Trading strategies

Explore practical techniques to help you plan, analyse and improve your trades.

Our library of trading strategy articles is designed to help you strengthen your market approach. Discover how different strategies can be applied across asset classes, and how to adapt to changing market conditions.

Volatility doesn't discriminate. But it can punish the unprepared.

Stops getting hit on moves that reverse within minutes. Premiums on short-dated options climbing. And the yen no longer behaving as the reliable hedge it once was.

For traders across Asia, navigating this environment means asking harder questions about risk, timing, and the assumptions baked into strategies built for calmer markets.

1. How do I trade VIX CFDs during a geopolitical shock?

The CBOE Volatility Index (VIX) measures the market’s expectation of 30-day implied volatility on the S&P 500. It is often called the “fear gauge.” During geopolitical shocks such as the current Iran escalations, sanctions announcements, and surprise central bank actions, the VIX can spike sharply and quickly.

What makes VIX CFDs different in a shock

VIX itself is not directly tradeable. VIX CFDs are typically priced off VIX futures, which means they carry contango drag in normal conditions.

During a geopolitical shock, several things can happen at once

- Spot VIX may spike immediately while near-term futures lag, creating a disconnect.

- Spreads on VIX CFDs can widen significantly as liquidity thins.

- Margin requirements may change intraday as broker risk models adjust.

- VIX tends to mean-revert after spikes, so timing and duration are critical.

What this means for Asian-hours traders

Asian market hours mean many geopolitical events can break while local traders are active or just starting their session.

A shock that hits during Tokyo hours may already be priced into VIX futures before Sydney opens.

Some traders use VIX CFD positions as a short-term hedge against equity portfolios rather than a directional trade. Others trade the reversion (the move back toward historical averages once the initial spike fades). Both approaches carry distinct risks, and neither guarantees a specific outcome.

2. Why are my 0DTE options premiums so expensive right now?

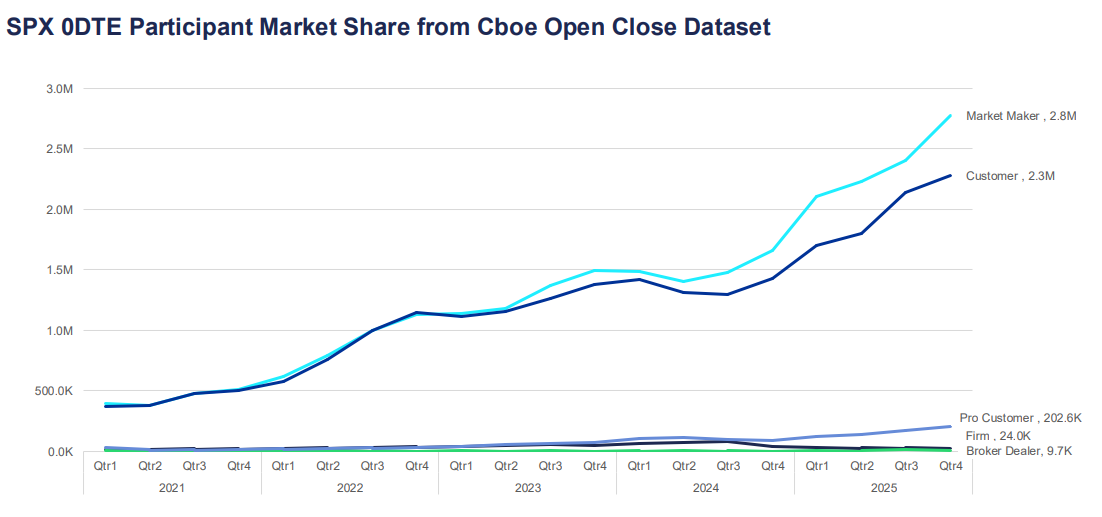

Zero days-to-expiry (0DTE) options expire on the same day they are traded. They have become one of the fastest-growing segments of the options market, now representing more than 57% of daily S&P 500 options volume according to Cboe global markets data.

For Asian-based participants accessing US options markets, elevated premiums during volatile periods can feel like mispricing, but usually reflects structural pricing factors.

Why premiums spike

Options pricing is driven by intrinsic value and time value. For 0DTE options, there is almost no time value left, which might suggest they should be cheap but the implied volatility component compensates for that.

When uncertainty increases, sellers may demand greater compensation for the risk of sharp intraday moves.

This can be reflected in

- Higher implied volatility inputs.

- Wider bid-ask spreads.

- Faster adjustments in delta and gamma hedging.

In higher-VIX environments, hedging flows can contribute to short-term feedback loops in the underlying index. This can amplify price swings, particularly around key levels.

What this means for Asian-hours traders

Many 0DTE options contracts see their most active pricing and hedging flows during US trading hours. Entering positions during the Asian session may mean facing stale pricing or wider spreads.

If you are seeing expensive premiums, it may reflect the market accurately pricing the risk of a large same-day move. Whether that premium is worth paying depends on your view of the likely intraday range and your risk tolerance, not on the absolute dollar figure alone.

3. How do I adjust my algorithmic trading bot for a high-VIX environment?

Many algorithmic trading systems are built on parameters calibrated during lower-volatility regimes. When VIX spikes, those parameters can become outdated quickly.

The regime mismatch problem

Most trading algorithms use historical data to set position sizes, stop distances, and entry thresholds. That data reflects the conditions during which the system was tested. If VIX moves from 15 to 35, the statistical assumptions underpinning those settings may no longer hold.

Common failure modes in high-VIX environments include

- Stops triggered repeatedly by noise before the intended directional move occurs.

- Position sizing based on fixed-dollar risk, which becomes relatively small compared to actual intraday ranges.

- Correlation assumptions between assets breaking down.

- Slippage on execution that erodes edge.

Approaches some algorithmic traders consider

Rather than running a single fixed set of parameters, some systems incorporate a volatility regime filter. This is a real-time check on VIX or ATR that triggers a switch to different settings when conditions shift.

Approach adjustments that some traders review in high-VIX environments

- Widen stop distances proportionally to ATR to reduce noise-driven exits.

- Reduce position size to maintain constant dollar risk relative to wider expected ranges.

- Add a VIX threshold above which the system pauses or moves to paper trading mode.

- Reduce the number of simultaneous positions, as correlations tend to rise during market stress.

No adjustment eliminates risk. Backtesting new parameters on historical high-VIX periods can provide some indication of likely performance, though past conditions are not a reliable guide to future outcomes.

4. Is the Japanese Yen (JPY) still a reliable safe-haven trade?

During periods of global risk aversion, capital has historically flowed into JPY as investors unwind carry trades and seek lower-volatility holdings. However, the reliability of this dynamic has become more conditional.

Why has the yen historically moved as a safe haven?

Japan’s historically low interest rates made JPY the funding currency of choice for carry trades and when risk-off sentiment hits, those trades unwind quickly, creating demand for yen.

Additionally, Japan’s large net foreign asset position means Japanese investors tend to repatriate capital during crises, further supporting JPY.

