Market news & insights

Stay ahead of the markets with expert insights, news, and technical analysis to guide your trading decisions.

Volatility doesn't discriminate. But it can punish the unprepared.

Stops getting hit on moves that reverse within minutes. Premiums on short-dated options climbing. And the yen no longer behaving as the reliable hedge it once was.

For traders across Asia, navigating this environment means asking harder questions about risk, timing, and the assumptions baked into strategies built for calmer markets.

1. How do I trade VIX CFDs during a geopolitical shock?

The CBOE Volatility Index (VIX) measures the market’s expectation of 30-day implied volatility on the S&P 500. It is often called the “fear gauge.” During geopolitical shocks such as the current Iran escalations, sanctions announcements, and surprise central bank actions, the VIX can spike sharply and quickly.

What makes VIX CFDs different in a shock

VIX itself is not directly tradeable. VIX CFDs are typically priced off VIX futures, which means they carry contango drag in normal conditions.

During a geopolitical shock, several things can happen at once

- Spot VIX may spike immediately while near-term futures lag, creating a disconnect.

- Spreads on VIX CFDs can widen significantly as liquidity thins.

- Margin requirements may change intraday as broker risk models adjust.

- VIX tends to mean-revert after spikes, so timing and duration are critical.

What this means for Asian-hours traders

Asian market hours mean many geopolitical events can break while local traders are active or just starting their session.

A shock that hits during Tokyo hours may already be priced into VIX futures before Sydney opens.

Some traders use VIX CFD positions as a short-term hedge against equity portfolios rather than a directional trade. Others trade the reversion (the move back toward historical averages once the initial spike fades). Both approaches carry distinct risks, and neither guarantees a specific outcome.

2. Why are my 0DTE options premiums so expensive right now?

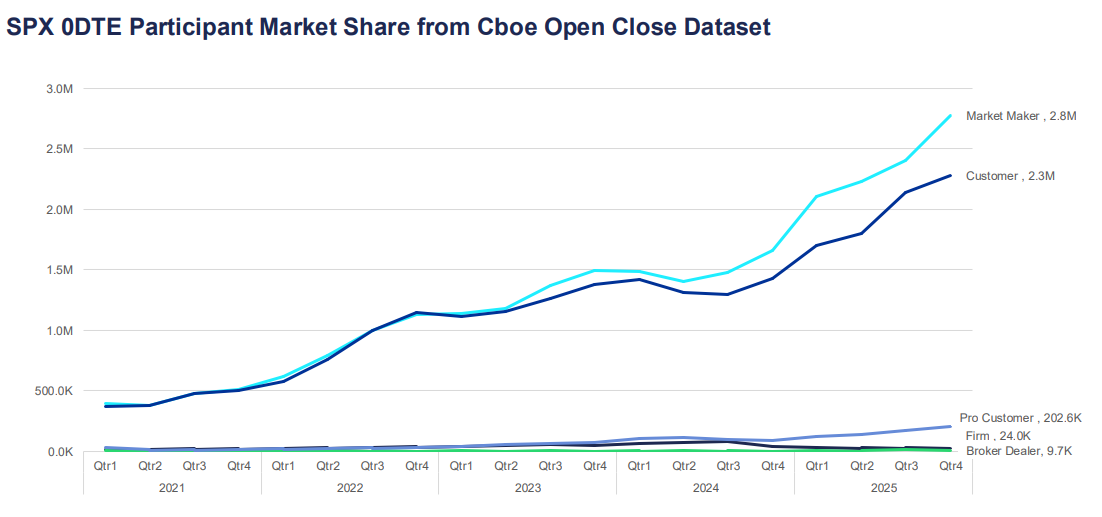

Zero days-to-expiry (0DTE) options expire on the same day they are traded. They have become one of the fastest-growing segments of the options market, now representing more than 57% of daily S&P 500 options volume according to Cboe global markets data.

For Asian-based participants accessing US options markets, elevated premiums during volatile periods can feel like mispricing, but usually reflects structural pricing factors.

Why premiums spike

Options pricing is driven by intrinsic value and time value. For 0DTE options, there is almost no time value left, which might suggest they should be cheap but the implied volatility component compensates for that.

When uncertainty increases, sellers may demand greater compensation for the risk of sharp intraday moves.

This can be reflected in

- Higher implied volatility inputs.

- Wider bid-ask spreads.

- Faster adjustments in delta and gamma hedging.

In higher-VIX environments, hedging flows can contribute to short-term feedback loops in the underlying index. This can amplify price swings, particularly around key levels.

What this means for Asian-hours traders

Many 0DTE options contracts see their most active pricing and hedging flows during US trading hours. Entering positions during the Asian session may mean facing stale pricing or wider spreads.

If you are seeing expensive premiums, it may reflect the market accurately pricing the risk of a large same-day move. Whether that premium is worth paying depends on your view of the likely intraday range and your risk tolerance, not on the absolute dollar figure alone.

3. How do I adjust my algorithmic trading bot for a high-VIX environment?

Many algorithmic trading systems are built on parameters calibrated during lower-volatility regimes. When VIX spikes, those parameters can become outdated quickly.

The regime mismatch problem

Most trading algorithms use historical data to set position sizes, stop distances, and entry thresholds. That data reflects the conditions during which the system was tested. If VIX moves from 15 to 35, the statistical assumptions underpinning those settings may no longer hold.

Common failure modes in high-VIX environments include

- Stops triggered repeatedly by noise before the intended directional move occurs.

- Position sizing based on fixed-dollar risk, which becomes relatively small compared to actual intraday ranges.

- Correlation assumptions between assets breaking down.

- Slippage on execution that erodes edge.

Approaches some algorithmic traders consider

Rather than running a single fixed set of parameters, some systems incorporate a volatility regime filter. This is a real-time check on VIX or ATR that triggers a switch to different settings when conditions shift.

Approach adjustments that some traders review in high-VIX environments

- Widen stop distances proportionally to ATR to reduce noise-driven exits.

- Reduce position size to maintain constant dollar risk relative to wider expected ranges.

- Add a VIX threshold above which the system pauses or moves to paper trading mode.

- Reduce the number of simultaneous positions, as correlations tend to rise during market stress.

No adjustment eliminates risk. Backtesting new parameters on historical high-VIX periods can provide some indication of likely performance, though past conditions are not a reliable guide to future outcomes.

4. Is the Japanese Yen (JPY) still a reliable safe-haven trade?

During periods of global risk aversion, capital has historically flowed into JPY as investors unwind carry trades and seek lower-volatility holdings. However, the reliability of this dynamic has become more conditional.

Why has the yen historically moved as a safe haven?

Japan’s historically low interest rates made JPY the funding currency of choice for carry trades and when risk-off sentiment hits, those trades unwind quickly, creating demand for yen.

Additionally, Japan’s large net foreign asset position means Japanese investors tend to repatriate capital during crises, further supporting JPY.

