- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- COTD: AMZN – Can Amazon Continue To Ride Pandemic Waves?

- Home

- News & analysis

- Shares and Indices

- COTD: AMZN – Can Amazon Continue To Ride Pandemic Waves?

News & analysisNews & analysis

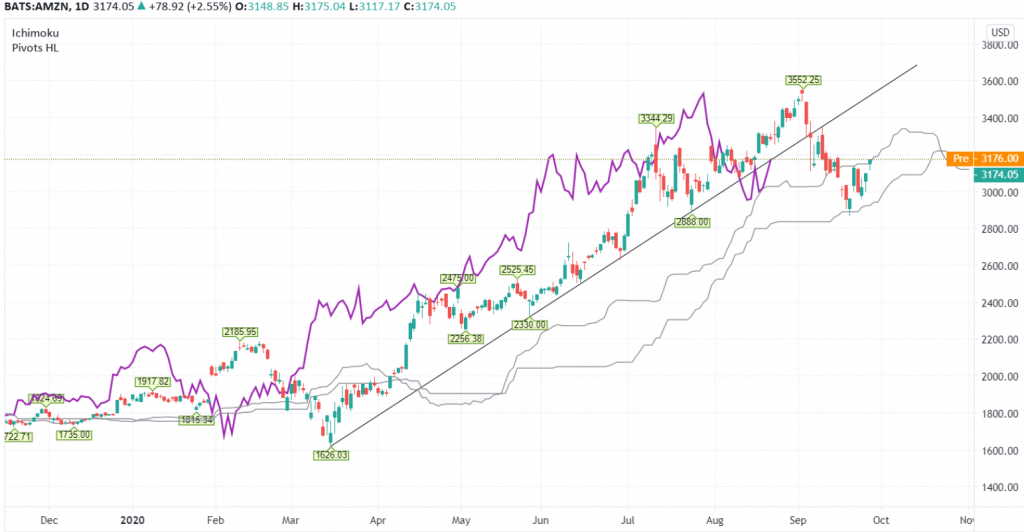

News & analysisNews & analysisAMZN – Daily

Amazon.com (AMZN) –

As a retail conglomerate, it doesn’t get much bigger than Amazon listed on the US Nasdaq exchange. Despite all the pandemic problems, AMZN found itself uniquely positioned to be one of the few companies able to maintain the status quo and even thrive amongst an already weakened retail sector.

At the beginning of this month, something quite significant occurred in the daily chart above. For the first time since March, the validated bullish trend line supporting the stock throughout 2020 thus far gave way and took the price down with it from $3,300 to $2,871 per share.

Some would argue that this sudden price drop demonstrates systemic problems within the retail sector itself, and this event was bound to happen sooner or later. However, when we apply the Ichimoku indicator, we start to see a different story emerge. It suggests the recent price fall may only be a temporary blip for Amazon and its dominance in this space remains intact.

For starters, the longer-term lagging span (purple line) remains above the cloud, providing us with confirmation of a bullish stance. Next, we have strong evidence that price action respects the Ichimoku indicators as per the clear bounce from the bottom of the cloud support at $2,890. And lastly, the cloud’s current overall thickness hints at good support for the stock going forward.

As we enter the fourth quarter, undoubtedly, most retail activity will continue to experience difficulties due to issues surrounding COVID-19. Even Amazon may not be able to deal with some unforeseen outcomes of the changing retail landscape. In the meantime, I suspect we may see a return to this longer-term bullish activity, albeit in a slower-paced manner. Remember, before March, the trend mainly consisted of a consolidated ranging pattern throughout 2019. Without any further shocks to the market, the stock may end up defaulting back to this behavior.

In summary, based on the Ichimoku data, a potential return to the $3,400 region seems reasonable, with key support for the stock located around $2,880 and $3,200, respectively.

For those interested in trading AMZN as a share CFD, Go Markets has this stock and many more, including companies from the ASX, NYSE, and the NASDAQ.

Note: Click on charts to enlarge.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

September: A Typical Scary Month for Investors

Poor Month for Markets Investors are generally apprehensive of the month of September as on average it is marked as the worst month for the stock market. After a staggering rally in August driven by broad-based vaccine optimism, global stimulus, improving economic data, better-than-expected earnings season and the outperformance of the technology...

September 30, 2020Read More >Previous Article

Inner circle Video – Using Autochartist for trade set ups and risk management

We were privileged this week to welcome back Autochartist CEO Ilan Azbel, who presented a highly charged, informative and exciting session for those w...

September 27, 2020Read More >Please share your location to continue.

Check our help guide for more info.