What has changed

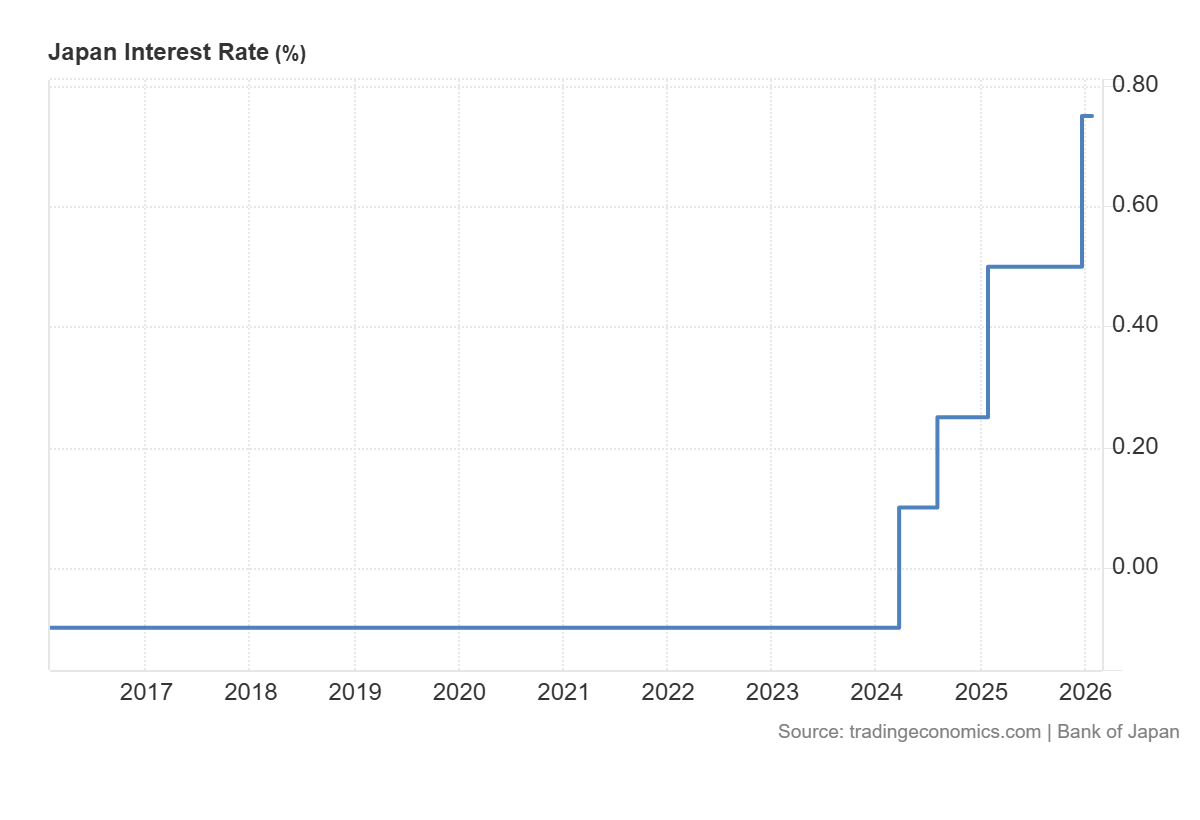

The Bank of Japan’s shift away from ultra-loose monetary policy in recent years has complicated the traditional safe-haven dynamic.

As Japanese interest rates rise:

- The scale of carry trade positioning may change.

- USD/JPY can become more sensitive to interest rate spreads.

- BoJ communication and domestic inflation data may influence JPY independently of global risk appetite.

The yen can still behave as a safe haven, particularly during sharp equity sell-offs. But it may respond more slowly or inconsistently compared to earlier cycles when the policy divergence between Japan and the rest of the world was more extreme.

What to watch

For traders monitoring JPY as a safe-haven signal, BoJ meeting dates, Japanese CPI releases, and real-time US-Japan rate spread data have become more relevant inputs than they were a few years ago.

5. How do I avoid ‘whipsawing’ on energy CFDs?

Whipsawing describes the experience of entering a trade in one direction, getting stopped out as the price reverses, then watching the price move back in the original direction.

Energy CFDs, particularly crude oil, are especially prone to this in volatile markets. And for traders in Asia, the combination of thin liquidity during local hours and sensitivity to geopolitical headlines can make this particularly challenging.

Why energy CFDs whipsaw

Crude oil is sensitive to a wide range of headline drivers: OPEC+ production decisions, US inventory data, geopolitical supply disruptions, and currency moves.

In high-volatility environments, the market can react strongly to each headline before reversing when the next one arrives.

- Price spikes on a headline, stops are triggered on short positions.

- Traders re-enter long, expecting continuation.

- A second headline or profit-taking reverses the move.

- Long stops are hit. The cycle repeats.

Approaches traders may consider to manage whipsaw risk

Some traders choose to change their risk controls in volatile conditions (for example, reviewing stop placement relative to volatility measures). However these may increase losses; execution and slippage risks can rise sharply in fast markets

Other approaches that some traders review:

- Avoid trading crude oil CFDs in the 30 minutes before and after major scheduled data releases.

- Use a longer timeframe chart to identify the prevailing trend before entering on a shorter timeframe, reducing the chance of trading against larger institutional flows.

- Scale into positions in stages rather than committing full size on initial entry.

- Monitor open interest and volume to distinguish between moves with genuine participation and low-liquidity fakeouts.

Whipsawing cannot be eliminated entirely in volatile energy markets. The goal of risk management in these conditions is not to predict which moves will hold, but to ensure that losses on false moves are smaller than gains when a genuine directional move follows.

Practical considerations for volatile Asian markets

Asian markets carry structural characteristics that interact with volatility differently from US or European markets:

- Thinner liquidity during local hours can exaggerate moves on thin volume, particularly in energy and FX CFDs.

- Events in China, including PMI releases, trade data, and PBOC policy signals, can move regional indices.

- BoJ policy decisions have become a more active driver of JPY and Nikkei volatility in recent years.

- Overnight gaps from US session moves are a persistent structural risk for traders unable to monitor positions around the clock.

- Margin requirements on leveraged products can change at short notice during high-VIX periods.

Frequently asked questions about volatility in Asian markets

What does a high VIX reading mean for Asian equity indices?

VIX measures expected volatility on the S&P 500, but elevated readings typically reflect global risk aversion that flows across markets. Asian indices such as the Nikkei 225, Hang Seng, and ASX 200 can often see increased volatility and negative correlation with sharp VIX spikes.

Can 0DTE options be traded during Asian hours?

Access depends on the platform and the specific instrument. US equity index 0DTE options are most actively priced during US trading hours. Asian traders may face wider spreads and less representative pricing outside those hours.

Are algorithmic trading strategies inherently riskier in high-volatility conditions?

Strategies calibrated during low-volatility periods may perform differently in high-VIX environments. Regular review of parameters against current market conditions is prudent for any systematic approach.

Has the JPY safe-haven trade changed permanently?

The Bank of Japan’s policy normalisation has introduced new dynamics, but JPY has continued to strengthen during some risk-off episodes. It may be more conditional on the nature of the shock and the BoJ’s concurrent posture.

What is the best way to set stops on energy CFDs in high-volatility conditions?

There is no universally best method. Many traders reference ATR to calibrate stop distances to prevailing conditions rather than using fixed levels. This does not guarantee exit at the desired price and does not eliminate whipsaw risk.

The financial markets are evolving rapidly, driven by increased data availability, computational advancements, and sophisticated trading strategies. Traders—both institutional and retail—are turning to artificial intelligence (AI) and, more specifically, Machine Learning (ML) to gain an edge in the markets. At its core, Machine Learning is a subset of AI that enables systems to learn from data and make predictions or decisions without being explicitly programmed.

This is a fundamental shift from traditional rule-based trading systems, which rely on static conditions and predefined rules. Instead, ML-powered strategies can adapt, refine, and improve their decision-making process over time, allowing traders to respond more dynamically to ever-changing market conditions. In this article we attempt to unravel not only what ML is but why is ML is likely to become such a dominant force in trading, how you might get ML to work for you, AND even if you are likely to sit on the sidelines what it all may mean for discretionary traders and how it could change the way process move.

Why Now? The Perfect Storm for ML Adoption Several key developments in technology and financial markets have contributed to the widespread adoption of machine learning in trading. I have identified the primary four factors which include: Explosion of Market Data Financial markets generate enormous amounts of data every second, including price movements, order book data, trading volumes, macroeconomic reports, earnings releases, news articles, and even sentiment indicators from social media.