What has changed

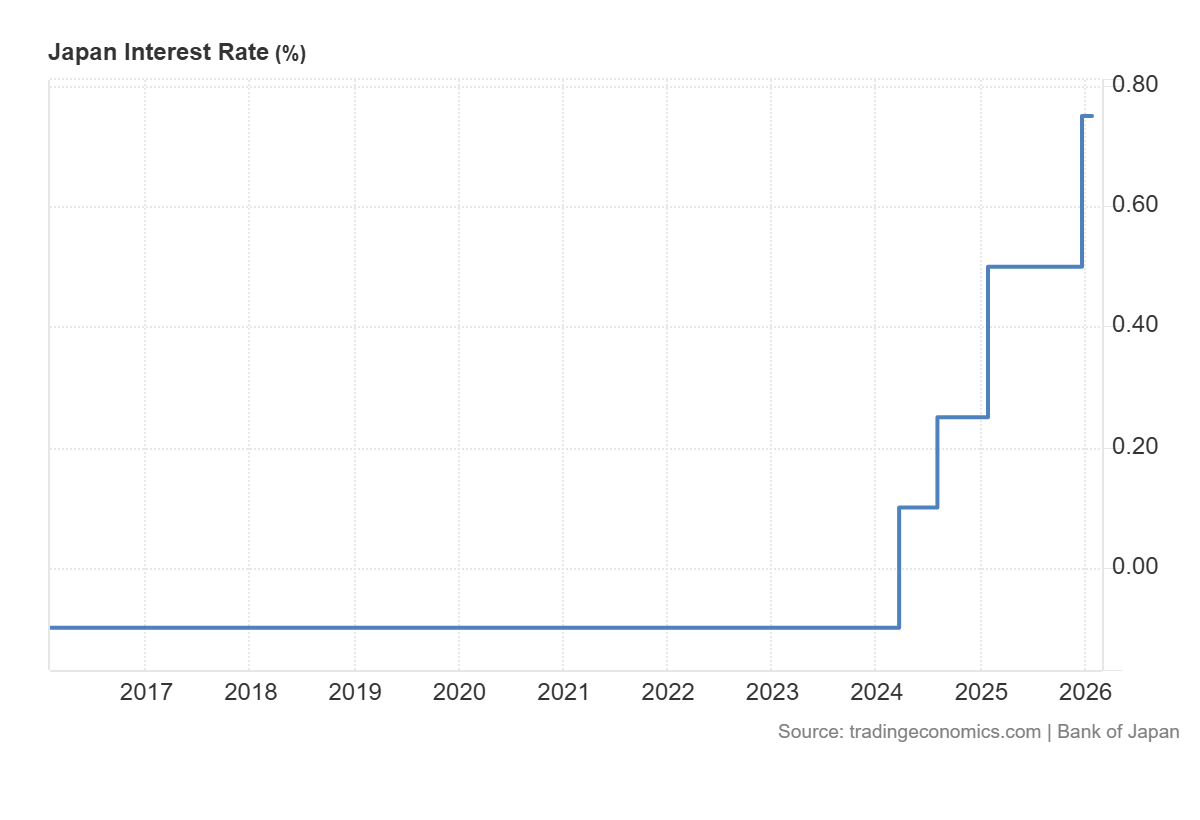

The Bank of Japan’s shift away from ultra-loose monetary policy in recent years has complicated the traditional safe-haven dynamic.

As Japanese interest rates rise:

- The scale of carry trade positioning may change.

- USD/JPY can become more sensitive to interest rate spreads.

- BoJ communication and domestic inflation data may influence JPY independently of global risk appetite.

The yen can still behave as a safe haven, particularly during sharp equity sell-offs. But it may respond more slowly or inconsistently compared to earlier cycles when the policy divergence between Japan and the rest of the world was more extreme.

What to watch

For traders monitoring JPY as a safe-haven signal, BoJ meeting dates, Japanese CPI releases, and real-time US-Japan rate spread data have become more relevant inputs than they were a few years ago.

5. How do I avoid ‘whipsawing’ on energy CFDs?

Whipsawing describes the experience of entering a trade in one direction, getting stopped out as the price reverses, then watching the price move back in the original direction.

Energy CFDs, particularly crude oil, are especially prone to this in volatile markets. And for traders in Asia, the combination of thin liquidity during local hours and sensitivity to geopolitical headlines can make this particularly challenging.

Why energy CFDs whipsaw

Crude oil is sensitive to a wide range of headline drivers: OPEC+ production decisions, US inventory data, geopolitical supply disruptions, and currency moves.

In high-volatility environments, the market can react strongly to each headline before reversing when the next one arrives.

- Price spikes on a headline, stops are triggered on short positions.

- Traders re-enter long, expecting continuation.

- A second headline or profit-taking reverses the move.

- Long stops are hit. The cycle repeats.

Approaches traders may consider to manage whipsaw risk

Some traders choose to change their risk controls in volatile conditions (for example, reviewing stop placement relative to volatility measures). However these may increase losses; execution and slippage risks can rise sharply in fast markets

Other approaches that some traders review:

- Avoid trading crude oil CFDs in the 30 minutes before and after major scheduled data releases.

- Use a longer timeframe chart to identify the prevailing trend before entering on a shorter timeframe, reducing the chance of trading against larger institutional flows.

- Scale into positions in stages rather than committing full size on initial entry.

- Monitor open interest and volume to distinguish between moves with genuine participation and low-liquidity fakeouts.

Whipsawing cannot be eliminated entirely in volatile energy markets. The goal of risk management in these conditions is not to predict which moves will hold, but to ensure that losses on false moves are smaller than gains when a genuine directional move follows.

Practical considerations for volatile Asian markets

Asian markets carry structural characteristics that interact with volatility differently from US or European markets:

- Thinner liquidity during local hours can exaggerate moves on thin volume, particularly in energy and FX CFDs.

- Events in China, including PMI releases, trade data, and PBOC policy signals, can move regional indices.

- BoJ policy decisions have become a more active driver of JPY and Nikkei volatility in recent years.

- Overnight gaps from US session moves are a persistent structural risk for traders unable to monitor positions around the clock.

- Margin requirements on leveraged products can change at short notice during high-VIX periods.

Frequently asked questions about volatility in Asian markets

What does a high VIX reading mean for Asian equity indices?

VIX measures expected volatility on the S&P 500, but elevated readings typically reflect global risk aversion that flows across markets. Asian indices such as the Nikkei 225, Hang Seng, and ASX 200 can often see increased volatility and negative correlation with sharp VIX spikes.

Can 0DTE options be traded during Asian hours?

Access depends on the platform and the specific instrument. US equity index 0DTE options are most actively priced during US trading hours. Asian traders may face wider spreads and less representative pricing outside those hours.

Are algorithmic trading strategies inherently riskier in high-volatility conditions?

Strategies calibrated during low-volatility periods may perform differently in high-VIX environments. Regular review of parameters against current market conditions is prudent for any systematic approach.

Has the JPY safe-haven trade changed permanently?

The Bank of Japan’s policy normalisation has introduced new dynamics, but JPY has continued to strengthen during some risk-off episodes. It may be more conditional on the nature of the shock and the BoJ’s concurrent posture.

What is the best way to set stops on energy CFDs in high-volatility conditions?

There is no universally best method. Many traders reference ATR to calibrate stop distances to prevailing conditions rather than using fixed levels. This does not guarantee exit at the desired price and does not eliminate whipsaw risk.

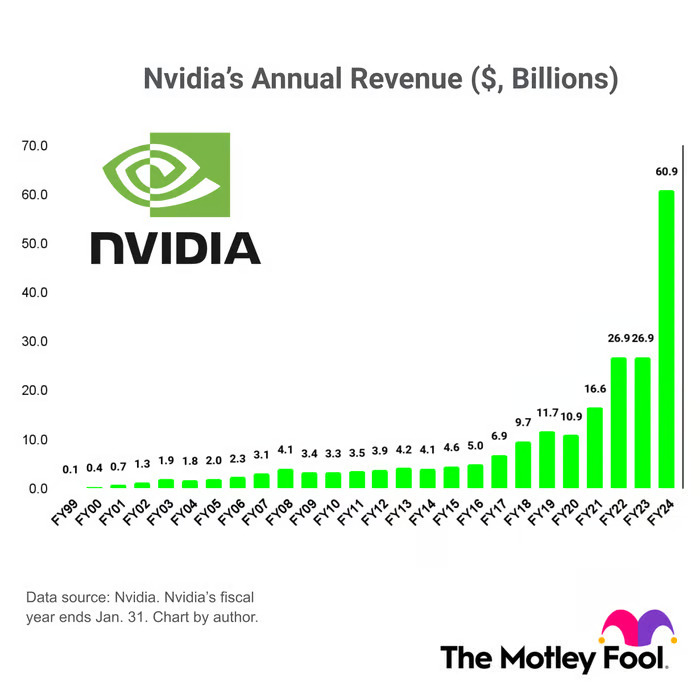

Most people think Nvidia got lucky with AI. They made chips that were good for gaming, and it turned out those same chips were good for machine learning.But that's not what happened at all…What actually happened reveals a fundamental misunderstanding of technology markets, and why investors often misread them.

