- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US stocks eke out a gains in choppy post FOMC session

- Home

- News & analysis

- Economic Updates

- US stocks eke out a gains in choppy post FOMC session

News & analysisNews & analysis

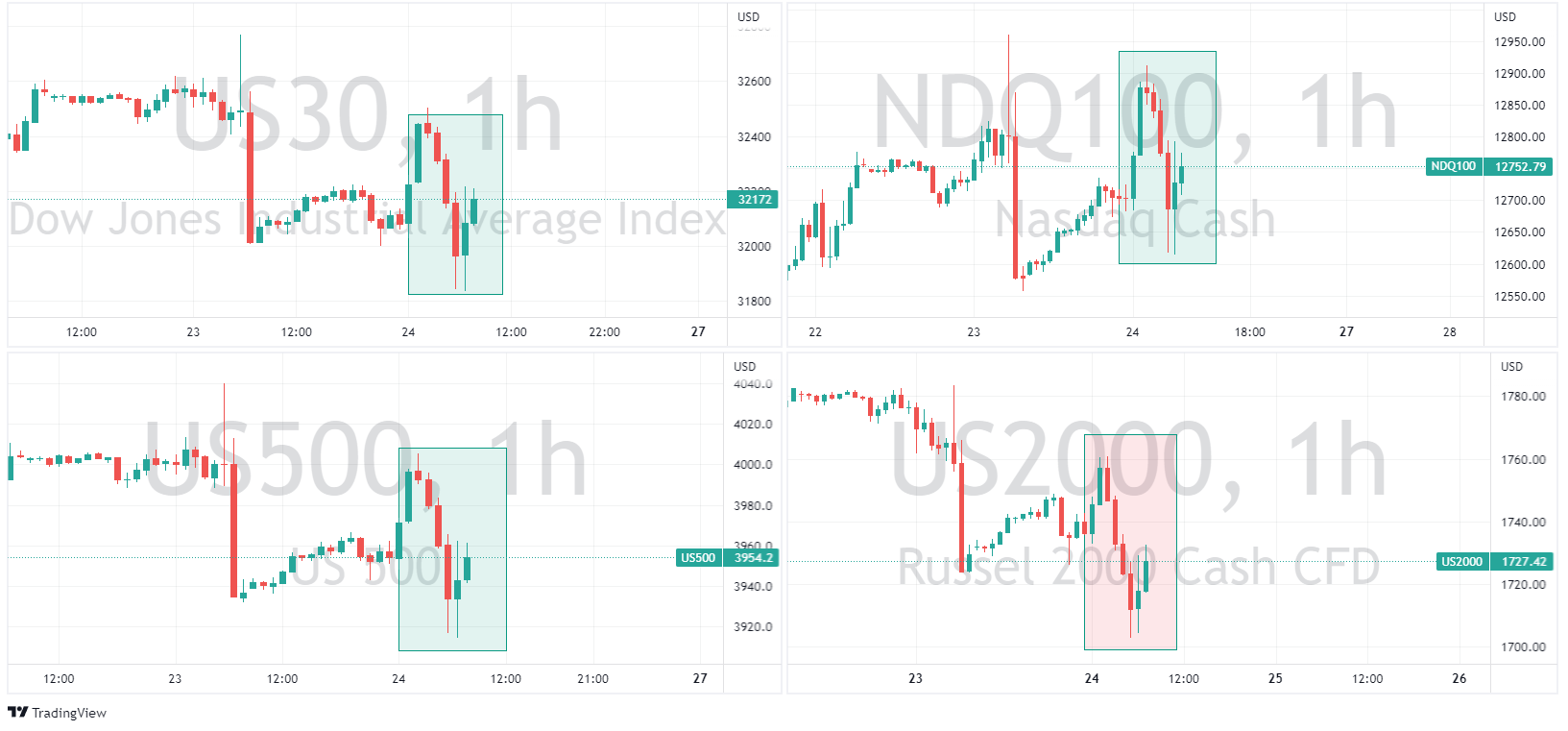

News & analysisNews & analysisUS equities managed to hold onto small gains despite a mid-session sell off, in a volatile session as traders continued to digest the FOMC decision. 3 of the 4 major indexes finished in the green, with the Nasdaq outperforming, up 1% while the Russell 2000 finished down for the day, dragged down by the continued poor performance in reginal bank stocks.