Historically, traders have relied upon basic statistical models or simple technical indicators to analyse this data. However, with ML, traders can now process and extract insights from vast amounts of structured and unstructured data far beyond human capabilities. For example, natural language processing (NLP), a branch of AI, can scan financial news sources, social media platforms like Twitter, and earnings call transcripts in real time to gauge market sentiment.

This allows traders to make more data-driven decisions, predicting how a specific news event might impact stock prices before traditional market participants react. Advancements in Computing Power The ability to leverage ML in trading was once limited by hardware constraints. However, the rise of cloud computing, GPU (graphics processing units) – which may be better than CPUs for acceleration of data pattern matching, and quantum computing research has dramatically increased the speed and efficiency of processing large datasets.

In practical terms, this means that ML models can be trained and executed in real-time, allowing traders (or trading algos) to make split-second decisions based on rapidly evolving market conditions. For instance, hedge funds and proprietary trading firms now run ML-driven models that execute high-frequency trades (HFT) at lightning-fast speeds. These models can analyse thousands of data points within milliseconds to determine the most optimal trade execution strategy.

Algorithmic Trading Dominance Institutional trading desks and hedge funds increasingly depend on sophisticated algorithms to identify patterns, predict price movements, and execute trades with precision. Machine learning adds an additional layer of intelligence, allowing these strategies to evolve and optimize continuously. For example, ML-powered quantitative trading strategies can adjust trading parameters dynamically, responding to shifts in volatility, changes in liquidity conditions, or sudden macroeconomic shocks (such as Federal Reserve rate decisions).

This gives firms a huge competitive advantage over traders using fixed-rule systems. Retail Trader Accessibility This is where it may become more relevant to you or I in a trading context! Machine learning is no longer limited to large institutions with deep pockets.

AI-powered tools and trading platforms are making ML-driven strategies more accessible to retail traders. Many brokers and third-party developers now offer plug-and-play ML models that traders can integrate into their trading systems, even without a deep understanding of coding or data science. For instance, platforms like MetaTrader 5, along with the help of those who know programming language, allow traders to build and test ML-based strategies, This democratisation of technology ensures that even independent traders and not just the big players can begin to utilise the leverage in decision making associated with AI-driven system development potential.

How is Machine Learning Used in Trading? Having covered why ML is a NOW issue in trading, let's explore in more detail how it can be used in trading so you can begin to understand its full potential. Machine learning is transforming trading strategies in several significant ways, enabling traders to gain insights, optimise trade execution, and react more dynamically to market movements and changes in sentiment.

Identifying Patterns That Humans Might Miss One of the most valuable aspects of machine learning is its ability to detect hidden patterns and relationships that may not be immediately obvious to human traders and traditional forms of technical analysis and standard indicators. Some key applications include: Detecting correlations between price, volume, sentiment, and macroeconomic indicators that are too complex for traditional analysis. Recognizing trading patterns such as mean reversion, momentum shifts, and breakout signals.

Using sentiment analysis on financial news, social media, and earnings reports to anticipate potential price movements. To give a potential example, an ML model can analyse Bitcoin price action, news sentiment, and trading volume to determine whether a sudden spike in tweets mentioning Bitcoin is more likely to trigger a short-term rally or a market dump. Optimising Trading Strategies for Higher Accuracy Machine learning doesn’t just help traders recognise patterns—it actively refines and optimizes trading strategies by learning from past market conditions and improving decision-making processes.

Reducing False Signals: ML models apply probability techniques in an attempt to limit the occurrence of false positives. This is particularly useful for traders whose strategies may struggle with whipsaws in volatile markets. Refining Trade Entry and Exit Points: Instead of rigid rules, ML systems dynamically adjust trade timing based on changing volatility, volume, and market sentiment.

Automating Risk Management: ML-powered risk models optimize stop-loss levels and position sizing based on the current market environment (and the likelihood that this may change) For example, a forex trader might use an ML system that widens stop-losses during high-volatility events like FOMC rate decisions and tightens them when price action is stable. Adapting to Changing Market Conditions Unlike traditional strategies, ML models dynamically adjust parameters in response to market shifts. Regime Detection: ML identifies when markets switch from trending to ranging, adjusting trading strategies accordingly.

Adaptive Position Sizing: Models automatically increase or decrease trade size based on real-time risk assessments. Feature Selection: ML continuously selects the most relevant technical indicators based on current market behaviour. For instance, an ML-driven strategy might rely on moving averages during a trend, but switch to RSI and Bollinger Bands when markets consolidate.

How Machine Learning Works in applying trading – A process model Machine learning follows a structured four-stage process when applied to trading. This process ensures that trading models are built, refined, and continuously improved to enhance the chances of profitability and appropriate adaptability. Should you dive into the world of ML this would provide an appropriate framework for you to follow.

Let’s break down each stage with examples of how traders and institutions can, and do, apply these concepts in real-world markets. Recognising Patterns – Collecting and Analysing Market Data The foundation of any machine learning model is data collection. Without accurate and comprehensive data, ML models cannot learn effectively.

In trading, this involves gathering historical and real-time market data, such as: Price action (open, high, low, close, and volume) Order book data (bids, asks, and execution flow) Macroeconomic indicators (inflation rates, GDP data, central bank decisions) News and sentiment analysis (financial news articles, earnings reports, and social media sentiment) Let’s give an example to help clarify how this could work. A hedge fund using ML might aggregate 10 years of historical price data from multiple asset classes (stocks, forex, crypto, commodities) along with real-time social media sentiment data from Twitter and Reddit. The model scans for correlations between news sentiment and asset price movements, allowing it to predict how a stock may react to a particular news headline before the broader market does.

Using Additional Factors – Feature Selection and Confluence Indicators Once raw data is collected, the next step is to identify the most relevant factors (also called features) that contribute to successful trading decisions. Feature selection helps filter out unnecessary noise and focus on variables that strongly influence price action. ML models use statistical techniques to evaluate which features matter most, including: Standard Technical indicators: Moving Averages, RSI, Bollinger Bands, MACD, etc.

Order flow dynamics: Imbalance between buyers and sellers at key price levels. Volatility measures: ATR (Average True Range) and historical volatility. Sentiment indicators: Word frequency analysis from news articles.

Again, here is an example to help illustrate this approach. Suppose a trader is building an ML model to predict breakout trades in the S&P 500 index. Initially, the model considers 100 different features, including volume, volatility, RSI divergence, Bollinger Bands, earnings reports, and Federal Reserve announcements.

After running a feature selection process, the model identifies that only five key factors have predictive power—for instance, breakouts are most reliable when combined with a sudden surge in trading volume, an increase in open interest, and a bullish sentiment score from recent news headlines. By narrowing down the list of variables, the ML system focuses only on high-probability signals, reducing false positives and improving accuracy. Testing and Adjusting Probabilities – Training the Model Once relevant features are identified, the next step is to train the ML model.

Training involves feeding historical data into the model, allowing it to learn how different market conditions impact trade outcomes. This phase involves: Backtesting: Running the model on past data to see how well it would have performed historically. Cross-validation: Splitting data into multiple sets to prevent overfitting (where the model memorizes past data instead of generalizing patterns).

Probability adjustments: Refining the model by increasing the weight of more reliable signals and reducing the impact of weaker ones. As an example, a forex trader using ML wants to develop a model that predicts trend reversals in EUR/USD. Initially, the model has an accuracy of 55%, which is slightly better than random chance.

However, after adjusting the model’s probability weighting, the trader discovers that reversal trades are significantly more reliable when price is near a key Fibonacci retracement level AND volatility is low. After refining these inputs, the model’s accuracy improves to 68%, making it a potentially more viable trading tool. This stage is crucial because many ML models fail when they are over-optimized for past data but don’t perform well in real-time markets.

