunday from Fed Governor Waller who warned the market was getting ahead of itself in calling the top in inflation and a Fed pivot. Markets then recovered as Fed Vice-chair Brainard said in a Bloomberg interview that it is probably appropriate to “soon” move to a slower pace of rate hikes, though this optimism didn’t last with equities selling off in the second half of the session. With a dearth of major figures to be released before the next Fed meeting in 4 weeks any comments from Fed members have taken on extra importance as to clues of what’s coming from the Fed next.

In FX the USD Index had a choppy, low volatility session to ultimately slightly stronger, The greenback attempted to pare some of its losses after last weeks CPI, but was ultimately unsuccessful as it could not maintain its European morning strength through the NY session. AUD was the relative G10 outperformer, seeing marginal gains against the Dollar, with AUDUSD trading in a tight range between 0.67239-66637.

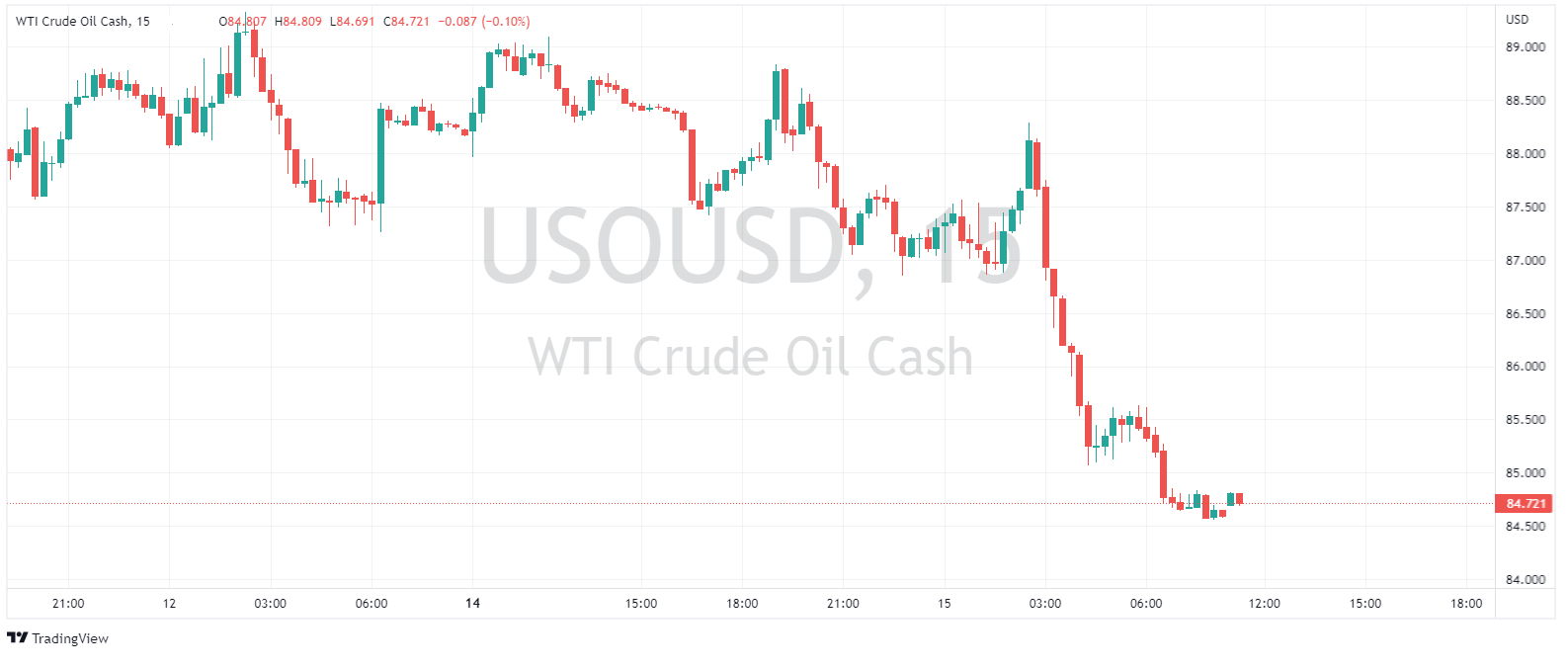

Oil prices were lower Monday with surging Beijing COVID cases and a mixed Dollar hitting the demand outlook, selling through the whole session to settle at the lows of the session with US Crude settling below $85 per barrel.

Cryptos, which everyone is watching after last week’s steep FTX inspired sell-off had another volatile session, with Bitcoin which was hammered to session lows just minutes before stocks were also hit, with confidence in the Cryptoverse shaken by the implosion of FTX, the volatility looks set to continue for now.

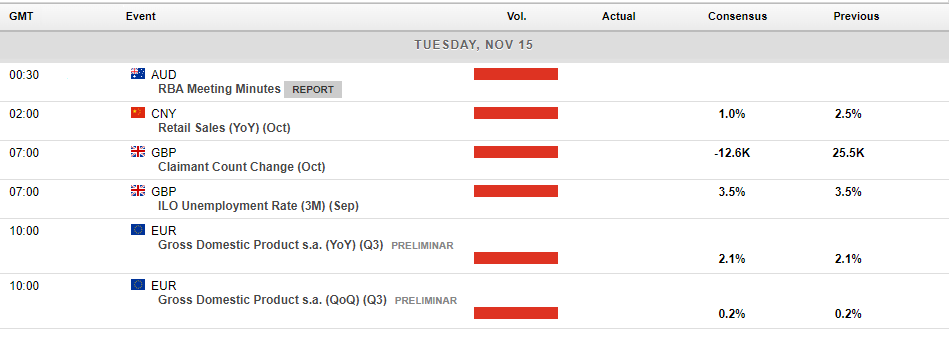

Today’s upcoming economic releases:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Walmart posts better-than-expected Q3 results – shares move higher

Walmart Inc. (NYSE: WMT) announced its latest financial results before the market open in the US on Tuesday. World’s largest supermarket chain reported total revenue of $152.8 billion for the quarter (up by 8.7% year-over-year) vs. $147.668 billion expected. Earnings per share reported at $1.50 per share (up by 3.4% year-over-year) vs. $1.3...

November 16, 2022Read More >Previous Article

Soft CPI figure sees Stocks, Bonds and Gold soar as the USD and yields collapse

Risk on was definitely back on in Thursdays US session after a softer than expected October Core CPI print, coming in at 0.3% vs the expected 0.5%, co...

November 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.