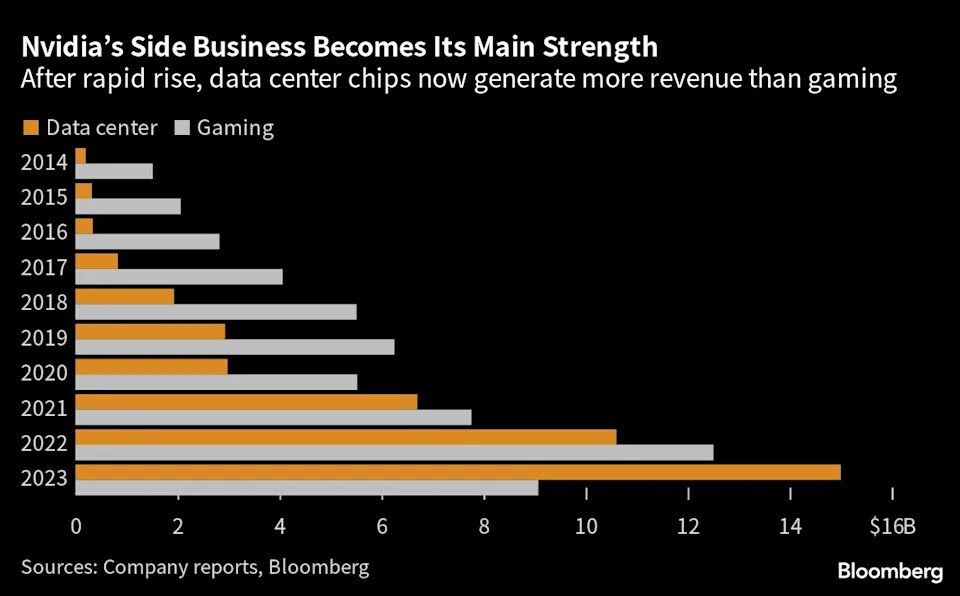

Nvidia’s data center revenue flipped gaming in 2023

Why Markets Misread Platform Plays

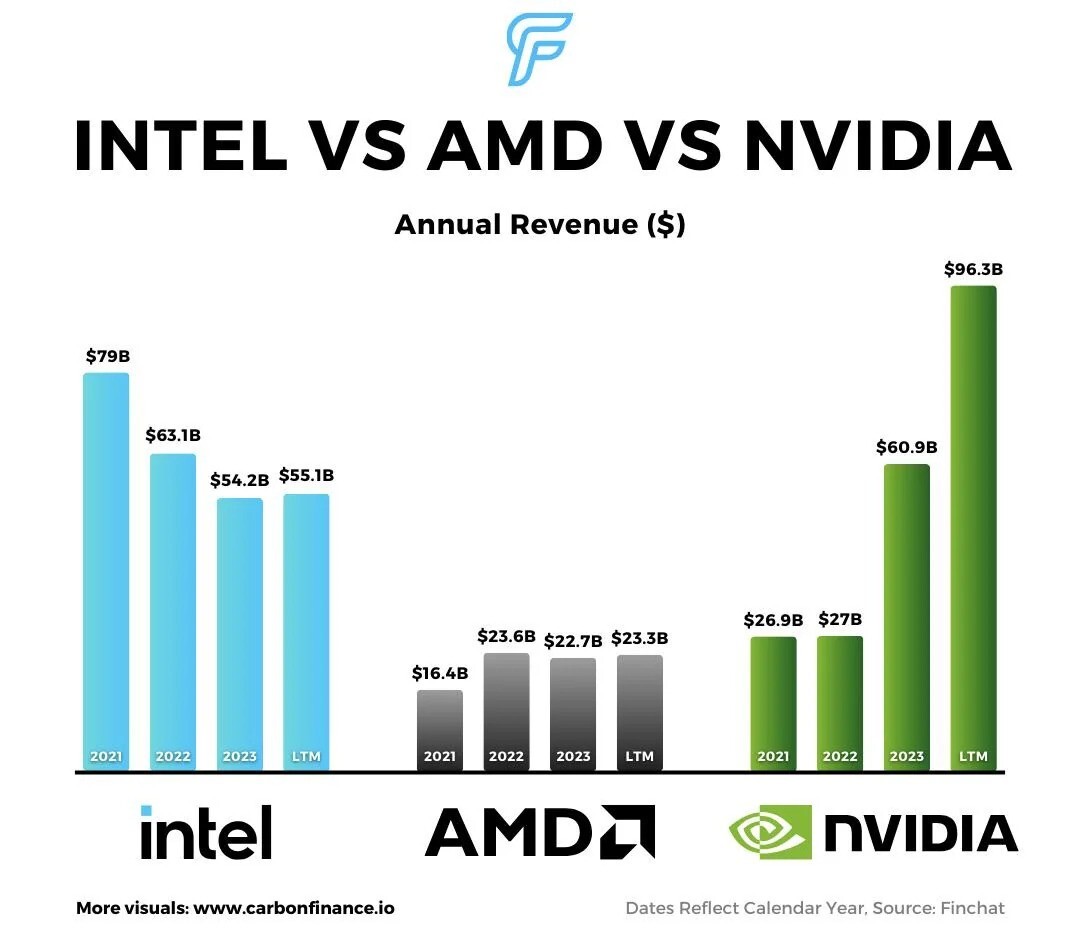

Markets consistently undervalue platform investments while they're being made, then overvalue them once they succeed. Platform plays often appear to be terrible business decisions for years before they become obviously valuable.CUDA — Nvidia's software platform that made it possible to harness graphics card compute power for general-purpose usage — is the perfect example of this.When Nvidia was spending heavily on CUDA in the mid-2000s, the market saw it as an expensive distraction from its core graphics business.The investment made no sense. They were giving away free software to sell hardware, in an industry where hardware margins were already under pressure.Markets tend to price such technology investments through the lens of existing applications rather than potential ones. They can see the current build cost but fail to factor in the potential future value.

The Economics of Platform Capture

Technology markets have the somewhat unique capacity to shift from competing products to competing ecosystems.If this shift from product to ecosystem wars occurs, traditional competitive analysis can become almost useless.In a product market, a 10% advantage might translate to a 10% market share gain. In an ecosystem market, a 10% advantage can translate to a 90% market share, due to network effects and switching costs.This is why established companies with superior resources often lose to platform challengers. AMD and Intel both had as much (or more) money and engineering talent as Nvidia during its CUDA development years. But they were competing in the wrong game. They were optimizing for product performance while Nvidia was building ecosystem lock-in.

The Platform Investment Paradox

Platform investments create a paradox for public markets. The companies that make the biggest platform bets often see their stock prices suffer during the investment phase.Product investments have visible, measurable returns that markets can model. Platform investments have uncertain returns that depend on market timing and adoption patterns that are impossible to predict.This is why markets consistently undervalue platform companies during their growth phase. Traditional financial metrics capture the cost of platform investment but miss the value creation occurring in the ecosystem.By the time platform value becomes visible in financial results, the strategic opportunity has usually already passed. The companies that capture platform markets are typically those that invest before the value is measurable, not after it becomes obvious.

Nvidia’s 25-year Annual revenue growth - image by Motley Fool

Ecosystem Network Effect

Every developer who learns CUDA makes the Nvidia ecosystem more valuable. Every model trained on Nvidia infrastructure increases switching costs for the entire AI market.Gaining a competitive advantage in platform markets is more about ecosystem momentum than building superior products. The platform that attracts the most developers and creates the most applications becomes increasingly difficult to displace.Markets often misinterpret this momentum as a temporary competitive advantage rather than recognizing it as a structural shift in the market. They keep expecting "competition" to erode platform dominance, not realizing that successful platforms tend to make competition irrelevant.

What This Means for Market Analysis

The Nvidia pattern suggests that technology market analysis needs to focus more on ecosystem dynamics and less on product comparisons. The companies that will dominate the next wave of technology markets are likely building platforms today for applications that don't yet exist at scale.This requires looking beyond current revenue and margins to understand what infrastructure is being built for the future. The most important question isn't whether a company has the best current product, but whether they're creating the ecosystem that future applications will be built on.Of course, such companies are unlikely to achieve the heights of Nvidia, but the ones that find success will likely follow the same pattern — years of patient platform building followed by explosive ecosystem capture when the market inflection point arrives.Trade Nvidia and thousands of other Share CFDs on GO Markets — starting from just US$0.02 per share with no monthly data fee.