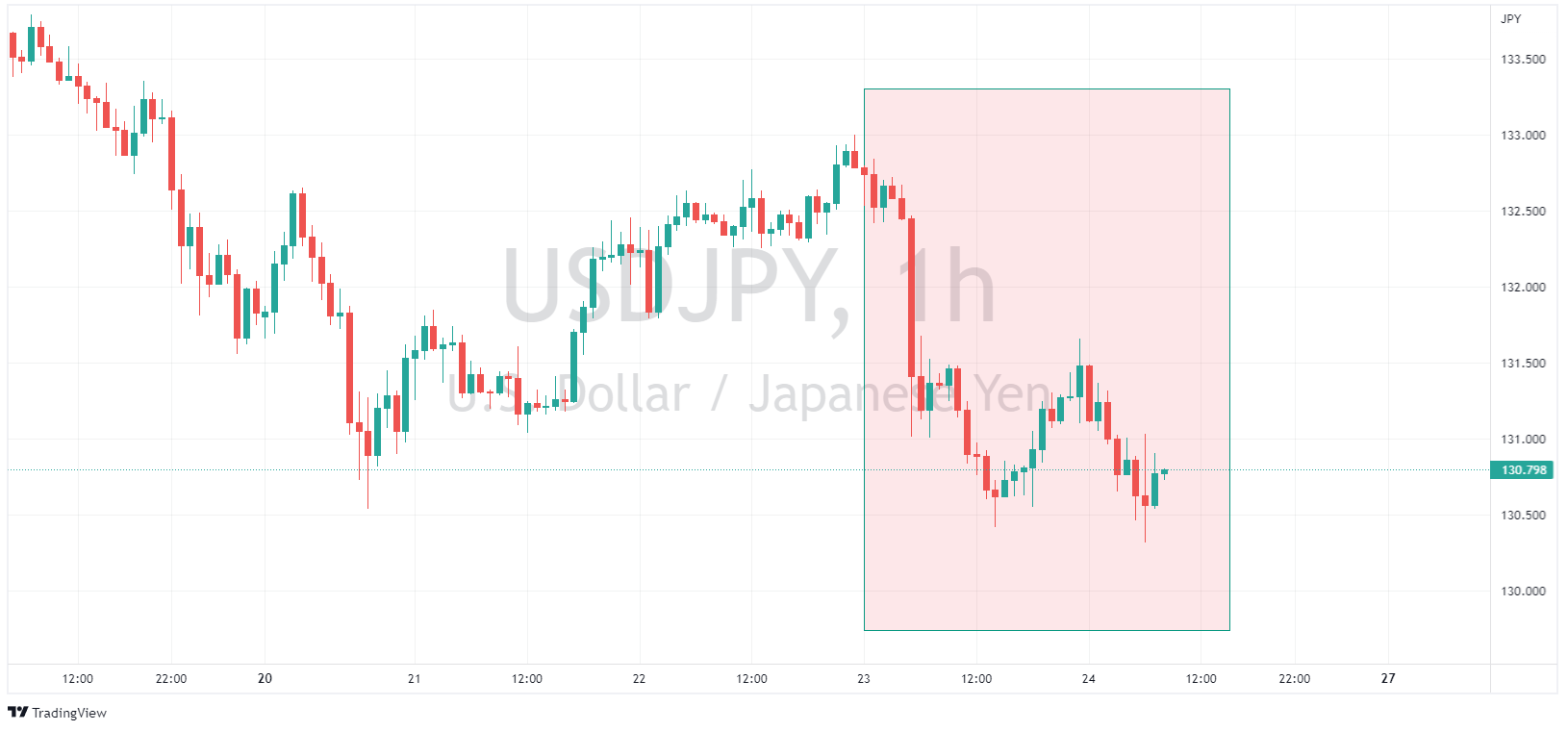

A choppy session in FX too, the USD finished slightly stronger against most its peers in a rollercoaster of a session, one exception was the Japanese Yen which did outperform as yield differentials tightened giving it support, this has been the main driver of the USDJPY since the Fed hiking cycle.

Gold again tested it’s major resistance at 2000$ USD an ounce before pulling back to settle at around 1990.. This is the 3rd time in 12 months gold has tested this level and been rejected so is a pivotal level to watch for gold traders.

