- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Central Banks

- Federal Budget 2018: A Mixed Reaction

News & analysisFederal Budget 2018: A Mixed Reaction

By Deepta Bolaky

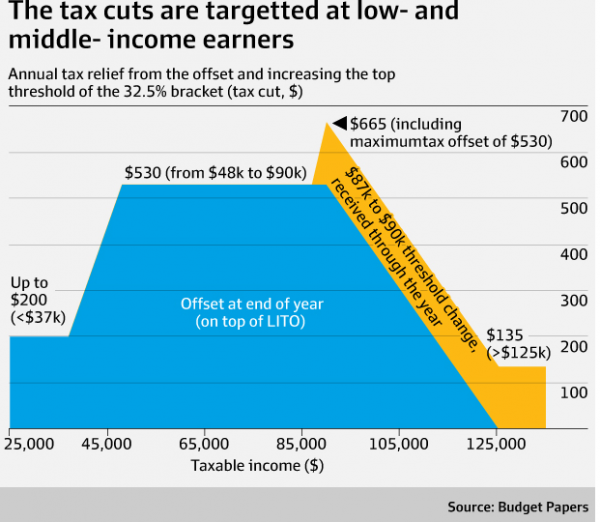

Treasurer Scott Morrison handed down his third incorporating tax cuts, superannuation benefits, aged care spending and significant infrastructure spending. The highlight is its plan to hand out $140 billion in tax cuts over the next 7 years possibly making the budget a strong “pre-election” one. It also focused on providing immediate tax relief to the low and middle-income earners by proposing an “offset at the end of the year” effective from 01 July 2018.

The government plans to partly compensate for the loss in revenue from the income tax cuts by taxing illicit tobacco and putting a $10,000 cap on cash payments in an attempt to crackdown on the black economy.

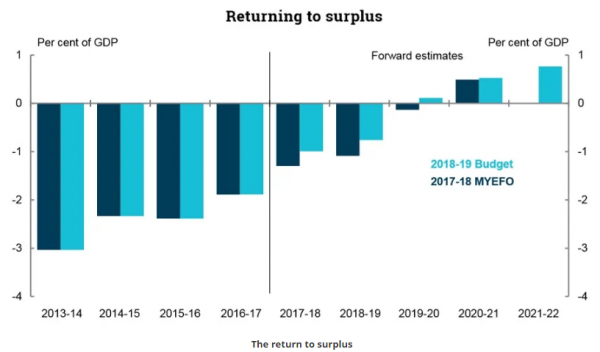

The Australian economy entered its 27th consecutive year of growth and bringing back a budget surplus within the next 2 years appears to be a realistic expectation according to the government. It is also expected that by 2028-29 net debt will decline to 3.8 per cent of GDP.

Source: Business Insider

Reactions from the markets so far…

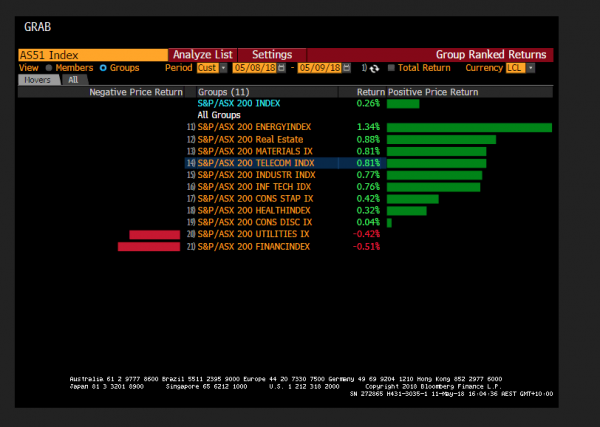

Whilst most sectors saw positives out of the proposed measure and policies, it was hard to see the same reaction from the financial sector which makes up almost 30 per cent of the S&P/ASX200 (by market capitalization) after the announcement of a new (proposed) tax on bank liabilities.

Consumer discretionary and Consumer staples were mostly positive as tax cuts are expected to boost consumer confidence and spending, seen as favorable for underlying stocks.

Infrastructure and Healthcare also got a lift following the proposed spending plans and policies.

No exit fees, a cap on annual fees for superannuation and an overhaul for R&D refunds were understandably drivers of a sell-off in Biotech and Superannuation stocks.

Source: Bloomberg

The positive sustained reaction from Bond markets is expected to last as the early balance surplus is a quite a crucial factor to consider since it will give support to the country’s AAA credit rating. The initial impact on the Australian Dollar remains mixed so far. However, it is worth keeping an eye to see how the Budget will unfold over the coming weeks and months.Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Central Bank Interest Rates

Central Bank Interest Rates By Klavs Valters A central bank's interest rate is a rate at which it typically lends money to local banks. This interest rate is charged by nations’ central or federal banks on loan advances to control the money supply in the economy and the banking sector. Each central bank has its own annual schedule when announc...

May 16, 2018Read More >Previous Article

World’s Largest Banks

World's Largest Banks By Klavs Valters Banks play a significant role in our day-to-day lives and as the global economy continues to expand year-on-...

May 7, 2018Read More >Please share your location to continue.

Check our help guide for more info.