- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US Equities mixed, Bonds and gold fly on SVB contagion fears

- Home

- News & analysis

- Economic Updates

- US Equities mixed, Bonds and gold fly on SVB contagion fears

News & analysisNews & analysis

News & analysisNews & analysisWell, that was an interesting session..

US futures opened flat on Monday, before news of a Federal bailout of SVB depositors saw index futures soar, the Dow up over 400 points early in the session.

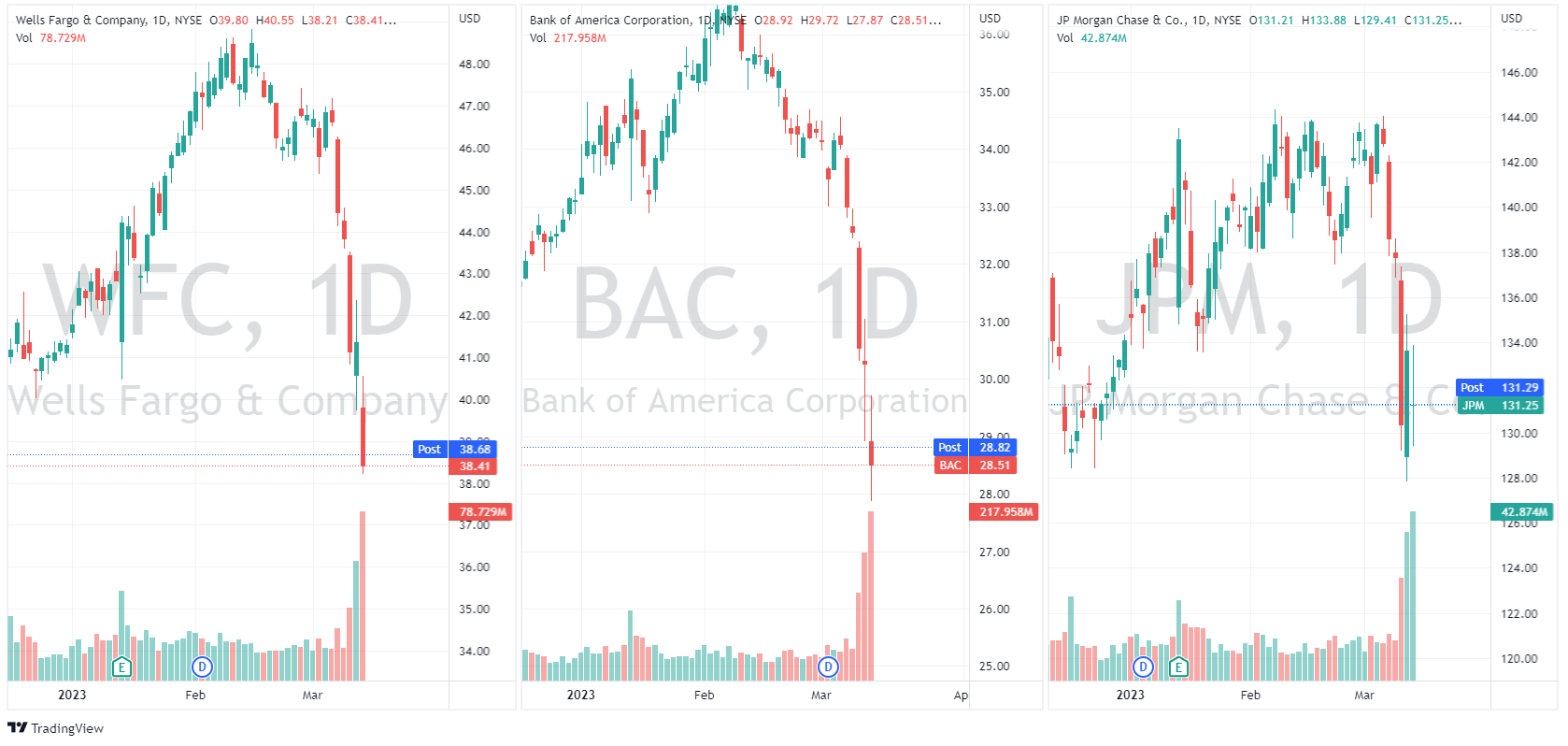

This didn’t last however as contagion fears saw stock sell off over the session, with only the Nasdaq able to hold onto a gain, which is not surprising considering that SVB’s biggest customers were tech related. The Russell 200 took the biggest hit, being home to many regional banks that saw large losses over the session. Many of these smaller banks activated the NYSE circuit breakers and were halted, while even the big guys took a hit, with Bank of America -5%, Wells Fargo -7% and “fortress” JP Morgan sliding over 2%