Few traders would suggest that effective risk management is highly critical to ongoing trading success. But there remains an ongoing debate about the optimal risk management method to use, and whether a system stop loss is something that is needed at all. There are a lot of traders who remain unconfident about what is best for their individual trading style. If you get it wrong, the likely scenarios are either you are stopped out too early by market noise only to see price subsequently move in your desired direction, or that placement means that you take a larger loss than planned. This is especially true in leveraged trading, where even small moves can have a significant impact. The potential for a catastrophic candle subsequent to a black swan event or even a sudden unplanned news item coming across the wires can do major damage to your account balance if you are not effectively protected.

Do You Need a Stop at All?

There are traders who argue against hard stops, preferring mental stops or flexible exits based on evolving price action. On the surface, this can sound appealing as it is price action that invariably dictates entry, so using the same logic for exit appears to be congruent.

What does this mean in reality?

The emotional pressure of not having a safety net can be significant and may shift during the life of a trade, particularly when a trade is not moving in your desired direction. The challenge of discipline in execution is difficult enough when a trade has moved into profit, but if you are in a losing position, this is amplifiedA catastrophic candle can occur at any time. Even if many events are predictable, some are not. A terrorist attack, a major environmental event, or a change in government policy can send prices spiralling in a heartbeat. Unless you are prepared to take on this risk, you need to be in front of a computer screen at all times. Even then, price movement may be exceedingly quick, causing major losses before you have a chance to take action.

Why Standard Stop Methods Often Fall Short

Fixed Pip or Percentage Stops

The idea of a fixed-size stop, whether it’s 50 pips or a 1% move from entry, appeals because it’s simple and clear-cut.However, markets don’t move in uniform increments. A 20-pip move on EURUSD might be normal activity in Asia on an hourly chart, but can be significantly different at the start of the European session.On the AUDNZD, a 1% move in price could take several hours to happen, but on a gold trade, it could happen in minutes.These stops lack sensitivity to volatility, timeframe, and market context. They may work on a single instrument in a single timeframe, but are likely not transferable to any other context.

The Problem with Round Numbers

The human mind is automatically drawn to round numbers.Traders often cluster buy and sell pending orders and stop orders around these levels, creating self-fulfilling reaction points for the market.If you have identified that your desired stop is near a round number, consider the “spacing” option, perhaps a buffer of 10-20$ ATR to take it away from the wicks we often see around these levels as stops are taken out. For example, if ATR is 30 pips and price is at a round number, consider setting your stop to 3-6 pips beyond the round number, giving your trade a fighting chance to survive the typical round number fake-out.

Key Level Stops

Similar to round numbers, key levels based on previous price action are logical places for prices to test and bounce, and trigger your stop.The same buffer principle described above could also be applied in this scenario. Looking at what a typical test and failure of levels in price distance on specific instruments may have some value, but this is the next level after a system is already in place, and does not account for volatility changes during a day.

The Case for the ATR Multiple Stop

The Average True Range (ATR) measures market volatility by averaging recent price ranges.When you multiply ATR by a specific factor, you create a volatility-adjusted stop that scales with the current instrument and timeframe you are trading.There are three main reasons that a multiple of ATR-based stops may overcome some of the challenges outlined earlier:

- They are flexible with and responsive to the underlying instrument character

- They provide consistency and the required automatic adjustment across instruments and on different timeframes

- They go some way to help avoid stops that are too tight in volatile markets or too loose in quiet ones

For example, on your chosen instrument, the ATR on a 15-minute chart may be 12 pips. If you were to have in your plan that stops will be placed 1.5x ATR away from the signal for entry, then you would place the stop 18 pips away.However, if you were trading a longer timeframe where the expectation is a great movement per candle, the ATR may be 20 pips; hence, your stop would be placed 30 pips away. You can then calculate the position size based on the difference between entry and stop compared with your risk tolerance. This is important not to miss; the key here is to keep risk within a tolerable limit while also making sure you are giving your trade a chance to breathe.

The ATR challenges

Let’s say that you have made the decision to explore an ATR stop further; there are additional decisions to make as to how you use this in your trading.

Challenge #1 - How Big Should Your ATR Multiple Be?

The “right” multiple depends on:

- Your trading style

- The market you trade

- Your timeframe

Here is a practical approach to get you started.

- Review your last 20 trades

- Check where your “undesirable” stops were hit. Record whether they were inside your chosen ATR multiple times. (Remember you are looking for probabilities here, not an “every time” solution.)

- Adjust and test until you find a range that minimises premature stop-outs without giving away too much profit potential.

1.5 ATR may be a good starting point to try, as this is a commonly used level by some traders.

Challenge #2 - Static ATR vs. Dynamic ATR Stops

Static ATR Stops are calculated at entry and remain fixed throughout the life of the trade, are simple, and require no adjustment.Dynamic ATR Stops are adjusted with changing volatility, which may be most relevant for trades held over multiple sessions, but does require regular monitoring.Ultimately, you need to make a choice that is right for you, and this may be a hybrid approach where there are defined times to adjust. Of course, this may be negated to a large degree, dependent on what point your initial stop begins to trail with the direction of the trade.

Challenge #3 Entry Signal Level vs. Entry Price — Where Should You Anchor Your Stop?

This is a nuance many may overlook. You need to plant your flag on how you are going to calculate your ATR-based stop. From your actual entry price, or from the signal level?Logically, the trade idea is proven to have moved against you when the reason for entry is no longer valid. However, there may be some price distance between these two levels, so one approach I have seen used is if the entry candle is more than X ATR above the signal line, then use this as your point.Again, if you need to find out what is right for you and your trading style, start with the simple first and then add the variation to see if there is a difference in outcomes.

This is Only Step One

Placing your stop is only the beginning of trade management. The next phase is knowing how and when to trail your stop so you can lock in profit as a trade moves in your direction.This is a story for another day, but worth mentioning as part of your “grand exit plan”. We have done both videos and articles on this, so it would be worth it once you have mastered this element to move on to the next.

Summary

The ATR multiple stop is one of the most adaptable and logical ways to set your initial risk level.It offers a structured way to try and avoid some of the classic stop placement pitfalls by accommodating market conditions, instrument volatility, and adaptability to the timeframe.But like any method, it has challenges that you need to be aware of in your decision-making:

- Choosing the right ATR multiple

- Deciding between static and dynamic approaches

- Aligning your stop with your entry price

All require planning, testing, and execution discipline. Your starting point is to test this out, ideally on trades you have taken previously, and incrementally build on a relatively simple approach.

Most traders follow a familiar routine when planning trades:They scan for a setup — a candlestick pattern, a moving average crossover, or a favourite indicator alignment. When they find one, they take the trade, set a stop somewhere "logical," and target a multiple of their risk.And, there is nothing wrong with this! It is systematic and structured, and if it is based on a specific set of unambiguous criteria within your trading plan, it can work to your advantage. But, perhaps there is another way to achieve improved trading outcomes?The potential flaw in the “every trader does it” approach is subtle but can be critical. It assumes that the setup itself automatically means the market will move as far as you expect, and be clean enough for the trade not to be impacted by market noise.However, without a logical, higher probability exit point, your supposed great entry could quickly turn into the wrong trade.This is where reverse engineering your trade (starting with the exit) comes in.

What Is Reverse Engineering in Trading?

Instead of beginning with the entry, you start with a different question: "Where is price most likely to go — and is there a logical reason for it to get there?"You look for the destination or a ‘zone’ where the price has a high probability of pausing or even reversing. Current price action is often dictated by previous price action to some degree. This could be a support or resistance area, a previous swing high or low, or a volatility cluster that you may expect the market to seek out and price to hit.Once you have identified this likely exit point, you work backwards:

- Is there enough space between the current price and this target for the trade to offer a meaningful reward compared to the risk you are taking?

- Where would a logical stop be to make this trade viable from the perspective of my own risk/reward profile?

- Do current conditions make this trade worth entering now, or would it be prudent to wait?

Instead of forcing entries every time a setup appears, you filter opportunities through a forward-looking lens of probability based on what could happen based on price action.

