- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- Year to Date: ASX200 Back in Positive Territory

- Home

- News & analysis

- Shares and Indices

- Year to Date: ASX200 Back in Positive Territory

- The state of Michigan officially certifies the election results for Joe Biden.

- The General Services Administration (GSA) which can ascertain the winner of a Presidential election based on certain criteria and govern under the law for presidential transitions, has recognised Joe Biden as the “apparent winner” and extended around $8 million in transition funding and making other resources available to the Biden transition team.

- The easing of lockdown restrictions in the second most populated state and the second’s largest city in the country.

- The positive vaccine updates coming from Pfizer and BioNTech, Moderna and AstraZeneca.

- The confidence in the Australian economy as compared to other major countries.

- Historically low-interest rates. Even though the RBA slashed interest rates to a historic low, there is a level of reassurance that the lower level of interest rates will stay for a longer period which means that the central bank is not expecting a deterioration in the Australian economy fuelling investors’ confidence.

- The Asia-Pacific Free Trade Agreement has provided another level of confidence at a time of global trade uncertainty. It has also elevated expectations that both countries might initiate some sort of dialogue after the Chinese Communist Party has frozen all communications with Australian ministers.

News & analysisNews & analysis

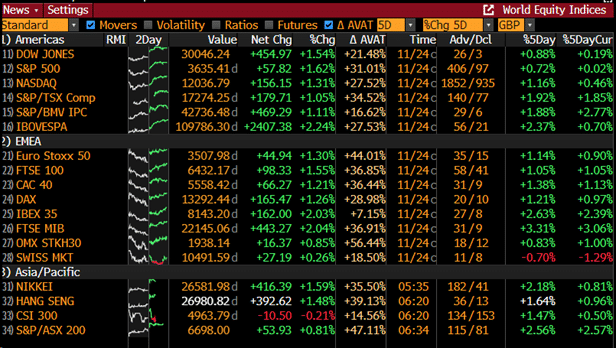

News & analysisNews & analysisThe Australian share market erased 2020 losses today following a strong performance on Wall Street on Tuesday which caused the blue-chip gauge to top 30,000 for the first time. Amid a series of recent positive vaccine updates, the US share market was buoyed by hopes that there is a less chance of a contested election:

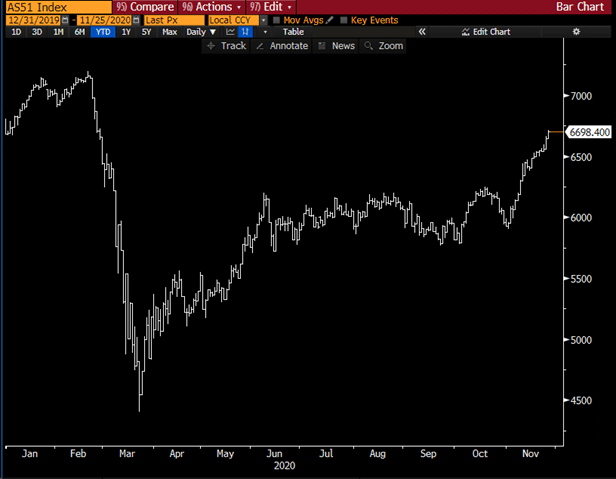

Source: Bloomberg TerminalAs of writing, the index was up by 0.8% to 6,698.40 points, and rose in positive territory for the year. Most sectors were trading in the green with the energy, financial, real estate and materials index being the best performers with more than 1% gains.

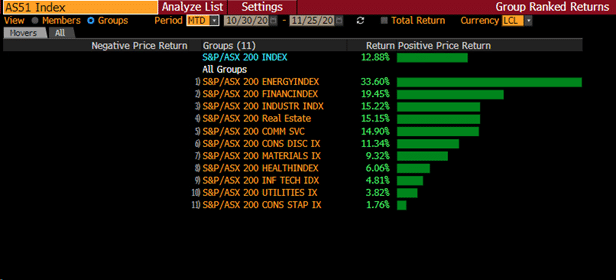

Source: Bloomberg TerminalAfter the release of the Federal Budget, Australian shares started to decouple from US and European stocks as investors endorsed the government blitz which boosted confidence. During the month of November, the Australian share market has rallied significantly on the back of:

The pandemic-battered sectors like energy, financials, and real estate were among the biggest gainers on the ASX during the month following the relaxation of lockdown measures. Technology and health stocks which were among investors’ favourites during the pandemic retreated lower during the month.

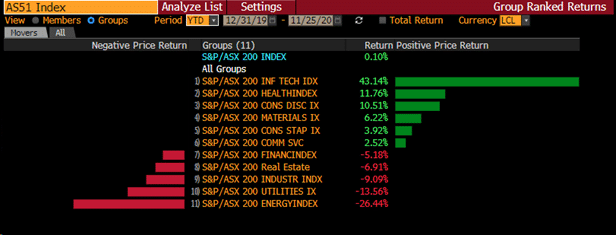

Source: Bloomberg TerminalYear to date – the technology and health sector continues to lead with the tech index currently up by a whopping 43%. Despite the improvement in the energy market over the past few weeks, the index is still standing as the worst-performing sector given the fundamental uncertainties.

Source: Bloomberg TerminalReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

November: US Election mayhem, second wave of lockdowns, and promising vaccine updates

An election-driven month With just a few days to month's end, the dynamics driving markets have changed compared to a few weeks ago. Risk sentiment was sliding under the influence of politics, mostly by the uncertainty around the US Presidential Election. More recently investors have breathed a sigh of relief on a series of positive vaccine upda...

November 27, 2020Read More >Previous Article

Stock in News – Tesla and Amazon

Tesla Inc Tesla Inc, the electric car maker is set to join the S&P500 on December 21. The Company’s share price rallied following the announce...

November 20, 2020Read More >Please share your location to continue.

Check our help guide for more info.