- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Coal prices soar as Australian Coal miners reach 52-week highs

- Home

- News & analysis

- Economic Updates

- Coal prices soar as Australian Coal miners reach 52-week highs

News & analysisNews & analysis

News & analysisNews & analysisCoal prices have spiked in recent times due to the energy crunch that has developed in Europe relating to pressures from Russia and Ukraine. Australian Coal companies have been the big beneficiaries of the rise in prices. White Haven Coal (WHC) and New Hope Corporation (NHC) have seen bullish price moves and are currently trading near their 52-week highs.

Geopolitical Pressures

Much of the rise of the price in coal can be attributed to the Russian and Ukrainian war. The crisis has put a lot of pressure on an already supply pressured market. Before the conflict, many countries were trying to lower their use of fossil fuels and therefore the production of coal across the western world slowed down. Conversely, Russia has been a large source of coal for Europe and in 2020 was the 6th largest producer of the resource. This is problematic as at the same time Europe has been reducing its production of Coal a situation is born out in which Europe needs to place an embargo on Russia but at the same time it relies on Russia for much of its coal and energy production.

Supply Crunch and price rise

The consequence is that prices of Coal and other energy prices have risen globally. Supply shortages in both China and India are indicative of the supply crunch and the driving up of the coal prices. Looking at the chart below it can be observed that the price of coal has risen since the start of the year. Even before the beginning of the Russian and Ukrainian conflict, the price was already rising. However, a big spike almost doubled the price of coal within a few days, as shorts covered their positions. Since the initial spike, the price has settled and consolidated.

Whitehaven Coal and New Hope Corporation

Two Australian companies that have performed well on the back of these rising prices have been Whitehaven Coal (WHC) and New Hope Corporation (NHC). In NHC’s, recent earnings report the company highlighted the increased selling price being a major factor in the company’s profitability. The company was able to average selling price of the coal was up by 147% with the average price being $192.38/t compared to the previous year price of $77.98/t. This price rise was a major catalyst in the rise of its share price.

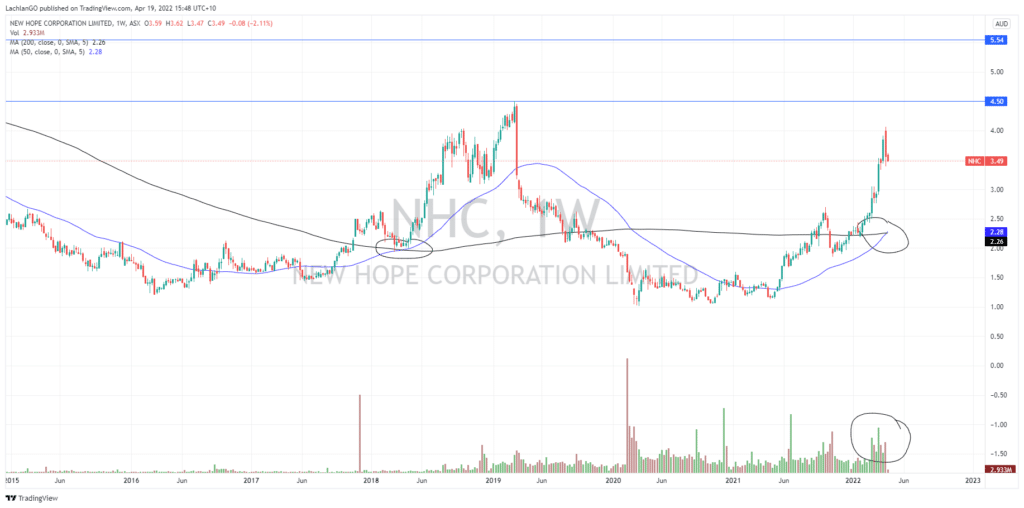

NHC

The NHC weekly chart shows a strong bullish move on the weekly chart. The price of the stock spiked in the beginning of March with the onset of the crisis. This break-out was supported by strong volume highlighting the buying strength. Furthermore, the 50 Period Moving average has just crossed over the 200 Period Moving average. In addition, the 50 Period Moving average has been accelerating at a reasonably good speed whilst the 200 has slowed down is poised to move upward.

The concern is that the most recent weekly candles are quite bearish. The price may need to consolidate before attempting to break the recent high at $4.06. If it can reach $4.06, targets of $4.50 and $5.50 may be the next areas of resistance. However, the price may find it difficult to move through the 4’s as there has been lots of price action in that range causing a large amount of supply.