Why the Exit-First Approach May Give You an Edge

When your focus is primarily on entry patterns, your risk-reward may suffer without you realising it. You may end up chasing trades where price has little room to move, ignoring close potential pause points in order to justify the trade, so squeezing risk-to-reward into the desire to simply get in, or worse, jumping in right before price reverses on you.The exit-first mindset, although perhaps seeming a little pedantic, may encourage you to engage more frequently in trades where:

- The market context supports a move in your favour.

- The price destination, and so reward, offers both logical and likely potential.

- The risk-to-reward is completely justified, without letting some of the “force a trade” demons take hold, resulting in you pressing the entry button without checking this.

This alternative approach in how you view trade decisions does not mitigate the necessity to place meaningful stops or trail positions, but it could have the ability to force you to trade with the bigger picture in mind, not just the immediate momentary signal.

How to Reverse Engineer a Trade

Step 1 — Define a High-Probability Exit Zone

Study the chart and identify where and why the market has a reason to go to a particular price point.This is not about predicting the future per se, but about recognising where price may be naturally drawn based on observable market structure and previous price behaviour.These zones often include areas like:

- A price level that has respected a support or resistance level on multiple occasions.

- A prior (and usually relatively recent) swing high or low that acted as a turning point.

- Major round numbers that commonly attract stop positioning.

These zones often act like magnets; they can be points where market participants have historically placed orders (and may have more pending orders) or reacted strongly in the past.With the focus on these likely destinations first, you force yourself to consider the broader market context before setups. Even if we like to think we will take this into account in any entry decision, to make it your thinking start point, rather than the excitement of a new set-up, is a logical way to keep those emotions channelled correctly.

Step 2 — Assess the Trade Space Between Price and Target

With your potential price destination mapped out with clear reasoning, the next step is to examine the space between the current price and your identified target zone.Make the decision as to whether the market offers a meaningful opportunity, or if it is already too late to enter to justify the risk.This is where you assess your reward potential relative to your probable stop-loss size.For example, if the price is only a few pips or points away from your exit target, it may not be worth entering, even if the setup appears to meet your planned entry criteria. Conversely, if price is a defined distance away from your end point, with enough space to move and few hurdles to negotiate (e.g., previous pause points), that could be the opportunity you are looking for.

Step 3 — Identify a Low-Risk Entry Within That Trade Space

Now you look for your familiar entry triggers — within a clearly defined context where you already know:

- The price you are targeting.

- How much room price could move before it hits your identified zone

- Where a stop could be placed logically whilst still retaining a desirable risk/reward ratio.

You may choose to wait for a pullback to a previous key level and confirmation of a bounce, evidence of increasing momentum, or look for confirmation of a continued directional move in price action patterns.So, you are entering with a plan built around where price is going and not just reacting to where price may be right now.Once you have practiced this a few times, this is an approach you can pre-plan, perhaps even prior to market open. Identifying your top 3 could provide clear guidance for the session ahead.

What This Approach Changes About Your Trading Psychology

Trading with the end in mind can help shift your focus from one of reacting to one of improved planning. The aim is to more naturally:

- Take fewer, higher-quality trades.

- Avoiding emotional decisions based on the ‘heat-of-the-moment’ setups and considering context more fully

- Managing your trades with more clarity as you understand the complete structure you are trading

Summary

We are not suggesting for one moment that you should abandon what you are doing now, particularly if it is yielding great results. This is an alternative that may be worth adding to your trading toolbox to potentially harness the power of trading with the end in mind. Reverse engineering your trades is a different way of looking at things, and probably a very new way of thinking about the market that differs from what is traditionally taught.It will by default force you to look at and respect structure, context, and reward potential before you ever consider pulling the trigger.By starting with the exit in mind, you naturally filter out lower-quality trades, focus on logical market movement, and step away from the emotional pull of “setup chasing.”It is also worth re-emphasising that there is no difference in the need for a carefully crafted and tested trading plan between this and any other strategy.

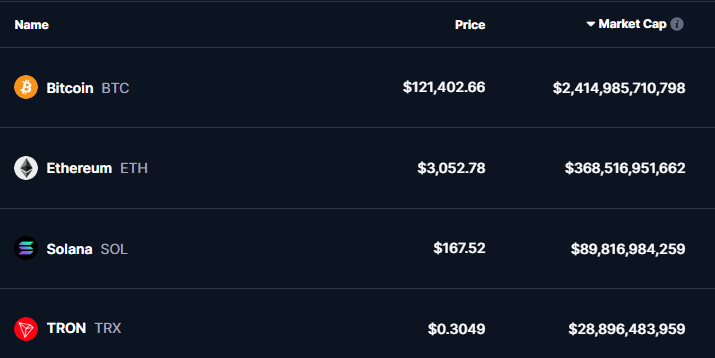

Bitcoin hit a new all-time high (ATH) on July 14, rising to $122k for the first time in its history. On this same day in 2010, a single Bitcoin was worth… $0.07.This incredible rise from a near-worthless digital experiment to a $2.5 trillion asset class begs the question: What is it exactly that makes Bitcoin so valuable?[caption id="attachment_712157" align="alignnone" width="1835"]

Bitcoin price 2012-2022[/caption]

What Gives Any Currency Its Value?

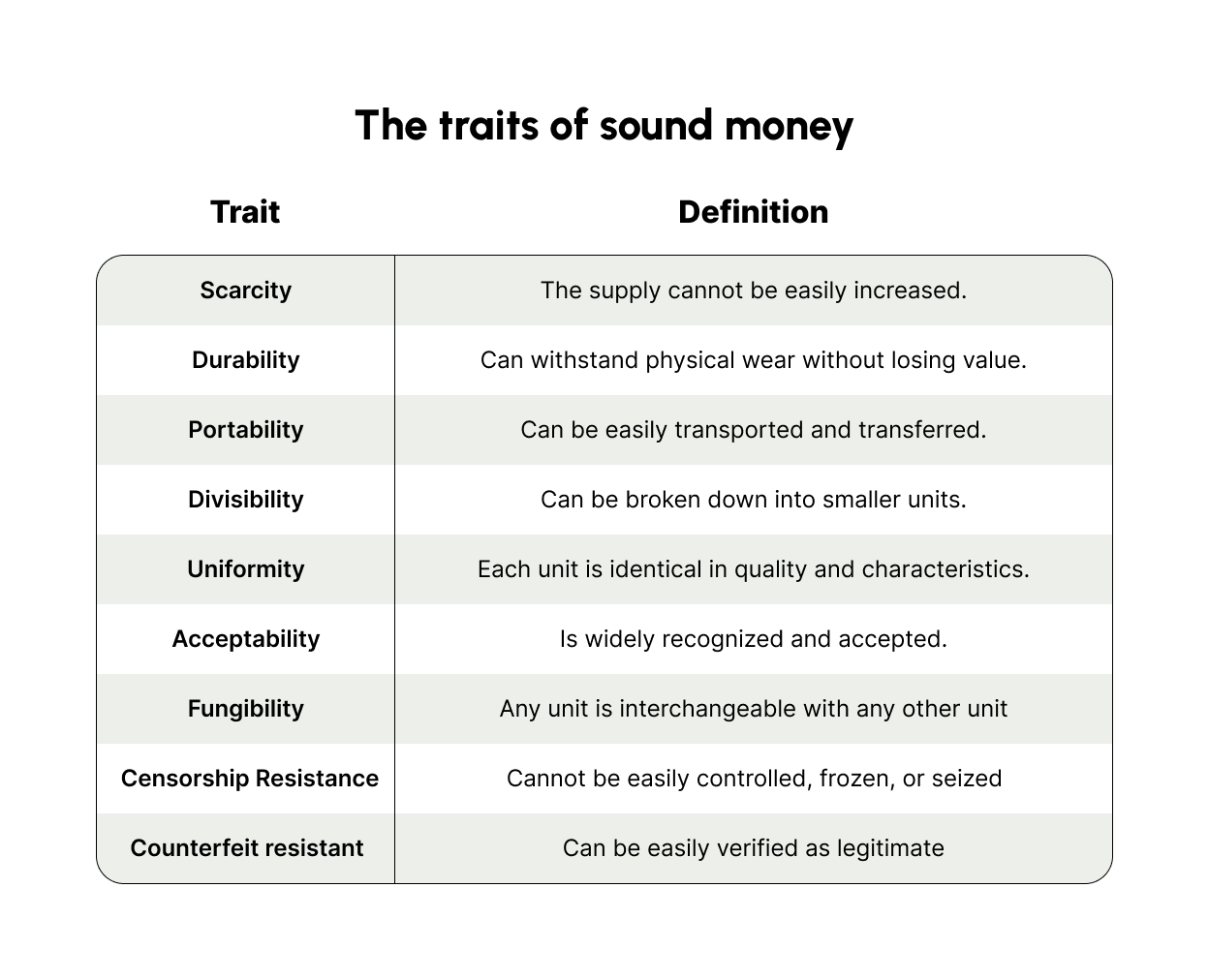

Since the dawn of organized trade, humans have searched for what economists call "sound money" — a currency that facilitates transactions while still maintaining value over time.

