- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- Tesla Q3 revenue falls short of Wall Street expectations – price target raised by Bank of America

- Home

- News & analysis

- Shares and Indices

- Tesla Q3 revenue falls short of Wall Street expectations – price target raised by Bank of America

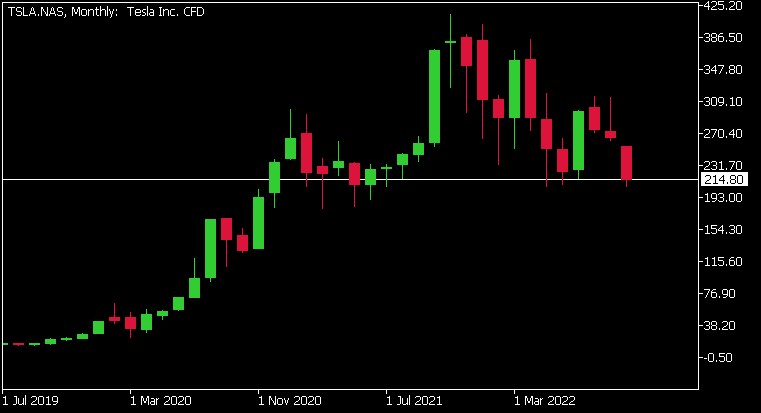

- 1 month: -26.10%

- 3 months: -21.51%

- Year-to-date: -39.46%

- 1 year: -28.44%

- Bank of America: $325

- Deutsche Bank: $355

- Wedbush: $300

- RBC Capital: $325

- Wells Fargo: $230

- Morgan Stanley: $350

- Mizuho: $370

- Goldman Sachs: $333

News & analysisNews & analysis

News & analysisNews & analysisTesla Q3 revenue falls short of Wall Street expectations – price target raised by Bank of America

20 October 2022 By Klavs ValtersTesla Inc. (NASDAQ:TSLA) reported its Q3 financial results after the closing bell on Wednesday.

World’s largest automaker exceeded earnings per share (EPS) estimates for the quarter but fell short on revenue.

Revenue reported at $21.454 billion (up by 56% year-over-year) vs. $21.982 billion expected.

EPS at $1.05 per share (up by 69% year-over-year) vs. $1.001 per share estimate.

”The third quarter of 2022 was another strong quarter with record revenue, operating profit and free cash flow. In the last 12 months, our free cash flow exceeded $8.9B. Our operating margin reached 17.2% in Q3. We achieved an industry-leading operating margin’ while encountering material headwinds YoY. Raw material cost inflation impacted our profitability along with ramp inefficiencies from Gigafactory Berlin- Brandenburg, Gigafactory Texas and 4680 cell production. Also, the U.S. Dollar (USD) continued to strengthen compared to all other major currencies in our markets.”

”We remain focused on increasing vehicle production as quickly as possible, by increasing our weekly build rate in Fremont and Shanghai and progressing steadily through the production ramps in Berlin and Texas. Logistics volatility and supply chain bottlenecks remain immediate challenges, although improving. We continue to believe that battery supply chain constraints will be the main limiting factor to EV market growth in the medium and long terms. Despite these challenges, we expect to continue to deliver every vehicle produced while maintaining strong operating margins,” Tesla said in a letter to shareholders.

Bank of America raised its price target for Tesla from $315 to $325 on Wednesday.

“In light of capital markets volatility, we would note that Tesla’s self-funding status is a notable advantage versus some start-up EV automaker competitors,” the bank said in a note to investors.

The stock was down by around 3% on Thursday, trading at $214.80 a share.

Stock performance

Tesla price targets

Tesla is the 6th largest company in the world with a market cap of $668.42 billion.

You can trade Tesla Inc. (NASDAQ:TSLA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Tesla, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap, Twitter

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Procter & Gamble beats estimates – the stock is up

The Procter & Gamble Company (NYSE:PG) reported its latest financial results before the opening bell on Wednesday. The largest consumer goods company in the world topped both revenue and earnings per share (EPS) estimates for the quarter – sending the stock price higher at the open. Revenue reported at $20.612 billion (up by 1% year-ove...

October 20, 2022Read More >Previous Article

USDCHF pair retraces as price level indicates a potential entry opportunity

The USD had a pullback in recent days as equities have rebounded allowing for other strong currencies such as the CHF to see From a techn...

October 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.