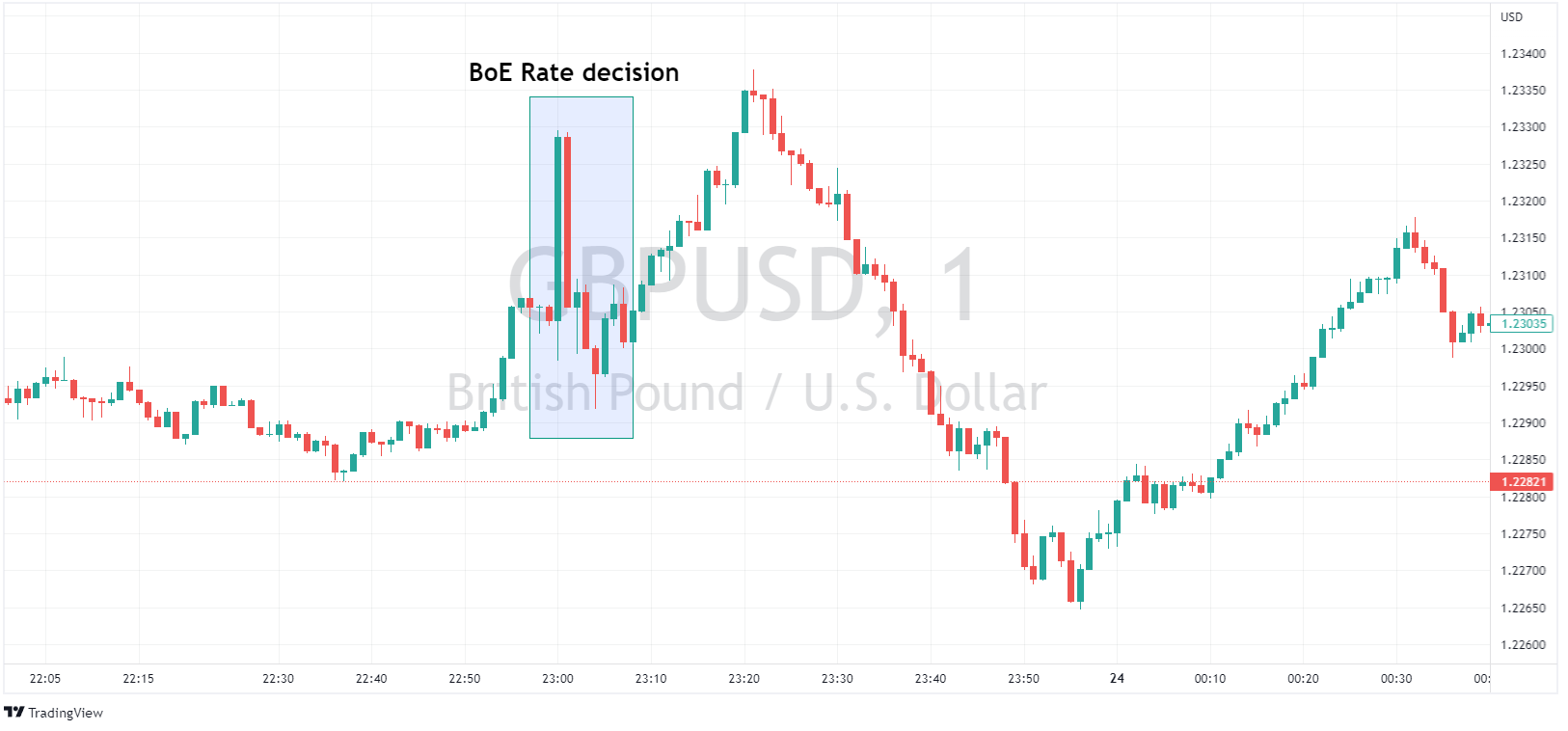

In Central bank news, the BoE as expected hiked 25bp and signalling that further tightening would be required, which is not surprising after the hot CPI figure on Wednesday, this saw a modest spike in GBPUSD but no real follow through.