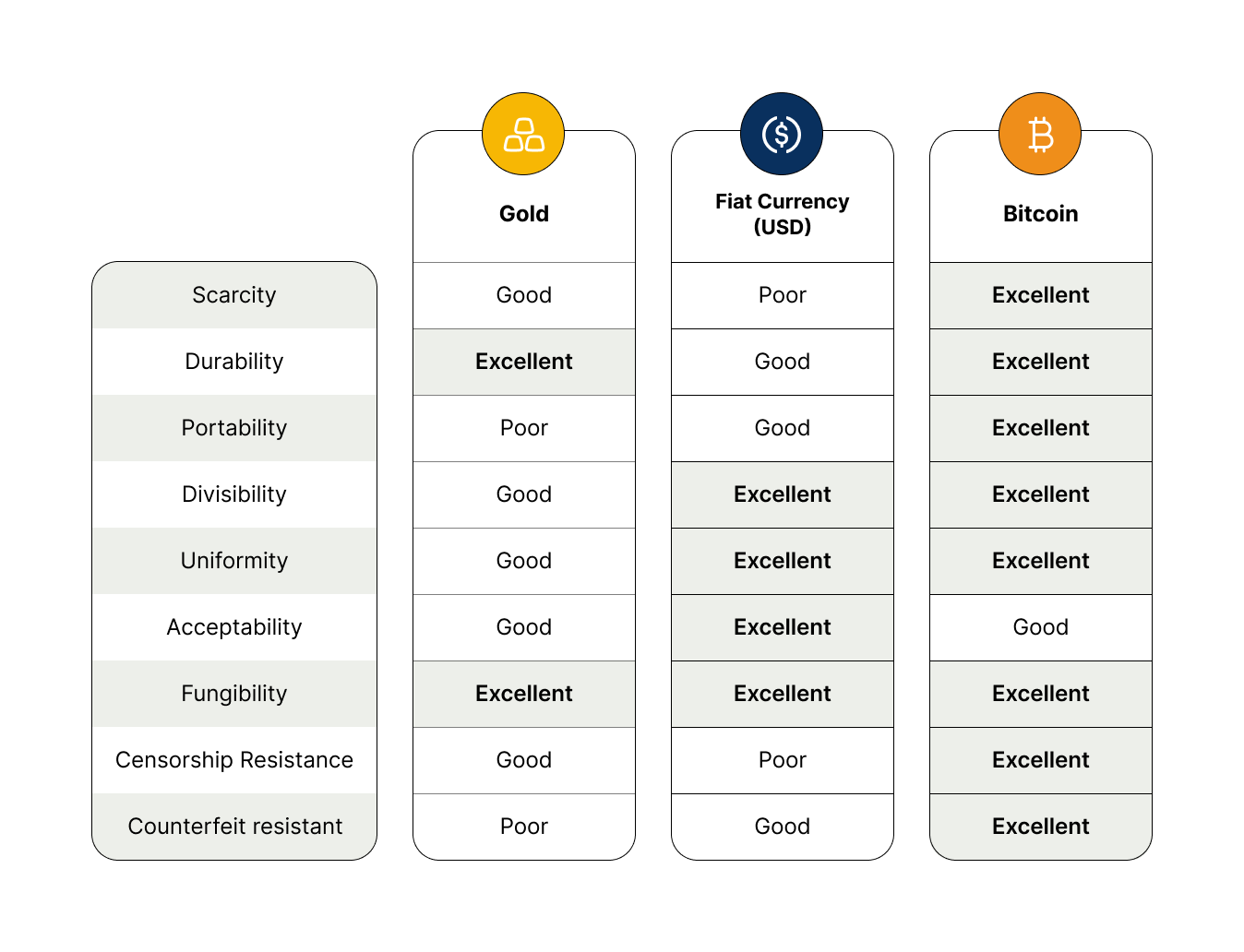

After centuries of trial and error, gold eventually emerged as the universally accepted currency. Its scarcity, durability, and divisibility made it great for storing and transferring value. But physical gold wasn’t able to satisfy all the traits of sound money — it was heavy, difficult to transport, and vulnerable to theft during long-distance trade.To address these limitations, a new solution was found — countries began issuing paper currency guaranteed by the government, backed by gold reserves.This paper currency is (more or less) the currency we know today. And for the past few hundred years, it was the currency that satisfied the most requirements for sound money.However, as we entered the digital age, the idea that a “digital currency” could be created to satisfy all sound money criteria began to gain traction.This is where Bitcoin comes in.

The Bitcoin Breakthrough

Multiple attempts to create a digital version of sound money were made throughout the 1990s and 2000s. But they all ran into the same problem: double spending.The inherent issue with anything digital is that it can be easily copied. There needed to be a way to prevent people from simply copying a digital currency file and “double-spending” it in multiple places.This created a situation where the last two traits of sound money — Censorship Resistance and Counterfeit Resistance — could not be satisfied simultaneously.To satisfy Counterfeit Resistance, double spending had to be prevented. To prevent double spending, a central authority was needed to verify transactions, which opened up the currency to censorship.It wasn’t until 2008, when a paper named “Bitcoin: A Peer-to-Peer Electronic Cash System“ was innocuously sent to a cryptography mailing list, that a solution was discovered.Instead of relying on a central authority, Bitcoin proposed a distributed network where every participant keeps a copy of every transaction that has ever occurred.This shared ledger (now better known as “the blockchain”) is maintained by a network of thousands of computers (nodes) around the world. When someone wants to send Bitcoin, they need to broadcast their transaction to the network. The computers then work together to verify that the sender actually owns the Bitcoin and hasn't already spent it elsewhere.If everyone has a complete record of all transactions, double spending becomes impossible. You can't spend the same Bitcoin twice because the entire network can see your complete transaction history.This breakthrough meant, for the first time, a form of currency existed that could (theoretically) satisfy all the traits of sound money.

However, the fact that Bitcoin satisfies these traits does not automatically make it valuable.Bitcoin’s “sound money” breakthrough was just a novelty; it still needs practicality with a clear fundamental value add to justify having any worth.

What Gives Bitcoin Its Fundamental Value?

It created a new technology. The blockchain solution was far more reaching than just preventing double-spending. Blockchain introduced a way to create permanent, tamper-proof records without requiring a central authority to maintain them.This unlocked possibilities across virtually every industry. Everything that previously required a trusted middleman to verify, record, or enforce agreements could now be rebuilt on this trustless infrastructure.It has absolute scarcity. Bitcoin's supply is permanently capped at 21 million coins, written into its code and enforced by the network. This creates predictable, verifiable scarcity. Unlike gold, where new deposits can be discovered, Bitcoin's scarcity is mathematically guaranteed.It is censorship-resistant. Bitcoin transactions cannot be blocked, reversed, or frozen by governments or financial institutions. This makes it valuable for those living in countries where traditional money systems might be unreliable or compromised.It is globally accessible. Anyone with internet access can send or receive Bitcoin anywhere in the world, 24/7. This makes it particularly valuable in regions with limited banking infrastructure or restrictive governments.Bitcoin is decentralized and secure. Because the Bitcoin network operates through thousands of nodes worldwide, it means no single entity can control, manipulate, or shut down the network.It is transparent and auditable. Every Bitcoin transaction is recorded on its public ledger that anyone can verify. This ledger has been running with 100% uptime for over 12 years, with its only two minor downtime events occurring early in its formative years.

