- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US stocks rally as banking sector fears ease, USD and Gold down, Yields up

- Home

- News & analysis

- Economic Updates

- US stocks rally as banking sector fears ease, USD and Gold down, Yields up

News & analysisNews & analysis

News & analysisNews & analysisUS stocks rally as banking sector fears ease, USD and Gold down, Yields up

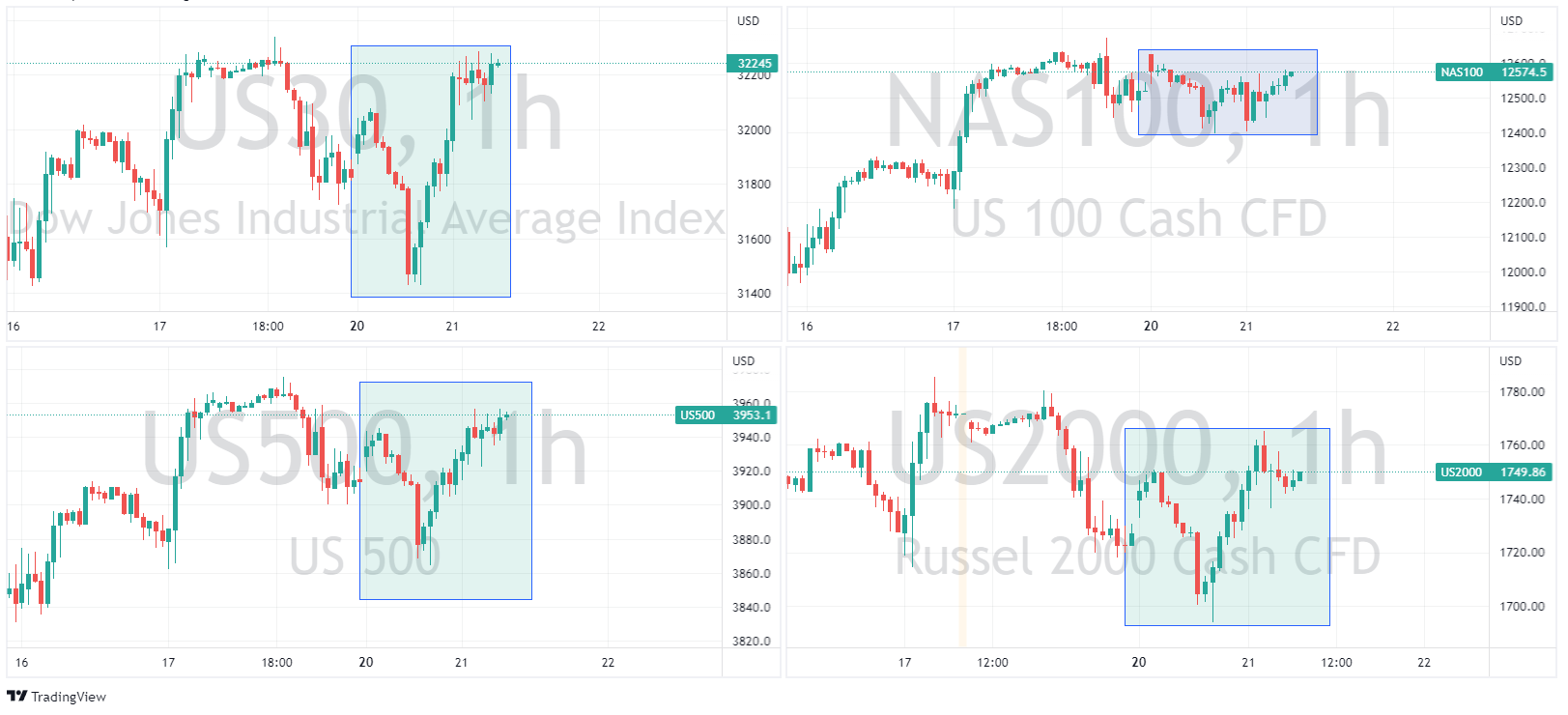

21 March 2023 By Lachlan MeakinUS markets rose modestly in Mondays session on a more positive tone in the banking sector following on from the UBS – Swiss government bail out of Credit Suisse over the weekend and hopes US banking regulators would backstop deposits to restore confidence in US mid-sized banks.

We saw green across all major indexes, the NASDQ being the lagged as bond yields rose to catch up with Fed expectations especially on the short end, which is a negative for tech and growth stocks which typically hold more debt and are more sensitive to interest rate risk.

