Go further with GO Markets

Trade smarter with a trusted global broker. Low spreads, fast execution, powerful platforms, and award-winning customer support.

20 Years Strong

Celebrating 20 years of trading excellence.

Built for traders since 2006.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for professionals and sophisticated investors.

Get Started with GO Markets

Whether you’re new to markets or trading full time, GO Markets has an

account tailored to your needs.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

March’s foreign exchange (FX) markets could be shaped by several high-impact releases clustered around the first half of the month. China PMIs, Australia GDP, Japan GDP and the Federal Reserve’s March meeting could all influence FX sentiment as the month progresses.

Quick facts

- US rate expectations remain stable, with CME FedWatch implying a greater than 85% probability of no rate change at the March FOMC meeting.

- China PMIs, CPI/PPI and trade data will help shape early-month regional risk tone.

- Australia's GDP, RBA decision, labour force data and CPI create a concentrated domestic event window for AUD.

- Japan GDP and the Bank of Japan (BoJ) policy meeting may influence domestic yield repricing and JPY volatility.

- Euro area CPI, industrial production and the ECB Monetary Policy Decision remain key for EUR stability.

US dollar (USD)

Key events

- Nonfarm Payrolls: 12:30 am, 7 March (AEDT)

- Consumer Price Index (CPI): 11:30 pm, 11 March (AEDT)

- Retail Sales: 11:30 pm, 17 March (AEDT)

- Federal Reserve policy decision: 5:00 am, 19 March (AEDT)

- Federal Reserve press conference: 5:30 am, 19 March (AEDT)

What to watch

The USD remains primarily driven by inflation and labour data and their implications for Federal Reserve pricing.

CME FedWatch pricing indicates that markets are assigning a greater than 85% probability of no rate change at the March FOMC meeting. This suggests positioning is currently anchored around a pause, increasing sensitivity to any inflation surprise that could shift expectations.

With a pause largely priced in, USD direction may hinge more on inflation trajectory and longer-term policy expectations than the decision itself. Firmer CPI or resilient labour data could reinforce yield support.

Key chart: US dollar index (DXY) weekly chart

Euro (EUR)

Key events

- Euro area CPI (flash estimate): 10:00 pm, 3 March (AEDT)

- Euro area industrial production: 9:00 pm, 13 March (AEDT)

- ECB Monetary Policy Decision: 12:15 am, 20 March (AEDT)

- ECB press conference: 12:45 am, 20 March (AEDT)

- Eurozone flash PMI: 8:00 pm, 24 March (AEDT)

What to watch

EUR direction remains linked to inflation persistence and whether growth data stabilise expectations around ECB policy.

Sticky inflation or improved activity data could limit easing expectations and support the EUR. Softer inflation and weaker production data may renew downside pressure, particularly if US data remain firm.

EUR/USD daily structure shows consolidation following an upside extension earlier in the year. Short-term momentum has moderated, with price holding above longer-term support levels.

Key chart: EUR/USD daily chart

Japanese yen (JPY)

Key events

- Japan GDP (Q4 2025, 2nd estimate): 10:50 am, 10 March (AEDT)

- Bank of Japan policy meeting: 18–19 March (AEDT)

- BOJ statement on monetary policy: 19 March (AEDT)

What to watch

JPY remains sensitive to domestic growth data and Bank of Japan policy decisions. Yield expectations and policy normalisation signals continue to influence USD/JPY and cross-JPY volatility.

The BOJ policy meeting and subsequent communication may influence short-term volatility and longer-term rate expectations, and by extension JPY sentiment.

Stronger GDP or policy signals reinforcing normalisation could support JPY via domestic yield adjustments. More cautious messaging may maintain yield differentials in favour of USD and AUD.

Key chart: AUD/JPY weekly chart

Australian dollar (AUD)

Key events

- Australia GDP: 11:30 am, 4 March (AEDT)

- RBA Monetary Policy Decision: 2:30 pm, 17 March (AEDT)

- Labour Force Survey: 11:30 am, 19 March (AEDT)

- Consumer Price Index (CPI): 11:30 am, 25 March (AEDT)

What to watch

AUD faces a domestic calendar centred around the 16–17 March RBA meeting. Growth, labour and inflation releases cluster within a three-week window, increasing the potential for volatility.