How Much of Bitcoin’s Value is Speculative?

So, Bitcoin has a good fundamental value proposition, but does it justify its nearly $2.5 trillion market valuation?The short answer is no. Just like gold, if you valued it only on its practical usability, its market cap would be significantly lower.Other cryptocurrencies like Ethereum, Solana, and Tron all have a far superior tech stack, yet Bitcoin has a valuation over five times these assets combined.

However, like gold, if you start to derive Bitcoin's value from beyond its core functionality, its huge market cap begins to make more sense.Bitcoin has achieved institutional adoption well beyond any of its counterparts. Major corporations, hedge funds, and even nation-states have added Bitcoin to their balance sheets. The most notable of which is MicroStrategy, with current holdings of 597,325 BTC.US Spot Bitcoin ETFs went live in January 2024, the first-ever crypto spot ETF in the US. They have seen over USD$50 billion in combined inflows since launch and generated the biggest first-year inflows on record (beating out Gold ETFs' long-standing record).And Donald Trump has signed an executive order to create a US Strategic Bitcoin Reserve — turning Bitcoin into a national stockpile asset alongside Gold and Oil to help prop up the US Dollar.More nuanced value can also be derived from things like Bitcoin’s 15-yeartrack record of resilience, its community network effects, and the anonymity of its creator — Satoshi Nakamoto.[caption id="attachment_712156" align="alignnone" width="968"]

Sculpture of Satoshi in Switzerland that vanishes from certain angles[/caption]All these factors, combined with its fundamentals, make a strong case for a high Bitcoin valuation. Whether that valuation is as enormous as $2.5 trillion is up for debate. Still, we can be confident that Bitcoin is not a purely speculative asset, like many critics have touted in the past.

Summary

Bitcoin has legitimate technical and economic properties that create genuine value. It is the first form of truly sound money, and it has introduced fundamental innovation that is revolutionary in many ways.However, like many new technologies, the market is still feeling out what it's actually worth. The $2.5 trillion valuation could be justified, or it could be a bubble, or both at different times.What is clear is that Bitcoin isn't going away. Whether it becomes a major part of the global financial system or remains a niche asset, it has established itself as a permanent fixture in financial markets that can't be ignored.Start trading Bitcoin and 38 other Cryptocurrency CFDs on GO Markets today.

There are few trades as appealing, or as risky, as trying to catch a market reversal. The idea of entering at the turning point and riding the new trend is exciting. However, most traders fail to consistently produce good trading outcomes on this potential, often entering too early without confirmation, and thus get caught at a pause point of a continuing powerful move.Trend reversals can indeed offer excellent reward-to-risk potential, but as with any trading approach, only when approached systematically, the confluence of key factors, and timing.

What Is a High-Probability Entry?

Before diving into reversals specifically, let’s define what we mean by a high-probability entry.A high-probability entry is a trade taken in conditions where:

- There is clear evidence from price action and structure

- There is an alignment with the overall market context, such as timing, favourable price levels, and volatility

- Risk can be logically defined and limited to within your tolerable limits

- It may offer a favourable risk-to-reward profile (providing you execute following a pre-defined plan)

This approach should underpin all trading strategy development. And be consistently executed according to your defined rules, which must be constantly reviewed and refined based on trading evidence.

Reversal vs. Retracement: Know the Difference

Many traders confuse a retracement with a reversal, often with potentially costly consequences. It is ok to exit on a retracement and be ready to go again if there is a breach of the previous swing high. But this must be part of your plan, with a strategy for trend continuation in place. However, if your plan suggests that you DON’T want to exit on retracements, then the following table gives some guidance on what potential differences may be. RetracementReversalA temporary move against the trendA complete shift in directional controlPrice often continues in original directionPrice begins trending in the opposite directionHealthy part of a trend’s rhythmMarks the end of a trendTypically shallow, to a Fib/MA/structureOften deep, may break previous swing structureVolume often reduced after swing high if long or swing low if short.Volume often increased after swing high if long or visa versa.

Understanding Trend Exhaustion

Before any reversal occurs, the existing trend must show signs of exhaustion. This is the first phase of a potential turning point — and one of the most overlooked.

How Trend Exhaustion Looks on a Chart:

- Climactic candles – multiple wide-range bars with expanding bodies.

- Failed breakouts – price pushes through a level but fails to hold.

- Reduced momentum – smaller candles, overlapping wicks, indecision bars.

- Volume spikes with no follow-through – smart money distributing or exiting.

- Multiple tests of the same level – a sign that the trend is running out of energy.

The Anatomy of a High-Probability Reversal

A strong reversal setup typically has three key factors that can be supportive of a of follow-through.

1. Location – Price at a Key Zone

- Major support/resistance level honoured

- Prior swing highs or lows at a similar price point

- Higher timeframe structure – I,e, agreement on a 4 hourly chart as well as an hourly.

In simple terms, if the price isn’t at a meaningful location, a meaningful reversal is less likely to occur.

2. Previous Signs of Trend Exhaustion

We have covered this above, with evidence that the current trend has now weakened, and there is some justification to prepare to enter a counter-trend.

3. Structural Confirmation

This is the trading trigger you are looking for as a potential signal for entry. Structural confirmation transforms an idea (“the price might reverse”) into an actual setup (“the reversal is underway”).Look for the following four signs:

- Trendline or key short-term moving average breached

- Lower highs and lower lows in an uptrend or higher lows in a downtrend

- Confirmation that a key swing point has been honoured

- Evidence that a retest and rejection of the broken structure has occurred.

This shows that momentum has not just stalled, it has now shifted.

Context Filters

Reversals are more likely to succeed when conditions are supported by other factors. This is to do with the identification of a strong market context where reversals are more likely to happen. These may include:

- Time of day: The open of London or US sessions, or into session close when there may be some profit taking on a previously strong move

- Volatility extremes: Price has expanded beyond its normal daily range (ATR-based or visually evidenced on a chart)

- Market sentiment: Everyone is already long at the top or short at the bottom — setting up for a squeeze

- Catalysts: Reactions to news, or data, that may cause a significant one-sided move

Adding context could make the difference between a technically correct trade and one that may offer a higher probability of going in your desired direction.

Recognising Common Reversal Patterns

There are classic chart patterns that may help visually reinforce the principles. They reflect exhaustion, rejection, and structural change, and may encourage many traders to follow the move, adding extra momentum to any initial move. PatternSignal TypeKey ClueConfirmation NeededDouble Top/BottomReversal StructureRepeated rejection of key levelBreak of swing low/high between peaksHead & ShouldersMomentum FailureFailed retest after strong pushNeckline breakPin BarExhaustion CandleSharp rejection with long wickOpposite-direction close after the pinEngulfingSudden Power ShiftOne candle overtakes previous rangeFollow-through candleRounding Top/BottomSlow Institutional TurnGradual stalling and reversalNeckline break of curveBreak of Structure (BoS)Structural ConfirmationNew higher low/lower high, support breakRetest and failure to reclaim broken level⚠️ These patterns should not be traded in isolation. Use them with context and only after signs of exhaustion and structure shifts.

FOUR Trader Reversal Traps to Avoid

Even with a solid framework, it’s easy to fall into common traps:

- Trying to pick the exact top or bottom - Wait for price to prove the turn, don’t anticipate and enter early

- Entering against the higher timeframe trend – Zooming out and checking alignment with higher timeframes may be prudent to reduce the likelihood of having to fight momentum on larger timeframes.

- Trading every reversal signal - Not all signals are valid or particularly strong. Look for the confluence of multiple factors covered earlier, not just the presence of a pattern.

- Letting bias override evidence - Just because you want a reversal to happen, it NEVER means it is there unless backed up by evidence.

Don’t Forget the Full Trading Story

A great setup means nothing without excellent execution. These ESSENTIAL facts are critical as with any trade, but there will never be an apology for reinforcing these.