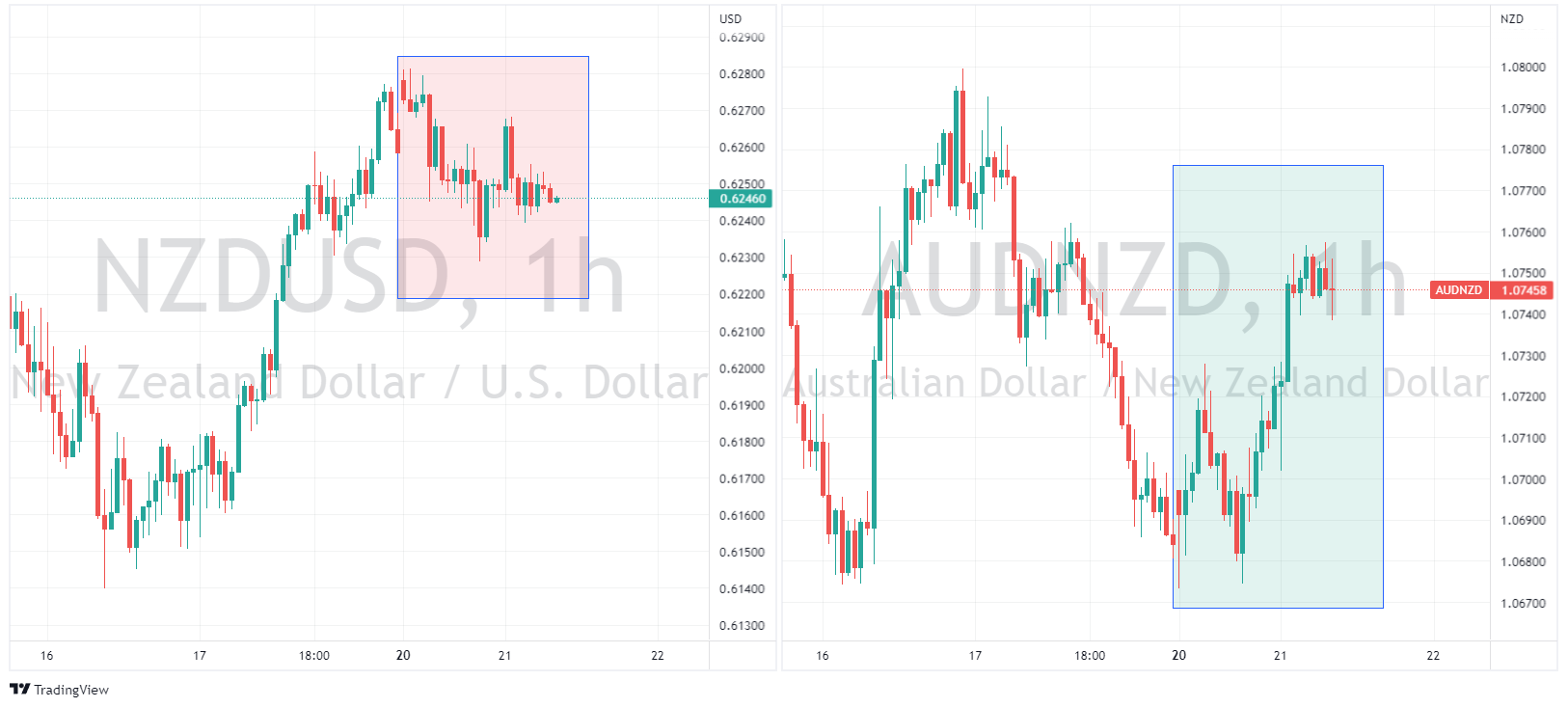

In FX the USD was weaker as the markets turned risk on for the session, the Euro was supported by efforts to limit the contagion of Credit Suisse, with ECB President Lagarde noted the exposure to EZ banks is in the millions, not billions, which was seen as Euro positive, this saw EURUSD above 1.07 and testing it’s March highs.

Cyclical currencies found tailwinds from the weaker dollar and upside in US equities with the exception of the NZD. The kiwi seemed to be hit by AUD/NZD flows which saw that pair rally above 1.0750 as the Aussie greatly outperformed on the improved risk sentiment.