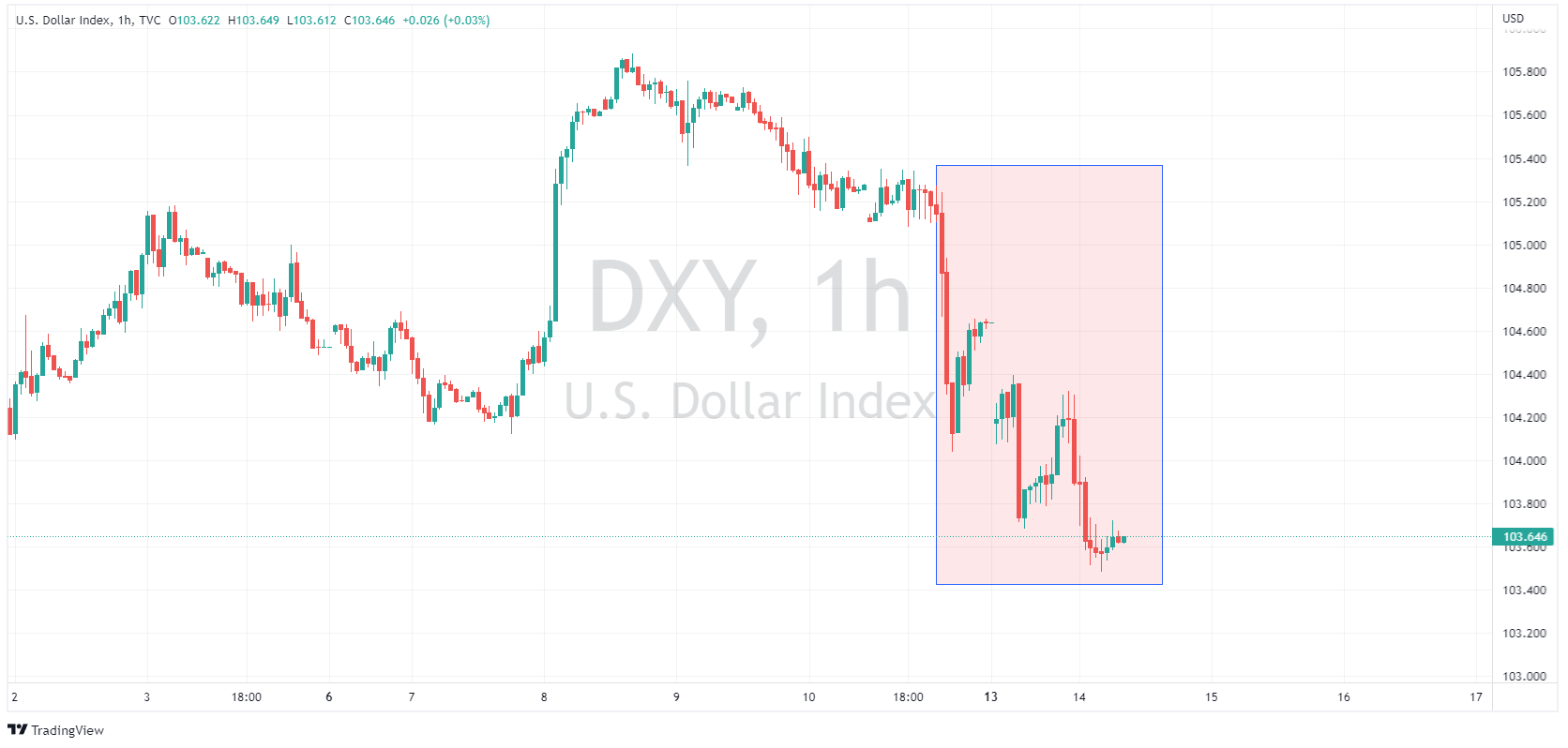

Markets repriced a big adjustment on the Feds move next week, 50bp was seen as an almost done deal only a few days ago which has now been completely priced out, with Fed Fund Futures now pricing in a 40% chance of no hike, 60% of a smaller 25bp hike.

This saw the Bonds rally strongly as yields dropped, and the USD take a hammering the Dollar index falling well below the 104 level.