Stronger GDP or persistent inflation could reinforce policy caution and support AUD. Softer labour or CPI outcomes may weigh on rate expectations and pressure AUD, particularly against USD and JPY.

Chinese data early in the month may also influence regional sentiment and commodity-linked currencies such as AUD.

The global initial public offering (IPO) market saw a resurgence in 2025. Proceeds increased 39% to US$171.8 billion across 1,293 listings, the sharpest annual rebound since the post-pandemic boom.

That momentum is now building into 2026 for what some financial analysts speculate could be the biggest IPO year in history.

A handful of mega-cap private companies, including SpaceX, OpenAI, and Anthropic, are exploring going public this year, with combined valuations that could exceed US$3 trillion.

2025 IPO market data

Top IPO candidates in 2026

1. SpaceX - US$1.5T valuation

SpaceX revenue reportedly hit US$15 billion in 2025, with analysts projecting an increase to US$22-24 billion in 2026. The company has been cash-flow positive for years, driven largely by its Starlink satellite broadband network.

Following its February 2026 all-stock acquisition of Elon Musk's AI company xAI, the combined entity also encompasses Grok AI and the social media platform X (Twitter).

Leading financial analysts have reported SpaceX is targeting a mid-2026 listing. Its next funding round is estimated to raise around US$50 billion, putting its initial market cap at US$1.5 trillion, which would make it the second-highest IPO valuation of all time.

This valuation would mean SpaceX would trade at 62–68 times projected 2026 sales. A steep premium that requires massive growth assumptions around Starlink and longer-term space-based AI ambitions.

2. OpenAI - US$850B valuation

OpenAI, the company behind ChatGPT, now reports more than 800 million weekly active users of its groundbreaking AI product.

Originally a nonprofit research lab, it has restructured into a for-profit entity developing large language models for consumer, enterprise, and developer applications.

OpenAI is reportedly targeting a Q4 2026 IPO, finalising a US$100 billion-plus funding round (its largest ever), which would put its valuation at US$850 billion.

However, OpenAI still needs to overcome some near-term hurdles to achieve the potential associated with such a high valuation.

It projects US$14 billion in losses in 2026 and does not expect profitability before 2029. It is facing intensified competition from Google Gemini and other AI startups cutting into its market share, and Elon Musk has filed a lawsuit against the company seeking up to US$134 billion in damages.

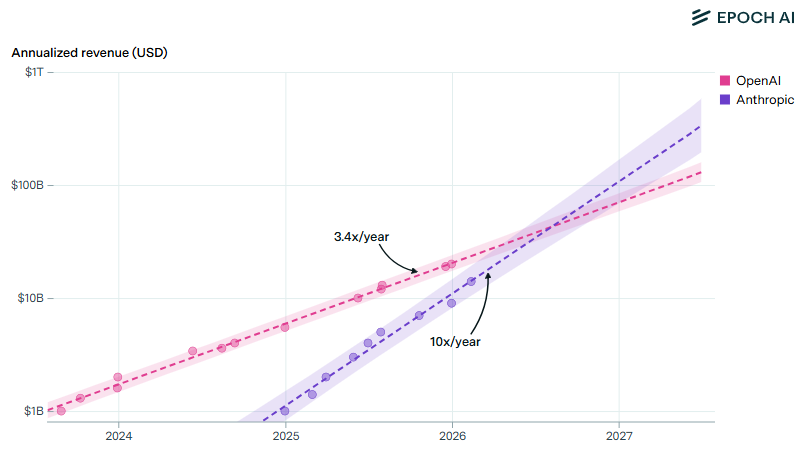

3. Anthropic - US$350B valuation

While OpenAI has leaned into consumer products, Anthropic has built its business around enterprise adoption. Roughly 80% of its revenue comes from business customers, and eight of the Fortune 10 are now Claude users.

Anthropic closed a US$30 billion funding round in February 2026 at a US$350 billion valuation, more than double its US$183 billion valuation from five months earlier.