The goal is to find patterns that repeat across different time periods and market conditions. One of the challenges of this of course is to determine what constitutes a reasonable amount of past data and how this differs depending on the timeframe under investigation. Programming and Evaluating Results – Testing in Live Markets Once an ML model has been trained and optimized, the final step is deploying it in real-time trading.

This process involves simulated (demo) trading, forward-testing, and continuous performance monitoring. At this stage, traders must ensure: The model performs well in real-time data streams, not just historical backtesting. It adapts to changing market conditions rather than being reliant on past patterns.

Risk management is incorporated so that even if predictions fail, drawdowns remain controlled. AND is consistently monitored to quickly identify and potential intervene on changing performance. For example, a hedge fund may develop an ML model to trade Bitcoin breakout patterns.

In backtests, the model had a 72% win rate. However, once deployed in live markets, it struggles due to sudden changes in Bitcoin’s liquidity conditions and large institutional order flows. To fix this, the fund integrates real-time order book analysis, allowing the model to detect large buy/sell orders from major players.

After this adjustment, the model stabilizes and achieves consistent profitability in live trading. Many traders assume that once an ML model is built, it will work indefinitely. Just to reinforce the need for consistent monitoring, remember markets are constantly evolving.

The most successful machine learning models are those that are continuously monitored, retrained, and optimised based on the impact of new data on previously developed systems. What Machine Learning may mean for market price action for all traders. The growing influence of machine learning in trading is reshaping how markets behave.

Whether choosing to be an active participant or simply a discretionary trader it is essential to give some thinking about how market prices, and the movement of such could be impacted through a proliferation of ML driven strategies and automated models. Here are FOUR key ways ML may already be altering price action dynamics: Smoother Trends with Fewer Pullbacks Historically, market trends have often experienced frequent retracements, with price pulling back before resuming its primary direction. However, as ML-powered trading models become more dominant, trends are becoming smoother and more sustained.

This is because ML-driven trend-following strategies can identify high-probability trend continuations and execute trades that reinforce directional movement. For example, large hedge funds using ML-driven strategies may enter scaling positions, gradually increasing exposure instead of making single large trades. This reduces erratic price movements and contributes to more gradual, extended trends.

Faster Breakouts & Fewer False Signals One of the biggest frustrations for traders is entering a breakout trade, only for price to quickly reverse—a phenomenon known as a false breakout or "fakeout." Machine learning is improving breakout trading strategies by identifying breakout strength indicators, such as volume surges, volatility expansions, and order flow imbalances. For instance, ML models analysing Bitcoin price action may detect that breakouts with a 30% increase in trading volume have a significantly higher chance of success compared to breakouts without volume confirmation. As a result, traders using ML-based breakout models filter out weak breakouts and focus only on those with strong supporting evidence.

Increased Stop-Loss Hunting & Engineered Liquidity Grabs As ML-powered algorithms become more sophisticated, they are increasingly able to predict where retail traders and traditional algorithmic strategies place stop-loss orders. This has led to a rise in engineered liquidity grabs, where price briefly spikes below key support levels (or above resistance levels) to trigger stop-loss orders before reversing in the intended direction. For example, an ML-driven institutional trading desk might analyse order book data and recognize that a high concentration of stop-loss orders sits just below a key support level.

The algorithm may execute a series of aggressive sell orders to trigger those stops, temporarily pushing the price lower. Once the stop losses are triggered, the algorithm quickly reverses its position and buys back at a lower price, capitalising on the forced liquidation of retail traders. More Algorithmic Whipsaws in Low-Liquidity Zones As ML-powered trading strategies become more widespread, low-liquidity markets are experiencing an increase in whipsaws and rapid price reversals.

This is because ML algorithms are constantly competing with one another, leading to aggressive, short-term volatility spikes when multiple models react to the same data simultaneously. For example, in markets with thin liquidity—such as exotic forex pairs or small-cap stocks—ML-driven strategies might detect an inefficiency and rush to exploit it. However, because multiple trading models recognize the same opportunity at the same time, prices can experience violent, rapid movements as algorithms aggressively adjust their positions.

This has made it increasingly challenging for manual traders to navigate low-liquidity environments without getting stopped out by unexpected reversals. Final Thoughts: Machine Learning as a Continuous Process There are two key takeaways I want you to get from this article. Firstly, machine learning is here to stay and is only likely to proliferate further impacting on strategy developed but at the CORE of trading – will impact on the traditional way we see asset prices move.

Even if not an active part of ML in how you decide to trade you need to keep abreast of what is happening in this world and the potential changes to traditional technical analysis techniques that may necessitate a review of how YOU trade now. Secondly, machine learning in trading is not a “set-it-and-forget-it” system. Rather, it is a continuous learning process where models must be refined, adapted, and improved based on real-time data and evolving market conditions.

Those who do embrace this are likely to fall very short of its potential. There are NO SHORT CUTS in the process described nor in the need for continuous and thorough performance measurement and evaluation. Traders and institutions that effectively integrate ML into their strategies gain a significant edge by leveraging data-driven decision-making, automation, and adaptive learning.

While ML does not guarantee success, it reduces human bias, improves accuracy, and enhances trading efficiency, making it one of the most powerful tools for modern market participants.

Introduction The ability to recognise and effectively use chart patterns is often considered a fundamental skill in technical trading. Traders across all levels, from beginners to institutional professionals, study recurring price formations in an attempt to predict future market movements. However, the actual reliability of these patterns is frequently debated.

Most traders are aware of terms like 'bullish flag,' 'double top,' or 'ascending triangle,' but what do these formations truly indicate in terms of statistical success rates and practical trading strategies? More importantly, how do we use them effectively rather than treating them as standalone signals? Key Principles: Why Reliability Matters in Trading Understanding the probability of a price move based on historical occurrences is essential for making strategic decisions.

Theoretically, at least, there are three considerations worth outlining when considering this as a topic. Risk Management Traders should be able to set more accurate stop-loss and take-profit levels by understanding the likelihood of pattern success. This helps reduce emotional decision-making and provides better-defined risk-reward ratios.

Confidence in Trade Execution If traders have quantified probabilities, they can trust their system instead of second-guessing trades. A data-driven approach particularly one that has demonstrated some evidence of success in live trading helps build system confidence and so maintain discipline, in multiple market conditions, Strategy Optimisation Patterns should not be used in isolation. They must be tested against various timeframes, market conditions, and confluence factors.

Not only with commonly used lagging indicators but also candle structure and trading volume. Optimizing trading strategies involves identifying weaknesses in pattern success rates. Reliability of Bullish and Bearish Patterns Historically, many authors have suggested potential reliability:scores of various patterns, We have summarised these and relevant ranges of such, in the following two tables, a) Bullish Patterns and Reliability Scores Pattern Type Description Reliability (%) Double Bottom A reversal pattern indicating a potential upward move after a downtrend. 60-75% Breakout (Bullish) Price moves above a resistance level with increased volume. 70-90% Head and Shoulders (Inverse) A reversal pattern indicating a potential upward move. 70-80% Bullish Flag A continuation pattern indicating consolidation before the uptrend resumes. 65-75% Ascending Triangle A continuation pattern indicating a potential upward move after consolidation. 50-60% Cup and Handle A continuation pattern indicating a potential upward move after a consolidation period. 60-70% Moving Average Crossover (Bullish) A shorter-term moving average crosses above a longer-term moving average. 55-65% b) Bearish Patterns and Reliability Scores Pattern Type Description Reliability (%) Double Top A reversal pattern indicating a potential downward move after an uptrend. 60-75% Breakout (Bearish) Price moves below a support level with increased volume. 50-70% Head and Shoulders A reversal pattern indicating a potential downward move. 70-80% Bearish Flag A continuation pattern indicating a brief consolidation before the downtrend resumes. 65-75% Descending Triangle A continuation pattern indicating a potential downward move after consolidation. 50-70% Bearish Divergence Price makes a higher high while an oscillator makes a lower high. 50-60% Moving Average Crossover (Bearish) A shorter-term moving average crosses below a longer-term moving average. 55-65% Potential Flaws in Generalised Reliability Figures However, despite theoretical benefits, to focus solely on the reliability of chart patterns would logically be an error.