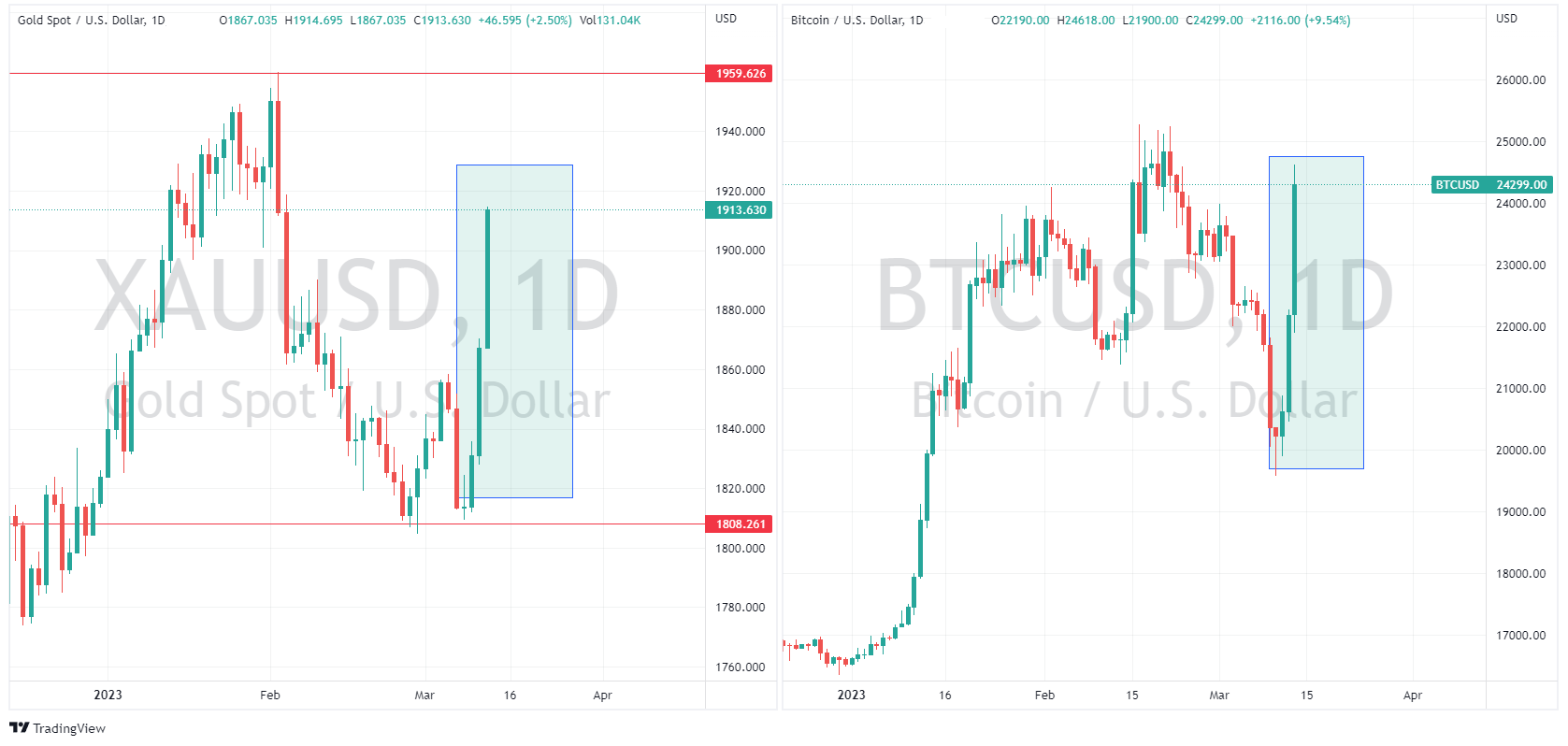

A weaker USD and jittery investors also sae alternative currencies rally strongly with Bitcoin flying to top the 24k USD level and Gold up over $30, breaking through the 1900 level.

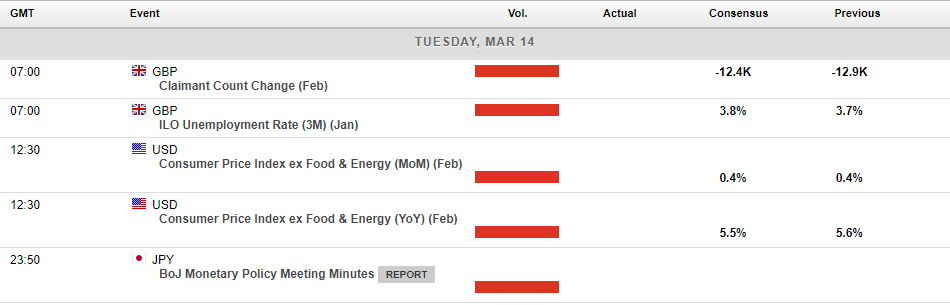

Tonight’s CPI figure was supposed to be the big news event of the week, it has taken a back seat somewhat but remains very important.. A weak reading could really cement the Fed hold narrative, a strong reading will put pressure on that.

Video Recap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

How to trade the US Dollar Index

The US Dollar Index (DXY) is a popular tool used by forex traders to assess the value of the US dollar relative to a basket of other major currencies. The DXY is calculated using the weighted average of six major currencies: the euro, yen, pound sterling, Canadian dollar, Swedish krona, and Swiss franc. To use the DXY to trade forex, you can fol...

March 14, 2023Read More >Previous Article

Bank of Canada keeps interest rates at 4.50%

This week, the Bank of Canada (BoC) released its decision to hold interest rates at the current level of 4.50%. In the rate statement, the BoC indicat...

March 10, 2023Read More >Please share your location to continue.

Check our help guide for more info.