Anthropic’s annualised revenue has been growing at 10x per year since 2024, well outpacing OpenAI’s growth of 3.4x per year. If this trend continues, Anthropic revenue could pass OpenAI by mid-2026. However, since July 2025, Anthropic’s growth rate has slowed down to 7x per year.

Anthropic has engaged law firm Wilson Sonsini to begin IPO preparations, and the recent appointment of former Microsoft CFO Chris Liddell to its board signals a governance push ahead of a potential late-2026 listing.

The company is not yet profitable, but its enterprise-heavy revenue mix and rapid growth trajectory make it one of the most closely watched IPO candidates this year.

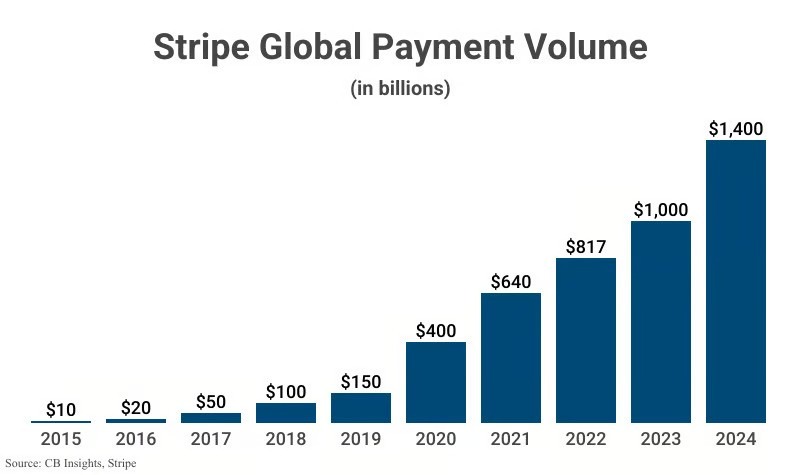

4. Stripe - US$140B valuation

Stripe processed US$1.4 trillion in total payment volume in 2024, roughly 1.3% of global GDP. Half the Fortune 100 now use Stripe, and recent moves into stablecoins and AI-to-AI "agentic commerce" payments are expanding its addressable market.

Stripe remains one of the most anticipated fintech IPOs globally, but the company has shown a lack of urgency to list in the past. Co-founder John Collison said at Davos in January 2026 that Stripe was "still not in any rush."

Rather than pursuing an IPO, Stripe has conducted tender offers every six months at rising valuations, providing employee liquidity without surrendering control.

These frequent tenders effectively function as a private-market alternative to going public. However, a traditional IPO is still on the cards in 2026, with the company's February tender offer valuing it at US$140 billion or more, and profitability since 2024 removing one of the key barriers to listing.

5. Databricks - US$134B valuation

Databricks completed a US$5 billion funding round in February 2026 at a US$134 billion valuation.

The company's annualised revenue exceeded US$5.4 billion in January 2026, growing a massive 65% year-on-year, with AI products generating US$1.4 billion.

CEO Ali Ghodsi has said the company is prepared to go public "when the time is right," with most analysts expecting a H2 2026 listing. At US$134 billion, Databricks is valued at more than twice publicly traded rival Snowflake (~US$58 billion).

Bottom line

2026 has the potential to be the biggest IPO year by valuation in history. With the most likely candidates, SpaceX and Databricks, matching the total valuation of all 2025 IPOs on their own.

If major AI players like OpenAI and Anthropic, as well as world-leading payment fintech Stripe, also list before the end of the year, 2026 could see over US$3 trillion in total value added to global markets through IPOs alone.

Markets move into the week ahead with inflation data across Australia and Japan, alongside elevated geopolitical tensions that continue to influence energy prices and broader risk sentiment.

- Australia Consumer Price Index (CPI): Inflation data may influence the Reserve Bank of Australia (RBA) policy path, with the Australian dollar (AUD) and local yields sensitive to any surprise.

- Japan data cluster: Tokyo CPI (preliminary) plus industrial production and retail sales provide an inflation-and-activity pulse that could shape Bank of Japan (BoJ) normalisation expectations.

