- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- ASX200 Trading Lower; Panic–Buying Drives Record Surge in Retail

- Home

- News & analysis

- Shares and Indices

- ASX200 Trading Lower; Panic–Buying Drives Record Surge in Retail

News & analysisNews & analysis

News & analysisNews & analysisThe Australian share market struggled to edge higher despite overnight gains on Wall Street. The S&P/ASX200 dropped on the open after a two-day advance as all three US equity benchmarks had pared gains in the final hours of trading dragged by dovish Fed comments.

In the afternoon, the index was down 37 points or 0.70% to 5,370. All Ordinaries was trading lower by 28 points or 0.51% to 5,450.

The majority of the sectors were trading in negative territory but significant losses of more than 1% were seen in the real estate and financial sectors. Bank stocks were heavily weighing on the index with Westpac, ANZ and NAB all down by 2% or more, while CBA was trading around 1% lower.

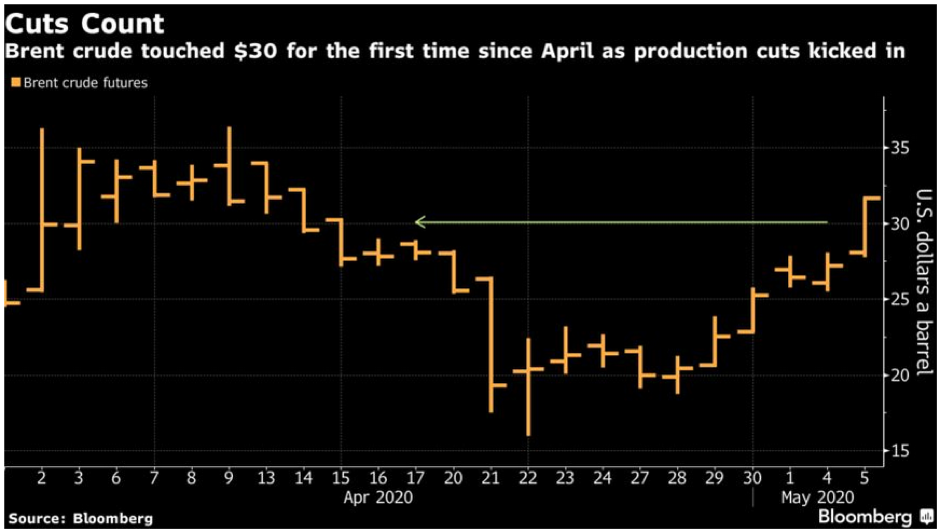

Source: BloombergAs of writing, the energy sector was the best-performing sector, supported by a surge in crude oil prices. For the first time since April, Brent Crude oil futures rose above $30 as production cuts started kicking in.

Source: BloombergOn the economic front, the Aussie Retail Sales turnover came above expectations at 8.5% in March compared to the 8.2% forecasted. Australia saw both record rises in food retailing and record falls in cafes, restaurants and takeaway food services. Panic-buying has driven the increases in food retailing (24.1%), household goods retailing (9.1%) and other retailing (16.6%) which has helped to compensate for the significant drop in other categories.

The Aussie dollar remains relatively muted at 64.30 US cents, despite the upbeat Retail Sales data.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Trading choices: Using a trading journal

We frequently refer both in the articles we publish and the weekly “Inner Circle” sessions we present, to the benefits of a trading journal. However, the reality is that many traders make the choice not to measure trading despite the logical benefits of doing so. Whether you do or don’t currently, the bottom-line decision you are...

May 8, 2020Read More >Previous Article

Tyson Foods & Skyworks Earnings Reports

Tyson Foods & Skyworks Earnings Reports Tyson Foods and Skyworks are among the two major earnings results released on Monday. The meat processo...

May 5, 2020Read More >Please share your location to continue.

Check our help guide for more info.