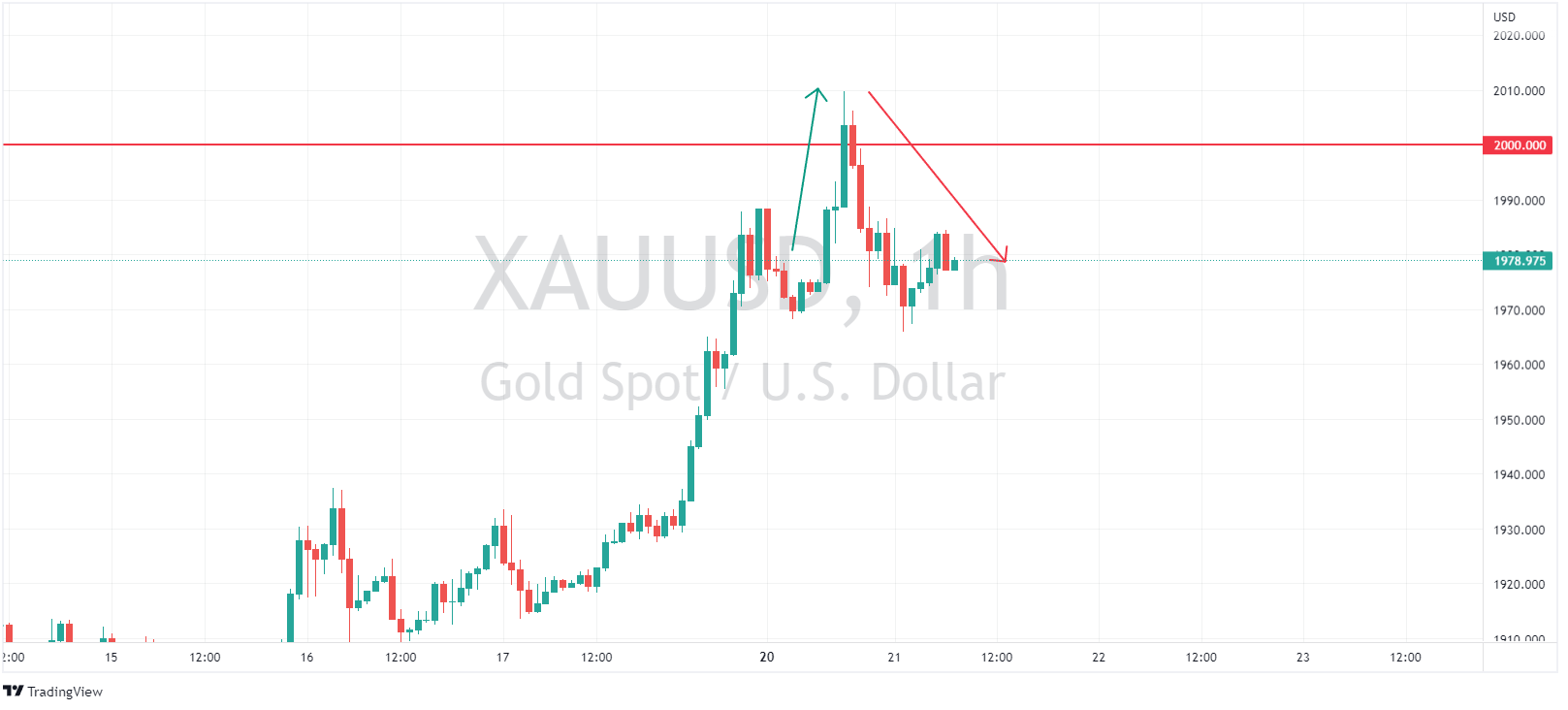

Gold briefly got above 2000 USD an ounce early in the session which was a 12 month high but as risk sentiment improved it retraced to finish the session in the red.

Oil also turned around mid session, after getting as low as 64& a barrel, rallying strongly into the end to a 67 handle.

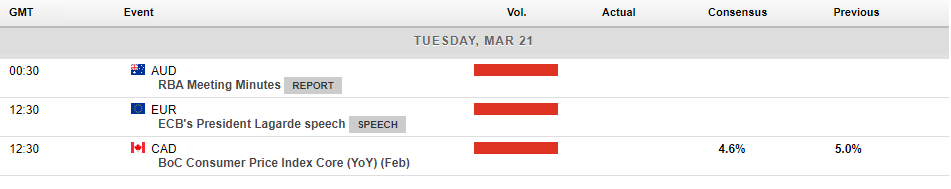

In upcoming economic news Later today is Canadian CPI where inflation is expected to show a moderation, any CAD traders out there should be keeping an eye on this one. For AUD traders the RBA will be releasing their March meeting minutes, with the market now pricing in a possibility of a rate cut at the April meeting, these minutes will take on a special importance.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Nike results announced

World’s largest sporting goods company, Nike Inc. (NYSE:NKE) reported fiscal 2023 financial results for its third quarter after the closing bell in the US on Tuesday. Nike beat both revenue and earnings per share (EPS) estimates for the quarter ending February 28, 2023. Revenue reported at $12.4 billion (up by 14% year-over-year) vs. $11.48...

March 22, 2023Read More >Previous Article

The week ahead – SNB, Federal Reserve and BoE rate decisions

US and European markets dropped steeply on Friday as investors remained shaken by the fallout of bank collapses in the US and the issues at Credit Sui...

March 20, 2023Read More >Please share your location to continue.

Check our help guide for more info.