There are potential flaws in doing this and we would suggest these are threefold. 1. Lack of Context These figures often (unless measured specifically) will not account for market conditions (trending vs. ranging markets). Different timeframes, direction, and instrument volatility can produce vastly different probabilities. 2.

Absence of Trade Management Factors Intra-trade movements (retracements, consolidations) impact the final success rate of a pattern, as well as candle structure and trading volume as previously mentioned. Exit criteria matter just as much, if not more, than entry probabilities. Without a clear context of what exit has been used in such probability calculations, to be frank, such numbers verge on the almost meaningless. 3.

The Role of Confluence A chart pattern alone is not enough. Other factors should confirm reliability, such as: Volume Key support/resistance levels or zones Market sentiment indicators Moving Toward Higher Probability Entries & Exits There is no doubt, that one of the biggest mistakes traders make is focusing too much on entry setups while neglecting to balance this with as much attention on trade exits. While choosing the right entry is important, arguably it is the exit strategy that ultimately determines profitability.

The Reality of Chart Patterns in Trading Many traders enter the market with the assumption that recognizing chart patterns is enough to become profitable. They rely on historical probabilities and assume that a pattern’s past success rate will repeat itself in the future. However, as we’ve explored, trading is not that simple.

The true edge in trading does not come from pattern recognition alone. It is worth emphasizing that despite reservations related to the probabilities, for the reasons expressed earlier, one still shouldn’t dismiss these as completely irrelevant. Of course, entry remains important.

As a potentially more fruitful approach, one would suggest that effective use of this information comes from understanding when and how to use a pattern effectively within a broader context. A pattern might work 70% of the time in theory, but what happens if: The market conditions change? The volume doesn’t confirm the breakout?

A key resistance level invalidates the move? The trader manages the trade poorly, leading to an early exit? This is why trading success is not about blindly trusting probabilities—it is about using real-world, data-driven insights to determine when a pattern has the highest probability of success.

Key Lessons for Traders Moving Forward So how do we balance this? Perhaps a consistent reminder of some basic truths. Probabilities Are Not Absolute Patterns do not have fixed success rates.

Their effectiveness depends on market conditions, timeframe, volatility, and confluence factors. A double top on a 5-minute chart in a choppy market is not the same as a double top on a weekly chart in a trending market. Entry is Important, But Exit is Crucial Trade exits, risk management, and stop placement ultimately define profitability—not just how good an entry looks.

Dynamic exits, such as volatility-based trailing stops, often outperform rigid take-profit targets. A Trading System Must Evolve with, and be Responsive to, Market Conditions No system works forever. The best traders consistently refine their strategies based on new data and performance insights.

Journaling and backtesting allow traders to identify patterns that work best in their preferred market. Technology & Automation Can Improve Consistency in decision making Algorithmic backtesting can help traders quantify pattern reliability under different conditions. Using tools like MetaTrader Strategy Tester, or even basic journaling and meaningful evaluation can uncover insights that an overview analysis might miss.

Final Thought: The Path to Becoming a Data-Driven Trader So how do we summarise this in practical terms? Perhaps it is right to emphasise that the transition from an average trader to a successful one is not about memorising patterns but about developing a systematic approach to trading. A data-driven trader does not ask, 'Does this pattern work?' Instead, they ask, 'When does this pattern work best, and how can I optimize my strategy around it?' The difference is mindset - and mindset is what separates profitable traders from those who struggle.

In this article, we take an in-depth look at the concept of strength of signal and its potential role in improving trading outcomes. Traders are constantly seeking ways to enhance their results consistently, and the idea of evaluating the strength of a trading signal may provide a pathway toward greater reliability and performance when applied to trading systems across multiple timeframes and instruments. By delving into this concept, we will explore not only what strength of signal means but also the key factors involved in its practical application in decision-making and trade execution.

Why Could Strength of Signal Be Important for Traders? Definition: Strength of signal refers to the degree of confidence and reliability a particular trading signal provides regarding anticipated market movements. It measures the quality and trustworthiness of a trading setup, aiming to increase the likelihood of success by filtering out weaker signals and focusing on higher-probability opportunities.

The idea of strength of signal is most commonly applied to trade entries, where traders seek to increase their chances of entering the market at an optimal point. This can lead to better overall performance by avoiding premature or low-confidence entries that could result in losing trades. However, strength of signal also holds significance in trade exits.

For instance, a strong signal at the entry point may weaken over time, indicating a lack of continuation in the trend. This change in signal strength could provide the trader with an early warning to exit the trade before a reversal occurs. At its most basic application, strength of signal may help traders decide whether to enter a trade.

However, its implications are far-reaching, influencing other critical aspects of trading such as: Position sizing: When the signal is stronger, a trader may feel more confident about increasing their position size. A weak signal, on the other hand, may prompt the trader to either reduce their position size or avoid entering the trade entirely. Accumulating positions: If a trader has already entered a trade and the strength of the signal improves, they might decide to add to the existing position.

This practice, known as scaling in, can maximize gains during favourable market conditions. Exit decisions: Weakening signal strength can serve as a warning sign to exit a position. If a trade was initially based on a strong signal but the factors driving that signal begin to diminish, it could indicate a shift in market sentiment, prompting the trader to take profits or cut losses.

Components of Strength of Signal The strength of a signal can be broken down into three broad categories: price action, trading volume, and the confluence of technical indicators. Each of these components contributes in its own way to the overall reliability of the trading signal. a. Price Action Price action is the cornerstone of technical analysis and is considered the most important component when assessing the strength of a signal.

This is because price action reflects real-time market sentiment and behaviour. Candle structure: The open, high, low, and close (OHLC) of a candlestick offers vital clues about the current battle between buyers and sellers. For example, long wicks might indicate rejection of certain price levels, while a series of bullish or bearish candles can point to the start of a trend.

Patterns and formations: Multiple candlesticks forming patterns (e.g., head and shoulders, triangles, or flags) can provide insight into potential reversals or continuations. Recognizing these patterns can significantly contribute to assessing signal strength. Timeframe comparison: Price action can vary significantly across different timeframes.

A signal that appears strong on a lower timeframe, such as a 5-minute chart, might weaken when compared to the price action on a daily or weekly chart. Evaluating the signal across multiple timeframes helps traders confirm its validity. Key levels: Price action near key levels, such as support and resistance or pivot levels, play a crucial role in signal strength.

The closer the market is to a critical level, the more likely a strong reaction will occur, either a bounce or a break, adding weight to the signal. b. Trading Volume Volume is another critical component of strength of signal, as it represents the number of shares, contracts, or lots being traded at a particular price. Volume provides insight into the level of market participation and the conviction behind price movements.

Volume confirmation: When volume increases in the direction of the price move, it signals strong market participation, adding confidence to the strength of the signal. A price movement without sufficient volume may be viewed with caution, as it could lack the momentum needed for continuation. Volume divergence: Divergence between price and volume can signal a weakening trend.

For instance, if prices are rising but volume is decreasing, it may indicate that the buying interest is waning, and the strength of the signal is diminishing. Volume spikes: Sudden spikes in volume can indicate institutional participation or a major market event. High-volume candles at key levels can often confirm the validity of a breakout or breakdown. c.

Other Indicator Confluence Technical indicators summarize historical price and volume data, and while they are lagging in nature, they are undoubtedly useful in adding an additional layer of confirmation to any signal evaluation. Commonly used indicators: Many traders rely on widely recognized indicators such as moving averages, RSI, MACD, or ATR. These indicators help identify trends, momentum, volatility, and potential reversals.

