- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Central Banks

- The Less-Dovish Central Bank

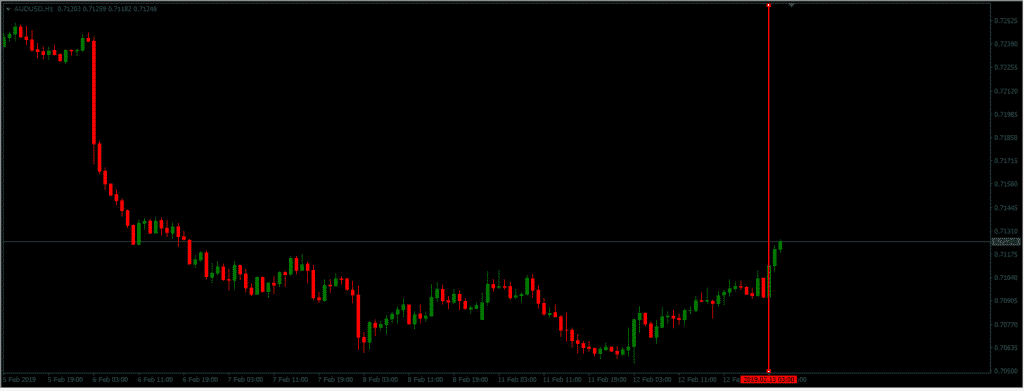

- NZDUSD jumped on the signals to hold on to rates though to 2020 while the AUDNZD dropped by almost the same extent. We saw movements above 100 pips following the Rate Statement.

- AUDUSD, which is highly correlated with the NZDUSD, added a few pips and built on gains from the uptick in the Westpac Consumer Confidence released before the RBNZ’s interest rate decision.

News & analysisThe Reserve Bank of New Zealand (RBNZ) made its first interest rate decision and monetary policy, but it was not what the market participants expected. The Central Bank did not follow the same dovish theme seen by other central banks. The Official Cash Rate (OCR) was left at 1.75%, as widely expected, and the RBNZ expects to keep the OCR at this level through 2019 and 2020.

“The direction of our next OCR move could be up or down.”

Governor Adrian Orr has downplayed the odds of a rate cut but has not entirely removed it off the table. Given the global risks and uncertainties, the chance of a rate cut is not eliminated but has not increased either.

The RBNZ strikes a “data-dependent” approach and says that they are comfortable with the inflation target and mid-point pressures. The Governor stretched that “they need data from the financial markets around how they are pricing and seeing the risks as well.” When asked about the rise in unemployment, Orr mentioned that “the surveys are not reflecting what we hear about the business tables”, and that “employment is near its maximum sustainable level”. Overall, the big picture here is that the RBNZ appears more confident that other central banks on its outlook for the New Zealand economy. The Central Bank noted that the low-interest rates and expected government spending would eventually support a pick-up in Gross Domestic Product over 2019.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

National Emergency

By Deepta Bolaky President Donald Trump has declared a national emergency over the US-Mexico border swiftly after the spending bill was approved. It is not the first national emergency the US will face. Other situations of emergency were triggered by former Presidents like Barack Obama or George W Bush, but it was primarily for purposes of add...

February 18, 2019Read More >Previous Article

Margin Call Podcast – S1 E5: Andrea Marani | CEO of OpenMarkets

Andrea Marani (Linkedin) is the CEO of OpenMarkets and longtime operator in the financial services space. A South African at heart, the now Aussie...

February 13, 2019Read More >Please share your location to continue.

Check our help guide for more info.