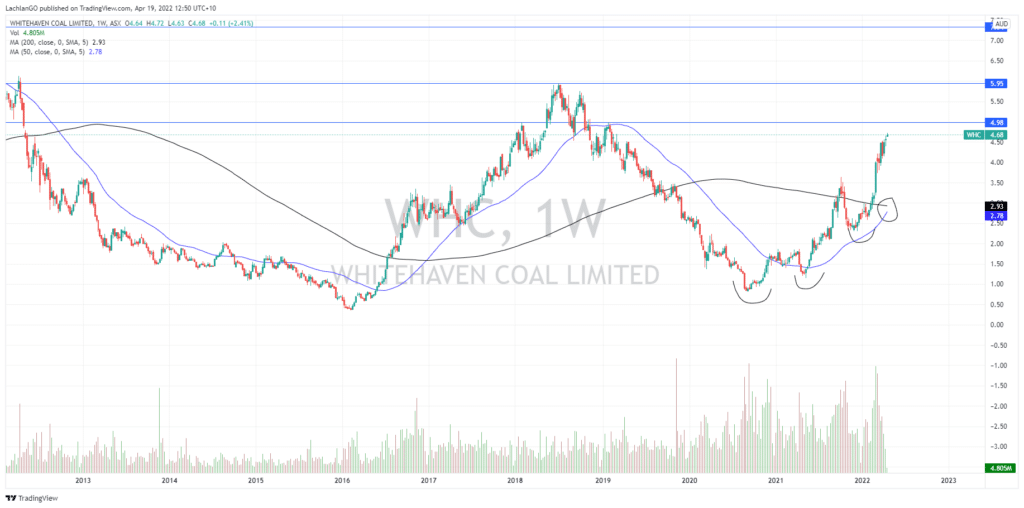

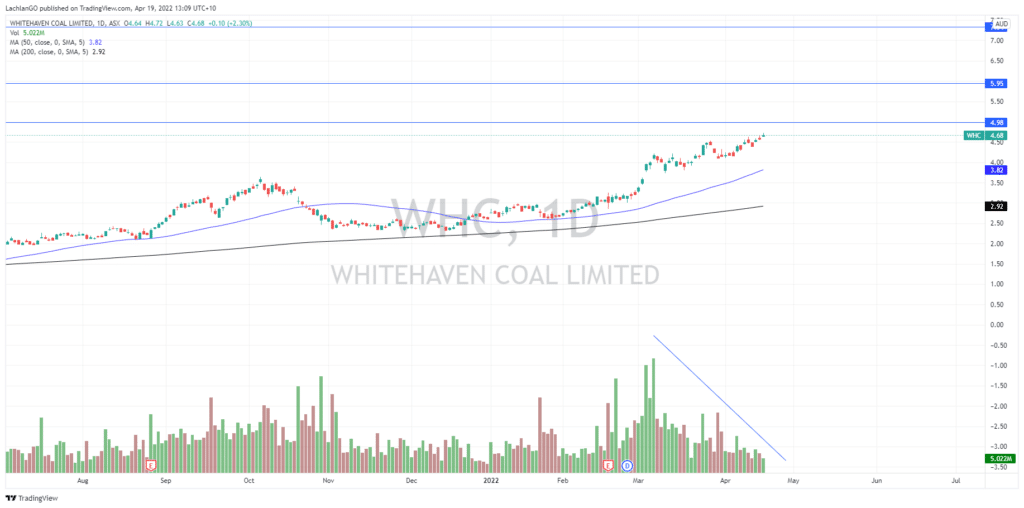

WHC

The WHC chart shows that the price has been coiling since the beginning of 2021. This is indicated by a series of higher lows as buyers begun to take control of the price. There is an obvious resistance point at 5.50 which on the weekly time frame acts as a longer-term target.

On the daily chart, as the price has approached the $5.00 target the volume has dropped off quite significantly. This may indicate two things. One is that sellers are no longer stepping up and that supply has dried up. The alternative is that buyers are beginning to weaken. Regardless of either outcome, an increase in either buy or sell volume will give an indication of which direction the price will move. Similar to the NHC chart the 50 Period Moving average is also close to crossing back over the longer 200 Period Moving average which will be a strong buying signal.

Ultimately, both WHC and NHC represent opportunities to capitalise on the recent surge in coal prices. With coal prices showing no sign of slowing down trading opportunities relating to these stocks may become apparent. Both stocks can be traded as CFDs on GoMarkets Meta Trader 5 platforms.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Netflix takes a dip

Netlfix Inc. reported its latest financial results after the closing bell on Wall Street on Tuesday. The online streaming service company reported revenue just shy of analyst estimates at $7.868 billion in the first quarter vs. $7.929 billion expected. Earnings per share topped expectations at $3.53 per share vs. $2.90 per share expected. ...

April 20, 2022Read More >Previous Article

Best-Performing Stocks: April 2022

It's been a volatile stretch for the stock market. From pandemic-induced sell-offs, record highs in 2021 and a bumpy start to 2022, the market has cer...

April 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.