The alignment of multiple indicators—often referred to as confluence —can significantly strengthen a signal. Categories of indicators: Trend indicators: Tools such as moving averages and parabolic SAR can help traders identify the overall direction of the market. A trade that aligns with the prevailing trend is likely to have a stronger signal.

Momentum indicators: Indicators like RSI and MACD provide insight into the speed of the price movement. A weakening momentum might indicate that a trend is losing steam, reducing the signal’s strength. Volatility indicators: Tools like ATR measure the degree of price fluctuation.

Sudden changes in volatility can affect signal strength, as low volatility periods may precede explosive movements. Mean reversion indicators: Bollinger Bands and similar indicators help traders identify overbought or oversold conditions. Trades taken at the extremes of these indicators can have stronger signals if supported by price action and volume.

The Role of News and Events as an influence on strength of signal evaluation Event risk is a crucial, yet often underestimated, component of signal strength. No matter how strong a technical signal appears, the release of major economic data or geopolitical news can drastically alter market conditions, leading to unexpected price movements. It’s essential for traders to remain aware of scheduled news events, such as central bank meetings or earnings reports, which can cause sudden volatility.

A strong technical signal might be overridden by fundamental factors, so incorporating event risk into the overall assessment of signal strength is a necessary practice. The Case for Weighting and a Strength of Signal Score To make the assessment of signal strength more objective, traders can develop a weighted scoring system. By assigning a value to each component (price action, volume, indicators, etc.), they can generate a Strength of Signal (SOS) score.

This score provides a quantitative measure to guide trading decisions. Weighting components: Not all factors carry equal importance. For instance, price action may be assigned a higher weight than indicator confluence, as it reflects current sentiment.

A possible weighting system could look like this: Sentiment change: 40% Candle structure: 20% Higher timeframe confirmation: 10% Volume: 10% Proximity to key levels: 10% Momentum: 5% Volatility change: 5% Instrument and timeframe differentiation: Different instruments and timeframes may require tailored weighting. For example, the weighting system for a fast-moving 30-minute gold chart might differ significantly from that of a more stable 4-hour AUD/NZD chart. Using a Score to Drive Trading Decisions Once a strength of signal score is established, it can be applied to various aspects of trade management: Entry decisions: A minimum SOS score (e.g., 60) could be required for entering a trade.

This ensures that only high-quality setups are considered. Position sizing: A higher SOS score could justify increasing position size. For example, if the score is above 70, a trader might increase their position by 1.5x the normal size, while a score above 80 might warrant doubling the position.

Exit decisions: A decreasing SOS score (e.g., below 30) might signal the need to exit the trade, helping traders protect profits or minimize losses. Summary The concept of strength of signal offers a structured approach to assessing the quality of trading setups. By incorporating factors like price action, volume, and technical indicators into a weighted system, traders can make more informed decisions, potentially improving both their consistency and performance.

Experimenting with different scoring systems and analysing their impact on your trading strategy is worthwhile investigating further in the reality of your own trading. Over time, a well-developed score can provide valuable insights into when to enter, accumulate, or exit trades based on the changing dynamics of the market.

Introduction to Scaling in Trading Scaling in trading involves adjusting the size of trading positions based on specific criteria or rules. This concept is crucial for both discretionary and automated traders, with the latter group often finding it easier to implement due to the structured, rule-based nature of automated systems. For discretionary traders, scaling introduces flexibility to tailor position sizes to fit current market conditions or account balance.

Scaling strategies can apply to an entire account or to selected strategies, depending on the trader’s goals, approach, and the quality of their data. A well-planned scaling approach can enhance profit potential while managing risk, whereas an ad-hoc or uninformed scaling practice often introduces additional risks without promising substantial rewards. This article outlines critical concepts and principles in developing a robust scaling strategy, helping traders determine a path suited to their trading goals and risk tolerance.

Types of Scaling Approaches The choice of scaling approach is based on factors such as experience, trading objectives, and risk tolerance. Any structured scaling approach generally surpasses none, and selecting one today doesn’t preclude exploring others later. We’ll examine four common approaches to assist you in making an informed decision.

Fixed Lot Size Scaling Fixed Lot Size Scaling involves trading a consistent lot size for each position, regardless of changes in account balance or market conditions. This approach is straightforward and accessible, especially for beginners who might not be ready to adapt position sizes actively. However, fixed lot size scaling can be restrictive; it does not account for changes in account value or market dynamics, limiting the ability to manage risk effectively during volatile market periods.

Example in Automated Trading Fixed lot size scaling is especially useful when transitioning a model from backtesting to live trading. For example, if an Expert Advisor (EA) performed well during backtesting with a fixed lot size of 0.1, starting live trading at this minimum volume is prudent. Doing so allows traders to verify live performance against backtest expectations, ensuring the EA’s effectiveness in real market conditions before considering scaling up.

Fixed Fractional Scaling Fixed Fractional Scaling trades a set percentage of the account balance, automatically adjusting position sizes with account growth or shrinkage. This inherently responsive approach aligns with the account’s performance. For example, a trader may risk 1% of the account per trade in leveraged trading, calculating this amount based on the potential loss if a stop-loss is triggered.

This risk tolerance can vary depending on the individual’s strategy and objectives. Benefits and Considerations This approach helps manage risk, especially as the account size fluctuates. However, the varying lot sizes across different instruments and exposures require close monitoring.

For example, in a portfolio with both Forex and commodity trades, the risks associated with each asset type might differ. Traders must consider this variability to ensure their risk exposure remains consistent. Selective Strategy Scaling Selective Strategy Scaling increases position sizes based on the proven success of specific strategies or components within strategies.

This approach accelerates gains, but reaching a critical mass of trades to evaluate performance becomes more challenging due to its selective nature. Example of Strategy-Specific Scaling Consider a trader using multiple strategies: one focusing on trend-following and another on range-bound markets. If the trend-following strategy demonstrates a high win rate and favourable profit factor over time, the trader may selectively scale this strategy’s position sizes.

Meanwhile, the range-bound strategy could be scaled conservatively until it shows consistent performance. Selective scaling like this allows traders to leverage their most reliable strategies for greater potential returns. Variable Scaling (Advanced) Variable Scaling is a sophisticated approach adjusting trade sizes based on market conditions, including price action, trends, signal strength, and volatility.

Advanced traders using variable scaling develop a system to dynamically adjust position sizes based on indicators, providing flexibility to respond to market changes. Example Using Volatility Suppose a trader monitors market volatility through the Average True Range (ATR) indicator. In periods of low ATR (indicating low volatility), the trader might scale down positions to reduce risk.

Conversely, during high volatility, they might increase position sizes to capitalize on larger price swings. This approach requires a deep understanding of technical analysis and specific criteria for guiding scaling decisions. Broad Principles for Effective Scaling Effective scaling relies on well-defined criteria aligned with account size, risk tolerance, and trading performance.

Key metrics include account balance, margin usage, and trade success metrics. Incremental scaling allows traders to gradually adjust position size, thus managing risk as trading volume increases. A structured scaling plan ensures scaling decisions align with the trader’s goals and risk management rules, avoiding emotional, unplanned adjustments.

Optimal Conditions for Scaling (“The When”) Scaling should be guided by specific performance metrics that assess result reliability. Key indicators include: Win Rate: Consistency in win rate over time is crucial. A stable win rate suggests that the strategy performs well across various market conditions.

Profit Factor: A ratio of gross profit to gross loss. Generally, a profit factor above 1.5 indicates more profitable trades than losses. Drawdown: The peak-to-trough decline in account balance.

Lower drawdown suggests more stability, supporting the case for scaling. When combined with net profit and worked out as a ratio, with automated trading we would expect a Net profit to drawdown ration of at least 8:1 Risk-Reward Ratio: A higher ratio shows that profit potential outweighs losses, making the strategy more viable for scaling. Sharpe Ratio: This risk-adjusted return measure indicates better performance relative to risk.