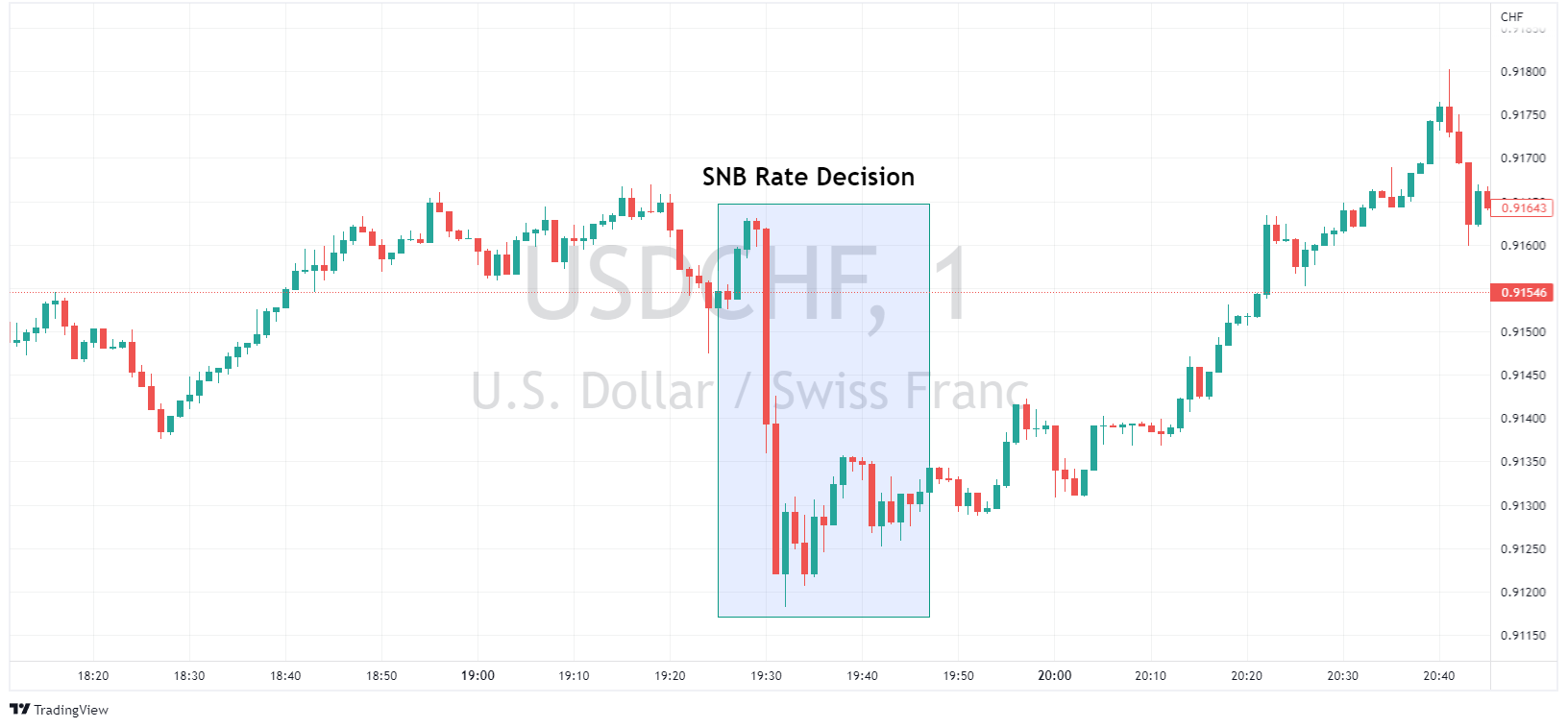

The SNB also hiked, 50 bp in their case as expected and reiterated in their statement that further tightening could not be ruled out, this saw a decent move higher for the Franc, though like the Pound was quickly retraced

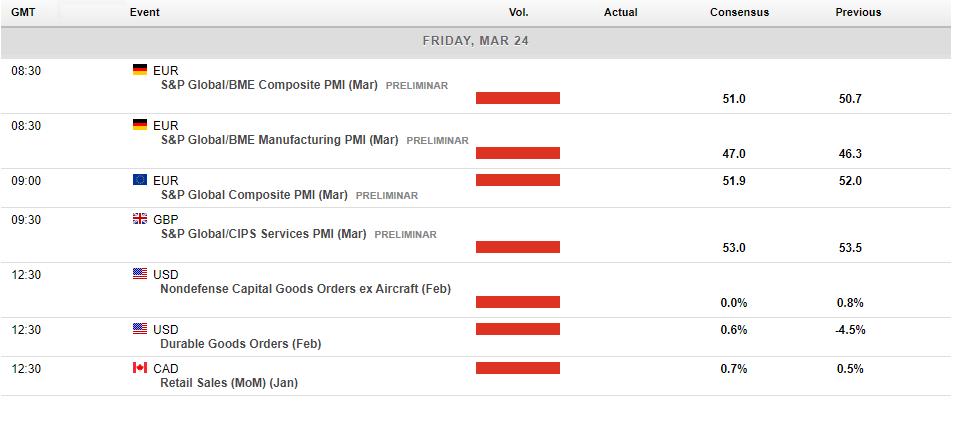

A raft of PMI figures are release later today, covering the Eurozone, UK and the US. Growth and recession concerns are still at the forefront of traders minds, so some volatility on these figures is a probability.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bollinger Bands – what are they and how can you use them in FX day trading

Bollinger Bands are one of the most popular indicators that FX and CFD traders use, invented in the 1980’s they are a technical analysis tool that are widely used by short and long term traders. The main uses for Bollinger Bands is determining turning points in the market at oversold and overbought levels and also as a trend following indicato...

March 24, 2023Read More >Previous Article

Red hot inflation in UK points to 25bp hike, BoE and SNB preview.

Bank of England Headline February inflation in the UK came at a hotter than expected 10.4%, well above the consensus of a drop to 9.9% and indicati...

March 23, 2023Read More >Please share your location to continue.

Check our help guide for more info.