- Eurozone & Germany CPI: Flash inflation readings will test the disinflation narrative and influence ECB rate-cut timing expectations.

- Oil and geopolitics: Brent crude has posted its highest close in around six months amid renewed Middle East tensions, reinforcing energy-driven inflation risk.

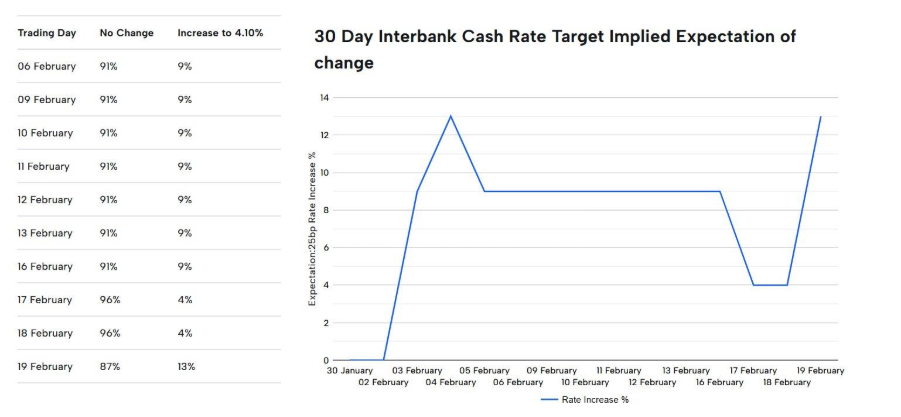

Australia CPI: RBA expectations to change?

Australia’s upcoming CPI release will be closely watched for signals on whether inflation is stabilising or proving more persistent than expected.

A stronger-than-expected print could be associated with higher yields and a firmer AUD as rate expectations adjust. A softer outcome could support expectations for a steadier policy stance.

Key dates

- Inflation Rate (MoM): 11:30 am Wednesday, 25 February (AEDT)

- CPI: 11:30 am Wednesday, 25 February (AEDT)

Monitor

- AUD volatility around the release.

- Local bond yield reactions.

- Interest rate pricing shifts.

Japan inflation and growth data

Japan’s late-week releases combine Tokyo CPI (preliminary) with industrial production and retail sales, offering a broader read on price pressures and domestic demand.

Tokyo CPI is often watched as a timely signal for national inflation dynamics and BoJ debate. Industrial output and retail spending add context on activity.

Surprises across this cluster can drive sharp moves in the JPY, particularly if results shift perceptions around the pace and persistence of BoJ normalisation.

Key dates

- Tokyo CPI: 10:30 am Friday, 27 February (AEDT)

- Industrial Production: 10:50 am Friday, 27 February (AEDT)

- Retail Sales: 10:50 am Friday, 27 February (AEDT)

Monitor

- JPY sensitivity to inflation surprises

- Bond yield moves in response to activity data

- Equity reactions if growth momentum expectations shift

Energy and safe-haven flows

Oil prices have climbed to their highest close in around six months amid renewed Middle East tensions.

Recent reporting on heightened regional military activity and shipping-risk headlines near the Strait of Hormuz has reinforced energy security as a market focus. The Strait of Hormuz remains a widely watched chokepoint for global energy flows.

Higher oil prices can feed into inflation expectations and influence bond yields. At the same time, geopolitical uncertainty can support the USD through safe-haven demand and relative rate positioning.

Monitor

- Brent crude price levels

- USD strength versus major currencies

- Yield movements as inflation risk premiums adjust

Eurozone and Germany inflation

Flash inflation readings from Germany and the broader eurozone (HICP) will test whether the region’s disinflation trend remains intact.

Germany’s release can influence expectations ahead of the aggregated eurozone figure. If core inflation proves sticky, expectations around the timing and pace of potential European Central Bank easing could shift.

Key dates

- Germany Inflation Rate: 12:00 am Saturday, 28 February (AEDT)

Monitor

- EUR volatility around inflation releases

- European sovereign bond yields

- Rate-cut probability adjustments

Key economic events