For instance, if a trader maintains a high win rate, profit factor, and low drawdown, they might consider scaling up. However, if metrics vary significantly, scaling should be approached cautiously. Determining How to Scale The degree to which you scale is a crucial component of your plan.

Scaling is often done incrementally, such as moving from a starting lot size of 0.1 to 0.3, 0.5, and so on, based on the strength of results. For instance, a trader may scale up by 0.1 lot for each 5% account growth, provided performance metrics remain stable. It’s essential to clearly define this scaling plan before implementation, follow it precisely, and review it over time to ensure it meets trading objectives.

Psychology and Challenges of Scaling Scaling involves a psychological shift, as traders manage larger positions with increased potential profit and loss. Traders often encounter procrastination, impatience, or anxiety, especially when adjusting to larger numbers. Managing Psychological Challenges To illustrate this principle in an example, if a trader accustomed to $100 maximum profits scales to a position where potential profits reach $400, the temptation to close trades early may be overwhelming.

To ease this transition, a trader might simulate the larger trades in a “ghost account,” which mirrors live trading without risking real capital. This simulation allows the trader to become comfortable with the numbers, building confidence without financial exposure. Creating and Committing to a Scaling Plan An effective scaling plan is data-driven, with metrics and thresholds to guide scaling actions.

Regular reviews ensure the plan adapts to evolving market conditions and performance outcomes. Like all elements of a trading system, a scaling plan requires discipline, objectivity, and data-driven actions rather than emotional reactions. Summary Scaling is an advanced trading concept that, when applied correctly, can optimize profit potential while managing risk.

This guide outlined various scaling approaches—Fixed Lot Size, Fixed Fractional, Selective Strategy, and Variable Scaling—each with distinct applications depending on the trader’s experience, strategy, and market conditions. Fixed lot size scaling offers simplicity and is suitable for beginners or automated trading, while fixed fractional scaling aligns well with account growth or decline. Selective strategy scaling focuses on increasing successful strategies' position sizes, while variable scaling dynamically adjusts to market conditions, requiring deep technical knowledge.

The guide also emphasized key performance metrics for effective scaling and highlighted the psychological challenges involved, with strategies for managing emotional responses. Ultimately, a successful scaling plan is disciplined, data-driven, and regularly reviewed to ensure alignment with trading objectives. Traders who develop and commit to a structured scaling approach can enhance their trading results by making informed, calculated adjustments to position sizes based on performance metrics and risk tolerance.

It's well-known that many discretionary traders struggle with discipline, emotional control, and other psychological hurdles that can impact their decision-making process, particularly when it comes to entering and exiting trades. One of the widely recognized benefits of automated trading models, however, is the belief that these psychological barriers are removed or significantly reduced. Automation, after all, is designed to eliminate human emotion from trading decisions.

However, the assumption that psychological challenges vanish with automated trading is far from reality. As you delve into the exciting world of creating and trading “Expert Advisors” (EAs), it is crucial to understand that psychological challenges still exist, albeit in a different form. You must be prepared to face various mindset issues during the EA development and trading process.

This article outlines and aims to inform on nine key potential psychological challenges traders might encounter when working with EAs and offers guidance on how to navigate them effectively. Use this checklist to develop an awareness of potential issues and take meaningful action to enhance your trading performance. 1. Over-Optimization and Curve Fitting One of the most common challenges traders face when developing EAs is the temptation to over-optimize their algorithms.

This refers to tweaking the EA to perform perfectly in historical backtests but at the expense of real-world effectiveness. While an over-optimized EA may show stellar performance on past data, it often falters when faced with live market conditions, leading to frustration and self-doubt. To mitigate this, it is vital to stay focused on each stage of the EA creation process and avoid the trap of endless refinement.

Always keep in mind two fundamental principles: The purpose of an EA is to reliably generate profits. Once this is achieved, the next step is simply scaling the strategy. The purpose of backtesting is not just to validate that the settings work but to justify moving to a forward test. 2.

Fear of Loss Fear and anxiety can emerge when transitioning from testing to live trading, especially when real money is involved. Traders may worry about losing their capital or encountering a significant drawdown that tests their emotional resilience. This fear can act as a barrier, preventing traders from taking their EAs live or increasing trade sizes, even when results suggest it is the right time to scale up.

Developing confidence in your EA through thorough backtesting and forward testing is key to overcoming this fear. 3. Lack of Control Another psychological hurdle is the feeling of losing control when relying on an automated system. With discretionary trading, traders are actively involved in every decision, whereas, with an EA, the algorithm executes trades without human intervention.

This can lead to feelings of helplessness, especially if the EA doesn’t perform as expected. Watching trades unfold on your account without direct involvement can be unnerving, tempting traders to interfere prematurely. Resisting the urge to manually override the EA is crucial.

Trust the system you’ve created, as long as it is backed by solid logic and testing. 4. Confirmation Bias Traders may fall into the trap of confirmation bias, where they only acknowledge the positive aspects of their EA’s performance while overlooking warning signs or evidence of flaws. This bias can be dangerous, as it blinds traders to potential weaknesses that may lead to significant losses over time.

Creating a set of objective performance measures, such as maximum drawdowns and key profit metrics, can help maintain a clear and rational perspective on the EA’s success. Emotional attachment to an EA that has taken considerable effort to build can cloud judgment, so it’s important to remain objective, especially when difficult decisions arise. 5. Overconfidence Success with one or more EAs can lead to overconfidence, which is a major psychological pitfall.

Traders may begin to overlook necessary refinements, substitutions, or additional testing. Early successes might lead them to believe they can expedite the process of moving an EA to live trading and scaling it, without taking the time to gather sufficient data from a large enough sample of trades. Patience is essential when transitioning to live trading.

Ensure that a critical mass of data is available before making decisions about scaling or altering your approach. 6. Impatience Many traders expect immediate results from their EAs, which can lead to impatience. This impatience often results in premature modifications or abandonment of strategies that could have been profitable over a longer time horizon.

There are no shortcuts in trading. Allow time for your EA to demonstrate its potential over a defined period, rather than making snap judgments based on short-term performance. Regularly comparing live results to backtests over a reasonable timeframe can provide the necessary context to assess whether an EA is working as intended. 7.

Adaptability Market conditions change, and EAs that perform well in one environment may struggle in another. The psychological challenge here lies in being open to the necessity of adaptation. Some traders may hesitate to make changes or replace an EA, fearing the effort it took to develop the original model.

Consistent monitoring and having clear criteria for when adjustments are needed are vital to long-term success. Embrace the process of refinement, knowing that adaptability is essential for keeping your EA portfolio profitable in different market conditions. 8. Social Comparison Comparing your EA’s performance to others can lead to feelings of inadequacy, envy, or frustration, especially if you perceive that your system isn’t performing as well as someone else’s.

Social comparison is common among traders, but it can lead to unnecessary emotional strain unless checked. It’s important to remember that traders are often more vocal about their successes than their losses. Maintain a focus on your own progress and the unique journey of developing a system that works for you. 9.

Emotional Resilience The ability to stay emotionally resilient during drawdowns or periods of underperformance is critical. Fear, anger, frustration, and impatience can cloud your judgment and negatively impact decision-making, including premature withdrawal of an EA. With any strategy there will be periods of under and over performance.

Accepting this is critical for good long-term decision making. Obviously, time is a great “calmer” in terms of developing not only confidence but also this acceptance. Anecdotally, new automated trades are most at risk until there is a “record of achievement”.

This is one of the key reasons why trading any new EA at minimum volume as you discover how it performs under live market conditions is vital. In Summary Addressing these psychological challenges is essential for success in the world of automated trading. Taking these points on board and stepping back to review where you are as many of these may creep in insidiously over time would seem prudent.

