- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Natural Gas analysis – another bull run coming?

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Natural Gas analysis – another bull run coming?

News & analysisNews & analysis

News & analysisNews & analysisNatural Gas price action has had an amazing two years, with the usually pretty boring commodity showing extreme volatility pushing it to all time highs before a dramatic collapse seeing it back where it started in 2020.

Like all the energy complex, Oil being a good example, the start of the Covid panic saw wild price fluctuations as traders came to terms with lockdowns and the related slowdowns, followed by unprecedented Central Bank stimulus. But the real push higher in Natural Gas came at the start of the war in Ukraine and the loss of Russian Gas for European suppliers, with fears of a cold winter with a much constrained supply of gas seeing the price spike to all-time highs.

But instead of a long cold gas starved winter the northern hemisphere experienced higher-than-average temperatures which meant the gas supply crunch wasn’t as dire as feared which sent liquefied natural gas prices tumbling to pre covid levels from a record all-time high.

With Natural gas back to historical support levels there is a technical and fundamental case for a move higher in the near future.

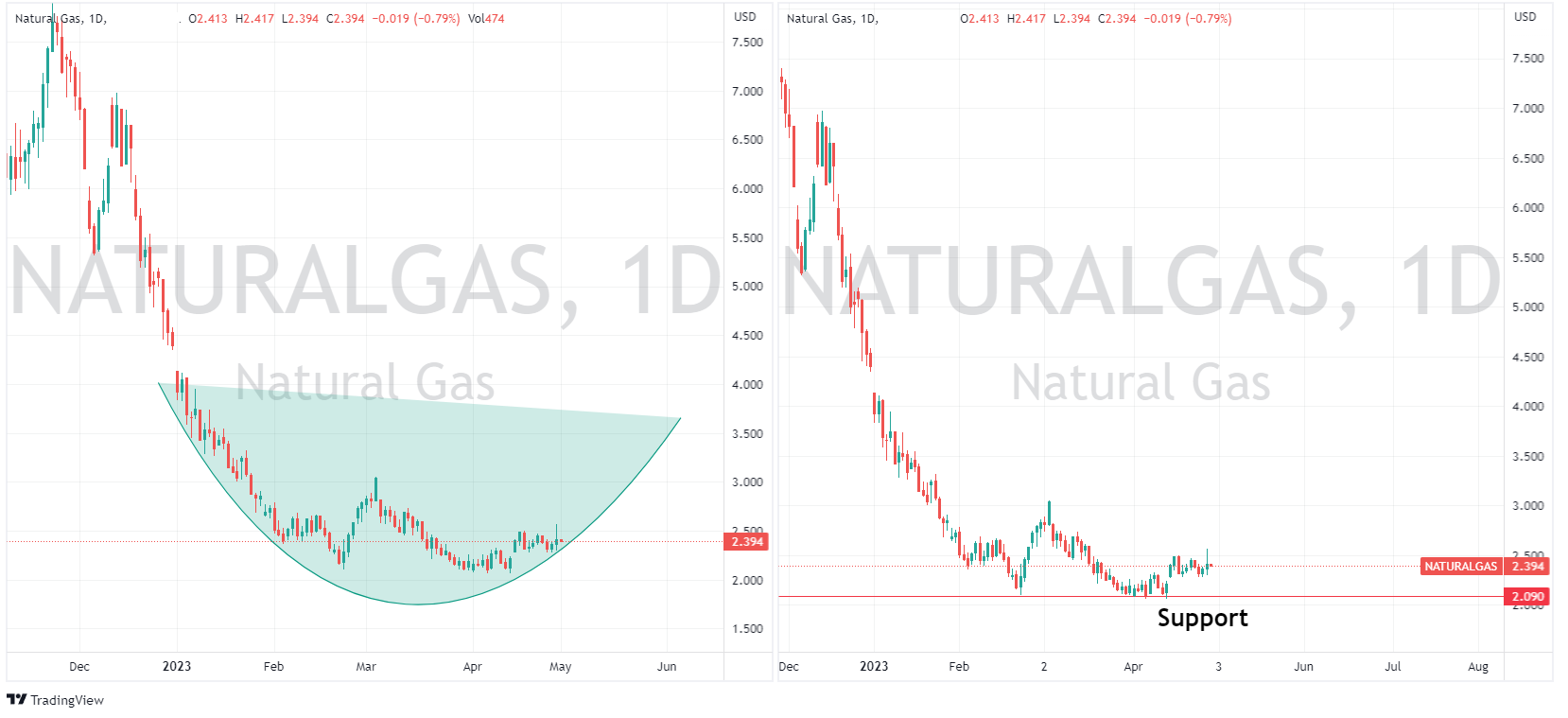

From a technical perspective, on a daily chart we can see that Natural Gas has found strong support since February around the 2.09 level, an historic level it found support at before the pandemic as well, we can also wee a rounding bottom pattern forming on a daily chart, this is considered one of the most reliable chart patterns in technical analysis.

According to a recent interview with Bloomberg by Yukio Kani, the chairman and CEO of Jera Co which is the worlds largest buyer of LNG, he is expecting a price spike again in natural gas this year due to Chinese re-opening demand, unusually war Northern Hemisphere weather increasing energy demand for cooling purposes and increased import capacity in Europe and China.

Certainly, a market worth watching going forward!

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

US stocks finish flat in choppy low volume session, JP Morgan buys First Republic

Major US indices finished little changed in a lighter than average session with London and Europe closed for the May Day holiday with traders looking ahead to a busy week in Central Bank action. The Dow Jones, S%P 500 and Nasdaq all finished modestly in the red, with the Russell 2000 being the only index to finish positively after a last-minute ...

May 2, 2023Read More >Previous Article

Key events in the week ahead – ECB, RBA and FOMC

US stocks rallied into month-end on Friday with the VIX falling beneath 16 to finish off a volatile but ultimately positive month for global markets d...

May 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.