Patience and execution discipline

Wait for your full criteria to be met. Avoid “almost” setups that feel tempting but don’t fully align with your full plan criteria. Likewise, when all your boxes are ticked, then take action.

Exit strategy

Use a mix of targets, structure-based trails, or scaling out, and know in advance how you’ll manage the trade once it starts moving.High-probability entries are only one part of a winning trade. Exit efficiently or you’ll waste great entry setups because of poor execution. There are many traders in this position; make sure you are not one of them.

Summary

High-probability reversals are not about being right at the top or bottom when you enter; this is rarely possible and adds additional risk without confirmation. They are about recognising and being ready when the trend is potentially changing, and taking action when:

- Price is at a key level

- The current trend shows clear signs of exhaustion

- Structure confirms the shift

- And context supports the move

Trade the evidence and your plan, not just what you think is likely to happen. Be patient, be ready, and when the setup is there, execute your trade with confidence.

Every serious trader has “had a go” at scalping at some point in their journey. The idea of rapid and high-frequency entries, quick profits, with dozens of trades in a single session, suggests that it is a fast path to achieving a potential income from trading. The theory is that if you can make just a few pips or points repeatedly and frequently, the results should compound quickly and on a sustainable basis. However, stories of multiple account blow-ups and trader burnouts as the effort in a higher stress situation takes its toll bring up justifiable questions as to whether this “good on paper” theory can translate into real-world trading success.

What Is Scalping?

Scalping involves placing a high volume of very short-term trades, aiming to capture small price movements with trades that are opened and closed within minutes or even seconds of entry. Scalpers rely on precision in action, timing, and tight cost control, rather than letting trades breathe or evolve into longer moves, as you see in other types of trading approaches.Scalping is commonly used in markets with the highest liquidity, where the spread is at its tightest.For example:

- Forex majors (e.g., EUR/USD, GBP/USD)

- Index futures (e.g., NASDAQ, DAX, FTSE)

- Commodities like gold (though spread and volatility can be a challenge)

How Does Scalping Work?

Traders using a scalping approach are looking for small inefficiencies or bursts of movement they can exploit repeatedly as sentiment shifts.Three common types of scalping techniques include: momentum scalping, mean reversion, and order flow scalping. The first two of these can be used on CFDs on Metatrader platforms. The latter is more common in futures markets.

Momentum Scalping

This approach involves looking for and jumping on breakouts or price surges as price momentum begins to build, with an exit quickly before price begins to pause. This is most commonly used at session opens or news events when the volume of traders is high and repositioning of trader positions may be at its highest. Faster timeframes are usually used, e.g., 1-minute candles, when there appears to be a brief but technically identifiable sentiment change.

Range-Bound / Mean Reversion Scalping

Mean reversion strategies are based on the principle that prices regularly trade in a range, often while market participants are waiting for the next piece of news or technical breach of either the top or bottom of that range. During this time, as the range high and low are tested, it is common that the price will return to the mean of that range after each unsuccessful test. Scalpers will attempt to identify these micro-ranges and short a test to the upper end or go long with tests of the bottom end. This can work best in the quieter part of sessions or during consolidation periods, with a breach of the defined support/resistance used as a relatively obvious risk management level.

Key Principles of a Successful Scalping Strategy

Execution Speed

Fast and reliable execution is critical to optimise scalping strategies. Slippage, delayed fills, and lower liquidity with wider spreads can eat into profits significantly in these strategies, where the profit target is often just a few pips. Scalpers may use dedicated VPS servers where latency is less and, when there is evidence that a strategy may be working, may attempt to create EAs that execute the criteria for entry and exit automatically to maximise the time your strategy is working on the market (i.e. it is doing this even when you are not in front of a screen).

Low Spread and Commission

Spread becomes an essential component of your profit potential, more so than with any other strategy. If you are aiming for 3–5 pips of profit and the spread takes most of this away, your market battle becomes even harder than it already is. Even a small difference in transaction costs can erode a scalper’s profitability significantly over hundreds of trades. GO Markets offers very competitive spreads as well as other options for spread traders to help you find the best solution for you.

Clear, Repeatable Entry Rules

Because scalping relies on speed and repetition, there is no room for ambiguity or options in any part of your trading rules for action. Entry criteria must be specific, precise, and must be actioned without hesitation once the defined action price hits your trigger level. What you use as these action points is irrelevant in this context, be it candle closes or tick movement, the rules need to be black-and-white and actioned accordingly.

Tight Risk Control

Risk management is important in any trading context, and in scalping, this is no different. Stops can be just a few pips or points away, and a single large loss due to second-guessing or not following the plan can easily and quickly undo gains from several winning trades. Having referenced the absolute necessity for specific and unambiguous criteria for entry, this is no less vital for exit if you are to achieve your target win rate, desired average won-loss, and maximum acceptable drawdown.

Time-Bound Trading

Scalping strategies, by their nature, are usually mentally intense with concentration levels critical when trading. Management of this should be front and centre of your time plan when you are trading. You should set clear, pre-determined, and non-negotiable start and end times, limiting the amount of time to maintain an optimum trading state and reduce the likelihood of errors in decision making. For example, if your scalping plan is best actioned on session opens, limit your time to these, then walk away.

Risks and Pitfalls of Scalping

While scalping can be successful if you adopt the key principles above, it’s also very easy to fall short of what is required to achieve success on an ongoing basis. Rigidly adhering to what is needed is something to constantly remind yourself of, as there are common key challenges that have the ability to derail the trader (and they often do).

Overtrading

Scalping may lead to ‘compulsive’ overtrading. The “thrill of the chase” created by the high intensity of this trading style can tempt traders to push past their planned trade limits, stray from the strict criteria for entry, as they try to force more trades. These rarely create positive trading outcomes.

Spread and Slippage

You need to become a measurement guru, watching key trading metrics on an ongoing basis, including the impact of cost,s is critical as previously stated. Widening spreads can be massively impactful on profit potential, and some would have a maximum spread as part of the entry criteria because of this. This can and should be reviewed during your trading activity and as part of your trading business ritual.

Psychological Strain

Scalping is high-pressure and “fast” decision-making and action-taking. This pace is not for every trader, and you must monitor both your behaviour and performance during trading, adhering to and reviewing the boundaries you have set, but also be honest with yourself to look at something else if this is just simply not a “fit” for you.

The Case for Automation?

Many scalpers explore the use of EAs for the automation of their tested scalping strategies. Of course, this will eliminate some of the critical challenges by taking away the immediate “in front of chart” stress.There is also a strong case that this will help in “not missing” trades through an inability to watch markets for 24 hours.Don't be fooled, though; this is not a shortcut. The same rigour in terms of creation, testing, and ongoing monitoring with refinement remains. It is not saving work — as much work is still required if you are to achieve any success. It is using a tool to provide more execution certainty. It is perhaps worth considering once you have a strategy that shows promise and ticks all of the boxes for the scalping strategy criteria.

A Simple Momentum Scalping Strategy (Example)

Here is an example of a very basic framework for a 1-minute momentum scalping setup on EUR/USD. *Note: This is merely an example of how scalpers may structure a scalping plan:Market: EUR/USDTimeframe: 1 MinuteSession: First 60 minutes of London OpenSetup Logic:

- Identify when price breaks a 5-bar high with momentum

- Volume increase from previous bar

- Look for a strong bullish candle (body >70% of range)

- Ensure spread is below 0.4 pips

Entry:

- Buy at breakout +2 pips on 1 minute bar close

Exit:

- Use a hard stop of 2 pips from entry signal

- Target 6 pips profit

- Trail stops to breakeven on a 3 pip move

Risk Notes:

- No more than 6 trades in a session to maintain focus

- Cap trading session time to 60 minutes.

Final Thoughts

Despite the attractive and exciting high-intensity battle of trader versus market, scalping is not a shortcut or a casual strategy. It’s a high-performance, rigid approach that requires great preparation, clarity of planning and action, reaction speed, and precision in execution. Take a step-by-step approach; it may be for you (and don’t be shy of walking away if you discover it is not). You need to put in the “hard yards” at the front end if you want to see trading rewards from scalping.