Practical steps you can take may include: Developing a deep understanding of your EA’s logic and parameters, so you trust the system you’ve built. Setting clear performance expectations and avoiding comparisons with others. Developing self-awareness and emotional regulation to stay calm during turbulent times.

Regularly reviewing and updating their trading strategy on which the EA is based, including sighting charts of trades taken and refinement of risk management strategies are always worthwhile. Consistent monitoring is vital. Taking breaks to avoid burnout and maintaining a healthy work-life balance.

Trading EAs do create an interesting set of challenges but as stated previously, awareness that these challenges may exist is the first step to be able to take meaningful action and continue the work on yourself. Whether you ae a discretionary or automated trader, this rule is unquestionable and always the start point of long term improvement in trading decision making. If you are interested in the GO Markets automated trading platform and strategy tester, and the education we can provide relating to this topic, please feel free to connect at [email protected] at any time.

Achieving long-term success in trading requires more than just knowledge and technical skills. It depends on building a foundation of mindset, behaviours, and self-awareness. This foundation is built on three critical drivers: Trading Confidence and Reliability, Trading Self-Relevance, and Trading Locus of Control.

These drivers work together to create a framework for sustainable growth and success in the market. However, failing to implement these drivers can lead to frustration, inconsistency, stagnation, and trading outcomes that fall short of what may be possible for you. In this article we explore these drivers in detail, enriched with definitions, examples, and insights into the consequences of neglecting them. 1.

Trading Confidence and Discipline Definition: Confidence is the belief in your ability to succeed and overcome challenges, while reliability is about creating consistent, dependable outcomes through your actions and systems. Confidence is the psychological pillar that allows traders to operate with clarity and conviction, even in volatile markets. This IS the KEY ISSUE in trading discipline.

Confident traders invariably are disciplined traders. This attribute needs work, being cultivated through deliberate practice and the accumulation of small wins over time. Core Concepts: Confidence in Your Ability to Take Action: What it means: This is about trusting in your capability to take the necessary steps, no matter how small or challenging, to achieve positive outcomes.

It requires the ability to see yourself as an active participant in your success, rather than a passive observer. This confidence grows through persistence and a willingness to learn from setbacks. You need to believe that even if you don’t have all the answers today, you are equipped to figure things out over time.

Example: A trader analyses their losses to identify mistakes and refine their approach, developing resilience to re-enter the market with improved strategies. Consequences of Neglect: Without confidence, traders may hesitate to take action or abandon trades prematurely, missing out on potential gains and learning opportunities. Confidence in the Importance of Taking Action and then Testing: What it means: Recognizing the value of consistent effort and the power of experimentation is essential in trading.

Small, deliberate actions, such as testing new strategies or refining old ones, provide insights that build trust in your systems. Testing allows you to bridge the gap between theory and application, proving to yourself that what you do matters and can lead to improved results. Example: A trader refines a new risk management rule on a demo account, building trust in its reliability.

Consequences of Neglect: Neglecting testing can lead to impulsive decisions based on unverified strategies, increasing the likelihood of inconsistent or poor outcomes. Confidence in Your Trading Systems: What it means: Believing in your system means trusting the process you’ve developed, knowing it has been built on solid foundations, and understanding that, over time, it is capable of delivering reliable results. This confidence doesn’t mean blind faith—it’s about the discipline to stick to your system because you’ve put in the work to validate it.

Example: A trader follows a trend-following system backed by thorough back testing and evidence in live markets of positive outcomes. Consequences of Neglect: Without trust in your system, you may second-guess trades, frequently change strategies, or fail to commit to a plan, resulting in erratic performance. The link between this and the ability to be disciplined is undeniable.

Believing in the Impact of Learning and Action: What it means: Understanding that your effort to grow and take deliberate action is the engine that drives success. This belief empowers you to view setbacks as opportunities for growth, rather than roadblocks. It shifts your focus from outcomes solely to recognising the important processes, enabling you to learn and improve continually.

Example: A trader uses mindfulness techniques to reduce emotional errors, significantly improving decision-making. Consequences of Neglect: Failing to learn from mistakes or take deliberate action can result in repeated errors and a lack of meaningful progress. Key Takeaway: Confidence and, subsequently, discipline are essential for building consistency.

Without them, traders are likely to operate reactively, undermining their potential for long-term success. 2. Trading Self-Relevance Definition: Trading self-relevance is the alignment of your trading activities with your values, goals, and purpose. It ensures that trading is not just an activity, but a meaningful pursuit tied to your identity and aspirations.

Core Concepts: Purpose: What it means: Having a clear “why” behind your trading journey is about understanding the deeper motivation that drives your actions. Purpose provides the emotional anchor that keeps you steady, even when the market becomes unpredictable. It transforms trading from a task into a mission, connecting it to something personally significant.

Example: A trader pursuing financial independence views trading as a means to an end, which keeps them motivated. Consequences of Neglect: Without a strong purpose, trading can feel aimless, leading to a lack of discipline, motivation, and ultimately, poor results. Level of Importance: What it means: Treating trading as a priority requires committing the time, energy, and focus necessary for improvement.

It involves recognizing the importance of consistent effort and giving trading the same respect as any other profession or life goal. Example: A trader allocates specific hours for market analysis, reflecting their commitment. Consequences of Neglect: Treating trading as a low priority can lead to inconsistent effort, incomplete preparation, and missed opportunities.

Developmental Evidence: What it means: Monitoring your progress and recognizing improvement is key to maintaining motivation. Evidence of growth reinforces that your actions are effective, encouraging you to stay the course. It creates a feedback loop where success builds confidence and confidence drives further effort.

Example: A trader reviews their journal weekly to identify profitable patterns. Consequences of Neglect: Without tracking progress, traders may lose confidence, fail to learn from their experiences, and struggle to refine their approach. Key Takeaway: Self-relevance connects your trading to your identity and goals.

Neglecting this alignment can lead to a lack of direction and reduced motivation to improve. 3. Trading Locus of Control Definition: Locus of control refers to your belief about whether outcomes are determined by your own actions (internal) or by external factors (external). Core Concepts: Internal Locus of Control (ILOC): What it means: Believing that your outcomes are shaped by your decisions, behaviours, and preparation.

This mindset puts you in the driver’s seat, enabling you to take responsibility for your actions and their consequences. It empowers you to adapt, improve, and proactively address challenges. Example: A trader reviews losses to identify mistakes and improve, rather than blaming external factors.

Consequences of Neglect: Without an ILOC, traders may externalize blame, failing to take responsibility for their growth and repeating the same mistakes. External Locus of Control (ELOC): What it means: Attributing outcomes to luck, market conditions, or other external influences. This mindset often leads to feelings of helplessness, as you perceive success as being outside of your control.

Example: A trader blames sudden news events for losses without analysing their own decisions. Consequences of Neglect: An ELOC mindset often results in a lack of accountability, leaving traders feeling powerless and unmotivated. Take charge of what you can control!

Here are the actionable aspects within your control to make sure that your locus of control remains primarily internal: What You Learn: Continuously improving knowledge through deliberate effort. Your Systems: Refining strategies with evidence and adapting to market changes. Your Trading Time: Managing when and how much you trade.

Performance Measurement: Evaluating progress using clear metrics. Execution: Maintaining discipline in trade management. Permission Not to Trade: Knowing when to step back.

Consequences of Neglect: Failing to focus on what you can control leads to frustration, emotional decisions, and a reactive mindset. Key Takeaway: An internal locus of control empowers you to take responsibility for your outcomes, fostering resilience and proactive growth. Summary - Bringing It All Together Ultimately, these three drivers— Trading Confidence and Reliability, Trading Self-Relevance, and Trading Locus of Control —must work in harmony to achieve lasting success.

They create a foundation for continuous growth, adaptability, and resilience. Neglecting these principles often results in frustration, stagnation, and missed opportunities. By adopting these drivers, you align your trading journey with a mindset built for success.